rules for sea and inland waterway transport

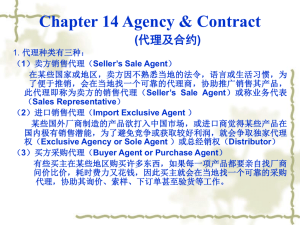

advertisement