B2C Online Transactions doc

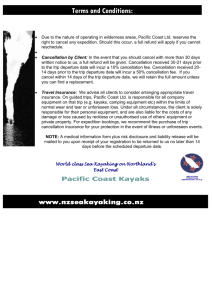

advertisement