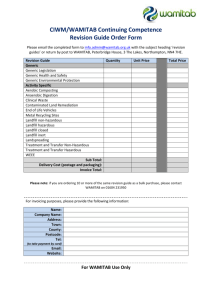

GENERAL INFORMATION

advertisement

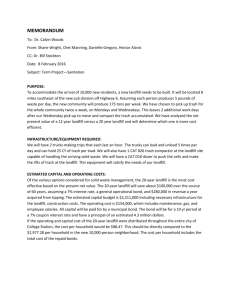

GENERAL INFORMATION 2. The solid waste service charge was established by resolution of the County Board of Commissioners on October 29, 1991. All properties (seasonally used as well as year round use) with a building value greater than $1,000 are assessed a base amount which is determined by the County Board annually. The base amount of this service charge is as follows: $15.00 in 1993-2014 $20.00 in 1992 There have been varying charges based on the classification (use) of the property and those with multiple uses were computed under the classification formula for each use of the property. Beginning with taxes payable in 2002, those properties with multiple uses, such as commercial property that is on the same parcel as the taxpayer’s homestead, are assessed one base charge for each identified use. Maximum charge per parcel is $45.00. All exempt properties with buildings located on them will be charged the base amount. All personal property and mobile homes (including travel trailers that do not have current tabs) with values greater than $1,000 will also be charged the base amount. Copies of the resolution adopting the ordinance that enabled the solid waste service charge to be placed on taxes are available at the County Administrator’s Office. The ordinance allows for appeals/adjustments only under the following circumstances: 1. Property was incorrectly classified (example: Residential rather than Commercial). 3. Property is actually vacant land. or Property is uninhabitable. If a taxpayer wishes to appeal the solid waste service charge, forms are available in the County Auditor-Treasurer's Office and Land Services (Solid Waste - Landfill). The appeal form must be filed by December 31 of the year the original billing occurs. These appeals will be investigated by the Solid Waste Coordinator and presented to the County Board for their consideration. Taxpayers will be notified of the results of the County Board action. Starting in 2001, a $5 coupon for services provided at the landfill site complex was initiated. These are mailed to any property that paid the solid waste service charge. WHY THE SERVICE CHARGE? The Solid Waste Assessment spreads the cost more widely than tax levies. The County intends to continue supporting its solid waste system through existing funding sources. This strategy was utilized to ensure those who dispose of their solid waste illegally and legally pay a portion of the total cost for solid waste management. The overall solid waste program is broken into two major facets – Solid Waste (non-landfill) and Landfill. The County will maintain the Solid Waste Assessment, and use these funds as the designated revenue source for Solid Waste activities not related to the two County landfills. The assessment is covering the majority of the cost of the solid waste services such as residential recycling, yard waste, household hazardous waste, problem material management, education, and the other nonlandfill/SCORE related programs. Specifically, the service charge helps fund the existing curbside recycling program in three cities and the 16 drop-off sites located throughout the remainder of the County. In 1993, the County opened a permanent household hazardous waste collection facility. This program offers proper disposal for household hazardous waste to county residents at no additional cost. In 2013, over 56.8 tons of household hazardous waste was processed. These funds were utilized to install eleven used oil drop-off sites throughout the County. In 2013, over 28,324 gallons of used oil was collected. The County also offers programs to address the proper disposal of used tires, electronics, appliances, used oil/filters, vehicle batteries, brush, mattresses, and yard waste. Some of these programs do have a nominal fee associated with them, and others are at no additional cost to county residents, since they are being funded through the service charge. Another program funded by this charge is to investigate any solid waste complaint. Under the current County funding structure, the landfill tipping fee accurately reflects the actual cost of the landfill operations versus the total integrated solid waste system cost. This is keeping the tipping fee low at the County landfill so it can compete with alternative disposal options that are also priced to reflect the cost of disposal only. Collection and treatment of precipitation on the new landfill that percolates through the garbage cost approximately $200,000 annually. Not only has the tipping fee paid for ongoing operations and maintenance, it is also covering the construction costs. In 1991 a lined landfill was constructed at a cost of $2.5 million. In 1992 a cover system was installed over the old landfill at a cost of $2 million. Additional construction since 1992 include: 1. 2. 3. 4. 5. 6. In 1995, Cell #2 was added to the new landfill to provide additional capacity - $800,000. In 1996, we installed a cover system over Cell #1 - $300,000. In 1997, installed a leachate recirculation system to provide alternative leachate management capacity - $200,000. In 2001, Cell #3 was added to the new landfill to provide additional capacity - $1.6 million. In 2007, Cell #4 and Pond #4 added to the new landfill to provide additional capacity - $1.7 million. In 2008, installed an active gas system to manage the landfill gas – 1.3 million. The County intends to provide any future construction without issuing further debt. Also by statute, the County is required to set aside funds to provide care of the new landfill 30 years after it is closed. Part of the tipping fee is going toward this requirement. Solid waste costs are increasing. However, the County source of funding for the integrated solid waste program has been stable and sustainable as highlighted by the fact the tipping fee nor the solid waste assessment has not changed since 1992. It is not expected these will need to be changed for the upcoming 10-year planning period. While on the other hand, State funding has fluctuated during fiscal crisis. Three options are available for funding for solid waste - tipping fees, tax levies, and a service charge. Each of the options has advantages and drawbacks. While tipping fees at the landfill seem the most equitable by providing a charge in proportion to the quantity of waste delivered, this option also provides a benefit to those disposing of waste illegally by burning or dumping elsewhere. Tax levies do not address the quantity of waste generated and does not address tax exempt properties, some of which generate substantial quantities of waste. The service charge spreads the cost more widely than tax levies. Both the service charge and property taxes ensure that those who dispose of their solid waste illegally pay a portion of the cost of solid waste management. Initially, a combination of these three options was selected. A tax levy was utilized to assist in paying a bond to close the old landfill. These funds were reimbursed to the General Fund from 2003 – 2007 from the Solid Waste account. Currently, we are only using Tipping Fees and the Service Charge, as the following table shows, to fund our solid waste management program. Revenue: Item Tipping Fees Service Charge 2008 $1,837,611 $584,689 Item Tipping Fees Service Charge 2009 $1,639,397 $559,077 Item Tipping Fees Service Charge 2010 $1,648,232 $584,111 Item Tipping Fees Service Charge 2011 $1,696,908 $588,862 Item Tipping Fees Service Charge 2012 $1,726,906 $592,122 Item Tipping Fees Service Charge 2013 $1,746,477 $590,374 SOLID WASTE SERVICE CHARGE How it is charged Background January 2014