TRR 128 - M2M Changes to Attachment AE

advertisement

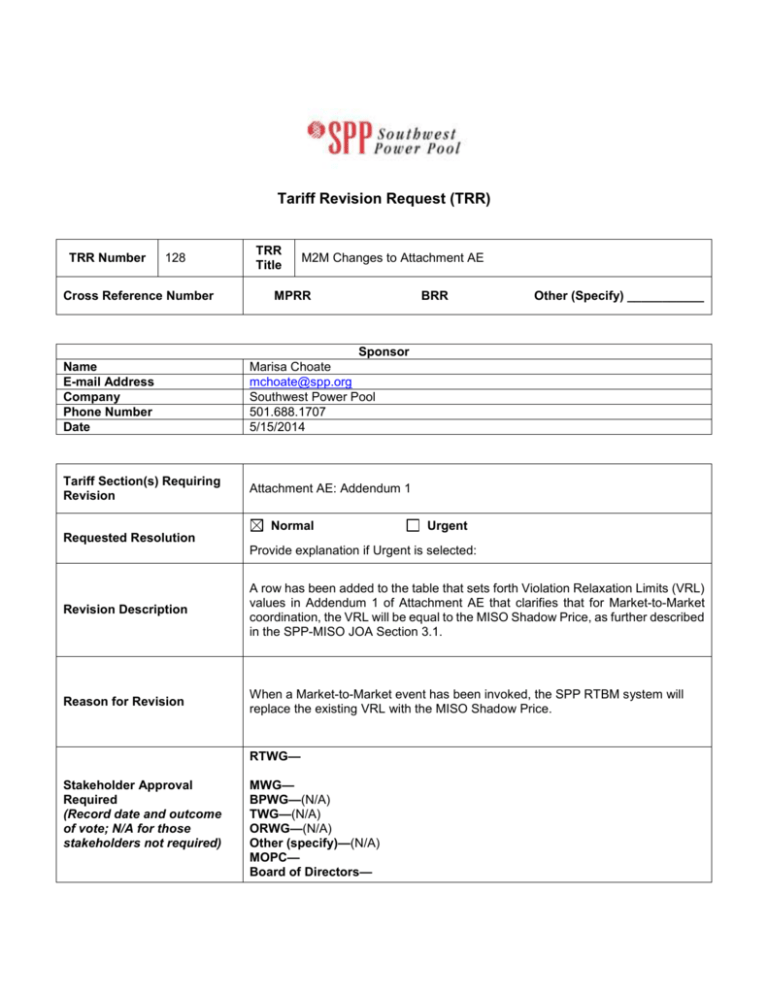

Tariff Revision Request (TRR) TRR Number 128 Cross Reference Number Name E-mail Address Company Phone Number Date Tariff Section(s) Requiring Revision TRR Title M2M Changes to Attachment AE MPRR BRR Other (Specify) ___________ Sponsor Marisa Choate mchoate@spp.org Southwest Power Pool 501.688.1707 5/15/2014 Attachment AE: Addendum 1 Normal Urgent Requested Resolution Provide explanation if Urgent is selected: Revision Description A row has been added to the table that sets forth Violation Relaxation Limits (VRL) values in Addendum 1 of Attachment AE that clarifies that for Market-to-Market coordination, the VRL will be equal to the MISO Shadow Price, as further described in the SPP-MISO JOA Section 3.1. Reason for Revision When a Market-to-Market event has been invoked, the SPP RTBM system will replace the existing VRL with the MISO Shadow Price. RTWG— Stakeholder Approval Required (Record date and outcome of vote; N/A for those stakeholders not required) MWG— BPWG—(N/A) TWG—(N/A) ORWG—(N/A) Other (specify)—(N/A) MOPC— Board of Directors— Yes—(Include any comments from the review) Legal Review Completed No Yes—Section No.: (Include a summary of impact and/or specific changes) Market Protocols Implications or Changes 4.1.4—Violation Relaxation Limits No Yes—Section No.: (Include a summary of impact and/or specific changes) Business Practices Implications or Changes No Yes—Section No.: (Include a summary of impact and/or specific changes) Criteria Implications or Changes No Other Corporate Documents Implications or Changes (i.e., SPP Bylaws, Membership Agreement, etc.) Yes—Section No.: (Include a summary of impact and/or specific changes) No Yes—(Include a summary of impact and/or specific changes) Credit Implications No Yes Impact Analysis Required No Proposed Tariff Language Revision (Redlined) Addendum 1 to Attachment AE Violation Relaxation Limit Values This Addendum 1 to Attachment AE sets forth the VRL values to be used in conjunction with the operation of the SPP Energy and Operating Reserve Markets. Constraint Type (1) Resource Capacity (2) Global Power Balance (3) Resource Ramp (4a) Operating Constraint Description VRL [$/MW] The minimum and maximum MW dispatchable output of a resource as indicated in a Resource Offer. Energy needed to balance resources and load. The ramp capability of a resource as indicated in the resource plan. A MW limit that can be imposed on SPP related to MW flow across a market node, a manually-identified transmission constraint, a Watch List transmission constraint, a flowgate constraint, or a transmission constraint identified by SPP’s Real-Time contingency analysis. 100,000 (4b) Operating Constraint Market-to-Market coordination (5) Regulation-up plus Spinning Reserve Constraint A MW value representing the sum of the Regulation-Up requirement and Spinning Reserve requirement 50,000 5,000 $500 when the loading is greater than 100% and less than or equal to 101% at each network constraint at each Operating Constraint. $750 when the loading is greater than 101% and less than or equal to 102% at each network constraint $1,000 when the loading is greater than 102% and less than or equal to 103% at each network constraint $1,250 when the loading is greater than 103% and less than or equal to 104% at each network constraint $1,500 when the loading is greater than 104% at each network constraint MISO’s Shadow Price as further defined in Section 3.1 of the SPPMISO JOA $200 Proposed Market Protocols Language Revision (Redlined) 4.1.4 Violation Relaxation Limits The DA Market, RUC processes and RTBM SCED enforce a number of operating constraints in developing the co-optimized market solution. In certain situations, attempting to enforce all constraints may result in a solution that is not feasible at a Shadow Price less than an appropriately priced Violation Relaxation Limit. In such cases, SPP must apply Violation Relaxation Limits (VRLs) in SCED. There are five categories of constraints and associated VRLs: (1) Resource Capacity Constraints; (2) Resource Ramp Constraint; (3) Global Power Balance Constraint; (4) Operating Constraint (which include PNode, Manual, Watch List, flowgate and Real-Time Contingency Analysis (RTCA) Constraints) and (5) Spinning Reserve requirement constraint. A higher VRL value is an indication of the relative priority for enforcing the constraint type. For example, the VRL value assigned to a ramp rate limit exceeds that assigned to a flowgate limit indicating that the flowgate constraint should be relaxed before the ramp rate constraint. If the VRL with the lowest value will not allow SCED to balance the market’s energy obligations, a higher VRL will be applied. In the case of the Operating Constraint VRLs, the values limit the cost of the dispatch needed to balance system injections and withdrawals by capping the Shadow Price depending upon the level of the violation. Similarly, the Spinning Reserve Constraint VRL limits the costs of redispatch need to meet the Spinning Reserve requirement by capping the Spinning Reserve Shadow Price. Addendum 1 to Attachment AE of the SPP Tariff sets forth the VRL values to be used in conjunction with the operation of the SPP Energy and Operating Reserve Markets. VRLs and associated values are intended to achieve the following objectives: (1) Mitigate the occurrence of price excursions or other extreme prices; (2) Remove the portion of a loading violation attributed to market flow on a flowgate within 30 minutes of the start of a VRL violation; (3) Mitigate the regulation burden placed on the Resources providing regulation services; (4) Limit contribution to CPS violations; and (5) Minimize the need for Manual Dispatch Instructions. Proposed Business Practices Language Revision (Redlined) N/A Proposed Criteria Language Revision (Redlined) N/A Proposed Revisions to Other Corporate Documents (Redlined) N/A Page 5 of 5