MAT 480 - nau.edu

UCC/UGC/ECCC

Proposal for Course Change

FAST TRACK

(Select if this will be a fast track item. Refer to Fast Track Policy for eligibility)

If the changes included in this proposal are significant, attach copies of original and proposed syllabi in approved university format .

1. Course subject and number: MAT 480 2. Units: 3

See upper and lower division undergraduate course definitions .

3. College: CEFNS 4. Academic Unit: Mathematics & Statistics

5. Current Student Learning Outcomes of the course.

Upon successful completion of the course, students will be able to:

1.

Demonstrate an understanding of the financial modeling process for creating mathematical models for well-posed financial problems.

2.

Model financial-world problems using techniques from stochastic calculus, partial differential equations, actuarial science, and probability theory.

3.

Investigate and interpret the validity and properties of a financial model.

4.

Present the results and conclusions drawn from model analysis.

5.

Contribute to a major collaborative modeling effort.

Show the proposed changes in this column (if applicable). Bold the proposed changes in this column to differentiate from what is not changing, and Bold with strikethrough what is being deleted . ( Resources & Examples for

Developing Course Learning Outcomes )

Upon successful completion of the course, students will be able to:

1.

Demonstrate an understanding of the financial modeling process for creating mathematical models for well-posed financial problems.

2.

Model financial-world problems using techniques from stochastic calculus, partial differential equations, actuarial science, and probability theory.

3.

Investigate and interpret the validity and properties of a financial model.

4.

Present the results and conclusions drawn from model analysis.

5.

Contribute to a major collaborative modeling effort.

5.

Solve problems dealing with the mathematics of financial economics similar to those encountered on professional actuarial examinations.

6. Current title, description and units . Cut and paste, in its entirety, from the current on-line

Show the proposed changes in this column

Bold the proposed changes in this column to

Effective Fall 2012

academic catalog * http://catalog.nau.edu/Catalog/ .

MAT 480 - Mathematics Of Finance Modeling

Return to search

Description: Principles of modeling actuarial and financial market events. Weiner and stochastic processes, binomial tree pricing, and Black-

Scholes analysis. Letter grade only. Course fee required.

Units: 3

Prerequisite: MAT 239 with a grade of C or better differentiate from what is not changing, and

Bold with strikethrough what is being deleted.

MAT 480 - Mathematics Of Finance Modeling

Return to search

Description: Principles of modeling actuarial and financial market events. Weiner and stochastic processes, binomial tree pricing, and Black-Scholes analysis .

Mathematical concepts of financial models used to describe the monetary-world phenomena of random markets.

Provides experience in creating and analyzing such models. Co-convened with MAT 580.

Credit not allowed for both MAT 480 and MAT

580.

Letter grade only. Course fee required.

Units: 3

Prerequisite: MAT 239 with a grade of C or better

* if there has been a previously approved UCC/UGC/ECCC change since the last catalog year, please copy the approved text from the proposal form into this field.

7. Justification for course change.

MAT 480 will co-convene with the proposed new course MAT 580. MAT 580 is being created to make it available for our MS Statistics graduate students who are interested in entering the actuarial profession. Many now take MAT 480, but this course will not apply toward their MS program, even though it is one of the most mathematically sophisticated courses among our four actuarial courses.

The changes in MAT 480 are slight, only intended to clarify the content and to reflect the creation of

MAT 580.

8. Effective BEGINNING of what term and year?

Fall 2015

See effective dates calendar .

IN THE FOLLOWING SECTION, COMPLETE ONLY WHAT IS CHANGING

CURRENT

Current course subject and number:

Current number of units:

Current short course title:

Current long course title:

Current grading option: letter grade pass/fail or both

Current repeat for additional units:

PROPOSED

Proposed number of units:

Proposed course subject and number:

Proposed short course title (max 30 characters):

Proposed long course title (max 100 characters):

Proposed grading option: letter grade pass/fail or both

Proposed repeat for additional units:

Effective Fall 2012

Current max number of units:

Current prerequisite:

Proposed max number of units:

Current co-requisite:

Proposed prerequisite (include rationale in the justification):

Proposed co-requisite (include rationale in the justification):

Current co-convene with:

NONE

Current cross list with:

Proposed co-convene with:

MAT 580

Proposed cross list with:

9. Is this course in any plan (major, minor, or certificate) or sub plan (emphasis)? Yes No

If yes, describe the impact. If applicable, include evidence of notification to and/or response

from each impacted academic unit.

The course is applicable toward the BS Mathematics Major and the newly proposed Actuarial

Science Minor. The change will not impact the BS Mathematics Major.

10. Is there a related plan or sub plan change proposal being submitted? Yes No

If no, explain.

The Actuarial Science Minor proposal is being submitted at the same time as this course change proposal.

11. Does this course include combined lecture and lab components? Yes No

If yes, include the units specific to each component in the course description above.

Answer 12-15 for UCC/ECCC only:

12. Is this course an approved Liberal Studies or Diversity course? Yes No If yes, select all that apply. Liberal Studies Diversity Both

13. Do you want to remove the Liberal Studies or Diversity designation? Yes No

If yes, select all that apply. Liberal Studies Diversity Both

14. Is this course listed in the Course Equivalency Guide ? Yes No

15. Is this course a Shared Unique Numbering (SUN) course? Yes No

FLAGSTAFF MOUNTAIN CAMPUS

Scott Galland

Reviewed by Curriculum Process Associate

01/07/2015

Date

Effective Fall 2012

Approvals :

Department Chair/Unit Head (if appropriate)

Chair of college curriculum committee

Dean of college

For Committee use only:

UCC/UGC Approval

Approved as submitted: Yes No

Approved as modified: Yes No

EXTENDED CAMPUSES

Reviewed by Curriculum Process Associate

Approvals:

Academic Unit Head

Division Curriculum Committee (Yuma, Yavapai, or Personalized Learning)

Division Administrator in Extended Campuses (Yuma, Yavapai, or Personalized

Learning)

Faculty Chair of Extended Campuses Curriculum Committee (Yuma, Yavapai, or

Personalized Learning)

Chief Academic Officer; Extended Campuses (or Designee)

Approved as submitted: Yes No

Approved as modified: Yes No

Effective Fall 2012

Date

Date

Date

Date

Date

Date

Date

Date

Date

Date

PROPOSED SYLLABUS

College of Engineering, Forestry and Natural Sciences

Department of Mathematics & Statistics

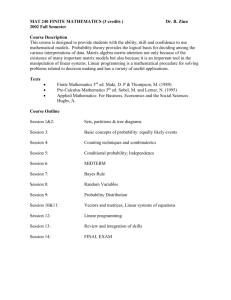

MAT 480 MATHEMATICS OF FINANCIAL MODELING

Semesters Offered: Spring of odd-numbered years Credit Hours: 3

Course Description/ Course Prerequisite:

MAT 480 Mathematics of Financial Modeling is a three semester-hour course meeting 150 minutes each week that develops the mathematical concepts of financial models used to describe the monetary-world phenomena of random markets. The course will provide experience in creating and analyzing such models. Co-convened with MAT 580. Prerequisite: MAT 239 or instructor consent.

Student Learning Expectations:

Upon completion of the course, students should be able to:

1. Demonstrate an understanding of the financial modeling process for creating mathematical models for well-posed financial problems.

2. Model financial-world problems using techniques from stochastic calculus, partial differential equations, actuarial science, and probability theory.

3. Investigate and interpret the validity and properties of a financial model.

4. Present the results and conclusions drawn from model analysis.

5. Solve problems dealing with the mathematics of financial economics similar to those encountered on professional actuarial examinations.

Course Structure and Approach:

Course material will be presented in an interactive lecture format. Assignments will give students experience in developing mathematical models of financial-world phenomena and minute-by-minute pricing of financial derivatives. These will use mathematics learned in previous courses as well as material presented as needed in this course. The course involves a significant amount of computer programming used for data and model analysis.

Required Text:

Derivative Markets, 3 rd ed., McDonald, Pearson Addison-Wesley.

Supplemental Resources:

Option Pricing: Mathematical Methods and Computation , P. Wilmott, S. Howison, J. DeWynne,

Cambridge University Press

An Introduction to the Mathematics of Financial Derivatives , S. Neftci, Academic Press

Course Outline:

6. Introduction and Basic Strategies: insurance, forwards, call and put options, long and short positions, spreads and collars, simple hedging (e.g., with a forward contract), futures and swaps.

(3-5 weeks)

7. Options: parity, American and European options, binomial option pricing, Black-Sholes formula, market-making and delta-hedging, exotic options (6-7 weeks)

8. Advanced pricing theory: Topics chosen from the lognormal distribution, monte carlo valuation,

Brownian motion and Ito’s lemma, additional application of the Black-Sholes equation, volatility, and interest rate models (3-5 weeks)

Effective Fall 2012

Assessment of Student Learning Outcomes and Timeline:

There will be at least two midterm exams and a comprehensive final exam. Many problems on the exams will be similar to problems encountered on professional actuarial exams. Some tests may include a take-home portion. Regular homework assignments (typically weekly) and/or quizzes will also be required. The homework may require computer programming. These will be weighted as follows.

Homework and quizzes: 30%

Midterm Exams: 40% (20% each)

Final Exam: 30%

Grading System

Grades will be based on percentages as follows.

A: 90

– 100%; B: 80 – 89%; C: 70 – 79%; D: 60 – 69%; F: 0 – 59%

Course Policies:

Attendance policy, Make-up policy and other policies

–

Varies by instructor.

University policies – Students are responsible for university policies found at http://nau.edu/OCLDAA/_Forms/UCC/SyllabusPolicyStmts2-2014/.

Effective Fall 2012