Link to - Filippo Rebessi

advertisement

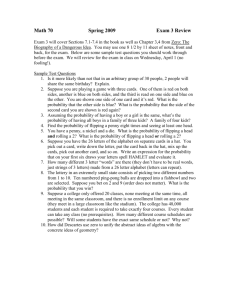

Econ 4401 – International Economics – Spring 2014 Homework #2 Due Date: 3/5/2014, 2:30 PM NO LATE HOMEWORK IS ACCEPTED Hand in your printed (and stapled) copy in class You have to turn in YOUR OWN copy of the assignment You can discuss your solutions with your classmates, but you MUST acknowledge anyone you worked with ********** 1) [20 points] Consider two Countries that share the same technology, South Africa and the UK, and two goods, Diamonds and Tea. There is a Free Trade Agreement in place between them. The Capital Labor ratio to produce Diamonds (K/LD) equals 3, while the Capital Labor ratio to produce Tea (K/LT) is 2. Trade between the two countries is described by the following table (Imports have negative sign, Exports have positive sign; the numbers reported are already converted in a common international currency): South Africa UK Diamonds +100 -100 Tea -30 +30 Suppose all the assumptions of the Heckscher-Ohlin model hold and answer the following: a) Which country do you expect to be relatively Capital Abundant, by looking at this data? Which country you expect to be relatively Labor Abundant? b) Suppose the endowment of Capital for South Africa gets bigger. At constant world prices, what do you expect will happen to South Africa’s production Mix? c) “Labor unions are likely to oppose the free trade agreement in the UK”: True or False? Briefly discuss why d) Suppose data is released on the endowment of Capital and Labor for South Africa and the UK, as the following Table describes: South Africa UK Capital (thousands of machines) Labor (thousands of workers) 1000 3000 500 500 Which country is relatively Capital Abundant? Is this consistent with the HeckscherOhlin Theorem? If not, propose a change to one of the assumptions to rationalize the observed trade pattern. 2) [20 points] Consider the reading posted for week 6 on the class webpage (“China hits back at EU wine over solar panel duties”. a) Suppose China is relatively capital abundant and wine is produced with a labor intensive technology. What does the H-O model predict? b) Suppose we have Increasing Returns to Scale in the Production of Solar Panels. One possible interpretation for this “Trade War” is that both countries in the EU and China want to become leading exporters of Solar Panels. Comment briefly on this statement. c) Suppose we start from a situation in which the EU and China’s K/L happen to be EXACTLY the same! In the initial situation there’s no trade between them. Suppose we have a demand shock in China and all of a sudden Chinese consumers want to consume more wine; demand for Solar Panels in China is unchanged. Also, demand in the EU is unchanged. What would the H-O model predict? d) Consider now the Ricardo’s model of Trade. Suppose China is exporting Solar Panels and importing Wine and trade is balanced. What happens to trade if there’s a positive demand shock for Wine in the EU? 3) [10 Points] Calculate the value of the Intraindustry Trade Index for Mexico and Germany using data from the following table Mexico Exports (millions of Mxn Pesos) Imports (millions of Mxn Pesos) 0 200 Furniture 130 750 Primary Metal Industries 20 500 Coal 230 0 Agricultural Crops 700 50 Industry Automobiles Germany Exports (millions of Euros) Imports (millions of Euros) Automobiles 1000 100 Furniture 350 750 Primary Metal Industries 850 500 Coal 50 300 Agricultural Crops 500 700 Industry