15.617 - John Akula

advertisement

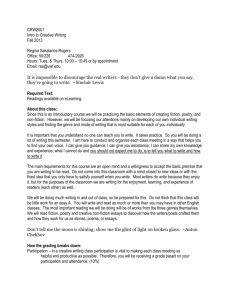

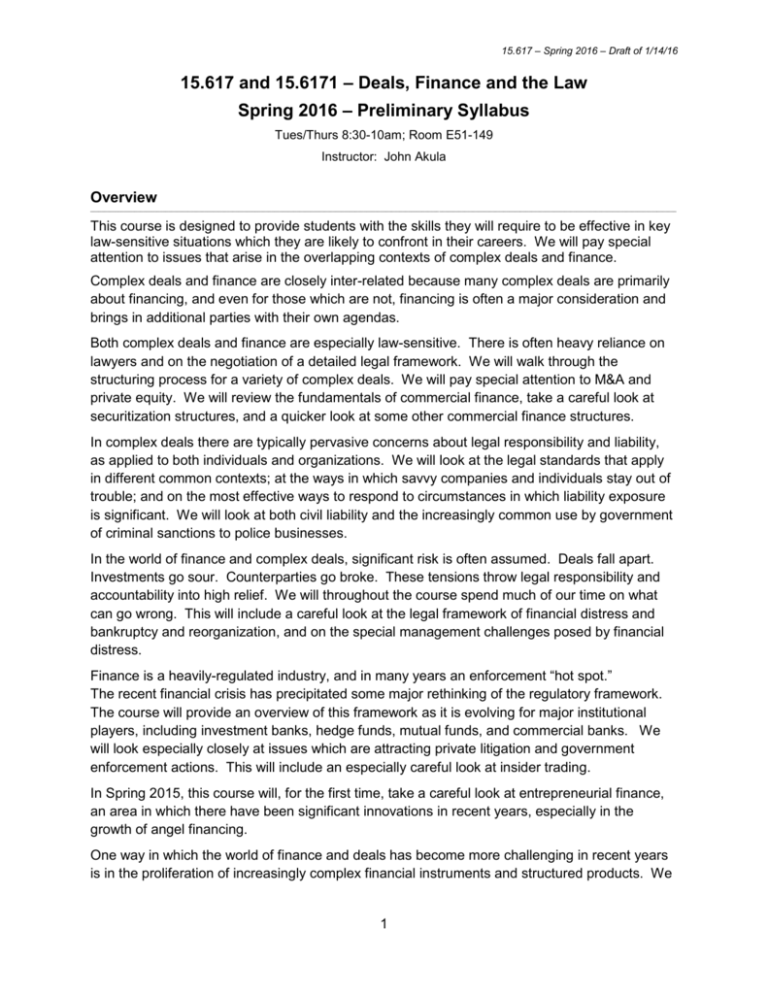

15.617 – Spring 2016 – Draft of 1/14/16 15.617 and 15.6171 – Deals, Finance and the Law Spring 2016 – Preliminary Syllabus Tues/Thurs 8:30-10am; Room E51-149 Instructor: John Akula Overview _____________________________________________________________________________________________________________________________ _____________________________________________________________________________________ This course is designed to provide students with the skills they will require to be effective in key law-sensitive situations which they are likely to confront in their careers. We will pay special attention to issues that arise in the overlapping contexts of complex deals and finance. Complex deals and finance are closely inter-related because many complex deals are primarily about financing, and even for those which are not, financing is often a major consideration and brings in additional parties with their own agendas. Both complex deals and finance are especially law-sensitive. There is often heavy reliance on lawyers and on the negotiation of a detailed legal framework. We will walk through the structuring process for a variety of complex deals. We will pay special attention to M&A and private equity. We will review the fundamentals of commercial finance, take a careful look at securitization structures, and a quicker look at some other commercial finance structures. In complex deals there are typically pervasive concerns about legal responsibility and liability, as applied to both individuals and organizations. We will look at the legal standards that apply in different common contexts; at the ways in which savvy companies and individuals stay out of trouble; and on the most effective ways to respond to circumstances in which liability exposure is significant. We will look at both civil liability and the increasingly common use by government of criminal sanctions to police businesses. In the world of finance and complex deals, significant risk is often assumed. Deals fall apart. Investments go sour. Counterparties go broke. These tensions throw legal responsibility and accountability into high relief. We will throughout the course spend much of our time on what can go wrong. This will include a careful look at the legal framework of financial distress and bankruptcy and reorganization, and on the special management challenges posed by financial distress. Finance is a heavily-regulated industry, and in many years an enforcement “hot spot.” The recent financial crisis has precipitated some major rethinking of the regulatory framework. The course will provide an overview of this framework as it is evolving for major institutional players, including investment banks, hedge funds, mutual funds, and commercial banks. We will look especially closely at issues which are attracting private litigation and government enforcement actions. This will include an especially careful look at insider trading. In Spring 2015, this course will, for the first time, take a careful look at entrepreneurial finance, an area in which there have been significant innovations in recent years, especially in the growth of angel financing. One way in which the world of finance and deals has become more challenging in recent years is in the proliferation of increasingly complex financial instruments and structured products. We 1 15.617 – Spring 2016 – Draft of 1/14/16 will review some key legal principles in the design of these instruments and products, including common derivatives, swaps, and asset-backed securities. Throughout the course, we will try to bring into focus the opportunities and risks confronting the different parties involved. For example, we will look at M&A from the points of view of both a mature company interested in a strategic acquisition and a young hi-tech company seeking a buyer. When we discuss structured products, we will consider the perspectives of both those who design them and their customers, especially the non-financial customers who use them for business purposes in operating companies. Our focus on the perspectives of particular parties will be accompanied by discussion of effective negotiating strategies. In many business contexts, the interests of a manager and the entity for which he or she works are closely aligned. But that is not always so. For example, a company and a manager are likely to have very different priorities in connection with a decision by that manager to move to a job elsewhere in the industry, or to set up a competing venture. Likewise, regulatory schemes sometimes draw a very clear distinction between individual and corporate accountability, and use that distinction as a leverage point in enforcement proceedings. Throughout this course, we will pay close attention to the distinction between what the law expects of organizations, and what it expects of individuals, and of the differences between keeping an organization out of trouble and keeping one’s self out of trouble. The course will focus primarily on the U.S. But an increasingly large proportion of complex deals such as M&A are cross-border transactions, and financial markets are global. We will take the time to consider the transnational dimension at every point in the course. The instructor was for many years a practicing lawyer and a partner in a leading U.S. law firm, and the approach to law in this course is very hands-on. For many topics, top lawyers from major firms will be invited into the course to share their perspectives and expertise. This course will provide students with practical frameworks and tools, and will focus on real-life problems and cases throughout. There is a class-by-class topical outline at the end of this syllabus. Prerequisites and prior experience _____________________________________________________________________________________________________________________________ _____________________________________________________________________________________ There are no prerequisites required or recommended for either of this course. You do not need any courses or other background in law or business – any needed background will be provided in the course. There is a “language of the law,” but the readings, lectures, and deliverables will all be designed with the fact in mind that English is a second language for many students. The course is intended to be ESL-friendly, and language-related complications will be kept to a minimum. Graduate and undergraduate students from all divisions of the university are welcome. Relationship to other law courses _____________________________________________________________________________________________________________________________ _____________________________________________________________________________________ My law courses are not a sequence, but an array of choices. Each course contains a similar core of material, and also a “tilt” towards certain particular interests. But the courses are more alike than different. So pick the one that sounds like the best fit for your interests, but if you have scheduling constraints, it also makes sense to let that guide your decision. Generally, a 2 15.617 – Spring 2016 – Draft of 1/14/16 student should not plan on taking more than one of my courses, but if you think that you should, an arrangement can be made. Expectations of students _____________________________________________________________________________________________________________________________ _____________________________________________________________________________________ Stellar registration: You should be registered for this class on Stellar. Class attendance: Much of the most important material in this course is presented in class and not in the readings, so students should plan on attending all of the classes. Classes will begin promptly at 8:35. Attendance will be a factor in grading. Absences for good cause (such as job hunting or family obligations) will not be penalized, so long as the number of such absences is not excessive. "Excessive" depends on the circumstances; however, more than 1 excused absence will get a hard look. You should e-mail the TA before or shortly after the class in question, with a “cc” to the instructor, to request an excused absence. (You do not need to include in the e-mail any personal details -- just a general statement of the reasons, e.g., job interview, family obligations). Under no circumstances should a student sign in for anybody but himself or herself. Please do not use laptops or cell phones during class. Class participation: All students are encouraged to participate in class discussion. Failure to participate is not penalized, but participation which is thoughtful, especially participation which demonstrates a firm grasp of the readings, may be a small positive factor in grading. Written exercises and deliverables: There are 2 written exercises, one around the middle of the semester and one about two weeks prior to the last class. A student may elect to do the exercises as an individual or as part of a team of up to 3 members. Each exercise will present a realistic business situation and require the student or team to assess its law-sensitive aspects. Both exercises are “open book.” The sources you may consult are the following: (i) the readings for the course; (ii) any other published source (but since in grading the exercise I will be looking for indications that you have done the readings assigned in this course, consulting other sources is not likely to do you much good) and (iii) any notes prepared by you, or by any other student currently enrolled in the class with whom you have prepared for the exercise. During the entire period for which each exercise is available, a student may not consult with any other person about the exercise. The time allotments for the exercises are generous enough so you do not have to write fast to do well. This may be of special importance for students for whom English is a second language. st 1 exercise 2nd exercise Date To be done Thursday March 3, 7pm-9pm To be done on Tuesday May 3, 7pm-9pm Material covered classes 1-7 Classes 1-20 Grading _____________________________________________________________________________________________________________________________ _____________________________________________________________________________________ Grading is not tied to a formula, but will be based approximately as shown below: 3 15.617 – Spring 2016 – Draft of 1/14/16 First exercise Second exercise Class attendance/participation 30% 50% 20% Textbooks and other readings _____________________________________________________________________________________________________________________________ _____________________________________________________________________________________ There are two required texts for the course, both of which students are encouraged to purchase: The Entrepreneur’s Guide to Business Law by Constance Bagley and Craig Dauchy, 4th ed, paperback (2011; South-Western); ISBN-10: 0538466464; ISBN-13: 978-0538466462. The book has been ordered at the Coop, and is available new for about $90 on Amazon. After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead by Alan S. Blinder (2013; Penguin Books [Hardback edition Princeton U. Press]; ISBN-10: 014312448X; ISBN-13: 978-0143124481. The book has been ordered at the Coop, and is available new for about $16.00 on Amazon. Other material will be posted on Stellar or distributed in class. Contact information _____________________________________________________________________________________________________________________________ _____________________________________________________________________________________ Instructor: John Akula E62-316 617-452-3619 (office) 857-928-4488 (cell) jakula@mit.edu Course Teaching Assistant: Shawn Robert Flaherty shawnrf@mit.edu Faculty Administrative Assistant: Patty Curley E62-311 617-253-5701 pcurley@mit.edu (see over for class-by-class topical outline) 4 15.617 – Spring 2016 – Draft of 1/14/16 Class-by-class topical outline Class/Date 1 Tues 2/2 2 Thurs 2/4 3 Tues 2/9 4 Thurs 2/11 5 Thurs 2/18 6 Tues 2/23 7 Thurs 2/25 8 Tues 3/1 9 Thurs 3/3 10Tues 3/8 11Thurs 3/10 12 Tues 3/29 13 Thurs 3/31 14 Tues 4/5 15 Thurs 4/7 16 Tues 4/12 17 Thurs 4/14 18 Thurs 4/21 19 Tues 4/26 20 Thurs 4/28 21 Tues 5/3 22 Thurs 5/5 23 Tues 5/10 24 Thurs 5/12 Topic Mergers and acquisitions (I) Mergers and acquisitions (II) Mergers and acquisitions (III) Mergers and acquisitions (IV) No class Tuesday 2/16 -- Monday class schedule Antitrust and fair competition (II) Antitrust and fair competition (I) Contracts (I) Contracts (II) Commercial Finance; Bankruptcy and Reorganization (I) Commercial Finance; Bankruptcy and Reorganization (Ii) Commercial Finance; Bankruptcy and Reorganization (III) No classes SIP Week 3/14 – 3/18 & Spring Break Week 3/21 – 3/25 Financial services regulation overview (I) Financial services regulation overview (II) Asset management (I) Asset management (II) Financial instruments and structured products (I) Financial instruments and structured products (II) No class Tuesday 4/19 – Patriots Day Entrepreneurial finance (I) Entrepreneurial finance (II) Enforcement, accountability and litigation (I) Enforcement, accountability and litigation (II) Enforcement, accountability and litigation (III) The Job Market (I) The Job Market (II) 5