The Impact of Resource Abundance and Resource Inequality on

advertisement

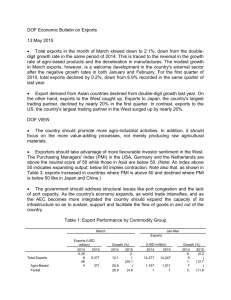

The Effect of Natural Resource Dependence on Human and Physical Capital in Latin America Working Paper Luisa Blanco School of Public Policy Pepperdine University lblanco@pepperdine.edu Robin Grier Department of Economics University of Oklahoma rgrier@ou.edu Abstract We study the impact of natural resource dependence on the accumulation of human and physical capital in a panel of 18 Latin American countries from 1975-2004. In a simultaneous model of human and physical capital, we show that resource dependence, measured as the total exports of primary goods (as a percentage of GDP), is not significantly related to factor accumulation. However, when we disaggregate natural resources into mineral, petroleum, and agricultural categories, we find a very different story. Petroleum export dependence is associated with higher levels of physical capital and lower levels of human capital, while agricultural export dependence has the opposite effect. That is, countries which are dependent on agricultural exports have low levels of physical capital and higher human capital. Thus, the effect of natural resources on factor accumulation is dependent on how resources are defined. JEL Categories: O13, O15, O16 Key Words: Latin America, human capital, physical capital, natural resources, education July 13, 2009 Acknowledgements: We thank Kevin Grier for his comments. We are also thankful to Josephine Huang for excellent research assistance. The paper has also benefited significantly from comments received at the American Economic Association and the Public Choice annual meetings, and the Diversity Initiative for Tenure in Economics Seminar at Duke University. I. Introduction The resource curse, where an abundance of natural wealth ends up being a curse rather than a blessing to a country, is a well-known paradox in the development literature. It is a paradox because resource abundance was once considered a key to economic growth and development. The industrial revolution in England was thought to be driven by the country’s large deposits of coal, while the rise of the US economy was at least partly based on its abundance of natural resources. Modern day examples of the curse abound, however. The Democratic Republic of the Congo, Angola, Gabon, Equatorial Guinea, and Nigeria are just a few developing countries which are rich in sub-soil wealth and poor in almost every other development indicator. In fact, if we were to construct a matrix of natural resources and wealth, we would find that no box would be empty of examples. While there are plenty of resource-rich countries which grew quickly, there are also countries like Japan, which grew extremely quickly in the post-WWII period with few natural resources. There are also countries like Somalia, which has neither natural resource nor economic growth. Thus, the anecdotal evidence suggests that the relationship between resources and development is far from clear cut. We investigate the effect of natural resource dependence on capital accumulation in a panel of 18 Latin American countries from 1975-2004. Our work contributes to the literature on the natural resource curse in four ways. First, we focus on resource dependence (or more specifically, export-dependence on resources) rather than resource abundance.1 The two are not necessarily the same, as Gylfason (2008) points out. Some resource-rich countries, like Australia or the United States, do not rely much on primary commodity exports, while other resource-rich countries, especially the oil-exporters, depend heavily on primary commodity exports. 1 See Brunnschweiler (2008) for more on this topic. 1 Second, we demonstrate that resources are not all alike in their effect on development. Specifically, we find that overall total primary commodity exports are not significantly related to the accumulation of human and physical capital. Petroleum exports, however, are associated with higher levels of physical capital and lower levels of human capital, while countries which export a large percentage of agricultural goods have higher human capital and lower physical capital than non-agricultural exporting countries.2 Third, while much of the literature has either focused on individual countries or large cross-sections, we focus on one particular region, Latin America. Large, cross-sectional studies pool data from a very heterogeneous group of countries. If these countries do not share a common set of coefficients, pooling them will yield biased results.3 Our sample is somewhat homogenous in that the countries share a common colonial background (or similar background in the case of Brazil). Latin America is also a resource-rich, and resource-dependent, region. As an example of resource abundance, the World Bank (2006) found that Latin America and the Caribbean have the second highest per-capita natural capital levels in the world, where natural capital is defined as the sum of all sub-soil assets, timber and non-timber resources, pasture and crop land, and protected areas.4 Further, much of the region is still highly dependent on the export of primary commodities. Even after more than fifty years of diversification towards manufacturing and away from primary goods, 68 percent of Latin America’s total merchandise exports in 2000-2004 still consisted of natural resources.5 2 By the term primary commodities, we refer to those commodities that Leamer (1984) argues are particularly resource-intensive, such as petroleum, forest products, animal products, tropical agricultural products, and cereals. 3 Grier and Tullock (1989) show that countries from Latin America, Asia, Africa, and Western Europe do not share a common set of coefficients in growth regressions. 4 The region has less natural per-capita natural capital than Europe and Central Asia ($11,031) but more than the Middle East and North Africa ($7,989). 5 See Table 1 for a ranking of the countries in our sample by the percentage of primary products exported as a percentage of total merchandise exports. The exports from Ecuador, Nicaragua and Venezuela are the most resource-intensive in Latin America, with primary products making up almost 90 percent of total exports. 2 Fourth, rather than focusing on the effect of resources on economic growth, we instead investigate the relationship between natural resources and physical and human capital accumulation. Grier (2002) shows that human and physical capital are simultaneously determined in Latin America and should be modeled as such. For that reason, we investigate the effect of resource dependence in a simultaneous model of physical and human capital. Section II discusses the effect of resource abundance on physical and human capital, while Section III discusses our methodology and data. Section VI discusses the results and the alternative measures of natural resource intensity that account for different types of commodities. We also discuss the link between resource dependence and institutions in Section IV. Section V concludes. II. Natural Resources and Capital Accumulation Most of the empirical work on natural resources emphasizes the link between resources and economic growth. 6 While it is important to study the relationship between resources and overall growth, we still need to identify the channels through which the resource curse works. That is, natural resource dependence can affect growth through its impact on factor accumulation or by its effect on productivity. In this paper we focus on the former. 6 There is an extensive amount of work that focuses on the relationship between resource abundance and economic growth. While some argue that it is possible that resource wealth can stimulate economic growth (Habakkuk, 1962; Lewis,1989; Brunnschweiler, 2008), much of the literature emphasize the drawbacks to resource abundance (Auty, 2001; Corden, 1984; Gelb, 1988; Neary and van Wijnbergen, 1986; Prebisch, 1950; Sachs and Warner, 1999 and 2001; Tornell and Lane, 1999, Arezki and van der Ploeg, 2007; Coxhead, 2007; and Bulte and Damania, 2008). See Lederman and Maloney (2008) for a good literature review on the impact of resource abundance on growth. 3 Sachs and Warner (1997), Gylfason (2008), Gylfason and Zoega (2006) identify several ways in which resources could negatively affect the accumulation of physical capital.7 First, natural resource wealth may shorten the time horizons of policymakers. They may consume more today, and invest less carefully and productively, than policymakers without access to resource wealth.8 Second, resource dependence may also result in the Dutch disease, where the exports of a profitable primary commodity cause the real exchange rate to appreciate, thus making manufacturing sectors less remunerative.9 If the manufacturing sector is more capital intensive than the commodity sector, then the disease would lead to less overall capital in the economy. Resource dependence can also distort the financial system, especially if most of the resource rents are deposited outside of the country, leaving the domestic banking sector undercapitalized. Entrepreneurs outside of the profitable resource sector may have trouble securing credit. There are also several ways in which resource dependence can affect human capital. Gylfason (2001b) argues that primary commodity sectors tend to use less skilled labor (and possibly less high-quality capital) and have few linkages to other sectors of the economy. Workers in the natural resource sector would have little to offer manufacturing firms looking for a highly skilled labor force, and a government that emphasizes primary commodities would have less need to push for educational investments. Stijns (2006), on the other hand, argues that natural resource wealth (at least in the form of minerals) should be positively related to education 7 On the other hand, the effect of resource dependence on physical capital may depend on what type of commodity is being considered. Mining, for example, is often a very technological complex process requiring a large amount of investment in human and physical capital. 8 Sachs and Warner (1997, p. 10) argue that “governments that controlled natural resource rents tended to waste the rents through profligate or inappropriate consumption.” They go on to note that governments in the 1970s and 80s “encouraged large public investments in projects that were hugely inefficient.” Thus, a commodity boom may lead to more public investment in the short term, but this may crowd out private investment over time. 9 Sachs and Warner (1997) argue that if governments try to counteract the Dutch disease by encouraging inward looking development, then we may see a negative association between natural resource wealth and investment. 4 levels. He argues (2005, p. 1061) that “it would be surprising that while mineral states tend to lavishly spend their revenues on numerous development projects and programs, education would be the only exception.” 10 Empirically, the relationship between natural resources and capital accumulation is mixed. Sachs and Warner (1997), in a cross section of 90 countries from 1970-1990, find no statistically significant relationship between resource wealth and savings, education, and investment. Gylfason (2001a) shows in a cross section of 162 countries from 1965 to 1998 that there is a negative correlation between the share of the labor force in the primary sector and investment rates and secondary education.11 More recently, Gylfason (2008) shows the importance of distinguishing between resource wealth and resource dependence. In a cross section of 108 countries from 1960-2000, he shows that school life expectancy is negatively related to resource dependence but positively correlated with resource wealth.12 Stijns (2006), in a sample of 70 countries from 1971 to 1995, however, shows that the correlation between education and natural resources also depends on how resources are measured. More specifically, he shows that mineral exports are positively correlated with education levels, while agricultural wealth is negatively correlated with education.13 Our paper departs from previous papers in that we investigate the role of resource dependence on physical and human capital accumulation in a well-specified simultaneous system. Most of the earlier papers on the topic calculate correlation coefficients between 10 Gylfason (2008) acknowledges this point, noting that Botswana, a country with enormous diamond wealth, spends more on education (relative to income) than any other nation in the world. 11 The education sample is shortened to 1980-1998 and includes 166 countries. 12 The United Nations defines school life expectancy as “ the total number of years of schooling which a child can expect to receive, assuming that the probability of his or her being enrolled in school at any particular future age is equal to the current enrolment ratio at that age.”(http://unstats.un.org/unsd/Demographic/products/socind/education.htm) 13 Maloney (2002) and Bravo-Ortega and de Gregorio (2006) show how higher levels of human capital can eliminate the negative impact that resource wealth can have on economic development. 5 measures of natural resources and either investment or education. We want to study the effect of resource dependence on factor accumulation while (1) controlling for other relevant variables which could affect human and physical capital, and (2) controlling for the fact that the two types of capital are jointly determined. The next section describes our methodology and the data used to test our hypotheses. III. Methodology and Data We investigate the effect of resource dependence on factor accumulation in a panel of 18 Latin American countries from 1975 to 2004. The sample includes Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, the Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay, and Venezuela. We average the data into 5 year intervals when possible, which allows us to capture information from fluctuations over time and average cross country differences.14 We model human and physical capital in a simultaneous system because Grier (2002) finds in a panel of Latin American countries from 1965 to 1990 that the two forms of capital are jointly endogenous: increases in the stock of physical capital raise average education levels, while increases in average education positively influence the physical capital stock. To construct the physical capital stock per worker variable, we use data from the Penn World Table (Version 6.2; Heston et al., 2006) and follow the perpetual inventory method used by Caselli and Feyrer (2007). Specifically, we estimate initial physical capital with the formula I0/(g+δ), where I0 is the level of investment in the earliest year available (1950 or 1951), g is the average geometric growth rate of the level of investment between the first year available and 14 Brunnschweiler (2008) notes that the exports of commodities are notoriously volatile and that measuring natural resource intensity with a single year of exports may produce misleading results. Using 5 year intervals will help to alleviate any such problems. 6 1970, and δ is the depreciation rate (equal to 6 percent). This means that the physical capital stock per worker in a specific year is the addition of the total capital stock per worker (depreciated at a rate of 6 percent) plus the amount of investment per worker in the previous year.15 We measure the stock of human capital as the average years of primary schooling in the population aged 25 and over. Although secondary schooling is commonly used as a measure of human capital (Mankiw et al., 1992), primary schooling is often a better measure of human capital in developing countries.16 In addition, there is a lot of variation in primary schooling rates in our sample. Even as late as 2000-04, Argentina, Chile, and Panama average more than five years of primary schooling, while Nicaragua, Colombia, and Guatemala report less than three years on average.17 Our measure of resource dependence is the total exports of primary commodities as a percentage of GDP. Table A1 in the Appendix presents a list of the commodities used to construct this indicator.18 For robustness purposes, we re-estimate our model using two alternative measures of dependence: total exports of primary commodities as a percentage of total exports and per-worker exports of primary commodities.19 15 While no approach to measuring physical capital is perfect, we believe that the Caselli and Feyrer (2007) method is appropriate for panel settings because it uses Penn World Tables data, which makes physical capital stock per worker measures comparable across countries. A ranking of countries by per-worker physical capital also make intuitive sense. In our initial period, for example, Venezuela and Argentina have the highest per worker stocks of physical capital, while Paraguay and Honduras have the lowest. These data is available upon request. 16 All the countries in our sample are classified as less developed countries by World Bank standards. 17 Indeed, for our sample, the standard deviation of primary education is almost double that for secondary education. 18 Data on primary commodities is from the United Nations Commodity Trade Statistics Database, SITC, Revision 1. Lederman and Maloney (2008) argue that using total exports overstates resource abundance in countries with export processing zones where commodities are re-exported. They advocate using the net exports of primary resources per worker. While this may be true for countries like Singapore and Trinidad and Tobago, we find no evidence that re-export zones of commodities are an important factor in our sample. Data from the UNCOMTRADE shows that only 5 countries re-exported commodities during the period of analysis, but this re-exporting was scattered over time and not significant in magnitude when compared with total exports. 19 Lujala et al. (2005) argue that using natural resources as a percentage of GDP may be an endogenous regressor in income and growth equations. Countries which are suffering from political instability and low income growth may 7 Estimating any simultaneous system is challenging, but it is especially difficult in a model where the two dependent variables both represent forms of capital. Identification of the system requires that we find variables that are correlated with the accumulation of one type of capital but not the accumulation of the other. In the physical capital equation, we include lags of government spending as a share of GDP, land distribution, trade openness, the standard deviation of the inflation rate, the number of coups and years in which a country experienced a civil war in the previous period.20 To help identify this equation, we assume that the lag of trade openness, the standard deviation of inflation, coups, and civil war directly affect the accumulation of physical, but not human, capital. There are several theoretical and empirical reasons to support this assumption. First, several papers test for an empirical relationship between education levels and trade openness and do not find strong support for the idea that the two are statistically related. Sachs and Warner (1995) find no evidence that closed economies have lower overall levels of education, while Harrison (1996), using several measures of openness, finds no robust relationship between the two.21 appear to be more dependent on primary commodities than they really are because the denominator (GDP) is falling faster than the numerator. We believe this criticism is probably most applicable to resource-rich Sub-Saharan African countries. While Latin America has experienced its fair share of political instability, for the most part the instability has not been as severe or as prolonged as it has in countries like Angola or the Congo. We also are not studying the effect of resource intensity on income or income growth, which should lessen the issue of endogeneity. Lastly, we use alternative measures, such as per-worker terms and share of total exports, which should not suffer from the same endogeneity issue. 20 Unlike Grier (2002), we measure inequality in terms of resources instead of income. Specifically, we follow Easterly (2007) and use the percentage of the total area of land holdings held as family farms. The advantage of using this indicator as a proxy for inequality is that it is consistently available over time for the countries included in the sample. We include the resource distribution measure in both equations since Easterly (2007) has shown that resource distribution also has a significant effect on education. 21 It is possible that the trade openness variable is highly correlated with the natural resource exports variable, thus giving misleading results about the impact of natural resources on capital accumulation. However, in our sample, trade openness and natural resource exports are not significantly correlated (the correlation coefficient is only 0.11) and we use the lag of trade openness in the physical capital equation. 8 Second, the theoretical literature on economic and political instability has not established a clear link between education rates and instability, and the empirical literature has focused almost entirely on the effect of instability on investment (or income growth). One paper that does evaluate education and instability, Fedderke and Klitgaard (1998), finds mixed results, depending on whether the instability threatens the political regime or not. In the human capital equation we include the level and square of the ethno-linguistic fractionalization index, the lag of the number of years in which the country was considered a democracy, the lag of government spending as a share of GDP, and the lag of land distribution.22 For over identification purposes, we assume that democracy and ethno-linguistic fractionalization directly affect the stock of human, but not physical, capital. Much of the empirical literature has failed to find a robust positive link between democracy and income growth.23 The link between education and democracy, however, seems to be quite strong. Theoretically, Saint-Paul and Verdier (1993) create a model where democracy leads to more redistribution and thus more spending on public education. Barro (1996) argues that democratization affects development mostly by increasing female education, which in turn brings down fertility rates. Helliwell (1994) provides supporting evidence in favor of this idea when he finds that the negative relationship between democracy and income growth is at least partially offset by the positive effect that democracy has on education levels.24 Like democracy, the effect of ethno-linguistic diversity on education seems clearer than its effect on investment. The literature has focused on diversity and income growth rather than 22 We use land distribution as a proxy of asset inequality. See Table 2 for a description of the variable and the data we use to construct it. 23 See Brunetti (1997) for a good survey of this literature. 24 Fedderke and Klitgaard (1998) show additional evidence that there is a strong relationship between democracy and education, although they argue that the correlation between the two depends a lot on how democracy is measured 9 investment per se and the results are decidedly mixed (see Lian and Oneal, 1997 and Nettle, 2000, for example). We argue that the fact that we are controlling for economic and political instability in the physical capital equation means that ethno-linguistic fractionalization should have a more direct impact on education than on investment. In sum, our identifying assumptions are that trade openness, inflation variability, and political instability directly affect physical capital and not human capital, while democracy and ethno-linguistic diversity directly affects human, but not physical, capital.25 Table 2 provides a detailed explanation of all the variables used in the analysis and their sources, and Table 3 provides summary statistics. Our model consists of the following two equations: Ln(PKstock)it = α0 + α1Ln(HKstock)it + α2Ln(Natural Resources)it + α3 Government Spending it-1 + α4 Land Distribution it-1 + α5Trade Opennessit-1 + α6 Std. Dev. of Inflation it-1 + α7 Coups it-1 + α8 Civil Warit-1 + uit1 (1) Ln(HKstock)it = β0 + β1Ln(PKstock)it + β2Ln(Natural Resources)it + β3Government Spending it-1 + β4 Land Distribution it-1 + β5 Democracy it-1 + β6 elf1960 + β7 elf19602 + uit2 (2) We estimate the system with a General Method of Moments (GMM) estimator, which accounts for the contemporaneous correlation of the error terms in the two equations and uses a 25 As a preliminary test of these assumptions, we estimated our system including one control variable at a time in the equation in which we assume it should be excluded. We find that these excluded variables are not statistically significant. 10 weighting matrix that is robust to heteroskedasticity.26 GMM minimizes a criterion function that is itself a function of the correlation between the instruments and errors terms, which allows us to test the null hypothesis that our over identifying restrictions are valid. The minimum value of the GMM criterion function multiplied by the sample size is distributed as a χ2 with the degrees of freedom equal to the number of over identifying restrictions in the model.27 We calculate and report this statistic for all of our estimations below. IV. Results A. The effect of natural resource dependency on human and physical capital Table 4 presents the results of our model using total exports of natural resources as a percentage of GDP as our measure of resource dependence (this measure uses all commodities reported in Table A1). The calculated J-test statistic (reported below the results) indicates that we cannot reject the null hypothesis that our identifying restrictions are valid even at the 15 percent level. We find that that physical and human capital are jointly endogenenous, where an increase in the stock of one type of capital has a positive and significant effect on the stock of the other. In addition, we find that inflation variability, coups, civil war, and trade openness are all negatively related to the accumulation of physical capital, although the coefficient on coups is not statistically significant. We show that government expenditures are positively and significantly related to physical capital, while land distribution (our proxy for inequality) is insignificantly different from zero. In the human capital equation, ethno-linguistic diversity has a 26 See Wooldridge (2002) for more on system GMM estimation. The weighting matrix used in our estimation is a White covariance matrix, which is robust to heteroskedasticity of unknown form. In the system GMM estimation we use simultaneous updating, which continuously updates the coefficients and weighting matrix, iterating until the coefficients and weighting matrix converge. 27 The critical value for all systems estimated is 8.12 at the 15 percent level with five degrees of freedom. 11 non-linear effect on human capital. The level of diversity is positive, the squared value is negative, and both are statistically significant at the one percent level. The lagged value of government spending has a negative coefficient, but is not statistically significant in the human capital equation. Land distribution has a statistically significant negative effect on human capital. As expected from other empirical results in the literature, democracy has a positive and significant effect on human capital. Turning to our main variables of interest, we find that natural resource dependence is negatively, but insignificantly, related to human and physical capital. This is consistent with the findings of Sachs & Warner (1999), who show that investment and natural resources are not significantly related. To test the robustness of this result, we re-estimate the system using two alternative measures of resource dependence: primary commodity exports as a percentage of total commodity exports and per-worker commodity exports. Systems 1 and 2 of Table 5 report the results. The sign and significance of the control variables in both systems are very similar to those reported in Table 4. Natural resource dependence, whether measured in per-worker terms or as a percentage of total exports, remains insignificantly related to physical and human capital. The term resource curse usually refers to the effect of resource abundance (or dependence) on overall economic growth. While we are studying factor accumulation and not income growth per se, our results do not indicate any evidence of a curse in Latin America.28 However, our measure of resource dependence consists of a wide range of commodities from different categories. The impact of natural resource dependence on capital accumulation may be 28 While we are studying factor accumulation and not income growth, the two should be positively related. The correlation between real per-capita income and our measure of physical capital from 2000-04 is 0.82, indicating that countries in the region that have more physical capital per worker also tend to have higher average per-capita incomes. 12 dependent on the type of resource in question. For example, the production of minerals requires different levels of physical and human capital than the production of agricultural goods. In the next section, we explore whether the effect of resource dependence on physical and human capital differs depending on the type of commodity that is being exported. B. The effect of different commodity types on capital accumulation As discussed above, it is possible that aggregate measures of resource dependence mask differences among various categories of commodities. Isham et al. (2005), for example, find that countries which have highly localized resources (called point source resources), like minerals and plantation crops, grow slower and have worse institutions on average than countries with more widespread natural resources. In this section, we disaggregate our resource variable into three categories of export dependence: mineral, petroleum, and agricultural.29 We first discuss the reasons why each of these categories may affect the accumulation of capital differently, and then re-estimate our system with a disaggregated measure of resource dependence. B.1 Mineral exports Mineral resources, such as diamonds and oil, may make countries particularly vulnerable to a resource curse, while other commodities, such as pasture land and forests, may be favourable for development. Sala-i-Martin and Subramanian (2003) make this point for the case of Nigeria, arguing that sub-soil assets like minerals and petroleum are bad for growth, while agriculture is not.30 The World Bank (2006, p. 27) calculates that Latin America has the third highest percentage of its natural resources in mineral form. Table 1 shows that mineral exports made up 29 We consider as mineral commodities the commodities from SITC codes 32, 34, 35, and 68. Petroleum is specified by the SITC code 33. Agricultural commodities include 1-9, 11, 12, 41-43, and 94 SITC codes. 30 On the other hand, Stijns (2005) makes almost the opposite claim, arguing that land abundance may negatively affect growth while minerals may have either a positive or negative effect. 13 20 percent of total merchandise exports on average in 2000-2004. While many of the countries in the sample are large mineral exporters, there is a lot of variation in the sample. For instance, more than 30 percent of total merchandise exports from Ecuador, Venezuela, Chile, Bolivia, Peru, and Colombia consist of mineral exports, while less than 2 percent do in Nicaragua, Paraguay, Honduras, Uruguay, and Costa Rica.31 Much of the resource-curse literature studies the effect of mineral assets on overall economic growth and the results so far have been mixed. The empirical literature on minerals and growth has produced mixed results, and the relationship between mineral export dependence and factor accumulation is similarly unclear as well.32 Mining is typically a very capital-intensive process, but one that may not have a lot of forward and backward linkages to the rest of the economy.33 It is possible that developing countries which rely heavily on mining exports could have widespread poverty combined with high per-capita levels of physical capital. Auty (2001), however, shows that fast-growing resource-poor countries had average gross fixed investment rates greater than 25 percent of GDP. He compares that to resource-rich Latin America, where Edwards (1997) found that investment levels averaged only 20 percent of GDP from 1960-1980. With respect to mineral export dependence and the accumulation of human capital, Gylfason (2001) and Birdsall et al. (2001) find evidence that the two are negatively related, while Davis (1995) and Stijns (2006) report a positive and significant relationship. One reason the results are so mixed may be that mineral resources should be divided into petroleum and non-petroleum categories. We explore the 31 Chile, for example, has “one of the largest and most-developed mining industries in the world” and is the “world's leading supplier of copper and copper ores and concentrates.”(WTO, Chile, p. 68). 32 Papyrakis and Gerlagh (2004) find in a large cross section of countries that mineral resources have both positive and negative effects on growth, but that the negative effects outweigh the positive ones. Davis (1995) reports a positive link between minerals and growth, while Stijns (2005) finds that the empirical relationship is mixed. 33 Auty (2001, p. 30) writes that “the mining sector usually employs much foreign capital but only a small, albeit well-paid workforce, so that final demand linkage (i.e. domestic spending by capital and labor) is modest.” 14 possibility in the next section that petroleum exports may have a separate effect on factor accumulation. B.1 Petroleum exports While petroleum is also a sub-soil resource and is often categorized as such, it is worth disaggregating the data further testing to see if petroleum exports have a separate effect on factor accumulation. Karl (2007, p. 7) argues that petroleum exports are even more prone to the resource curse than other minerals, noting that “petroleum may be one of the hardest resources to utilize well; countries dependent on oil exports seem particularly susceptible to policy failure.” On the other hand, the effect of petroleum exports on capital accumulation is likely to be similar to that of minerals in general in the sense that the oil industry is highly capital intensive with very few linkages to the rest of the domestic economy. Karl (2007, p. 11) finds that educational attainment and spending on education are both lower on average in oil exporting countries, “in the OPEC countries, for example, 57 percent of all children go to secondary school compared with 64 percent for the world as a whole; OPEC spends less than 4 percent of the GNP on education compared with almost 5 percent for the world as a whole (in 1997 figures).” The reason why education lags in these countries is not obvious, but Karl (2007) reasons that perhaps governments are less concerned with educating the citizenry because they feel they can import the skilled personnel to work in the oil sector. B.3. Agricultural exports 15 Manufacturing is typically more capital intensive, both in terms of skills and equipment, than agricultural production. So in this sense it would not be surprising to find a negative relationship between agricultural export dependence and lower physical and human capital. This would be especially true if countries are experiencing the Dutch disease, where the primary good sector is pushing out the more technologically advanced manufacturing sector. It is also possible that large plantation crops, such as sugar or tobacco, may be similar to mineral sectors in that they are capital-intensive enclaves with little linkages to the rest of the economy. Citing Baldwin (1956), Auty (2001) argues that if commercial plantation owners dominate the economy, they may see little reason to expand educational opportunities or work towards economic diversification. They would be interested in infrastructure development only to the extent that it facilitated the exporting of their crops. Appendix A.2 provides the top five agricultural exports for each country in 2006 and lists the exports of each product as a percentage of total merchandise exports and total agricultural exports. Nicaragua and Honduras rely more on agricultural exports than any other countries in the sample, with agricultural goods making up more than 65 percent of both countries’ natural resource exports. In addition, despite many years of export diversification attempts, total agricultural exports in most of the countries in our sample are dominated by few products. For example, five commodities (soybeans, beef, maize, soybean cake, and soybean oil) make up 83 percent of Paraguay’s agricultural exports.34 Unlike the case of mineral resources, Stijns (2006) finds that agricultural export intensity is negatively related to human capital. Isham et al. (2005) argue that only 3 of the 17 Latin 34 Likewise, the top five agricultural exports of Honduras (coffee, bananas, palm oil, melons, and sugar) make up 77 percent of its total agricultural exports, while the top five in Bolivia (soybean cake, soybean oil, nuts, sunflower oil, and oilseed flower) and Ecuador (bananas, organic materials, cocoa beans, fruit, and sugar confectionery) make up 74 percent and 76 percent, respectively, of their total agricultural exports. 16 American countries in their sample are diffuse resource exporters (Argentina, Honduras, and Panama). The fact that so few of Latin American countries export diffuse commodities may mean that agricultural export dependence negatively affects factor accumulation. B.4. Results We disaggregate our original resource variable into mineral, petroleum, and agricultural categories. 35 Table 6 reports the results, with System 1 using mineral, petroleum, and agricultural exports as a percentage of GDP, and System 2 using per-worker measures of each category. We find that the different types of commodities have very different effects on factor accumulation. While the coefficients on mineral and petroleum exports are both positively related to physical capital and negatively correlated with human capital, the petroleum results are more statistically significant. 36 Petroleum exports as a percentage of GDP (and in per-worker terms) is positive and significant at the 0.01 level in the physical capital equation and negative and significant at the 0.01 level in the human capital equation. The effect of mineral exports on physical capital is only marginally significant in System 1, and its relationship with human capital is never statistically significant. 37 35 Note that commodities with the SITC codes 21-29, 63, and 64 in Table A1 are not included in either the mineral or agricultural classification. These commodities do not fit in either category and are better classified as materials. When we add a materials variable to our model, we find that the coefficient is statistically insignificant and that its inclusion does not affect the sign or magnitude of the coefficients on the other commodity types. These results are not included for purpose of space but are available upon request. 36 Our measure of mineral export dependence consists of commodities classified as minerals and metals. Since the natural log cannot be taken of a zero value, we adjusted 4 observations for Paraguay to a number very close to zero (we imputed 1E-13 for the following variables: mineral exports GDP share, per worker mineral exports, petroleum exports GDP share, and per worker petroleum exports). For robustness sake, we also estimated the systems using the natural resource variable in levels. We do not report the results for reasons of space but they are very similar to those reported in Table 6. 37 We also estimated the model with mineral, petroleum, and agricultural exports as a percentage of total exports and found very similar results. The results are not reported here for reasons of space. 17 Table 6 also shows that indicate that agricultural export dependence has a very different effect on factor accumulation. Agricultural exports are negatively and significantly related to physical capital accumulation and positively and significantly related to human capital accumulation (both at the 0.01 level). This means that countries which export more agricultural goods (either as a percentage of GDP or in per-worker terms) tend to have lower levels of physical capital but higher levels of education.38 We calculate the direct and net effect of mineral, petroleum, and agriculture exports on capital accumulation using the coefficients from System 1 in Table 6 (columns 1 and 2). An increase in mineral dependence of one percent leads to an increase in per-worker physical capital of 0.01 . Thus, the direct effect of mineral export dependence on capital accumulation is small, an important finding since mineral wealth is often pointed to as a source of the resource curse. The direct effect of a one percent increase in petroleum exports is reflected in an increase in physical capital of 0.06 percent and a decrease in human capital of 0.03 percent. Agricultural dependence has the opposite effect, with an increase of agricultural exports as a share of GDP of one percent is associated with a decrease in physical capital of 0.21 and an increase in human capital of 0.07 percent. Since the two forms of capital are jointly determined, there are spillover effects between them and we need to calculate the long-run equilibrium effect of each commodity group on capital. The net effect of a one percent increase in mineral exports results in an increase in physical capital by 0.02 percent and an increase in human capital of 0.01 percent. Thus the net effect of minerals is positive on capital accumulation, but the effect is of small magnitude. The net effect of a one percent increase in petroleum exports results in an increase in physical capital 38 The signs and significance of the control variables are similar to those reported in Tables 5 and 6, except government spending now has a significant negative effect on the accumulation of human capital. 18 by 0.02 percent, but a decrease on human capital by the same magnitude. Thus, the overall quantitative effect of petroleum dependence on capital accumulation is quite small. The net effect of an increase of agricultural exports as a share of GDP by one percent is reflected in the long run as a decrease in physical capital by 0.22 and a decrease in human capital by 0.003 percent. From this result, we conclude that the effect of agricultural export dependence on capital accumulation is negative on physical capital and close to zero on human capital. In sum, our results demonstrate that not all resources affect factor accumulation in the same way and that studies of the impact of resource dependence on development should disaggregate resources into categories. Specifically, we find that petroleum and agricultural exports have a significant (but opposite) effect on capital accumulation. While the net effect of petroleum on physical capital is positive, the effect of agricultural exports is negative. In addition, only petroleum has a negative net effect on the accumulation of human capital. Thus, while the evidence is somewhat mixed, there does not seem to be strong and consistent evidence of a resource curse in Latin America, at least in terms of factor accumulation. In the next section, we test the robustness of our results by controlling for several institutional variables. C. The link between Resource Dependence and Institutions The literature on the resource curse has increasingly emphasized the important role of institutions in determining whether resource abundance positively or negatively affects economic growth. The idea is that resource-rich countries often have institutions that deter growth and the accumulation of capital because of the rent seeking opportunities that this natural wealth presents. Resource dependence may also negatively affect democratic institutions and bureaucratic quality, leading to corruption, less civil liberties, and economic stagnation.39 39 Boschini et al. (2003), Isham et al. (2005), Karl (2007), and Ross (2001), among others emphasize how natural resources have a significant impact on institutions. 19 We have been less concerned about the role of institutions in this paper because our main purpose was to determine whether Latin American countries did in fact suffer from a resource curse, in the sense that they had lower capital accumulation than less resource-dependent countries. We find no evidence of an overall curse in Latin America, in that primary commodity export dependence is not significantly related to either human or physical capital accumulation. The exporting of minerals also does not have a quantitatively important effect on capital accumulation. However, with agricultural commodities, there is some evidence that export dependence negatively affects the stock of physical capital. In this section, we test whether this negative relationship disappears once we control for institutional factors. We already have one institutional variable in our system of equations—democratic rule— but here we add several additional measures of institutional quality (constraints on the executive, civil liberties, corruption, and law and order).40 Their inclusion in the system allows us to determine whether the relationship between agricultural exports and capital accumulation holds up even when we are controlling for institutions. We include the variables into the system one at a time and find that in all cases, the sign and significance level of the petroleum and agricultural variables remain unchanged.41 Thus, we can conclude that the negative relationship between agricultural exports and physical capital does not disappear when we control for several institutional measures common in the literature. 40 We used the five year average of the indicator of constraint on the executive provided by Marshall and Jaggers (2007). For the civil liberties variable, we construct the 5 year average with the available observations for the period of analysis from the Civil Liberty Dataset (Skaaning, 2006). We chose this dataset due to its wide coverage in the Latin American region over a long period of time. For the corruption and law and order variables, we used data from the International Country Risk Guide (Political Risk Service Group, 2007). We calculate the average of corruption and law and order over the whole period, using observations from 1984 through 2004 (earlier observations are not available). 41 Results not included for purpose of space but are available upon request. 20 V. Conclusion We find novel results about the impact of natural resource wealth on development in a sample of Latin American countries. We show that overall resource dependence has no significant effect on capital accumulation, which would seem to refute the idea that there is a natural resource curse at work in Latin America, at least with respect to factor accumulation. In addition, we demonstrate that not all resources effect capital in the same way. We find that it is petroleum, and not mineral exports in general, which has a significant effect on capital accumulation. This is an important distinction since several of the countries in the region are large petroleum exporters. Further, we find that the effect of agricultural dependence on capital accumulation is very different than the effect of petroleum dependence. Agricultural export dependence negatively affects physical capital and this impact is quantitatively larger than the effect on any of our other measures of natural resource dependence. The impact of agricultural dependence on capital accumulation finding deserves further research. It would be interesting to investigate the relationship between agricultural production and capital in more depth. The effect of agricultural production on capital accumulation might be dependent on the degree of land concentration, where the impact of plantation agriculture on capital accumulation differs from the effect of smallholder agriculture. The type of technology used in agricultural production and the geographic characteristics of land might also explain the impact of agricultural dependence on capital accumulation. In addition, while our results illuminate the relationship between natural resources and capital accumulation for the Latin American area, further work could extend these results by investigating the relationship in other regions. The results here may not be easily generalized, as the effect of natural resources on economic development is likely to vary across regions. 21 References Acemoglu, Daron, 1996, A Microfoundation for Social Increasing Returns in Human Capital Accumulation, Quarterly Journal of Economics 111(3): 779-804. Arezki, Rabah and Frederik van der Ploeg, 2007, Can the Natural Resource Curse Be Turned Into a Blessing? The Role of Trade Policies and Institutions, International Monetary Fund, IMF Working Papers 07/55. Auty, Richard M. (ed.), 2001, Resource Abundance and Economic Development (Oxford: Oxford University Press). Auty, Richard M. and Kiiski Sampsa, 2001, Natural Resources, Capital Accumulation, Structural Change, and Welfare. In R. M. Auty (Ed.), Resource abundance and economic growth (Oxford: Oxford University Press): 25-34. Baldwin, R.E., 1956, Patterns of settlement in newly settled regions, Manchester School of Social and Economic Studies 24, 161-179. Barro, Robert and Lee, Jong-Wha, 2001, International Data on Educational Attainment: Updates and Implications, Oxford Economic Papers 53(3): 541-63. Barro, Robert, 1996, Democracy and Growth, Journal of Economic Growth 1, 1-27. Benhabib, Jess and Spiegel, Mark, 1997, Growth and Investment across Countries: Are Primitives All that Matter? Working paper, New York University. Birdsall, N., Pinckney, T., & Sabot, R., 2001, Natural resources, human capital, and growth. In R. M. Auty (Ed.), Resource abundance and economic growth (Oxford: Oxford University Press): 57-75. Boschini, Anne, Jan Pettersson, and Jesper Roine, 2007, Resource Curse or Not: A Question of Appropriability, Scandinavian Journal of Economics 109(3): 593-617. Bravo-Ortega, Claudio and de Gregorio, José, 2006, The Relative Richness of the Poor? Natural Resources, Human Capital and Economic Growth in Daniel Lederman and William Maloney (eds.) Neither Curse Nor Destiny: Natural Resources and Development (Stanford, CA: Stanford University Press). Brunetti, Aymo, 1997, Political Variables in Cross-Country Growth Analysis, Journal of Economic Surveys, 11: 163-190. Brunnschweiler, Christa N., 2008, Cursing the Blessings? Natural Resource Abundance, Institutions, and Economic Growth, World Development 36(3): 399-419. 22 Bulte, Erwin and Richard Damania, 2008, Resources for Sale: Corruption, Democracy and the Natural Resource Curse, B.E. Journal of Economic Analysis and Policy: Contributions to Economic Analysis and Policy 8(1), article 5. Caballé, Jordi and Santos, Manuel, 1993, On Endogenous Growth with Physical and Human Capital, Journal of Political Economy 101(6): 1042-1067. Caselli, Francesco, and Feyrer, James, 2007, The Marginal Product of Capital, Quarterly Journal of Economics 122(2): 535-568. Castello, Amparo and Domenech, Rafael, 2002, Human Capital Inequality and Economic Growth: Some New Evidence, Economic Journal 112(478): 187-200. Corden, Max, 1984, Booming Sector and Dutch Disease Economics: Survey and Consolidation, Oxford Economic Papers 36(3): 359-80. Coxhead, Ian, 2007, A New Resource Curse? Impacts of China's Boom on Comparative Advantage and Resource Dependence in Southeast Asia, World Development 35(7): 1099-1119. Cross National Time Series (CNTS), online: http://www.databanksinternational.com/ Davis, Graham, 1995, Learning to Love the Dutch Disease: Evidence from the Mineral Economies, World Development 23(10): 1765-1779. Easterly, William and Levine, Ross, 1997, Africa's Growth Tragedy: Policies and Ethnic Divisions, Quarterly Journal of Economics 112(4): 1203-1250 Easterly, William, 2007, Inequality Does Cause Underdevelopment, Journal of Development Economics 84(2): 755-776. Edwards, Sebastian, 1997, Why are Latin American Saving Rates So Low? In N. Birdsall and F. Jasperson (Eds.), Pathways to Growth: Comparing East Asia and Latin America (Baltimore, MD: Johns Hopkins University Press), 131-158. Food and Agricultural Organization of the United Nations (FAO), 2008, TradeSTAT, online: http://faostat.fao.org/site/535/default.aspx#ancor. Fedderke, Johannes and Klitgaard, Robert, 1998, Economic growth and social indicators: an exploratory analysis, Economic Development and Cultural Change 46(3): 455489. Galor, Oded and Moav, Omer, 2006, Das Human-Kapital: A Theory of the Demise of the Class Structure, Review of Economic Studies 73(1): 85-117. 23 Gelb, Alan, 1988, Oil Windfalls: Blessing or Curse? (New York: Oxford University Press for the World Bank). Grier, Kevin and Gordon Tullock, 1989, An Empirical Analysis of Cross-National Economic Growth, 1951-1980, Journal of Monetary Economics 24: 259-276. Grier, Robin, 2002, On the Interaction of Human and Physical Capital in Latin America, Economic Development and Cultural Change 50(4): 891-912. Gylfason, Thorvaldur, 2001a, Nature, Power, and Growth, Scottish Journal of Political Economy 48(5): 558-588. Gylfason, Thorvaldur, 2001b, Natural Resources, Education, and Economic Development European Economic Review 45(4-6): 847-859. Gylfason, Thorvaldur and Zoega, Gylfi, 2001, Natural Resources and Economic Growth: World Economy, 2006, 29, (8), 1091-1115. Gylfason, Thorvaldur, 2008, Development and Growth in Mineral-Rich Countries, CEPR Discussion Paper 7031. Gylfason, Thorvaldur and Gylfi Zoega, 2006, Natural Resources and Economic Growth: The Role of Investment, World Economy 29(8): 1091-1115. Habakkuk, H.J., 1962, American and British Technology in the Nineteenth Century (Cambridge, Mass: Cambridge University Press). Harrison, Ann, 1996, Openness and Growth: A Time Series-Cross Country Analysis for Developing Countries, Journal of Development Economics 48: 419-447. Helliwell, John F., 1994, Empirical Linkages between Democracy and Economic Growth, British Journal of Political Science 24: 225-248. Heston, Alan, Summers, Robert and Aten, Bettina, 2006, Penn World Table Version 6.2, Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania. Isham, Jonathan, Michael Woolcock, Lant Pritchett, and Gwen Busby, 2005, The Varieties of Resource Experience: How Natural Resource Export Structures Affect the Political Economy of Economic Growth, The World Bank Economic Review 19(2): 141-174. Kaldor, Nicolas, 1966, Causes of the Slow Rate of Growth in the United Kingdom (Cambridge, England: Cambridge University Press). Karl, Terry, 2007, Oil-Led Development: Social, Political, and Economic Consequences, CDDRL Working Paper No. 80. 24 Kosempel, Stephen, 2004, A Theory of Development and Long Run Growth, Journal of Development Economics 75(1): 201– 220 Leamer, Edward, 1984, Sources of International Comparative Advantage: Theory and Evidence (MIT Press; Cambridge, Massachusetts) Leamer, Edward, 1995, The Heckscher-Ohlin Model in Theory and Practice, Princeton Studies in International Finance, 77 (Princeton University; Princeton, New Jersey) Lederman, Daniel and Maloney, William, 2008, In Search of the Missing Resource Curse, Economía 9(1): 1-39. Lewis, Stephen, 1989, The Experience of Primary Exporting Countries, in Hollis Chenery and T.N. Srinivasan (eds.) Handbook of Development Economics, Volume II (Amsterdam: North-Holland), Chapter 29: 1541-1600. Lian, Brad and John R. Oneal, 1997, Cultural Diversity and Economic Development: A CrossNational Study of 98 Countries, 1960-1985, Economic Development and Cultural Change 46: 61-78. Lujala, Paivi, Peter Glesditsch and Elisabeth Gilmore, 2005, A Diamond Curse? Civil War and a Lootable Resource, Journal of Conflict Resolution 49(4): 538-62. Maloney, William, 2002, Missed Opportunities: Innovation and Resource-Based Growth in Latin America, Economía 3(1): 111-167. Mankiw, Gregory, Romer, David, and Weil, David, 1992, A Contribution to the Empirics of Economic Growth, Quarterly Journal of Economics, 107(2): 407-437. Marshall, Monty, and Jaggers, Keith, 2007, Democracy IV Project, online: http://www.systemicpeace.org/inscr/inscr.htm. Neary, Peter and van Wijnbergen, Sweder, 1986, Natural Resources and the Macroeconomy (MIT Press). Nettle, Daniel, 2000, Linguistic Fragmentation and the Wealth of Nations: The Fishman-Pool Hypothesis Reexamined, Economic Development and Cultural Change 48: 335-348. Oxford Latin American Economic History Database (OXLAD), online: http://oxlad.qeh.ox.ac.uk Papyrakis , Elissaios and Reyer Gerlagh, 2004, The resource curse hypothesis and its transmission channels, Journal of Comparative Economics 32, 181-193. Political Risk Service Group, 2007, International Country Risk Guide Dataset, online: http://www.prsgroup.com/ICRG_Methodology.aspx. 25 Prebisch, Raúl, 1950, The Economic Development of Latin America and its Principal Problems (New York: UN Economic Commission for Latin America). Romer, Paul, 1993, Idea Gaps and Object Gaps in Economic Development, Journal of Monetary Economics 32(3): 543-573. Sachs, Jeffrey and Andrew Warner, 1995, Economic Reform and the Process of Global Integration, Brookings Papers on Economic Activity 1: 1-95. Sachs, Jeffrey and Warner, Andrew, 1999, The Big Push, Natural Resource Booms and Growth, Journal of Development Economics 59(1): 43-76. Saint-Paul, Gilles and Thierry Verdier, 1993, Education, Democracy and Growth, Journal of Development Economics 42: 399-407. Sala-i-Martin, Xavier and Arvind Subramanian, 2003, Addressing the Natural Resource Curse: An Illustration from Nigeria, NBER Working Paper 9804. Skaaning, Svend-Erik, 2006, The Civil Liberty Dataset, online: http://www.democracy-assessment.dk/start/page.asp?page=22. Stijns, Jean-Philippe, 2006, Natural Resource Abundance and Human Capital Accumulation, World Development 34(6): 1060-1083. Tornell, Aaron and Philip Lane, 1999, Voracity and Growth in Discrete Time, Economic Letters 62(1): 139-145. United Nations Commodity Trade Statistics Database (UN COMTRADE), online: http://comtrade.un.org/. United Nations Statistical Division, 2008, Annual Totals Table (ATT) for Imports and Exports, online: http://unstats.un.org/unsd/trade/imts/annual%20totals.htm. Vanhanen, Tatu, 2003, Democratization: a Comparative Analysis of 170 Countries (London: Routledge). Wooldridge, Jeffrey, 2002, Econometric Analysis of Cross Section and Panel Data (Cambridge: MIT Press). World Bank, 2006, Where Is the Wealth of Nations? Measuring Capital for the 21st Century, Washington, D.C. World Development Indicators (WDI), online: http://go.worldbank.org/B53SONGPA0 World Trade Organization, Trade Policy Review, various issues, online: http://www.wto.org/english/tratop_e/tpr_e/tpr_e.htm. 26 Zeng, Jinli, 2003, Reexamining the Interaction between Innovation and Capital Accumulation, Journal of Macroeconomics 25(4): 541-560. 27 Table 1. Commodity exports as a percentage of total merchandise exports (2000-2004 average) Mineral Exports Agriculture Exports Material Exports Total Commodity Exports Ecuador Nicaragua Venezuela Paraguay Chile Bolivia Honduras Peru Colombia Guatemala Uruguay Dominican Rep. El Salvador Brazil Costa Rica Mexico 45 2 86 0 30 31 1 30 39 8 2 16 7 7 1 11 38 77 1 35 26 27 65 28 18 51 47 41 35 22 31 5 7 10 1 52 30 22 14 21 8 7 16 4 10 19 5 2 91 89 89 86 85 81 81 79 65 65 65 61 52 47 38 18 Regional Average 20 35 14 68 Source: Authors’ construction using UNCOMTRADE dataset. Mineral commodities include the commodities from SITC codes 32-35, and 68. Agricultural commodities include 1-9, 11, 12, 41-43, and 94 SITC codes. The materials category include commodities with the SITC codes 21-29, 63, and 64 See Table A1 in the Appendix for a description of the commodities included in each category. 28 Table 2. Variable Description and Sources Variable Description Physical Capital Stock We estimate the physical capital stock per worker following the perpetual inventory method and use Caselli and Feyrer’s (2007) approach to estimate the initial capital stock. The initial stock is estimated as I0/(g+δ), where I0 is the level of investment in the earliest year available (1950 or 1951), g is the average geometric growth rate of the level of investment between the first year available and 1970, and δ is the depreciation rate equal to six percent. The level of investment in a specific year (It) is estimated as the product of the real GDP per capita (Laspeyres constant prices), population, and investment share. The number of workers in a specific year is calculated as the product of the real GDP per capita (Chain series constant prices) and the population divided by the real GDP per worker. The physical capital stock per worker in a specific year is the addition of the initial level of capital stock per worker in the previous year (depreciated at a rate of 6 percent) plus the amount of investment per worker in the previous year. Source: Authors’ calculation using data from Penn World Tables (PWT, Heston et al., 2006). Human Capital Stock The average years of primary schooling of the population aged 25 and over. Data available in a 5 year frequency, where we use data from 1999 (the latest available observation) for the 2000-2004 observation. Source: Barro and Lee (2001). Total exports of natural resources (per worker) Primary exports divided by the labor force. Total exports, estimated by including commodities in Table A1 (SITC Version 1, codes: 0, 1, 2, 3, 4, 63, 64, 68, and 94) divided by the labor force, which is calculated as the population between 15 and 64 years old. Source: Authors’ calculation using data from UN COMTRADE and WDI. Total exports as a Total exports as a share of GDP (Total Exports). Total exports, estimated share of GDP (Total by including commodities in Table A1 (SITC Version 1, codes: 0, 1, 2, 3, Exports) 4, 63, 64, 68, and 94), divided by total GDP (Total Commodities Exports) in current US dollars. Source: Authors’ calculation using data from UN COMTRADE and WDI. Resource distribution The share of the total area of holdings that considered family farms. Data available in a 10 year frequency (1978, 1988, etc), where observation in the decade is used for the two 5 year observations in a decade. Source: Vanhanen (2003). Government share Government share of real GDP per capita. Source: PWT (Heston et al., 2006). Trade openness Exports plus imports as a share of real GDP per capita (Laspeyres constant prices). Source: PWT (Heston et al., 2006). 29 Table 2 (continued). Variables Description and Sources Variable Description Standard deviation of inflation The standard deviation of the inflation rate in each 5 year period. Source: Oxford Latin American Economic History Database (OXLAD, 2003) Coups Number of coups in the 5 year period. Source: CNTS. Civil war Number of years in the 5 year period that there is a civil war. Source: CNTS. Ethno-linguistic fractionalization Ethno-linguistic fractionalization index in 1960. Measures the probability that two randomly selected people from a given country will not belong to the same ethno-linguistic group. Time invariant. Source: Easterly and Levine (1997). Democracy Number of years in the 5 year period a country was considered a democracy (democracy score greater that 7). Source: Marshall and Jaggers (2007). Note: 5 year averages are constructed with available observations for 1970-74, 1975-79, 1980-84, 198589, 1990-94, 1995-99, and 2000-04, unless otherwise noted. Linear interpolation was used to construct the measure of total exports for the Dominican Republic in the 1990s due to data unavailability. 30 Table 3. Summary Statistics, 1975-2004 Mean 10.199 Max. 11.359 Min. 9.080 Std. Dev. 0.630 1.203 1.777 0.291 0.293 Government share t-1 19.411 48.863 10.766 6.424 Resource distribution t-1 24.426 54.000 5.000 10.688 Trade Openness t-1 47.534 190.963 7.245 36.077 228.472 6008.391 0.284 887.411 Coups t-1 0.194 2.000 0 0.502 Civil war t-1 0.315 5.000 0 1.047 Democracy t-1 1.898 5.000 0 2.242 Ethno-linguistic fractionalization 0.259 0.680 0.040 0.205 ln(NR exports GDP share) -2.247 -1.292 -3.778 0.566 ln(Per-worker NR exports) 5.735 7.497 4.467 0.671 ln(NR exports total exports share) -0.312 -0.015 -1.945 0.342 ln(Agricultural exports GDP share) -3.110 -1.569 -6.536 0.975 ln(Per-worker agricultural exports) 4.870 6.731 2.368 0.906 ln(Mineral exports GDP share) -6.950 -2.175 -29.934 3.965 ln(Per-worker mineral exports) 0.886 6.349 -29.934 4.948 ln(Petroleum exports GDP share) -6.122 -1.463 -29.934 3.477 ln(Per-worker petroleum exports) 1.779 7.455 -29.934 4.162 ln(Human Capital stock) ln(Physical capital per worker) Std. deviation of inflation t-1 All variables have 108 observations 31 Table 4. The Effect of Natural Resource Intensity on Human and Physical Capital (GDP share) Variable Constant ln(Human Capital) Physical Capital 7.39 (18.3) 2.32 *** (9.3) ln(Physical Capital) ln(Natural Resources) Resource distribution t-1 Government share t-1 Trade openness t-1 Std. dev. inflation t-1 Coups t-1 Civil war t-1 -0.03 (0.3) 0.001 (0.2) 0.02 ** (2.3) -0.004 *** (4.8) -0.00005 ** (2.2) -0.03 (0.9) -0.08 *** (3.2) -1.11 (2.3) 0.344 *** (6.460) -0.014 (0.4) -0.005 ** (2.2) -0.005 (1.5) 0.02 *** (3.2) 2.29 *** (4.4) -3.23 *** (4.4) Democracy t-1 Ethno-linguistic frac. Ethno-linguistic frac. 2 Observations J-test J-test probability Human Capital 108 3.29 0.65 The numbers in parentheses are t-statistics. ***, **, and * represent statistical significance at the one, five, and ten percent level. Time dummies were estimated but not reported for reasons of space. 32 Table 5. The Effect of Natural Resource exports on Human and Physical Capital (per worker and total export share) System 1 Variable Constant ln(Human capital) Physical Capital 7.4 (21.2) 2.39 *** (9.5) ln(Physical capital) ln(Natural resources) Resource distribution t-1 Government share t-1 Trade openness t-1 Std. dev. inflation t-1 Coups t-1 Civil war t-1 -0.12 (0.9) 0.0001 (0.02) 0.019 ** (2.3) -0.004 *** (4.2) -0.00004 * (1.8) -0.03 (0.9) -0.08 *** (2.9) Democracy t-1 Human Capital -1.11 (2.2) 0.204 *** (3.8) -0.02 (0.3) -0.004 * (1.84) -0.005 (1.6) Physical Capital 6.9 (14.8) 2.11 *** (6.8) 0.14 (1.4) 0.001 (0.1) 0.018 ** (2.5) -0.004 *** (4.4) -0.00003 (1.3) -0.07 * (1.7) -0.07 ** (2.5) 0.02 *** (2.8) 2.27 *** (3.7) -3.16 *** (3.7) Ethno-linguistic frac. Ethno-linguistic frac.2 Observations J-test J-test probability System 2 108 3.03 0.69 Human Capital -1.17 (2.6) 0.197 ** (3.2) 0.03 (0.6) -0.004 ** (2.1) -0.005 * (1.8) 0.01 * (1.8) 2.19 *** (4.3) -3.07 *** (4.02) 108 2.97 0.70 The numbers in parentheses are t-statistics. ***, **, and * represent statistical significance at the one, five, and ten percent level. Time dummies were estimated but not reported for reasons of space. System 1 uses the total exports of primary commodities as a percentage of total commodity exports, while System 2 uses per- worker exports of primary commodities (see Table A1 for the commodities included). 33 Table 6. The Effect of Mineral, Petroleum, and Agricultural Exports on Capital Accumulation Variable Constant ln(Human capital) System 1 Physical Capital 8.05 (28.90) 1.69 *** (9.92) ln(Physical capital) Human Capital -2.42 (4.64) 0.01 * (1.81) 0.06 *** (7.71) -0.21 *** (5.59) 0.34 *** (6.42) -0.001 (0.43) -0.03 *** (4.35) 0.07 *** (3.07) Resource distribution t-1 0.001 (0.43) -0.003 ** (2.22) Government share t-1 0.02 *** (3.64) -0.01 *** (2.56) Trade openness t-1 -0.002 *** (4.03) ln(Mineral exports) ln(Petroleum exports) ln(Agricultural exports) Std. dev. inflation t-1 System 2 Physical Capital 8.90 (32.12) 1.94*** (9.72) 0.01*** (3.06) 0.06*** (7.49) -0.19*** (4.30) -0.00002 (0.18) 0.01*** (2.65) -0.02 (0.74) -0.05** (2.04) Civil war t-1 -0.07 *** (3.05) -0.07*** (2.90) Ethno-linguistic frac.2 J-test J-test probability 3.64 0.60 -0.004 *** (2.87) -0.01 ** (2.36) -0.00002 (1.30) Coups t-1 Ethno-linguistic frac. 0.31 *** (7.05) -0.003 (1.23) -0.02 *** (3.95) 0.09 *** (4.46) -0.003*** (3.91) -0.00003 (1.57) Democracy t-1 Human Capital -2.51 (5.49) 0.01 *** (2.88) 2.06 *** (3.66) -2.96 *** 0.01 ** (2.19) 1.85 *** (3.33) -2.69 *** (3.66) (3.35) 5.36 0.37 The numbers in parentheses are t-statistics. ***, **, and * represent statistical significance at the one, five, and ten percent level. Time dummies were estimated but not reported for reasons of space. System 1 uses mineral (SITC codes 32, 34, 35 and 68), Petroleum (SITC code 33), and agricultural (SITC codes 0, 1, 4, and 9) exports as a percentage of GDP, while System 2 uses per-worker mineral, Petroleum, and agricultural exports. Both estimations have 108 obs. 34 Table A.1. All Natural Resource Intensive Commodities SITC Section 0 1 2 3 4 6 9 Category (subcategory with SITC subsection) Food and live animals 1 Meat and meat preparations 2 Dairy products and eggs 3 Fish and fish preparations 4 Cereals and cereal preparations 5 Fruit and vegetables 6 Sugar, sugar preparations and honey 7 Coffee, tea, cocoa, spices & manufactures 8 Feedstuff for animals excluding unmilled cereals 9 Miscellaneous food preparations Beverages and tobacco 11 Beverages 12 Tobacco and tobacco manufactures Crude materials, inedible, except Petroleum 21 Hides, skins and fur skins, undressed 22 Oil seeds, oil nuts and oil kernels 23 Crude rubber including synthetic and reclaimed 24 Wood, lumber and cork 25 Pulp and paper 26 Textile fibers not manufactured, and waste 27 Crude fertilizers and crude minerals, not elsewhere specified 28 Metalliferous ores and metal scrap 29 Crude animal and vegetable materials, not elsewhere specified Mineral Petroleum, lubricants and related materials 32 Coal, coke and briquettes 33 Petroleum and petroleum products 34 Gas, natural and manufactured 35 Electric energy Animal and vegetable oils and fats 41 Animal oils and fats 42 Fixed vegetable oils and fats 43 Animal and vegetable oils and fats, processed Manufactured goods classified chiefly by material 63 Wood and cork manufactures excluding furniture 64 Paper, paperboard and manufactures thereof 68 Non ferrous metals Commodities and transactions not classified elsewhere in the SITC 94 Animals, not elsewhere specified, including zoo animals, dogs and cats 35 Appendix A.2. Top agricultural exports in 2006 as a % of total exports and agricultural exports Country Product % of total Exports % of Agricultural Exports Argentina Soybean cake Soybean oil Soybeans Wheat Maize 9.39% 6.01% 3.83% 3.17% 2.72% 59.4% Bolivia Soybean cake Soybean oil Shelled Brazil nuts Sunflower oil Oilseed flower 5.01% 2.81% 1.66% 0.79% 0.47% 74.4% Brazil Soybeans Raw Sugar Meat-Cattle/Boneless Coffee, green Chicken meat 4.11% 2.86% 2.27% 2.13% 2.12% 37.2% Chile Wine Grapes Apples Fruit Prp Nes Crude organic materials 1.72% 1.38% 0.68% 0.50% 0.49% 50.8% Colombia Coffee, green Crude organic materials Bananas Refined sugar Sugar confectionery 6.06% 4.16% 1.98% 1.04% 0.82% 72.5% Costa Rica Bananas Pineapples Coffee, green Food prep nes Crude organic materials 7.72% 5.36% 3.05% 2.67% 2.46% 68.6% 36 Country Product % of total Exports % of Agricultural Exports Dominican Republic Cigar Cheroots Bananas Raw sugar Cocoa beans Alcoholic beverages 13.65% 6.77% 5.18% 3.10% 2.91% 75.3% Ecuador Bananas Crude organic materials Cocoa beans Fruit prp nes Sugar confectionery 5.36% 2.04% 1.54% 1.42% 1.30% 75.9% El Salvador Coffee, green Raw sugar Breakfast cereals Pastry Non-alcoholic beverages 12.96% 4.94% 3.72% 3.44% 3.15% 68.6% Guatemala Coffee, green Raw sugar Bananas Nutmeg and cardamom Natural rubber 14.51% 9.34% 6.78% 2.61% 2.10% 61.1% Honduras Coffee, green Bananas Palm oil Melons Raw sugar 20.73% 6.96% 3.52% 1.70% 1.53% 77.7% Mexico Beer of barley Tomatoes Alcoholic beverages Chiles and peppers Food prep nes 0.73% 0.44% 0.29% 0.25% 0.21% 35.8% 37 Country Product % of total Exports % of Agricultural Exports Nicaragua Coffee, green Meat-cattle/boneless Raw sugar Shelled groundnuts Cigars cheroots 19.54% 7.49% 4.84% 3.80% 1.21% 73.0% Panama Bananas Other melons Watermelons Pineapples Raw sugar 10.04% 8.86% 6.47% 3.40% 1.96% 70.1% Paraguay Soybeans Meat-Cattle/boneless Maize Soybean cake Soybean oil 23.04% 21.36% 8.69% 7.03% 4.85% 83.7% Peru Coffee, green Preserved vegetables Asparagus Chiles and peppers Mangoes 2.16% 0.97% 0.79% 0.31% 0.25% 58.9% Uruguay Meat-cattle/boneless Milled rice Soybeans Carded/combed hair Cheese 23.42% 4.18% 3.50% 2.91% 2.17% 63.7% Venezuela Alcoholic beverages Wafers Cocoa beans Sesame seeds Cigarettes 0.03% 0.03% 0.02% 0.02% 0.02% 37.7% Data from TradeSTAT (Food and Agricultural Organization of the United Nations (2008)) and the Annual Totals Table for Imports and Exports (UNSD, 2008). 38