document

advertisement

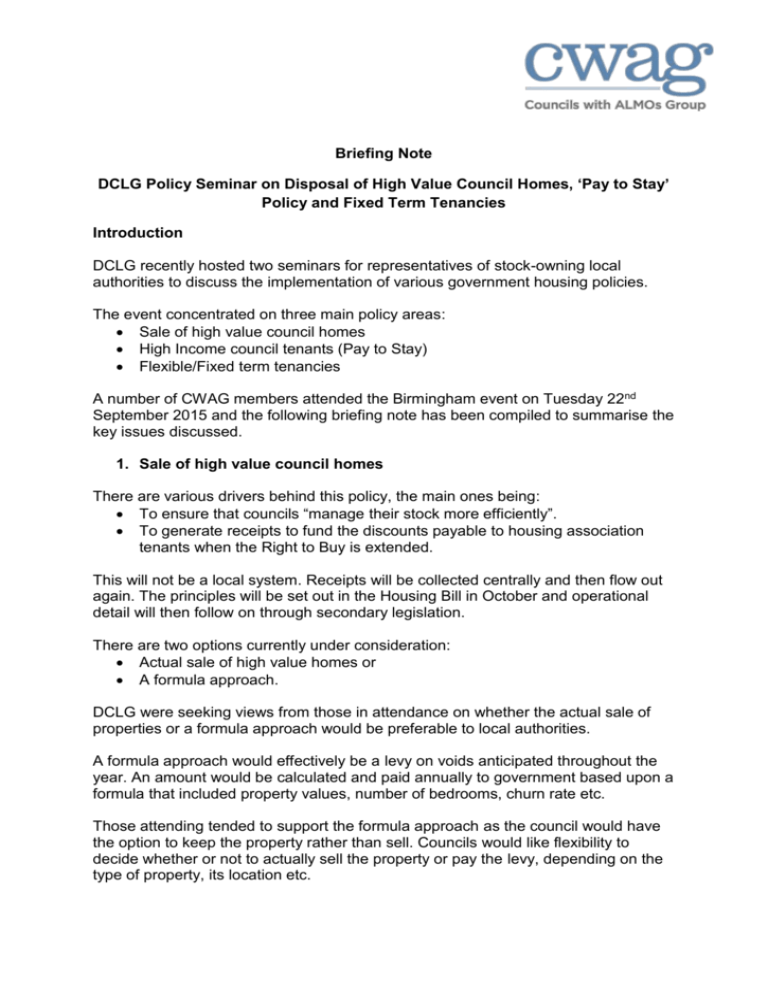

Briefing Note DCLG Policy Seminar on Disposal of High Value Council Homes, ‘Pay to Stay’ Policy and Fixed Term Tenancies Introduction DCLG recently hosted two seminars for representatives of stock-owning local authorities to discuss the implementation of various government housing policies. The event concentrated on three main policy areas: Sale of high value council homes High Income council tenants (Pay to Stay) Flexible/Fixed term tenancies A number of CWAG members attended the Birmingham event on Tuesday 22nd September 2015 and the following briefing note has been compiled to summarise the key issues discussed. 1. Sale of high value council homes There are various drivers behind this policy, the main ones being: To ensure that councils “manage their stock more efficiently”. To generate receipts to fund the discounts payable to housing association tenants when the Right to Buy is extended. This will not be a local system. Receipts will be collected centrally and then flow out again. The principles will be set out in the Housing Bill in October and operational detail will then follow on through secondary legislation. There are two options currently under consideration: Actual sale of high value homes or A formula approach. DCLG were seeking views from those in attendance on whether the actual sale of properties or a formula approach would be preferable to local authorities. A formula approach would effectively be a levy on voids anticipated throughout the year. An amount would be calculated and paid annually to government based upon a formula that included property values, number of bedrooms, churn rate etc. Those attending tended to support the formula approach as the council would have the option to keep the property rather than sell. Councils would like flexibility to decide whether or not to actually sell the property or pay the levy, depending on the type of property, its location etc. DCLG acknowledged that considerations for any attributable debt, as well as the cost of valuing, marketing and selling properties, would need to be made. Clarification will also be required on the relationship to general housing consents and the timing of sales. A proportion of receipts will be available for funding new provision / replacements. There may also be discretion on what is built, for example, different tenures. DCLG were keen to know the preferred route for refunding replacement properties for those sold, suggesting three potential options: directly by local authority; via registered providers; or through a funded HCA programme. The preference within those attending was for direct re-provision by councils but only if the new properties were exempt from forced sale. DCLG are considering exemptions from forced disposal for new build properties and for supported housing and adapted properties. There are also likely to be exemptions for certain properties in rural areas. There is still no detail available on the thresholds that will determine the definition of “high value”; however, it is unlikely that the regional figures produced prior to the election will be used. DCLG favour a more local valuation, possibly based on local authority boundaries. DCLG also stated that there will be a cap on the number of properties that local authorities will be required to sell, therefore high value local authority areas and low value local authority areas will be required to dispose of a similar number of properties. 2. Pay to Stay Primary legislation will be required to implement high value & pay to stay. The framework for this policy will be in the October Housing Bill with the detail about how it will work following in secondary legislation. The planned implementation date for this policy is April 2017. DCLG could not yet say how they would define income or what a household was. The discussion centred on the ability of councils to find out tenants’ earnings; what support could be provided by HMRC; and what period near market rent would be charged for, particularly where tenant’ earnings fluctuated. DCLG were keen to hear views on how the policy could be implemented without being a disincentive for work and how the government could receive the higher rent payments without an additional administrative burden being placed upon local authorities. There were no answers on this. As yet there is no definition of ‘near market rent’, however it seems likely that payments to government for ‘near market rent’ will be based upon the actual rent for the property and not what the local authority has managed to collect. Exemptions are still to be explored. Councils highlighted concerns about the potential impact on wider service provision created by the wage threshold and the potential perverse incentives for households to reduce working hours in order to stay within the cap. 3. Fixed term tenancies Full details will be in the Housing Bill and there will be no consultation on this policy. Three reasons were given for this approach: Local Authorities were given the chance to introduce flexible tenancies in the Localism Act and had not used them To make better use of stock To use as a platform into home ownership Changes will be introduced for new tenants from 1 April 2017. Councils will be able to choose any length of tenancy between 2 and 5 years. The view from DCLG was that a tenant would not lose their tenancy as long as they stayed in their home. It was unclear how existing tenants transferring between properties would be treated. Concerns were raised that if a tenant were to lose a lifetime tenancy by transferring, this would discourage downsizing. Some concerns were also raised about the legal position of converting introductory tenancies to fixed term tenancies due to the time limit within the current legislation. DCLG is keen to hear how local authorities will manage the process of introducing fixed term tenancies. There was no information about how these changes will be monitored or regulated.