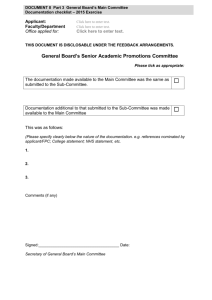

HPL-656 (05-14) Hospital Application

advertisement

AXIS HEALTHCARE PROFESSIONAL LIABILITY INSURANCE POLICY HOSPITAL APPLICATION (for surplus lines coverage) AXIS SURPLUS INSURANCE COMPANY Producer Agency Name: Producer Name: Telephone: E-Mail: Applicant Named Insured: County: Address: City/State/Zip: CEO: Risk Manager: Website: www. Authorized representative for insurance matters: Telephone: Number of years the Applicant has been in operation: Number of years the Applicant has been under present ownership: Other Entities List all owned (50% or more) entities to be considered as a Named Insured, or attach a separate list: Name Type/Purpose of Facility Retroactive Date Facility Information Type (check all that apply) Children’s Hospital Clinic Convalescent or Nursing Home General Acute Care Hospital Hospice Psychiatric Hospital Research Hospital Surgical Center Teaching Hospital Ownership and Control Governmental Individual Partnership Corporation Tax Status For Profit Not for Profit Medicare Approved The facility is (check all that apply): Accredited by AOA* Member of American Hospital Association Accredited by JCAHO* Member of State Hospital Association *Date of last survey: *Accreditation Period: Details of Requested Coverage Requested Effective Date: Expiration Date: Medicare Approved Other (describe below): Date Quote is Needed: Requested Limits Professional Liability General Liability Employee Benefits Admin. Liability (EBL) Excess Liability Umbrella Liability HPL-656 (05-14) $ $ per claim aggregate $ $ per claim aggregate $ $ per claim aggregate $ $ per claim aggregate $ $ per claim aggregate Claims Made Retroactive Date: Occurrence Coverage Claims Made Retroactive Date: Claims Made Retroactive Date: Total number of employees: Claims Made Retroactive Date: Claims Made Retroactive Date: Page 1 of 11 Deductible None Professional Liability General Liability Employee Benefits Admin. Liability (EBL) $ $ per claim aggregate $ $ per claim aggregate $ $ per claim aggregate Self-Insured Retention None Professional Liability SIR applies to: Professional Is there an Insurance Trust? $ $ per claim aggregate General Yes No EBL Is there an Insurance Captive? Applies to: Indemnity Only or Indemnity & Expense Indemnity Only or Indemnity & Expense Indemnity Only or Indemnity & Expense Applies to: Indemnity Only or Indemnity & Expense Other: Yes No Who currently handles claims within the SIR? Prior Insurance History Complete the following professional liability insurance history: Current carrier*: Claims Made Occurrence Effective Date: Expiration Date: Retroactive Date: Limits: $ /$ Deductible/SIR $ Expiring premium: $ Claims Made 1st prior carrier : Occurrence Effective Date: Expiration Date: Retroactive Date: Claims Made 2nd prior carrier : Occurrence Effective Date: Expiration Date: Retroactive Date: If you are currently insured on a claims-made policy, are you obtaining Extended Reporting Period Yes (“Tail”) Coverage from your current insurance carrier? *attach copy of current policy No Note: To prevent possible gaps in your Claims-Made coverage, either Extended Reporting Period Coverage from your current insurer or Prior Acts Coverage from AXIS must be purchased. Prior Acts Coverage is subject to underwriting approval and may not be available to all applicants. Census Data BEDS Occupancy: The daily average number of occupied beds shall be the sum of the annual occupancy divided by 365. Acute Care Beds are defined as: All beds licensed by the state, including but not limited to, all beds designated for burn, coronary, intensive care, medical, surgical, pediatrics, or other acute care patients. Number of Licensed Beds Average Annual Occupied Beds Current Year 1st Prior 2nd Prior Current Year 1st Prior 2nd Prior Acute Care Cribs & Bassinets Psychiatric Rehabilitation Swing Beds NURSING HOME BEDS N/A (applicant has no nursing home beds) Skilled Care Intermediate Care Residential Care Independent Living HPL-656 (05-14) Page 2 of 11 Visits & Procedures Emergency Medicine Mental Health Alcohol/Drug Rehabilitation Physical Rehabilitation/Therapy Home Health Care Nursing Home Visits Other Outpatient Visits (excluding Bariatric) Inpatient Surgeries (excluding Bariatric) Outpatient Surgeries Bariatric Surgeries (Outpatient/Inpatient) Total Deliveries (including C-sections) Cesarean Sections (C-sections) Vaginal Births after C-Section (VBACs) Other exposures (specify): Current annual visits Projected annual visits / / Personnel List the number of each provider type: NOTE: No individual coverage is afforded to specialties marked with an “*” unless specifically requested. Provider Type *Employed Physician *Employed Resident Nurse Anesthetist Nurse Midwife Nurse Practitioner Physician Assistant Podiatrist Psychologist Dentist Employees Independent Contractors Have Separate Coverage Yes No Yes No Yes No Yes No Yes No Yes No Yes No Yes No Yes No *If coverage is requested, individual applications may be required. Services None of these Indicate if the Applicant presently provides or operates, or plans to provide or operate any of the following: Abortion Clinic Dental Services Intensive Care Unit Pediatrics Ambulance Service * Dialysis Long-Term Care Rehabilitation Bariatric Surgery ‡ Emergency Room Neonatal ICU Research/Experimental Surg. Birthing Suites Fitness Center * Nursery Robotic Surgery Blood Bank * General Medicine OB / GYN Skilled Nursing Teleradiology ‡ Cardiac Cath. Center General Surgery Oncology Chemical Dependency Geriatrics Organ Transplants Telemedicine (non radiology) Concierge Medicine HMO Outpatient Surg. Transplants Coronary Care Unit Home Health Pain Management Transportation Services Day Care * Hospice Pathology Trauma Centers Other (describe): ‡ Supplemental application is required. *Complete the following information for SERVICES selected above: Ambulance Service # of runs per year: Employed EMTs/Paramedics? If “Yes,” how many? Blood Bank Are you accredited by: Hospital patients only HPL-656 (05-14) # of vehicles: Yes No AABB CAP Used by outside patients Fitness Center On premises Patient only Day Care Kids per day: General public Swimming pool Caregiver/Child Ratio: Page 3 of 11 Emergency Department What is the JCAHO designation of the Emergency Department? N/A Level I (tertiary) Level II (comprehensive) Level III (basic) Level IV (standby) Level V Emergency Department is staffed by (check all that apply): Employed Physicians Contract Group Staff Physicians If under contract, provide name of group: Required Professional Liability limits: $ /$ Are all ER physicians required to be Board Certified or eligible in Emergency Medicine? Yes Are the ER physicians required to respond to cardiac/respiratory arrests or other medical Emergencies Yes occurring in the institution? Is the Emergency Room equipped with the following: a. Emergency resuscitation care equipped with defibrillator Yes b. Electrocardiograph machine Yes c. Staffed radiology room(s) Yes d. Dedicated triage area and staff Yes e. Dedicated trauma room(s) and staff Yes f. Dedicated laboratory personnel Yes Do any of the Emergency Department staff routinely work more than a eight (8) hour duty shift? If Yes “Yes,” explain: Surgery Are any of the following performed at your facility and/or outpatient surgicenters? Procedure Hospital Outpatient Center Cosmetic Surgery Experimental Surgery Laser-Assisted Surgery / LASIK Surgery Neurosurgery Sex Change / Gender Reassignment Surgery Weight Reduction / Bariatric Surgery Pathology Pathology Department is staffed by (check all that apply): Employed Physicians Contract Group If under contract, provide name of group: Required Professional Liability limits: $ /$ None Not Performed No No No No No No No No No Annual # Done Staff Physicians Anesthesia Anesthesiology Department is staffed by (check all that apply): Employed Physicians Contract Group Staff Physicians If under contract, provide name of group: Required Professional Liability limits: $ /$ Are all anesthesiologists required to be Board Certified or eligible in Anesthesiology? Yes No Do CRNA’s provide anesthesia services? Yes No CRNA employment by: Applicant Anesthesiology Surgeon Independent Contractor Is the anesthesia care performed by CRNA’s supervised and reviewed by the anesthesiologists? If Yes No “No,” explain: Radiology Radiology Department is staffed by (check all that apply): Employed Physicians Contract Group Staff Physicians If under contract, provide name of group: Required Professional Liability limits: $ /$ Are all radiologists required to be Board Certified in Radiology or Nuclear Medicine? State the number of X-ray machines owned and/or operated: How many are used for: Diagnosis: Treatment: HPL-656 (05-14) Yes No Both: Page 4 of 11 Obstetrics How many of each do you have? Labor rooms Delivery rooms Birthing suites Is the delivery room suite separate from the surgical suite? Yes No What is the C-section rate for the previous 12-month period ? Are you in current compliance with all ACOG standards, including those that pertain to C-sections? Yes No Is an Obstetrician available in-house twenty-four (24) hours per day for the obstetrics suite? If “No,” Yes No what is the maximum time allowed for arrival at the facility? Is an Anesthesiologist or CRNA available in-house twenty-four (24) hours per day? If “No,” what is the Yes No maximum time for arrival at the facility? If the Applicant has a neonatal intensive care unit (NICU), what is the total number of neonates admitted in the last 12 months? N/A (we do not have a NICU) Is the Applicant a regional referral center for newborns requiring intensive care? If “Yes,” how many Yes No were transferred from other facilities? Is a full-time attending neonatologist on-site in the NICU twenty-four (24) hours per day? Yes No Do providers other than Obstetricians (Family Practice with OB, CNMs, etc.) ever deliver babies in Yes No your hospital? If “Yes,” explain: Staff Credentialing & Privileges Are credentials for all Physicians and Allied Professionals checked and approved prior to granting staff privileges? Are privileges probationary? What is the amount of probationary time? Are new staff members proctored? Are there any Physicians or Allied Professionals who are not licensed or who have restricted licenses or privileges? Are Physicians and Allied Professionals privileges reviewed at least once every other year? Are all foreign medical graduates certified by the Educational Council for Foreign Medical Graduates (ECFMG) or have they passed the FLEX? Are independent Physicians and Allied Professionals required to maintain professional liability insurance? What are the required limits? $ /$ Are certificates of insurance required as verification of insurance? Risk Management Is there an individual who is designated with the job title and role of Risk Manager? If “No,” explain: Is there a written, formalized Risk Management plan? If “No,” explain: Is this plan regularly reviewed for effectiveness and/or any necessary changes? If “Yes,” how often is the plan reviewed? Is there an ongoing Quality Assessment or Improvement plan? If “No,” explain: Yes No Yes Yes No No Yes No Yes No Yes No Yes No Yes No Yes No Yes Yes No No Yes No Contractual Agreements Identify any remaining contracted professional services performed at the hospital not previously identified None (all have been previously identified) Home Health Occupational Therapy Physical Therapy Laboratory Pharmacy Respiratory Therapy Other: Does the applicant require contractors to provide verification of professional liability insurance? If Yes “Yes,” what limits are required? $ /$ Are all contracts reviewed by legal counsel prior to execution? Yes Does the applicant indemnify (hold harmless) any other party for liability? If “Yes,” submit a copy of Yes the agreement with this application. Does the applicant rent or lease equipment to or from others? Yes Does the applicant contract outside entities for the removal and/or disposal of any of the following wastes? Yes Low Level Radioactive Other Radioactive Hazardous or Toxic Medical or Infectious If “Yes” to any of the above, is evidence of insurance required? What are the minimum limits Yes required? $ Does the applicant have any on-site dumps, landfills, or other disposal areas? Yes HPL-656 (05-14) No No No No No No No Page 5 of 11 General Information Does the applicant engage in any of the following: a. Formal clinical research under the auspices of an institutional review board? b. Administration of non-FDA approved pharmaceuticals (experimental drugs)? c. Biomedical device research and development? d. Animal research? e. Medical and/or surgical experimentation that is not approved by an IRB? If “Yes” to any of the above, provide details: Has the Applicant or other associated entity ever had its license revoked, suspended or placed on probation by any licensing agency? If “Yes,” explain: Has the Applicant ever been investigated by any third party for alleged fraud, erroneous billing or entered into a Compliance Integrity Agreement? If “Yes,” explain: Has the Applicant entered into any joint ventures or limited partnerships? If “Yes,” explain: (name of venture, % of ownership & description) Is any part of the Applicant operated/leased by a management corporation? If “Yes,” give the name of the corporation, details of the structure and provide a copy of the contract: Does the Applicant participate in any teaching programs or have affiliations with educational institutions? If “Yes,” explain: Does the Applicant anticipate any facility or service expansions within the next year? If “Yes,” explain: Yes Yes Yes Yes Yes No No No No No Yes No Yes No Yes No Yes No Yes No Yes No Does the Applicant anticipate any sale of assets, mergers, acquisitions, consolidation or change in Yes operations or services within the next twelve (12) months? If “Yes,” explain: Provide a detailed explanation for the following questions answered “Yes”, on a separate sheet of paper: Has any company ever declined, cancelled, refused to renew, restricted, or surcharged your Yes professional liability insurance? Have there been any complaints or suits brought against the applicant by a member of its medical staff Yes or any other provider working in the facility? Is the applicant aware of any conduct, circumstance, occurrence, incident, or accident that is likely to or reasonably could be expected to give rise to a claim that has not yet been reported to the current Yes and/or prior insurance carrier? Physical Premises List all buildings the applicant owns, controls, or occupies or attach a separate list. Construction Year # Of Address Use (Brick, Fire Built Stories Resistive etc.) Does the Applicant own, rent, or charter any aircraft or helicopters? Does the Applicant have or maintain a heliport/helipad? a. If “Yes,” where is the pad located (e.g., parking lot, top of building etc.) b. Is the area identified with warning signs and/or fencing? c. Is the area equipped with proper lighting for night or foul weather landings? d. How many annual landings do you have? Does the Applicant own ambulances or other emergency vehicles? Do all locations meet applicable National Fire Protection Agency (NFPA) building codes? Total Sq. Ft. No No No No Complete Sprinkler System Yes No Yes No Yes No Yes No Yes No Yes No Yes Yes No No Yes Yes No No Automobile Exposures If the applicant owns, controls, or hires any automobiles, attach a copy of your business auto coverage if you desire excess or umbrella coverage from AXIS for this exposure and complete the following: Type of ownership # of Private Passenger Autos # of Multi-Passenger Autos # of Ambulances Owned Non-owned or hired HPL-656 (05-14) Page 6 of 11 THE UNDERSIGNED AUTHORIZED OFFICER OF THE APPLICANT DECLARES THAT THE STATEMENTS SET FORTH HEREIN ARE TRUE, AND AFFIRMS THAT IF THE INFORMATION SUPPLIED IN THIS APPLICATION CHANGES BETWEEN THE DATE OF THIS APPLICATION AND THE EFFECTIVE DATE OF INSURANCE, THE UNDERSIGNED WILL IMMEDIATELY NOTIFY THE INSURER OF SUCH CHANGES, AND THE INSURER MAY WITHDRAW OR MODIFY ANY OUTSTANDING QUOTATIONS OR AUTHORIZATIONS OR AGREEMENT TO BIND INSURANCE. FURTHERMORE, THE UNDERSIGNED DECLARES THAT THE SIGNING OF THIS FORM DOES NOT BIND COVERAGE NOR COMMIT TO ORDERING COVERAGE. Alabama Fraud Statement “Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison or any combination thereof.” Arkansas, Louisiana, Rhode Island, and West Virginia Fraud Statement “Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.” Colorado Fraud Statement “It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies.” District of Columbia Fraud Statement “Warning: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.” Florida Fraud Statement “Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete or misleading information is guilty of a felony of the third degree.” Kentucky Fraud Statement “Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information, or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.” Maine Fraud Statement “It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.” Maryland Fraud Statement "Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison." New Jersey Fraud Statement “Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.” New Mexico Fraud Statement “Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil fines and criminal penalties.” Ohio Fraud Statement “Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.” HPL-656 (05-14) Page 7 of 11 Oklahoma Fraud Statement “WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.” Oregon Fraud Statement Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents materially false information in an application for insurance may be guilty of a crime and may be subject to fines and confinement in prison. In order for us to deny a claim on the basis of misstatements, misrepresentations, omissions or concealments on your part, we must show that: A. The misinformation is material to the content of the policy; B. We relied upon the misinformation; and C. The information was either: 1. Material to the risk assumed by us; or 2. Provided fraudulently. For remedies other than the denial of a claim, misstatements, misrepresentations, omissions or concealments on your part must either be fraudulent or material to our interests. With regard to fire insurance, in order to trigger the right to remedy, material misrepresentations must be willful or intentional. Misstatements, misrepresentations, omissions or concealments on your part are not fraudulent unless they are made with the intent to knowingly defraud. Pennsylvania Fraud Statement “Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.” Tennessee, Virginia and Washington Fraud Statement “It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.” This application is for insurance to be placed on a surplus lines basis with AXIS Surplus Insurance Company. Applicant’s Signature Print Name & Title Date (must be signed by the President, CEO, Chairman, Executive Director, CFO, COO or Risk Manager) Attach copies of the following with this application: Current Audited Financial Statement Risk Management Plan Current Professional Liability Policy Medical Staff Bylaws Current Loss Run(s) (valued within 60 days for the current year and a minimum of 5 additional years) Agreements where other parties are indemnified JCAHO or other Accreditation survey (JCAHO - Submit a copy of the most recent JCAHO Accreditation Letter, Scoring Grid and Type 1 Recommendations and responses) Business auto declarations page and loss runs (if excess/umbrella auto coverage desired) HPL-656 (05-14) Page 8 of 11 Supplemental Claim Information Form A copy of this completed and signed supplement is required for all claims involving the applicant. Copies should be made as needed. Claim Basics Applicant Name: Claimant Information: Initials: Date of Alleged Incident: Additional Defendant(s): None Insurer to Whom Claim was Reported: Claim Status Dismissed with Prejudice Defense Verdict Plaintiff Verdict Settlement Open Age: Date Claims was Made: Gender: M F List: Dismissed without Prejudice Total Award: $ Total Award: $ Amount of Reserve: $ Amount Paid on Your Behalf: $ Amount Paid on Your Behalf: $ Amount of Plaintiff’s Demand: $ Claim Description Alleged act(s) on which the claim was based: Description of the Claim: Injury or Damage alleged to have been caused: Other information (optional): I attest that the above information is true and complete to the best of my knowledge, that this information becomes a part of my application for coverage to AXIS, and that it is subject to the same conditions and warranty of my AXIS application. Applicant’s Signature Print Name & Title Date (must be signed by the President, CEO, Chairman, Executive Director, CFO, COO or Risk Manager) HPL-656 (05-14) Page 9 of 11 Nursing Home Supplement Applicant Check this box to confirm all is the same here as it is for the hospital Named Insured: County: Address: City/State/Zip: CEO: Risk Manager: Website: www. Authorized representative for insurance matters: Telephone: Facility History How long has the facility been in operation under your control? Is the facility certified for Medicaid reimbursement? If “No,” explain: Has the facility’s license ever been revoked? If “Yes,” explain: Facility Type Skilled Nursing Facility (24-hour nursing care services are provided) Intermediate Care Facility (medical, nursing, social & rehabilitative services are provided) Personal Care Facility (non-continuous nursing care with supervised living care) Other (describe): years Yes No Yes No months Ownership Corporate Ownership (100%) (list name of corporate owner): Joint Venture / Partnership (list all parties with their % of ownership): Individually owned (list name of individual owner): Other (describe): Facility Services Are all bedridden patients on the ground floor? If “No,” explain: Yes No Are any of the following services contracted from outside the facility? Yes No Dental Dialysis Grooming/Beauty Inhalation Therapy Physical Therapy X-Ray Other (describe): Are Certificates of Insurance required from all contractors for outside services? Yes No If “Yes,” what limits of insurance are required? $ Does the nursing home own or operate any of the following services? Yes No Home Health Care Services Durable medical Equipment Service Adult Day Care Wellness / Fitness Center Program Pharmacy for patients only Pharmacy for non-patients Does the facility sponsor any recreational events involving residents and outsiders? Yes No If “Yes,” describe: What is your ratio of patients to nurses? patients to nurses How many of each of the following employees do you have (if none, show 0)? LPNs RNs Nurse Aides Therapists Pharmacist Volunteers Other (describe): Do you have a transportation arrangement in place for patients requiring acute care? If “Yes,” list the facility name and # of miles from your facility: Is a physician appointed to act as the Medical Director of the facility Yes No Do you credential all attending physicians treating patients in your facility? Yes No I attest that the above information is true and complete to the best of my knowledge, that this information becomes a part of my application for coverage to AXIS, and that it is subject to the same conditions and warranty of my AXIS application. Applicant’s Signature Print Name & Title Date (must be signed by the President, CEO, Chairman, Executive Director, CFO, COO or Risk Manager) HPL-656 (05-14) Page 10 of 11 AXIS Surplus Insurance Company Professional Employee Roster (make copies of this page as needed) Last Name First Name PT?* Specialty NPI#** Retroactive Date 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. *PT = part-time (check box for employees working 20 hours per week or less) ** National Provider Identifier number HPL-656 (05-14) Page 11 of 11