Repeal of the Carbon Tax - Treatment of Synthetic Greenhouse Gases

advertisement

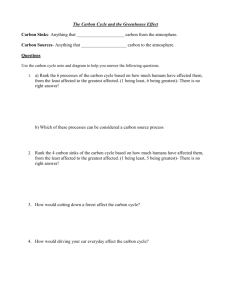

REPEAL OF THE CARBON TAX – TREATMENT OF SYNTHETIC GREENHOUSE GASES The carbon tax repeal legislation received the Royal Assent on 17 July 2014 and the bills as part of this package are now law, with effect from 1 July 2014. This means that the equivalent carbon tax on synthetic greenhouse gases no longer applies and the costs associated with re-gassing refrigeration and air-conditioning equipment will be lower. Information for licensed importers of synthetic greenhouse gases and equipment containing these gases is available at: www.environment.gov.au/protection/ozone/licences How are synthetic greenhouse gases treated under the equivalent carbon tax? During 2012-13 and 2013-14, synthetic greenhouse gases had an equivalent carbon tax applied through the Ozone Protection and Synthetic Greenhouse Gas Management legislation. Gases covered were hydrofluorocarbons, perfluorocarbons, sulfur hexafluoride, and any equipment or products which contain these gases were also covered, with limited exemptions. How much was the equivalent carbon tax on synthetic greenhouse gases? The tax per tonne of synthetic greenhouse gas was based on the carbon tax and the carbon dioxide equivalence for each gas. - For example R134a, a common refrigerant gas used in domestic refrigeration and air conditioning, has a global warming potential 1,300 times that of carbon dioxide. During 2013-14, importers paid an equivalent carbon tax of $31,400 per tonne on the import of this gas. Removing the carbon tax will lower the cost of re-gassing refrigeration and air-conditioning equipment. - For a typical small supermarket refrigeration system this is a saving of over $10,000. - For a beer cooling system at a hotel or club this is a saving of $3,100. - For a domestic split system air-conditioner this is a saving of $83. - For a passenger motor vehicle this is a saving of $19. When did the equivalent carbon tax on synthetic greenhouse gases end? Now that carbon tax repeal is law, businesses will not incur new equivalent carbon tax liabilities on synthetic greenhouse gases imported or manufactured from 1 July 2014. Equivalent carbon tax liabilities incurred for imports and manufacture up to 30 June 2014 must be met in full. How will the Government ensure lower prices now that the carbon tax is repealed? The ACCC will monitor and enforce reasonably expected price reductions across key sectors, particularly the electricity, gas and synthetic greenhouse gas sectors. The ACCC will also have, for one year following the repeal of the carbon tax, new powers to take action against businesses that engage in carbon tax-related price exploitation, or that make false or misleading claims about the effect of the carbon tax repeal on prices. These new provisions complement the existing provisions of the Australian Consumer Law that prohibit misleading and deceptive conduct and false or misleading representations. These new provisions require companies supplying synthetic greenhouse gases to pass on all cost savings associated with repeal of the carbon tax. - Penalties of up to $1.1 million for corporations and $220,000 for individuals will apply for carbon tax-related price exploitation following the repeal. - Bulk synthetic greenhouse gas importers can be penalised 250 per cent of any cost savings from the carbon tax repeal that they do not pass on to customers; - Bulk synthetic greenhouse gas importers will be required to substantiate their cost savings to the ACCC. How will Australia continue meet its international obligations to reduce ozone depleting substances and synthetic greenhouse gases? The ‘synthetic greenhouse gas cost recovery levy’ will continue to apply at $165 per metric tonne. The levy funds the Ozone Protection and Synthetic Greenhouse Gas Programme to reduce emissions of ozone depleting substances and synthetic greenhouse gases. The recovery and destruction of ozone depleting substances and synthetic greenhouse gases will continue after 30 June 2014: - Refrigerant Reclaim Australia’s refrigerant recovery and destruction program, which was established by industry in 1993, will continue to operate; - Membership of Refrigerant Reclaim Australia will remain a licence condition for refrigerant importers; 2 - The legal requirement for technicians to return recovered waste refrigerants for disposal will remain; and - The offence provision for emissions of refrigerants not in accordance with the regulations will remain. More information equivalent carbon price for synthetic greenhouse gases www.environment.gov.au/protection/ozone/synthetic-greenhouse-gases/equivalentcarbon-price ACCC – carbon tax repeal www.accc.gov.au/business/carbon-tax-repeal Disclaimer While reasonable efforts have been made to ensure that the contents of this publication are factually correct, the Commonwealth does not accept responsibility for the accuracy or completeness of the contents, and shall not be liable for any loss or damage that may be occasioned directly or indirectly through the use of, or reliance on, the contents of this publication. 3