Manufacturing Transition Programme Funding

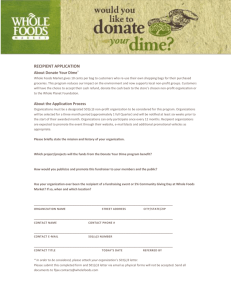

advertisement