Export Basics Doc Here

advertisement

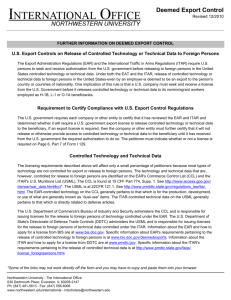

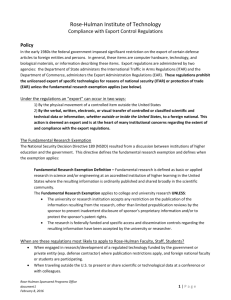

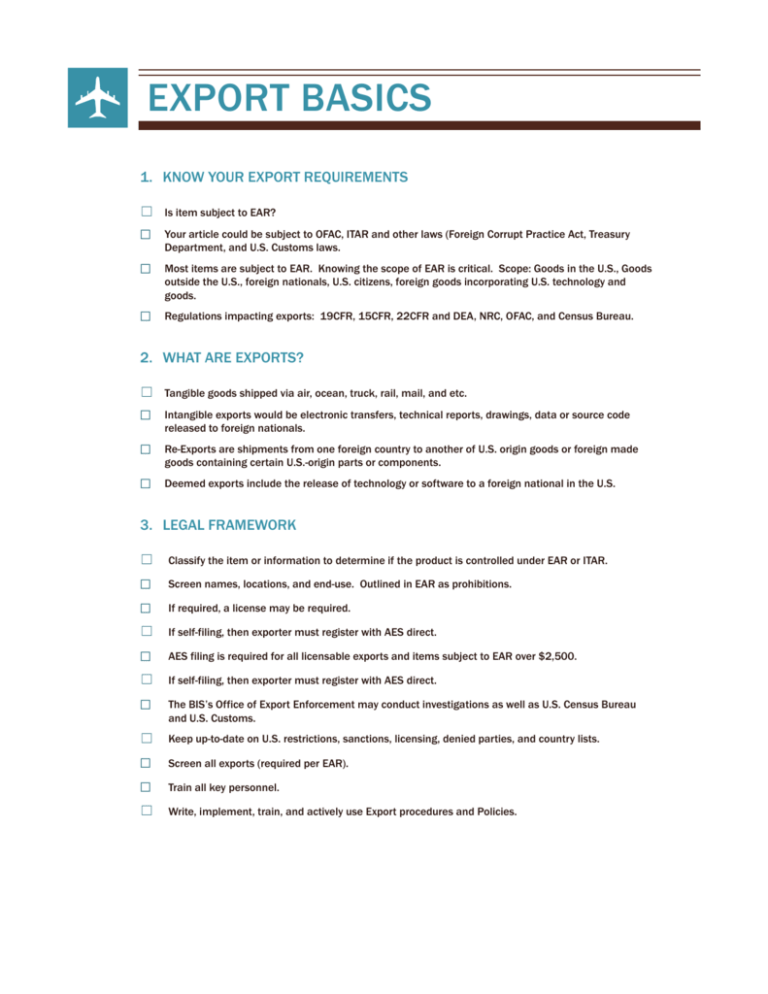

EXPORT BASICS 1. KNOW YOUR EXPORT REQUIREMENTS ☐ Is item subject to EAR? ☐ Your article could be subject to OFAC, ITAR and other laws (Foreign Corrupt Practice Act, Treasury Department, and U.S. Customs laws. ☐ Most items are subject to EAR. Knowing the scope of EAR is critical. Scope: Goods in the U.S., Goods outside the U.S., foreign nationals, U.S. citizens, foreign goods incorporating U.S. technology and goods. ☐ Regulations impacting exports: 19CFR, 15CFR, 22CFR and DEA, NRC, OFAC, and Census Bureau. 2. WHAT ARE EXPORTS? ☐ Tangible goods shipped via air, ocean, truck, rail, mail, and etc. ☐ Intangible exports would be electronic transfers, technical reports, drawings, data or source code released to foreign nationals. ☐ Re-Exports are shipments from one foreign country to another of U.S. origin goods or foreign made goods containing certain U.S.-origin parts or components. ☐ Deemed exports include the release of technology or software to a foreign national in the U.S. 3. LEGAL FRAMEWORK ☐ Classify the item or information to determine if the product is controlled under EAR or ITAR. ☐ Screen names, locations, and end-use. Outlined in EAR as prohibitions. ☐ If required, a license may be required. ☐ If self-filing, then exporter must register with AES direct. ☐ AES filing is required for all licensable exports and items subject to EAR over $2,500. ☐ If self-filing, then exporter must register with AES direct. ☐ The BIS’s Office of Export Enforcement may conduct investigations as well as U.S. Census Bureau and U.S. Customs. ☐ Keep up-to-date on U.S. restrictions, sanctions, licensing, denied parties, and country lists. ☐ Screen all exports (required per EAR). ☐ Train all key personnel. ☐ Write, implement, train, and actively use Export procedures and Policies. 4. RECORDKEEPING ☐ The export license including any and all documents submitted in accordance with the requirements of the EAR in support of, or in relation to, an export license application. ☐ Specifically: Memoranda, notes, correspondence, contracts, invitations to bid, pro-forma invoice, books of account, financial records, International Import Certificates, Import or end-user certificate, statement by ultimate consignee and purchaser, evidence of delivery, AES documentation, air waybill, bill of lading, dock receipt, purchase order, packing list, invoice (with destination control statement), certificates of origin, and additional requirements determined by the authority under which the control is required. The above mentioned outline is only part of what is necessary to comply with all aspects of an export. Other items an exporter must consider are as follows: 1. Management commitment statement. 2. Risk Assessment. 3. Written export compliance program. 4. Cradle to grave export compliance security screening and addressing vulnerabilities. 5. Freight forwarder guidance. 6. Export compliance monitoring and audit/assessing. 7. Process to handle exceptions, problems, violations and taking corrective actions. 8. Compliance guideline summary. Page 2