03.07.2015 MIS 214 PS#6 John Swanson , president of Market

advertisement

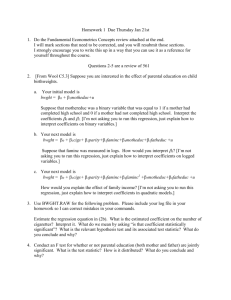

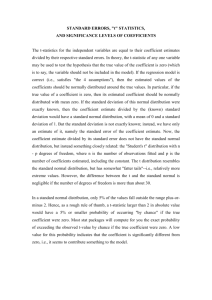

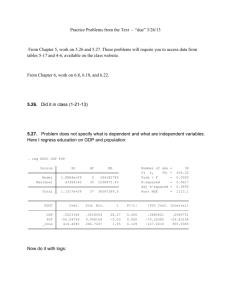

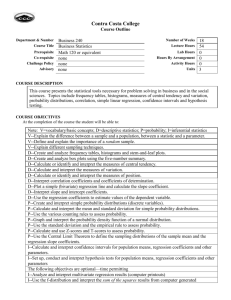

03.07.2015 MIS 214 PS#6 1. John Swanson , president of Market Research Inc., has asked you to estimate the coefficients of the model Y = B0 + B1X1 +B2X1^2 + B3X3 where Y is the expected sales of office supplies for a large retail distributor of offices supplies, X1 is the total disposable income of residents within 5 miles of the store, and X2 is the total number of persons employed in information-based businesses within 5 miles of the store,. Recent work by a national consulting firm has concluded that the coefficients in the model must have the following restriction: B1 + B2 = 2 Describe how you would estimate the model coefficients using least squares. 2. Consider the following nonlinear model with multiplicative errors: Y = B0 x X1^B1 x X2^B2 x X3^B3 x X4^B4e B1 + B2 = 1 B3 + B4 = 1 Show how you would obtain the coefficient estimates. Coefficients restrictions must be satisfied. Show all your work and explain what you are doing. 3. The following model was fitted to explain the selling prices of buildings in a sample of 815 sales: 𝑦̂ = -1264 +48.18x1 + 3382x2 - 1859x3 + 3219x4 +2005x5 (0.91) (515) (488) (947) (768) (768) 2 R = 0.86 where 𝑦̂ = selling price of the building in dollars x1 = sqaure footage of living are x2 = size of garage, in number of cars x3 = age of building, in years x4 = dummy variable taking the value 1 if the building has a fireplace and 0 otherwise x5 = dummy variable taking the value 1 if the building has hardwood floors and 0 if it has vinyl floors a. Interpret the estimated coefficient of x4. b. Interpret the estimated coefficient of x5. c. Find a 95% confidence interval for the impact of a fireplace on selling price, all other things being equal. d. Test the null hypothesis that type of flooring has no impact on selling price against the alternative that, all other things being equal, buildings with hardwood floors have a higher selling price than those with vinyl flooring. 4. The following model was fitted to data on 32 insurance companies. Y = 7.62 – 0.16X1 +1.23X2 (0.008) (0.496) 2 R = 0.37 Where Y = price-earnings ratio X1 = size of insurance company assets, in billions of dollars X2 = Dummy variable taking the value 1 for regional companies and 0 for national companies. The number in parentheses under the coefficients are the estimated coefficient standard errors a. Interpret the estimated coefficient on the dummy variable. b. Test against a two-sided alternative the null hypothesis that the true coefficient on the dummy variable is 0. c. Test at the 5% level the null hypothesis b1 = b2 = 0, and interpret your results. 5. An analyst want to estimate dependence of sales of a product (Y) on its own price (X1) and price of the competitor’s product (X2) using linear regression, based on a sample of data obtained from 20 stores. Fill the missing parts in the following regression outputs (From a to l) Do not write on the following table Standard deviation of error: k, coefficient of determination: l (letter l not number 1) SS d.f. MS F Regression a c 200 g Error b d f Total 420 e p-value Variable bi Constant 10.5 standard-dev of bi t-stat p-value 3.9 X1 -2.6 h -0.75 X2 1.7 i j 0.10