BAB final report GOOD

advertisement

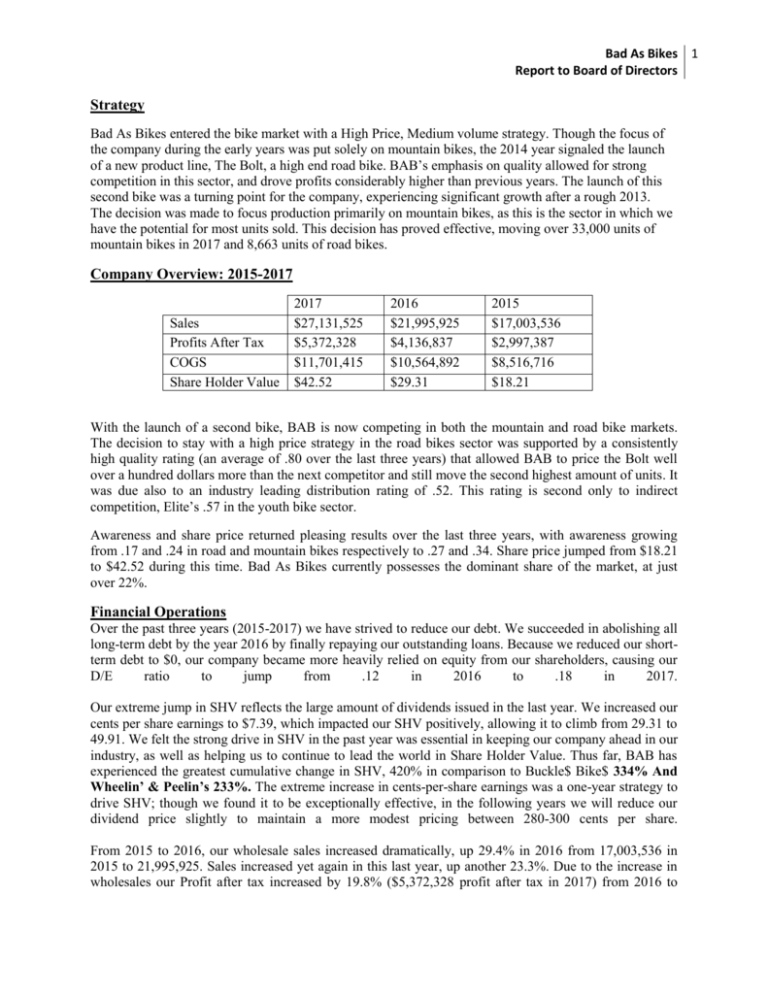

Bad As Bikes 1 Report to Board of Directors Strategy Bad As Bikes entered the bike market with a High Price, Medium volume strategy. Though the focus of the company during the early years was put solely on mountain bikes, the 2014 year signaled the launch of a new product line, The Bolt, a high end road bike. BAB’s emphasis on quality allowed for strong competition in this sector, and drove profits considerably higher than previous years. The launch of this second bike was a turning point for the company, experiencing significant growth after a rough.2013. The decision was made to focus production primarily on mountain bikes, as this is the sector in which we have the potential for most units sold. This decision has proved effective, moving over 33,000 units of mountain bikes in 2017 and 8,663 units of road bikes. Company Overview: 2015-2017 Sales Profits After Tax COGS Share Holder Value 2017 $27,131,525 $5,372,328 $11,701,415 $42.52 2016 $21,995,925 $4,136,837 $10,564,892 $29.31 2015 $17,003,536 $2,997,387 $8,516,716 $18.21 With the launch of a second bike, BAB is now competing in both the mountain and road bike markets. The decision to stay with a high price strategy in the road bikes sector was supported by a consistently high quality rating (an average of .80 over the last three years) that allowed BAB to price the Bolt well over a hundred dollars more than the next competitor and still move the second highest amount of units. It was due also to an industry leading distribution rating of .52. This rating is second only to indirect competition, Elite’s .57 in the youth bike sector. Awareness and share price returned pleasing results over the last three years, with awareness growing from .17 and .24 in road and mountain bikes respectively to .27 and .34. Share price jumped from $18.21 to $42.52 during this time. Bad As Bikes currently possesses the dominant share of the market, at just over 22%. Financial Operations Over the past three years (2015-2017) we have strived to reduce our debt. We succeeded in abolishing all long-term debt by the year 2016 by finally repaying our outstanding loans. Because we reduced our shortterm debt to $0, our company became more heavily relied on equity from our shareholders, causing our D/E ratio to jump from .12 in 2016 to .18 in 2017. Our extreme jump in SHV reflects the large amount of dividends issued in the last year. We increased our cents per share earnings to $7.39, which impacted our SHV positively, allowing it to climb from 29.31 to 49.91. We felt the strong drive in SHV in the past year was essential in keeping our company ahead in our industry, as well as helping us to continue to lead the world in Share Holder Value. Thus far, BAB has experienced the greatest cumulative change in SHV, 420% in comparison to Buckle$ Bike$ 334% And Wheelin’ & Peelin’s 233%. The extreme increase in cents-per-share earnings was a one-year strategy to drive SHV; though we found it to be exceptionally effective, in the following years we will reduce our dividend price slightly to maintain a more modest pricing between 280-300 cents per share. From 2015 to 2016, our wholesale sales increased dramatically, up 29.4% in 2016 from 17,003,536 in 2015 to 21,995,925. Sales increased yet again in this last year, up another 23.3%. Due to the increase in wholesales our Profit after tax increased by 19.8% ($5,372,328 profit after tax in 2017) from 2016 to Bad As Bikes 2 Report to Board of Directors 2017. These gains have put us above the industry average and all other firms for past three years consecutive years. Our closest competitor in terms of profit is Buckle’$ Bike$, who sit close behind BAB, with a profit after tax value of $5,132,254 in 2017. Our Cost of Goods Sold has steadily decreased over the past few years, finally falling approximately 1 million dollars from the year 2016 to 2017 (from $10,564, to 11,701,415). Though the actual dollar amount of COGS has increased since 2015, proportionate to our increasing sales, COGS is actually down 48% in 2016 to 43.1% in 2017. Our COGS is the largest in the industry, far surpassing the industry average of $7,695,164, however so do our whole sale sales, which allow us to accommodate our high costs. Marketing Over the last three years, Bad As Bikes has turned from a middle of the pack company to the industry leader. Any successful company must find an effective balance between marketing and production and BAB seems to have found a cohesive approach to coordinating the two. A combination of effective branding, distribution, advertising, and public relations contributed to BAB’s success over the last three years. Branding Since 2015 BAB has increased product branding expenditure from $500,000 to $900,000, which is higher than all of our competition. Wheelin’ & Peelin’ spent $600,000 and Buckle’$ Bike$ spent $645,000. Our increased emphasis on branding, as well as our advertising and PR, helped our brand awareness climb from .14 to .27 in the road bike’s sector and .24 to .34 in mountain bikes. The target awareness rating for mountain bikes is .25 and for road bikes .1, which places us comfortably above both the industry averages (.23, .24) as well as the target ratings. Advertising & Public Relations In 2017 BAB maintained a upper-range total product advertising expenditure of $3.35 million, and a PR budget of $2.25 million. With PR ratings of .16 and .48 for mountain and road bikes respectively, BAB stayed ahead of the industry averages of .15 and .45, as well as the targets of .1 and .30. The variance between the two ratings can be attributed to the difference in spending, as well as the target market’s sensitivity to PR (low for mountain, high for road). Our advertising expenditure is significantly higher than both Wheelin’ & Peelin’ & Buckle’$ Bike$. However, Elite is spending $400,000 more, which can be attributed to the fact that they are in the youth sector. The strong PR rating, alongside the aforementioned increased awareness rating, contributed to the success of our road bike, The Bolt, and combined with our awareness rating allowed BAB to become the second highest mover of units in both of its sectors. Distribution Bad As Bikes made the decision to lower retail margins in exchange for increased distribution channel support. While this strategy was extremely effective for sports stores and distribution of our mountain bike climbed from a rating of .2 to .32, which is well above the industry average of .21, driving sales of our mountain bike model by approximately 11,000 units, this tactic did not have the desired effect for bike shops. Our road bike’s distribution rating dropped from .66 to .52 (a decrease of 16%, though still above the .4 industry average) and while market research suggests that the target consumer of road bikes is not sensitive to distribution, sales of the Bolt did drop slightly from 2015 to 2017, which does indicate that this did have a negative impact. Operational Decisions Operational decisions account for the largest portion of company spending. Bad As Bikes 3 Report to Board of Directors Quality, Sales, & Retail Pricing Product quality is of the utmost importance to Bad As Bikes. We believe strongly that our quality rating is the factor that allows us to price our products the way that we do and move the second largest amount of units in the world. Our quality rating averaged .80 over the past three years (with .81 in 2017) and we have every reason to trust that it is this consistently high number that lets BAB price our road bike model at $1,755 which is well above the industry average of $1,580 and more than $300 dollars higher than our closest competitor, Wheelin’ & Peelin’. For 2017 in the road bike industry we sold nearly 1,000 units less than Wheelin’ & Peelin’, but we topped their retail sales by more than $6,000,000 due to our excellent performance in mountain bikes, where they remain our competition only in terms of price. Elite, the company with the highest volume of mountain bikes sold, prices their model $45 less than our $620, so we also out performed them in terms of both wholesale and retail sales. Since 2015 our sales have consistently been greater than our competition’s sales and the number of mountain bikes being sold has increased significantly since 2015, from 22,570 to 33,480 in 2017. Inventory Currently there are just over 4,000 excess mountain bikes in inventory and no road bikes. Typically we aim to have fewer than 300 in inventory, because we would rather have a few extra than lost sales. Having excess units in inventory is easily remedied the following year by producing slightly fewer bikes in that sector, although over the course of the last several years we have become better at forecasting demand, with a current forecast accuracy of 91%. Capacity With the launch of a new product line came the purchasing of capacity. Upon the release of the Bolt, we increased our capacity from 20,000 to 25,000 and by 2017 had increased this number to 40,000, which is above the industry average of 31,915. Having a higher capacity allows us to produce enough bikes to satisfy demand in both of the sectors in which we compete. Wastage & Idle Time The industry average wastage time is 27%, though this number could be perceived as deceptively low due to the fact that Firm 6 and Firm 7 both have wastage of only 17%. Two of our strongest competitors, Buckle$ Bike$ and Elite, both have more wastage than BAB, at 40% and 46% respectively. This wastage reduces our efficiency and hinders the amount of bikes we could be producing at our current capacity. In contrast to our high wastage, BAB’s idle time is at 0%, tied with Buckle$ Bike$ for the lowest in the world, which means that we are currently producing as many bikes as is physically possible for our laborers and factories. Bad As Bikes 4 Report to Board of Directors Bad As Bikes 5 Report to Board of Directors Bad As Bikes 6 Report to Board of Directors Future Objectives: Bad As Bikes has big goals for the next five years. After experiencing success in both the mountain and road bike sectors, we believe that the best move for the growth of the company will be the pursuit of the following: Launch of Youth Bike Maintaining High Expenditure on Quality & Efficiency Branding, Advertising & Distribution Spending Increase Market Share Maintaining low D/E, driving SHV Recommendations: Big goals require a cohesive approach in order to be achieved. This is how we plan to reach our future objectives: The Children Are Our Future: Launch of the Funksta2018 Our key recommendation for the future of Bad As Bikes is the launch of a youth bike for the year of 2018. Because of our high product awareness and quality index, our simulations predict that we will dominate the market, moving upwards of 70,000 units by our third year of production, and 90,000 by our fifth. Though Buckle$ Bike$ had a successful product launch in 2015, we believe we can overtake them in this sector. Our plan is to: Create a strong presence with high spending in advertising during the first stages of the launch Produce an initially more expensive model with a lower SCU number in order to hit the ground running. Price aggressively low, as the children’s sector is congested with medium priced bikes. By entering the market at a low price of $240, it is foreseeable that BAB will dominate sales in youth bikes. An emphasis on advertising will drive sales of our youth bike well over 85,000 units by 2022. Our planned advertising expenditure for the youth bike would be 3,000,000 annually Quality & Efficiency spending Bad As Bikes will continue to place an emphasis on quality. We plan to: Maintain a quality rating above .81 by spending annually between 2 and 4 million on quality and efficiency separately. This will also allow us to produce more youth bikes and increase our quality, which will also increase our shareholder value. Increase capacity to 78,000 units by 2022 to accommodate for youth bike production Stay current by updating the designs of our bikes every 1-2 years in order to manufacture bikes with the lowest SCU numbers and highest appeal to customers. Branding, Advertising, & Distribution Branding and advertising will continue to be important to the company in the future, and we plan to maintain our leading distribution rating by: Bad As Bikes 7 Report to Board of Directors Maintaining retailer margins of 23%, 27% and 25% for discount, sport, and bike stores respectively Continuing to invest a generous amount into distribution channel support, especially in the youth bike sector. Continue Spending on advertising to a total of $6,000,000 annually by 2022. This cost is driven mainly by the youth bike sector’s sensitivity to advertising Our goal is to have a market share of 35% by 2022. If we can accomplish our goals in marketing by 2022, a 35% market share is feasible. Driving Share Holder Value BAB feels that a strong company is indebted to no one; we expect our company’s share price to continue to climb and as such plan on issuing 50,000 shares within the next three years, bringing total shares issued to just over 980,000 and increasing our SHV. We believe that one of the reasons our share holders value our company is due to our low debt to equity ratio and we intend to strive to keep this low while maintaining a strong hold over the amount of shares issued. SHV is expected to more than triple to upwards of $160 by 2023 as the company will continue to pay out dividends of between 280-300 cents per share (dividends paid will increase as more equity is repurchased). Conclusion Since the launch of the road bike model, BAB has grown significantly from the under-performing company that we were in the years leading up to 2015. A successful combination of marketing and production/distribution strategies allowed Bad As Bikes to reach over-all growth in terms of distribution, quality, and awareness ratings. By actively reducing debt, paying out generous dividends, and focusing on quality and advertising, our shareholder value has skyrocketed since 2015, with a cumulative change of 420% since start up years. Though there is fierce competition to contend with in the highly valued Buckle$ Bikes, the distributionrich Elite, and comparatively priced Wheelin’ & Peelin’, Bad As Bikes has risen to the top despite a rocky start, and the prospect of a third product being launched in the next year gives us reason to believe that BAB will continue to lead the world in bike sales.