Good evening ladies and gentlemen

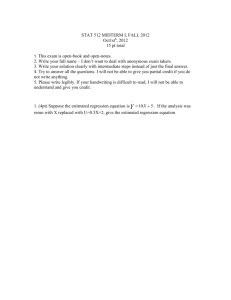

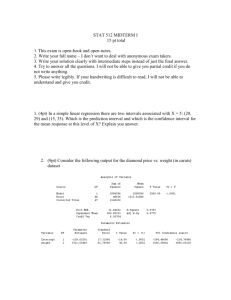

advertisement