Final I-Cubed Regulations

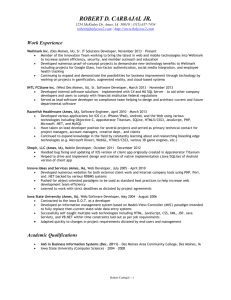

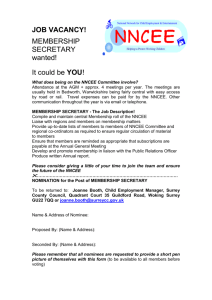

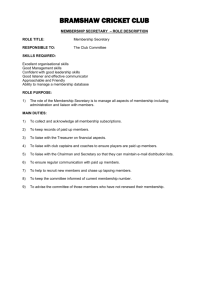

advertisement