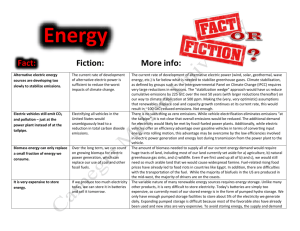

modelling of the Australian generation sector

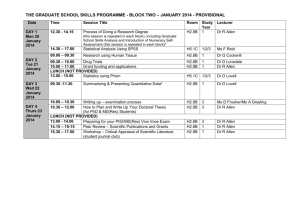

advertisement