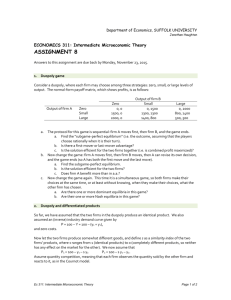

impacts evaluated

advertisement