Challenges for the west coast region

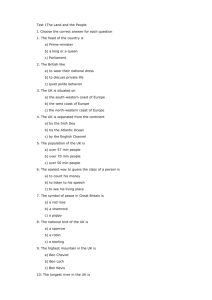

advertisement