Normand St-Pierre, Ph.D., PAS 1

advertisement

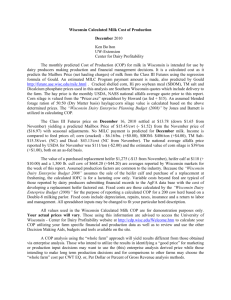

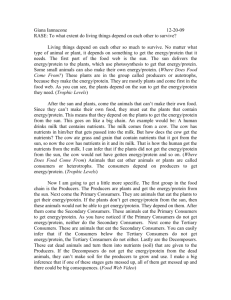

Feed and nutrient costs in dairy production: will it get any worse? Normand St-Pierre, Ph.D., P.A.S.1 Professor and OSU-Extension Dairy Specialist The spot market for corn has broken the $7/bu mark; will it get any worse? If I could answer this question with 100% certainty, I would not be working for Ohio State… The fact is that nobody knows what feed prices will be in 6 months from now or even next month for that matter. There are too many unpredictable factors involved in the corn and other feed markets to make any price forecast anything else than… maybe a good guess. Meanwhile, dairy producers do not have to remain on the sideline and watch their profit margins disappear – assuming that profit margins even existed to start with. In fact, the more turbulent corn and soybean markets are nearly always accompanied with bargain opportunities for other feedstuffs. All feeds move somewhat in sympathy with the corn and soybean markets, but they do not all share the same “sympathy”: some are overexuberant, while others drag their feet – a bit like teenagers at chore time. Feed Ingredients An important thing to do when feed prices are rapidly changing is to ensure that most of the feed ingredients used in a ration are justified from a nutritional and economic basis. The economic viewpoint is obviously important. This can be done using a method that we have developed at Ohio State and have implemented in a software called Sesame. Using this method, feed ingredients are compared using the value of their nutrients. In dairy production, the economically important nutrients are net energy for lactation (NEL), metabolizable protein (MP), effective neutral detergent fiber (eNDF), and non-effective NDF (neNDF). Using this approach and market prices of feedstuffs in central Ohio effective at the end of January 2011, one can compute what each available ingredient was worth, and categorize ingredients as bargains (clearly under-priced), at break-even (market price reasonably close to their calculated ‘worth’), or over-priced (market price clearly exceeding the economic value of the nutrients). Results are presented in Table 1. Readers who have followed this column over the months will notice a new format used to present the results. This new table summarizes the information in regards to the prices used for the analysis (i.e., the market prices), the differences between market prices and the calculated values (what we call ‘Deviation’), and a categorization of feed ingredients into 3 categories: bargains, at break-even, or over-priced. As usual, we caution the readers that these results are time and location dependent. Market prices may have changed sufficiently between the time this analysis was done and the time of publication to affect the outcome of certain feeds. Also, we never imply that a balanced ration can be made solely of bargain feeds or without any over-priced feeds. A reasonable strategy should be to minimize the usage of over-priced feeds and maximize the usage of bargain feeds within the confine of a balanced ration. 1 E-mail: st-pierre.8@osu.edu Tel: 614/292-6507 Fax: 614/292-1515 Table 1. Market prices, deviations from break-even values, and categorization of feed ingredients used in dairy, central Ohio market, week of January 31, 2011.1 Deviation represents the difference between market price and the calculated value of a feedstuff. For example, a deviation of $10/ton for alfalfa hay means that the market price is $10/ton above the value of the nutrients in alfalfa hay. The Class column categorizes ingredients as follows: x = ingredient is significantly over-priced, = ingredient is significantly under-priced (i.e., a bargain), and a blank column means that the ingredient is priced about for what it is worth. 1 Price of Nutrients As explained in previous columns, a nice byproduct of this type of analyses is that the implicit prices of the economically important nutrients are estimated. Results for the end of January are shown in Table 2. The cost of both dietary NEL and MP are significantly above their 6-year averages, whereas the 2 fiber components are somewhat within their expected ranges. Table 2. Estimated cost per unit of nutrients, central Ohio, week of January 31, 2011. Returns to Dairy Producers: the Cow-Jones Index Using a ‘standard’ cow producing milk at a level that approximates the national average, it is easy to calculate the cost of feeding this cow given the nutrient costs shown in Table 2. This ‘standard’ cow is a 1,500 lb cow producing 65 lb/day of milk at 3.6% fat and 3.0% protein. This cow requires 31.3 Mcal/day of NEL, 4.64 lb/day of MP, 10.2 lb/day of eNDF, and 3.4 lb/day of neNDF. The total daily cost to supply these nutrients is $5.39/cow/day, or $8.29/cwt of milk. The average cost of the ration dry matter is estimated at 11.1 ¢/lb. Using Federal Order component prices for January, this cow generates $8.91/day of gross milk revenues, which equates to $13.70/cwt. The difference between the gross revenues per cwt and nutrient costs per cwt constitutes an index of milk revenues minus feeding costs without having to define a specific diet. We have named this index the Cow-Jones Index, as it mimics the information of the Dow-Jones Index for the U.S. stock market. In January, the Cow-Jones Index for Ohio stood at $5.41/cwt. A Cow-Jones of ~ $8/cwt indicates that milk is produced at break-even, whereas a Cow-Jones exceeding $9/cwt is indicative of profitability in the dairy sector. We have monitored this index since 1998 after the Federal Order reform. Results since January 2005 are shown in Figure 1. Clearly, one can observe the devastating situation that dairy producers were put under during 2009. What has not been fully recognized is that 2010, although better than 2009, was in fact NOT a profitable year for dairy producers. The severe bleeding of equity that was experienced in 2009 did stop for the most part, but the average dairy producer was still operating with milk prices below his/her cost of production, basically making a living out of the depreciation. Obviously, this situation is not sustainable. Although the futures markets for Class III and Class IV milk prices are historically high at the time of this writing, it is unclear how much of the additional gross revenues that are expected in the coming months will be spared from the increase in feed costs. Effective risk management might be imperative. Figure 1. The Cow-Jones Index from January 2005 through January 2011. A Cow-Jones under $8/cwt (the red zone) indicates that milk is produced at less than average breakeven costs of production. A Cow-Jones exceeding $9/cwt (the green zone) indicates that the average production is occurring under profitable conditions. The yellow zone is one of transition.