12.2 232-236 Is equal and fair the same thing? Why? Explain what

advertisement

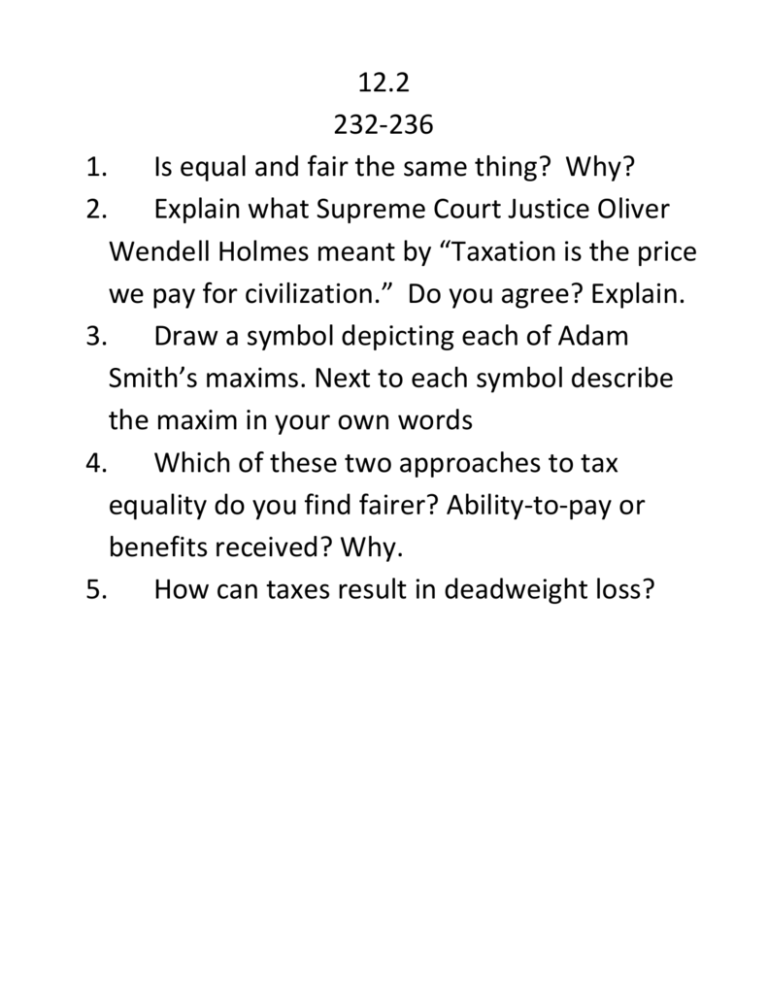

12.2 232-236 1. Is equal and fair the same thing? Why? 2. Explain what Supreme Court Justice Oliver Wendell Holmes meant by “Taxation is the price we pay for civilization.” Do you agree? Explain. 3. Draw a symbol depicting each of Adam Smith’s maxims. Next to each symbol describe the maxim in your own words 4. Which of these two approaches to tax equality do you find fairer? Ability-to-pay or benefits received? Why. 5. How can taxes result in deadweight loss? 12-3 236-242 Name _______________________ date ______________ Tax base-what is taxed Tax rate- percentage that is paid in tax Tax structures Proportional taxes- same tax to all levels Progressive tax- more tax as income increases Regressive tax- less tax as income increases Income tax- federal government and most states collect income tax Pay roll tax- social security and Medicare Split evenly between employee and employer Fixed rate (12.4% and 2.9%) S.S. is capped at a certain amount making it regressive Property tax- taxes on buildings and land Levied (voted on in an area) Proportional tax Sales tax- regressive tax on bought good or services Corporate taxes- tax on profits of corporations Excise tax- taxes on things government wants to regulate Luxury tax- tax on luxury goods and services Fees and tolls- regressive tax goods and services used Estate taxes- tax on assets left to heirs Tax Income tax with a marginal tax rate Social Security tax 5 cent per dollar sales tax Corporate income tax Tax on jewelry Park entry fee Estate tax Tax base Tax structure Fair or unfair? WHY 12-4 242-245 1. What is the difference between discretionary and mandatory spending? 2. What are the top three areas of spending (discretionary and mandatory) figure 12.4B 3. What are entitlement programs? Give some examples. 4. Come up with a tax plan. Identify the tax base, and tax structure. Describe what the tax revenue will go towards, and who will be in charge of spending the money (feds, state, local). Finally explain why you feel the tax is fair. EX. Tax- 1 cent tax on every text message Tax base- service Tax structure- regressive Tax towards education State will collect and distribute to local school districts It is fair because those who text more will pay more. Further more help reduce texting in inappropriate situations (driving, in class, etc.)