Supplemental Data Section 1 Back-of-the

advertisement

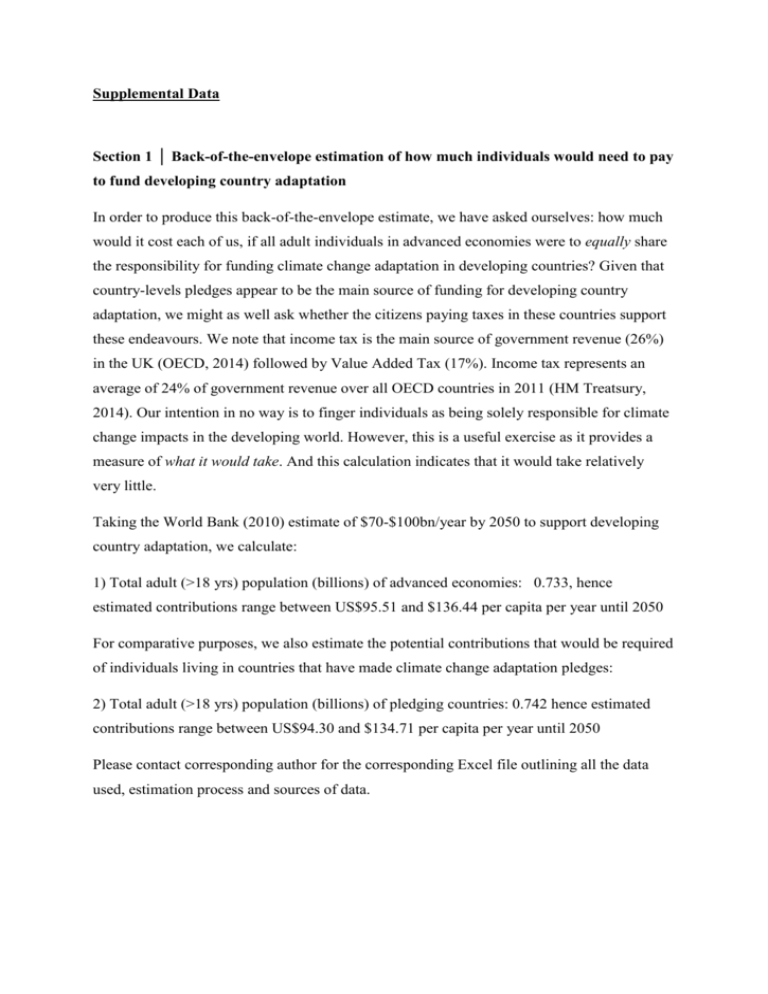

Supplemental Data Section 1 │ Back-of-the-envelope estimation of how much individuals would need to pay to fund developing country adaptation In order to produce this back-of-the-envelope estimate, we have asked ourselves: how much would it cost each of us, if all adult individuals in advanced economies were to equally share the responsibility for funding climate change adaptation in developing countries? Given that country-levels pledges appear to be the main source of funding for developing country adaptation, we might as well ask whether the citizens paying taxes in these countries support these endeavours. We note that income tax is the main source of government revenue (26%) in the UK (OECD, 2014) followed by Value Added Tax (17%). Income tax represents an average of 24% of government revenue over all OECD countries in 2011 (HM Treatsury, 2014). Our intention in no way is to finger individuals as being solely responsible for climate change impacts in the developing world. However, this is a useful exercise as it provides a measure of what it would take. And this calculation indicates that it would take relatively very little. Taking the World Bank (2010) estimate of $70-$100bn/year by 2050 to support developing country adaptation, we calculate: 1) Total adult (>18 yrs) population (billions) of advanced economies: 0.733, hence estimated contributions range between US$95.51 and $136.44 per capita per year until 2050 For comparative purposes, we also estimate the potential contributions that would be required of individuals living in countries that have made climate change adaptation pledges: 2) Total adult (>18 yrs) population (billions) of pledging countries: 0.742 hence estimated contributions range between US$94.30 and $134.71 per capita per year until 2050 Please contact corresponding author for the corresponding Excel file outlining all the data used, estimation process and sources of data. Section 2│Reasons for not wanting to contribute toward developing country adaptation (% respondents who agreed with reason) - respondents could choose all the reasons they felt explained their choice. Reason for choosing to contribute £0 % who agree Number of respondents who were asked this question (n=569) 1. I/Our household cannot afford to pay 0.56 2. These impacts are not going to affect me or my household 0.06 3. Governments should pay for this by reallocating money in their current budgets, rather than by raising extra taxes 0.42 4. I need more information about climate change to answer this question. 0.12 5. I need more information about the adaptation programmes that I am being asked to contribute towards to answer this question 0.12 6. I am not interested in climate change 0.11 7. I would prefer to make an individual voluntary donation, rather than a mandatory contribution that everyone has to contribute towards 0.17 8. I would rather pay towards more important issues, such as crime and unemployment 0.15 9. Despite assurances about transparency and accountability, I don’t trust that the Worldwide Adaptation Fund would spend the money appropriately 0.27 10. I do not value programmes involving adaptation to climate change 0.12 11. I don’t believe that we should put a price on helping vulnerable communities and species adapt to climate change 0.05 12. I am only hypothetically willing to pay £0 towards adaptation; if the Worldwide Adaptation Fund actually asked for my support, I would probably re-assess my response 0.08 Statements 3,4,5,7, 9 and 11 are classed as ‘non-valid’ representations of WTP Statements 3, 4, 5, 7, 9 and 11 are classed non-valid representations of value, either because they are protests against the payment vehicle (statements 3, 7 and 9), protests against the use of a market mechanism to value climate change adaptation (statement 11), or because preferences do not yet exist for the goods being valued (e.g. statements 4 and 5). Because respondents can choose a selection of reasons to explain their zero contribution, the validity of a zero WTP value is determined by estimating the balance of valid and non-valid responses: if the number of non-valid reasons is more than the number of valid reasons, then is £0 is dropped from the analysis. Otherwise, it is considered valid and retained for analysis. Section 3 │ Information Treatment A standard requirement of CV surveys is that the information and scenario is worded in as neutral and unbiased terms as possible. This was applied to the standard CV survey, which begins with the paragraph: “Climate change” refers to major changes in temperature, rainfall, snow, or wind patterns lasting for decades or longer. Scientists have been gathering information on changes in the climate that have taken place over the past 100 years. This is some of what they have been finding.” The persuasive information treatment however did not include this paragraph. Instead, respondents read the following: “Our planet is in peril. Research shows that climate change is already happening sooner and faster than scientists had previously predicted.” The information in subsequent sections covering climate change impacts and adaptation was the same in both survey versions. Additionally, the treatment excluded reminders to respondents about their other expenses and about other demands on public finance. Thus, in the control (standard CV) survey, respondents were reminded: “Before you answer, I’d like you to remember that you have other expenses.” They were also reminded that there are other demands on public finances: “Also, please remember that there are other demands on public and global finances, such as development aid and peace-keeping efforts. Therefore, I’d like you to consider how important it is to you that we invest in adaptation to climate change compared to all the other development and societal goals.” The persuasive survey did not include these reminders. However, both surveys urged respondents to be as realistic as possible: “Finally, please think about what you really would contribute - as if the increase in income tax were to be made effective as of today.” Section 4│Valuation scenario Suppose there was a Worldwide Adaptation Fund - an international institution responsible for overseeing the implementation and management of Adaptation Programmes across the globe. These Adaptation Programmes would be designed to alleviate the negative impacts of climate change on nature and the environment, agriculture, human health and the built environment. Funding for these Adaptation Programmes would come from all individual countries as a percentage of their GDP. This means that everyone would have to pay a little more income tax. Industries would pay extra taxes, as well as households. This institution would aim for the very highest levels of transparency and accountability. To do this, it would adopt best practices in governance and donor relations. All financial movements would be made publicly available in different media (e.g. website, printed document etc) on a monthly and/or annual basis, including information on employee compensation. These and other similar measures would be critical in ensuring the successful implementation of Adaptation Programmes across the globe. On the following page, we describe four Adaptation Programmes that would be implemented by the Worldwide Adaptation Fund. I’d like you to think how much these programmes are worth to you. Then please consider whether you would be willing to pay a surcharge on your household income tax, even if it were only a very small amount, to support these worldwide Adaptation Programmes. Before you answer, I’d like you to remember that you have other expenses. Also, please remember that there are other demands on public and global finances, such as . development aid and peace-keeping efforts. Therefore, I’d like you to consider how important it is to you that we invest in adaptation to climate change compared to all the other development and societal goals. Also, remember that the impacts of climate change will mostly affect people in the developing world and future generations. Finally, please think about what you really would contribute - as if the increase in income tax were to be made effective as of today. Adaptation Programme Your money will go towards: Nature & the Environment Development of more protected areas & corridors linking these Improved wildlife disease surveillance & control Increased control of wildfires & floods Agriculture Development & use of different crop varieties Soil management & erosion control e.g. planting more trees Crop relocation if necessary Building & staffing of health centres Development of heat-health action plans Improved disease surveillance & control Health Built Environment Protection of built cultural heritage i.e. castles, churches & other cultural sites Building seawalls & storm surge barriers Restoration & rebuilding of damaged assets Worldwide ALTERNATIVELY, you can contribute an overall amount to the Adaptation worldwide adaptation fund, and they will allocate the money amongst Fund the different Adaptation Programmes according to need. Please select your preferred option: Tick one only a. I prefer to contribute towards one or more of the separate Adaptation Programmes b. I prefer to contribute an overall amount towards the Worldwide Adaptation Fund, who will allocate the money amongst the different adaptation programmes according to need c. I don’t want to contribute towards climate change adaptation □ □ □ GO TO A GO TO B SKIP A &B A. Please choose the amount(s) that best represent the maximum you would be willing to pay, as an increase in household income tax, from the drop-down lists. Adaptation Programme Nature & the Environment Your money will go towards: Development of more protected areas & corridors linking these Improved wildlife disease surveillance & control CHOOSE THE MAXIMUM AMOUNT YOU ARE WILLING TO CONTRIBUTE as an increase in household tax DROP-DPOWN LIST Increased control of wildfires & floods Development & use of different crop varieties Agriculture Soil management & erosion control e.g. planting more trees DROP-DPOWN LIST Crop relocation if necessary Building & staffing of health centres Development of heat-health action plans Improved disease surveillance & control Health DROP-DPOWN LIST Protection of built cultural heritage Built Environment i.e. castles, churches & other cultural sites Building seawalls & storm surge barriers Restoration & rebuilding of damaged assets This is the total amount you would be prepared to pay: DROP-DPOWN LIST TOTAL (CONFIGURATOR) B. Please choose the amount that best represents the maximum you would be willing to pay, as an increase in household income tax, from the drop-down list. You can contribute an overall amount Worldwide to the Worldwide Adaptation Fund, and Adaptation they will allocate the money amongst Fund the different Adaptation Programmes according to need. DROP-DPOWN LIST Drop-down list A (payment ladder for WTP towards individual sector programmes) WTP increments £0 per year 20p per year 50p per year £1 per year £2 per year £3 per year £5 per year £7 per year £9 per year £11 per year £14 per year £17 per year £20 per year £23 per year £26 per year £29 per year £32 per year £35 per year £38 per year £42 per year £46 per year £50 per year £55 per year £70 per year £85 per year £100 per year £125 per year £150 per year £200 per year £300 per year £500 per year £750 per year Selection 7 Drop-down list B (payment ladder for WTP towards Worldwide Adaptation Fund) WTP increments 20p per year 50p per year £1 per year £2 per year £3 per year £5 per year £7 per year £10 per year £14 per year £17 per year £20 per year £25 per year £35 per year £50 per year £65 per year £80 per year £100 per year £125 per year £150 per year £200 per year £300 per year £500 per year £750 per year £1,000 per year £1,500 per year £2,000 per year Selection 8 Supplemental Data references HM Treasury. (2014) Budget 2014. Available on www.gov.uk/government/publications OECD. (2014) Stat Extracts. National Accounts at a Glance. Available on http://stats.oecd.org/. 9