Chapter 12: Financial Returns and Risk Concepts Multiple Choice 1

advertisement

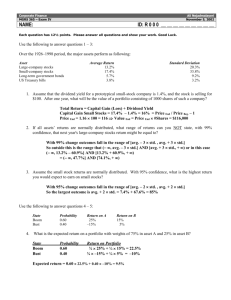

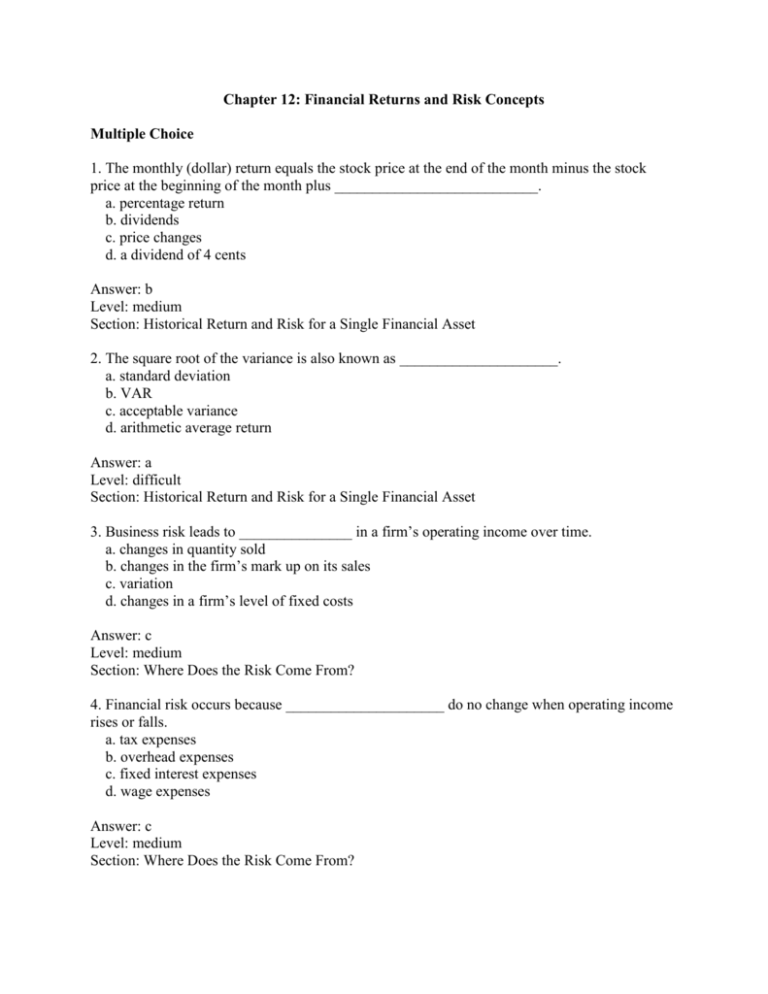

Chapter 12: Financial Returns and Risk Concepts Multiple Choice 1. The monthly (dollar) return equals the stock price at the end of the month minus the stock price at the beginning of the month plus ___________________________. a. percentage return b. dividends c. price changes d. a dividend of 4 cents Answer: b Level: medium Section: Historical Return and Risk for a Single Financial Asset 2. The square root of the variance is also known as _____________________. a. standard deviation b. VAR c. acceptable variance d. arithmetic average return Answer: a Level: difficult Section: Historical Return and Risk for a Single Financial Asset 3. Business risk leads to _______________ in a firm’s operating income over time. a. changes in quantity sold b. changes in the firm’s mark up on its sales c. variation d. changes in a firm’s level of fixed costs Answer: c Level: medium Section: Where Does the Risk Come From? 4. Financial risk occurs because _____________________ do no change when operating income rises or falls. a. tax expenses b. overhead expenses c. fixed interest expenses d. wage expenses Answer: c Level: medium Section: Where Does the Risk Come From? 5. A boom economy, normal conditions, and recession all include the three scenarios that are found in the state of _______________. a. nature b. business risk c. expected risk d. financial risk Answer: a Level: easy Section: Expected Measures of Return and Risk 6. Rather than using a limited number of states of nature with specific values for inflation and economic growth, _______________ allows many different combinations of the important variables that may determine stock returns. a. reticence b. replication c. simulation d. affectation Answer: c Level: medium Section: Expected Measures of Return and Risk 7. Which of the following is not a component of the required rate of return? a. real risk-free rate of return b. inflation expectations c. risk premium d. appropriate discount rate Answer: d Level: difficult Section: Historical Returns and Risks of Different Assets 8. Securities prices change over time. Therefore, any change in price must reflect a change in ________________. a. asset prices b. expected cash flows, the discount rate, or both c. how to interpret market data d. overseas market conditions Answer: b Level: difficult Section: Efficient Capital Markets 9. A market in which prices reflect all public and private knowledge including past and current information is called a _________________________. a. non-efficient market b. semi-strong form efficient market c. weak form efficient market d. strong form efficient market Answer: d Level: medium Section: Efficient Capital Markets 10. A _______________________ is a market in which all publicly available information, both current and past, is reflected in asset prices. a. weak form efficient market b. semi-strong form efficient market c. strong form efficient market d. non-efficient market Answer: b Level: medium Section: Efficient Capital Markets 11. The total risk of a portfolio can be measured by its ________________. a. combined return b. changes in the level of interest rates c. variance or the standard deviation of its returns d. weighted average of asset variances Answer: c Level: easy Section: Portfolio Returns and Risk 12. A positive correlation ___________________________. a. is a statistical concept that relates movements in one set of returns to movements in another set over time. b. occurs when two time series tend to move in conjunction with each other. c. occurs when two time series tend to move in opposite directions. d. occurs when we invest in several different assets rather than just a single one. Answer: b Level: difficult Section: Portfolio Returns and Risk 13. The Capital Asset Pricing Model (CAPM) states that the expected return on an asset depends on a. the standard deviation of its historical returns. b. the risk-free rate. c. its level of diversifiable risk. d. its level of systematic risk. Answer: d Level: medium Section: Capital Asset Pricing Model 14. What kind of portfolio contains all risky assets? a. human capital portfolio b. market portfolio c. beta portfolio d. capital asset portfolio Answer: b Level: easy Section: Capital Asset Pricing Model 15. Much of the long standing regulations in U.S. markets resulted from the situation surrounding __________________________. a. the stock market crash of 1929. b. the Sarbanes-Oxley Act of 2002. c. the Securities Act of 1933. d. the Securities Act of 1934. Answer: a Level: easy Section: Ethics and Job Opportunities in Investments