Consumer theory - Economics Learning Standards

advertisement

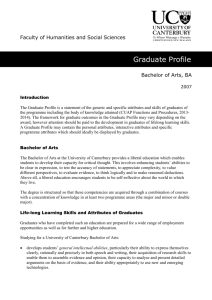

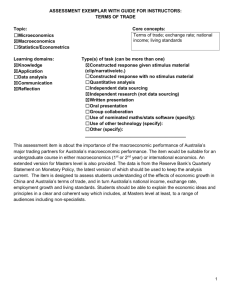

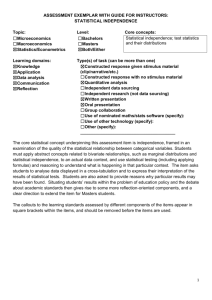

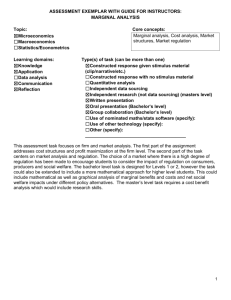

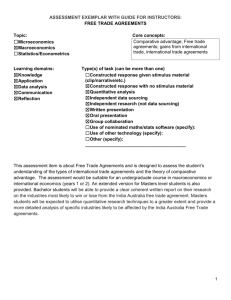

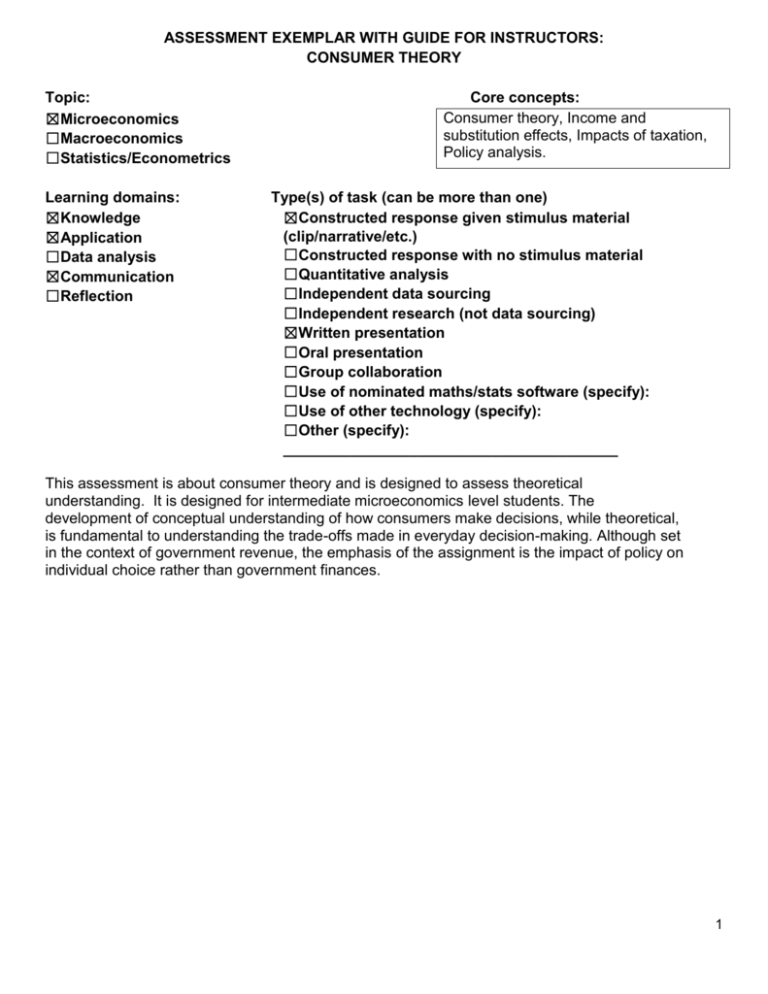

ASSESSMENT EXEMPLAR WITH GUIDE FOR INSTRUCTORS: CONSUMER THEORY Topic: ☒Microeconomics ☐Macroeconomics ☐Statistics/Econometrics Learning domains: ☒Knowledge ☒Application ☐Data analysis ☒Communication ☐Reflection Core concepts: Consumer theory, Income and substitution effects, Impacts of taxation, Policy analysis. Type(s) of task (can be more than one) ☒Constructed response given stimulus material (clip/narrative/etc.) ☐Constructed response with no stimulus material ☐Quantitative analysis ☐Independent data sourcing ☐Independent research (not data sourcing) ☒Written presentation ☐Oral presentation ☐Group collaboration ☐Use of nominated maths/stats software (specify): ☐Use of other technology (specify): ☐Other (specify): ________________________________________ This assessment is about consumer theory and is designed to assess theoretical understanding. It is designed for intermediate microeconomics level students. The development of conceptual understanding of how consumers make decisions, while theoretical, is fundamental to understanding the trade-offs made in everyday decision-making. Although set in the context of government revenue, the emphasis of the assignment is the impact of policy on individual choice rather than government finances. 1 Bachelors level task Individual written assignment Approx 1500 words Assuming you are employed by the Department of Treasury and the Commonwealth government is seeking ways to improve the Federal budget situation which is in deficit. Two different policy options are being considered: Policy option 1: Increasing marginal income tax rates. Policy option 2: Increasing the goods and services consumption tax (GST) but leaving food exempt from the GST. You are required to write a report which analyses the likely in principle impacts on consumers of the two policy changes. In your report i) Initially assume that households purchase two types of goods: GST exempt “Food”, and GST taxed “Other goods”. Compare how each of the two policy options would impact on household consumption choices assuming both categories of goods are normal goods. [KB1, AB1] ii) Illustrate the likely impact of the two policy options on household consumption choices if it is assumed that lower income households spend a higher proportion of their income on food and consider food to be an inferior good. [KB1, AB2] iii) Assuming both policies raised similar levels of revenue, explain which policy you would recommend and why? [To avoid unnecessary complication in your answer assume revenue from both policy options goes to the Commonwealth Government.] [AB2, CB1] 2 Masters level task Individual written assignment Approx. 1500 words Assuming you are employed by the Department of Treasury and the Commonwealth government is seeking ways to improve the Federal budget situation which is in deficit. Three different policy options are being considered: Policy option 1: Increasing marginal income tax rates. Policy option 2: Increasing the goods and services consumption tax (GST) but leaving food exempt from the GST. Policy option 3: Broadening the GST to include all goods and services without exception You are required to write a report which analyses the likely in principle impacts on consumers of the three policy changes. In your report i) Initially assume that households purchase two types of goods: GST exempt “Food”, and GST taxed “Other goods”. Compare how each of the policy options would impact on household consumption choices assuming both categories of goods are normal goods. [KM1, AM1] ii) Illustrate the likely impact of the policy options on household consumption choices if it is assumed that lower income households spend a higher proportion of their income on food and consider food to be an inferior good. [KM1, AM2] iii) Assuming the policies raised similar levels of revenue, explain which policy you would recommend and why? [To avoid unnecessary complication in your answer assume revenue from all policy options goes to the Commonwealth Government.] [AM2, CM1] Advice to assessors: This assessment task is technical and it is expected that students will be able to disaggregate consumption choices and discuss income and substitution effects. The task could be extended to include increases in transfer payments to low income household designed to offset the tax effects. 3 Learning domain Learning outcomes Bachelor Degree Masters Degree Knowledge KB1 Bachelor graduates will be able to identify, coherently explain and synthesise core economic concepts KM1 Masters graduates will be able to identify, coherently explain and synthesise core and advanced economic concepts, including recent developments in the discipline Application Bachelor graduates will be able to: Masters graduates will be able to: AB1• frame problems in terms of core economic concepts and principles AM1• frame and critically analyse problems in terms of core and advanced economic concepts and principles AB2• apply economic reasoning and analytical skills, in order to make informed judgments and decisions AM2• apply advanced economic reasoning and analytical skills, including quantitative techniques where appropriate, in order to make informed judgments and decisions AM3• plan and execute a research-based project Data analysis Bachelor graduates will be: Masters graduates will be able to: DB1• able to use economic data to address typical problems faced by economists DM1• select and apply an appropriate empirical method to address typical problems faced by economists DB2• aware of, and able to implement, basic empirical techniques and interpret the results DM2• critically evaluate the results Communication CB1 Bachelor graduates will be able to present a clear and coherent exposition of economic knowledge, ideas and empirical evidence both orally and in writing, individually or in collaborative contexts CM1 Masters graduates will be able to communicate complex ideas clearly and coherently, in written form and interactive oral form to expert and non-expert audiences, individually or in collaborative contexts Reflection Bachelor graduates will be able to reflect on: Masters graduates will be able to reflect on and evaluate: RB1• the nature and implications of assumptions and value judgments in economic analysis and policy RM1• the nature and implications of assumptions and value judgments in economic analysis and policy RB2• interactions between economic thinking and economic events, both historical and contemporary RM2• interactions between economic thinking and economic events, both historical and contemporary RB3• the responsibilities of economists and their role in society RM3• the responsibilities of economists and their role in society 4