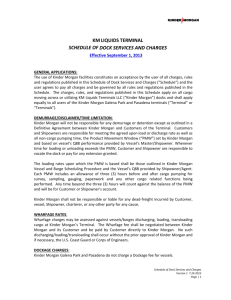

The Future of Kinder Morgan Moving forward with Kinder Morgan

advertisement

The Future of Kinder Morgan Moving forward with Kinder Morgan, we will continue to establish a strong footprint in North America’s energy sector. We plan to create a more prosperous future by dealing with four main components in our company. These four components include: ethics/social responsibility, company image and reputation, future profits to maintain consistent growth, and the likelihood of long-term success. Year after year Kinder Morgan has continued to grow since we began our operations in 1997. By improving these above components, we hope to see an even greater growth and success in the company. Our goal is to work our way down the rankings from 100th in the world to competing against the #1 energy company- Exxon Mobil Corporation. This is all attainable if we continue to thrive and advance as a successful energy company. Ethics/social responsibility Kinder Morgan prides itself as being one of the most socially responsible companies in North America. We plan to uphold this reputation as we continue to grow. Our employee’s are well aware of how paramount Kinder Morgan’s reputation is and have all signed an extensive Code of Business Conduct and Ethics. In the future, it will be mandatory for all external companies involved in any Kinder Morgan projects to have the top managers sign this code, along with a contract that gives Kinder Morgan authority to dismiss the company if proper ethics/conduct are not followed. Although are ethics are well established within the company, we must continue to try and negate negative public concerns on our environmental impact. Although we already have our Ethics Hotline, we plan to extend this hotline to include a line where the public can phone our experts to address any environmental concerns. We will also expand our already informative website to add a section where we exhibit our company’s history with past environmental predicaments, how we dealt with them, and how we have/will improve in the future. As we change technology and procedures in order to limit harm on the environment, we will also make this information available to the public. We will keep their trust by never leaving them in the grey and ensuring that we are constantly improving Kinder Morgan to reflect any environmental concerns. In order improve our relationship with the government, we will work as closely with them as possible and review any practices that do not go above and beyond legislation standards. As new legislation and social concerns shift, it will become mandatory for training to be given to our employees in order to ensure that they all have full knowledge of the affairs at hand. Our reputation is directly in the actions of our employees, and we will do everything in our power to uphold our trust and reputation with the public. Company image and Reputation As noted above, society is increasingly concerned with oil industry and its impact on environmental issues. These concerns from the public put our company image at a huge risk. In order for Kinder Morgan to prosper, we need to inject a positive image of Kinder Morgan to public. Kinder Morgan is a well-known profitable company. We need to take some of these profits and give back to the public in order to improve our company’s image and reputation. We could do this by sponsoring events that help give back to the communities that our touched by Kinder Morgan’s pipelines. Moreover, Kinder Morgan could give scholarships and donations to programs that work towards environmental sustainability, or engineering programs that work toward improving pipeline quality. By giving back to the community and acknowledging their concerns, we can help maintain and improve our company image and reputation. Future Profits Kinder Morgan encompasses a number of companies that include: KM Energy, KM Management, and El Paso Pipeline. Currently our enterprise is worth approximately $100 billion. With our current projects rapidly expanding, we can expect by the end of Q4 to be worth approximately $104 billion. Our stock price, KMI, has seen a high of $40.02 and currently sits at $36.49. As expected with the current growth of KMI, our stocks should see the $45 mark as of Q3 of 2014. We expect an earnings growth of 20% by Q$ of 2014, which would raise our company value to about $115 billion. This is a combined accumulation of KMI enterprise’s projects, current and future. Likelihood of Long-Term Success Kinder Morgan currently stands as one of the most stable and profitable energy companies. Its potential for future growth, relative to its competitors, looks to be very promising. The company continues to strengthen its foothold in natural gas, as well as an increase in pending approvals that will substantially increase its pipeline capacity. Although the Trans Mountain Pipeline expansion project may reduce some of the company's more liquid assets in order to favor the costs of building new pipelines, the project is essential because it provides an instrumental longterm asset to the company. It will allow the company to maintain its current dividend structure that better ensures shareholder loyalty. If there is one threat to the long- term success of Kinder Morgan, it is the societal pressure on the government to increase its efforts toward alternative energy sources other than oil. Although this issue may be a distant one, the concern is that the pressure will lead to increased taxes and regulations on oil extraction and transport, which results in a lower profit margin. This is less of a risk for Kinder Morgan though compared to its competitors for Kinder Morgan relies more heavily on domestic extraction as opposed to overseas oil. It is expected that if the Canadian and American governments increase regulations, foreign oil would take the majority of the loss. This is because neither government can afford the job losses that a collapse of the sector would create, nor can they tariff each other's oil due to a free trade agreement in place. Overall, the likelihood of long-term success for Kinder Morgan appears to be very high. Overall, with the rapid development of the oil and gas industries, it is both important and necessary that Kinder Morgan re-evaluates and refines its objectives. In order to continue gaining recognition and fight our way to prosperity, we have determined areas of weakness that need further development. With increased social responsibility and public awareness, we are less likely to face government and public blockades on future projects. Moreover, as we improve our public image, public organizations such as Green Peace are less likely to draw negative attention towards us. Future profits rely on our ability to expand the company in both the transport sector, as well as moving in and taking over other areas in energy, such as refinement. We are confident that this is the right direction for Kinder Morgan to take, and focusing on these areas will lead to prosperity.