lmo-exempt work permits - Canadian Association of Professional

advertisement

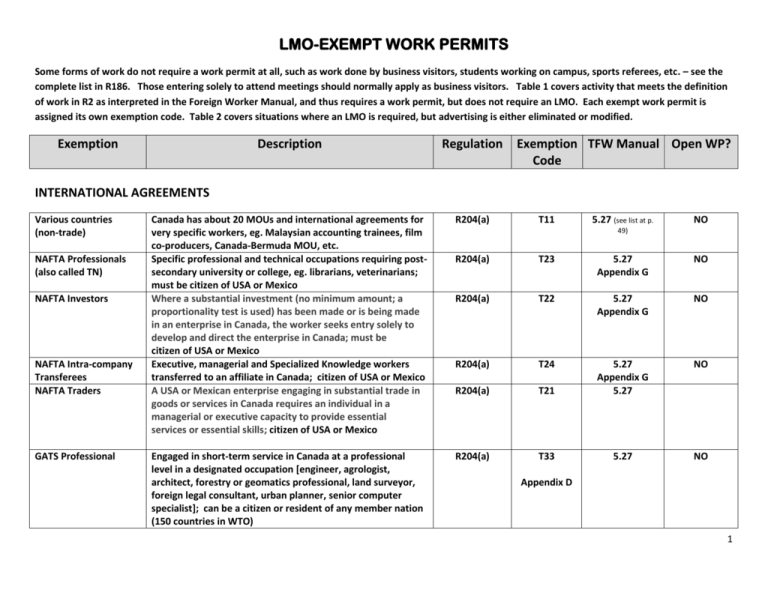

LMO-EXEMPT WORK PERMITS Some forms of work do not require a work permit at all, such as work done by business visitors, students working on campus, sports referees, etc. – see the complete list in R186. Those entering solely to attend meetings should normally apply as business visitors. Table 1 covers activity that meets the definition of work in R2 as interpreted in the Foreign Worker Manual, and thus requires a work permit, but does not require an LMO. Each exempt work permit is assigned its own exemption code. Table 2 covers situations where an LMO is required, but advertising is either eliminated or modified. Exemption Description Regulation Canada has about 20 MOUs and international agreements for very specific workers, eg. Malaysian accounting trainees, film co-producers, Canada-Bermuda MOU, etc. Specific professional and technical occupations requiring postsecondary university or college, eg. librarians, veterinarians; must be citizen of USA or Mexico Where a substantial investment (no minimum amount; a proportionality test is used) has been made or is being made in an enterprise in Canada, the worker seeks entry solely to develop and direct the enterprise in Canada; must be citizen of USA or Mexico Executive, managerial and Specialized Knowledge workers transferred to an affiliate in Canada; citizen of USA or Mexico A USA or Mexican enterprise engaging in substantial trade in goods or services in Canada requires an individual in a managerial or executive capacity to provide essential services or essential skills; citizen of USA or Mexico R204(a) Engaged in short-term service in Canada at a professional level in a designated occupation [engineer, agrologist, architect, forestry or geomatics professional, land surveyor, foreign legal consultant, urban planner, senior computer specialist]; can be a citizen or resident of any member nation (150 countries in WTO) Exemption TFW Manual Open WP? Code INTERNATIONAL AGREEMENTS Various countries (non-trade) NAFTA Professionals (also called TN) NAFTA Investors NAFTA Intra-company Transferees NAFTA Traders GATS Professional T11 5.27 (see list at p. NO 49) R204(a) T23 5.27 Appendix G NO R204(a) T22 5.27 Appendix G NO R204(a) T24 NO R204(a) T21 5.27 Appendix G 5.27 R204(a) T33 5.27 NO Appendix D 1 GATS Intra-company Transferees Dealt with as general ICTs under IRPR R205 C12 5.27 NO Free Trade Agreements (Traders, Investors, Professionals, and Intra-company Transferees Besides NAFTA, several other FTAs provide some labour mobility depending on purpose or occupation to citizens, and in some cases permanent residents, of COLOMBIA, PERU, COSTA RICA, CHILE, ISRAEL R204(a) T21 T22 T23 T24 5.27 5.30 NO PNP Agreements: Provincially selected (TFW-PS) MOU with a province may permit LMO-exempt work permit before nomination (varies per province – see list of provincial Annexes in FW Manual) R204(c) T13 PNP Agreements: Provincial Nominee MOU with a province may permit LMO-exempt work permit at POE after nomination where nominee is “urgently required” by the nominating employer; otherwise CPC-V R204(c) T13 PNP Agreements: Ontario – Dependent Children Pilot project for working age dependent children destined to Ontario July 1, 2009 – July 30, 2012 - See Operational Bulletin 123 R204(c) T13 (WDP) PNP Agreements: Alberta Pilot project for working age dependent children of NOC O, A or B workers destined to Alberta July 1, 2009 – July 30, 2012 See Operational Bulletin 122 R204(c) PNP Agreements: Alberta Pilot project for spouses and common-law partners of long haul truck drivers destined to Alberta July 1, 2009 – July 30, 2012 - See Operational Bulletin 146 PNP Agreements: Alberta PNP Agreements: British Columbia Appendix B For complete list of Canada’s Free Trade Agreements (FTAs) see “Negotiations and Agreements” on DFAIT’s website 5.27 (see list of Annexes at p. 53) NO 5.27 5.27 Generally,NO; Exceptions eg. AB Strategic Recruitment YES T13 (WDP) 5.27 YES R204(c) T13 (LTD) 5.27 YES Pilot project for Occupational Specific Work Permits: Steamfitter/Pipefitter in Alberta: June 1, 2011 – May 31, 2013 – See Operational Bulletin 279B R204(c) T13 5.27 Pilot project for spouses and common-law partners of NOC C and D workers destined to BC – August 15, 2011 – February 15, 2013 – See Operational Bulletin 337 R204(c) T13 (LSS) 5.27 Both available depending on applicant’s credentials YES (see p. 54) 2 CANADIAN INTERESTS – SIGNIFICANT BENEFIT Significant benefit (general) Significant benefit (Entrepreneurs/Selfemployed) Significant benefit (IntraCompany Transferees - ICT) Significant benefit (Emergency repairs) GATS Intra-Company Transferee Create or maintain significant cultural, social, or economic benefits or opportunities for Canadians/PRs Entering Canada to operate a business owned or partially (at least 50%) owned by the foreign national R205(a) C10 5.28 – 5.29 NO R205(a) C11 5.30 NO Transferring expertise in executive or senior management capacity, or through specialized knowledge, to the Canadian parent, subsidiary, branch or affiliate of a foreign enterprise Personnel needed for emergency repairs to industrial or commercial equipment to prevent labour disruption Mobility among 150 member countries of the WTO; even if meet more specific GATS criteria, are processed under the R205(a) general ICT provisions R205(a) C12 5.31 NO R205(a) C13 5.32 NO R205(a) C12 5.31 NO (p. 68) CANADIAN INTERESTS: RECIPROCAL EMPLOYMENT Reciprocal employment: (General) Create or maintain reciprocal employment of Canadians or PRs as shown by a particular company or organization R205(b) C20 5.33 NO Reciprocal employment: (Cultural Agreements) Specific cultural agreements btw Canada and France, Belgium, Brazil, Germany, Italy, Japan, Mexico, and China; World Youth Program, eg ‘volunteer’ farm work Working holiday program (WHP) operated by DFAIT as part of an array of youth (18-35) exchange programs with several countries, eg. Korea, Mexico, UK , Poland – all have slightly different terms Operated by DFAIT for students from numerous countries R205(b) C20 5.36 NO R205(b) C21 5.34 YES Reciprocal employment: International Experience Canada (IEC) - WHP Reciprocal employment: IEC - SWAP Reciprocal employment: IEC (General Youth Mobility) Young professionals, Co-Ops, exchanges through such organizations as AIESEC, IAESTE and numerous others – see complete list in Appendix E – Criteria vary per program Appendix E R205(b) R205(b) C21 5.34 YES C21 Appendix E 5.34 NO Appendix E 3 Reciprocal employment: Academic exchanges Reciprocal employment: Research, education or training program Reciprocal employment: Research, education or training program Reciprocal employment: Research, education or training program Guest lecturers, school teachers, visiting professors R205(b) C22 5.35 Co-op terms where research, education or training is integral to a program of Canadian studies (up to 50% of program); R205(c)(i) C30 5.37 Students working as part of a program of study in Canada sponsored by eg. CIDA, NSERC, AEC; Commonwealth Caribbean program; holders of research chairs Students in career colleges and language schools; High school students requiring co-op term R205(c)(i) NO NO (employer is institution) C30 5.37 NO (employer is institution) R205(c)(i) C30 5.37 NO (employer is institution) CANADIAN INTERESTS: PUBLIC POLICY AND COMPETITIVENESS Spouses/common-law partners of skilled workers Eligible if partner is NOC O, A or B; or skilled worker under R186; also includes provincial nominees (incl C&D occupations); spouse of Post-grad if PG doing skilled work R205(c)(ii) C41 5.38 YES Spouses/common-law partners of foreign students For duration of study permit R205(c)(ii) C42 5.38 (and OP 12, s. YES Post-grads Maximum 3-year WP following graduation from Canadian post-secondary institution R205(c)(ii) Post-Doc Fellows and award recipients Ph.D. holders on stipend or salary for research, advanced study or teaching; research award recipients of Canadian or foreign institutions R205(c)(ii) C44 5.38 NO Off-campus employment Full-time students at post-secondary institutions after 6 months of study; for 20 hrs/wk plus school breaks R205(c)(ii) C25 5.38 and OP 12, s. 5.23) YES Medical and dental residents; fellowship holders Completing a residency at Cdn hospital or clinic as part of medical training; specialists advancing medical research R205(c)(ii) C45 5.38 (and OB 230) NO 5.22) C43 5.38 (and OP 12, s. YES 5.24) 4 CANADIAN INTERESTS: RELIGIOUS AND CHARITABLE Religious workers Charitable workers Carrying out duties for Canadian religious organization (not including R186 spiritual leaders) without remuneration Carrying out duties for Canadian charitable organization without remuneration R205(d) C50 5.39 NO R205(d) C50 5.39 NO Unable to support self otherwise; fee exempt work permit Unable to support self otherwise; not fee exempt Unable to support self otherwise; not fee exempt R206(a) R206(b) R206(b) S61 S62 S62 5.40 5.40 5.40 YES YES YES R207(a) A70 5.41 (and OB 370) YES R207(b) A70 5.41 YES R207(c) R207(d) A70 A70 5.41 5.41 YES YES R207(e) A70 5.41 YES R208(a) H81 5.42 YES R208(b) H82 5.42 YES SELF-SUPPORT Refugee Claimant Failed refugee claimant Subject to unenforceable removal order, eg. awaiting PRRA or PRRA claimant APPROVED IN PRINCIPLE FOR PR STATUS BY CPC-V Live-in Caregivers Inland spousal and C/L partners Protected persons Humanitarian and Compassionate Family members of R207 applicants Completed 2 years of live-in caregiving; applied for PR but eligibility determination in LIC class pending Only after approval in principle; can request WP (and submit fee) with application or upon AIP After being conferred protected person status under A95(2) Only after approval in principle under H&C, while awaiting landing Spouse, common law partner or dependent child of above categories, if family member is in Canada HUMANITARIAN REASONS Destitute students TRP holders Short term relief for foreign students in financial difficulty in Canada through circumstances beyond their control TRP must be for 6 months or longer; no means of support 5 TABLE 2 For more information on these advertising requirements see: “Variations to Minimum Advertising Requirements” on HRSDC website. LMO IS NEEDED, BUT NO ADVERTISING OR RECRUITMENT REQUIRED: 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) Post-grad WP holder expiring – Employer (existing or new) must be making a permanent job offer in O, A or B occupation Owners/operators Specialized service technicians or providers Warranty work CSQ holders from Quebec IT Specialists [7 NOC Codes] – Quebec only Digital Entertainment Software Engineer (NOC 2173) – B.C. only Digital Artist (NOC 5241) - B.C. only Entertainment sector – short term positions, needed on short notice for limited time in one location(eg television crew, boxers, singers) Employee of foreign government, mission or international organization Live-in Caregivers – if hired from within Canada, e.g. new employer Live-in Caregivers – leaving an abusive situation in Canada Live-in Caregivers – where employer moving to new province and wishes to take LIC LMO IS NEEDED – BUT ALTERNATE RECRUITMENT IS PERMITTED: 1) Live-in Caregivers – As per specific recruiting policy for initial LCP work permit from abroad 2) Academics (University Professors) – For academics not covered by other exemptions, must be hired as per SC policy “Hiring Foreign Academics in Canada” 3) Camp counsellors (Ontario only) – Must show efforts to recruit from prior campers, and Canadian students 4) Union positions/promotion of FN to new position – Must show internal recruitment process under collective agreement was followed 5) Exotic dancers – only “headliners” – Otherwise, recruitment as per Employer Bulletin 6) Instructors in faith-based schools (provincially recognized) – Instead of job bank, may advertise in relevant e.g. faith-based, publications for 3 months 7) Seasonal Agricultural Worker in Quebec – Must recruit according to “Hiring Temporary Foreign Workers in Quebec” LMO Exempt Work Permits ~April 2012 - LG 6