Specific Instructions

advertisement

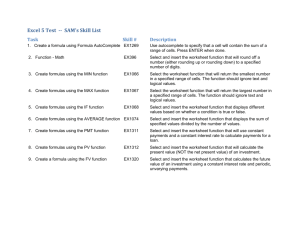

MGT 326 Project 2 Fall 2015 Project 2 Purpose: 1. To attain further understanding of project decision making and capital budgeting concepts and processes learned in class through practical application in order to become more proficient with the fundamental techniques of business decision making. 2. To increase skill with MS Excel®. Requirement: Given the estimated initial cash flows of three mutually exclusive projects, decide which one to recommend for implementation. Specific Instructions: 1. Complete the incremental cash flows work sheet for each project. a. You are provided with an Excel® worksheet for each project that lists the initial variable costs per unit, total fixed costs, depreciation expense and number of units sold. These are incurred on a semiannual basis (i.e. m = 2). 1) The sales price and all associated costs are expected to grow at an annual rate of 3% per year over the life of each project. Depreciation expense will remain constant. 2) The number of units sold for Project 1 is expected decrease at an annual rate of 8%. The number of units sold for Project 2 is expected increase at an annual rate of 11%. The number of units sold for Project 3 is expected increase at an annual rate of 3%.. 3) The profits of all projects are taxed at an annual rate of 35%. b. Each project is expected to last five years. The estimated future cash flows are recognized at the end of each semiannual period. c. Ensure that “Units Sold” figures are integers (whole numbers). 2. Complete the worksheet entitled Profile. a. Copy the incremental cash flows (from the incremental cash flow worksheets) for each project into the appropriate cells. b. Fill out the project NPV columns by computing NPV at each different discount rate. The profiles for each project will automatically be generated on the chart provided. 3. Complete Sheet 4 by computing the WACC of the firm and the IRR and Discounted Payback Period for each project. a. WACC: The capital structure for the firm as well as all the inputs needed to compute the component costs are provided. Compute the component costs and the WACC in the cells provided. b. IRR: Use the IRR function. Since the future cash flows occur on a semiannual basis, the value produced by the IRR function is a semiannual rate. Convert this value to an annual rate. c. DPB: Since the cash flows are semiannual, the DPB function on the TI BA II Plus won’t produce an accurate value. You must compute the DPB by discounting each cash flow to t = 0 then computing the net cumulative cash flows for each time period until you find the payback point. Express the DPB in years. 4. After you have completed Sheet 4, copy it and title the copy “Sheet 4 Formulas”. While on this worksheet, click on the “Formulas” tab and select the “Show Formulas” option. This will display all the formulas you used for your calculations. MGT 326 Project 2 Fall 2015 5. Recommend a project on Sheet 5. a. Discuss any observations and reservations concerning your computations. Include a discussion on the following issues: 1) Reliability of the IRR calculations. 2) Possible impact that a change in the firm’s WACC may have on the decision. a. Assume that the yield curve is currently upward sloping and is expected to remain so for the foreseeable future. b. Assume that you firm’s minimum WACC will be at least 3.0000% and its maximum WACC will be no more than 16% during the life of these projects 3) Relative riskiness of the projects. b. Declare your recommendation and your supporting rationale. Your rationale should address the decision criteria which you generated in previous parts of this project. Format: 1. All work must be produced and presented in Excel® using the file entitled Project 2 Workbook.xls that I have provided. This file is a template for you to fill-in and use to meet the requirement. It can be found on the “Homework” page on the course website. Ensure the title page includes your name(s) and indicates which section(s) you are in. Your completed project must include all worksheets provided as well as Sheet 4 Formulas. Ensure all the information intended to be displayed on a certain page fits on that page (except for Sheet 4 Formulas; this worksheet may take several pages). 2. Do not submit your work in binders or folders. Simply staple your pages together. Staple the pages in the upper left corner. Additional Guidance: 1. You may work individually or with a (one) partner. If you choose to do the latter, you may submit your work jointly as a single document. 2. This assignment is due NLT 12:00 pm, 7 December 2015. Late submissions will receive a substantial penalty. You may turn in your projects in class prior to the due date. If I am not in my office when you intend to turn in your project, turn it in to Vanessa Kline. If she is not available, turn in your projects to the ASM Reception Desk. Do not slip your projects under my door. Note on Academic Integrity: I expect each student or pair of students to do original work. Any incidence of copying the work of others, plagiarism from published works, or any other violation as outlined in the Student Guide concerning academic integrity, will result in your dismissal from this course with a failing grade and referral to the ASM Associate Dean for further disciplinary action.