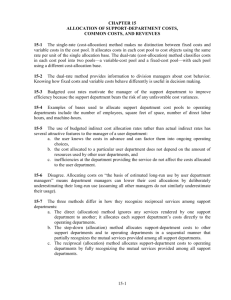

Handout #2B Support Cost Allocation

advertisement

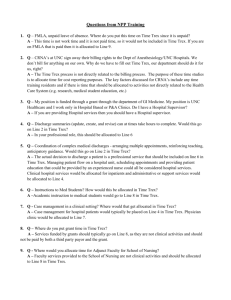

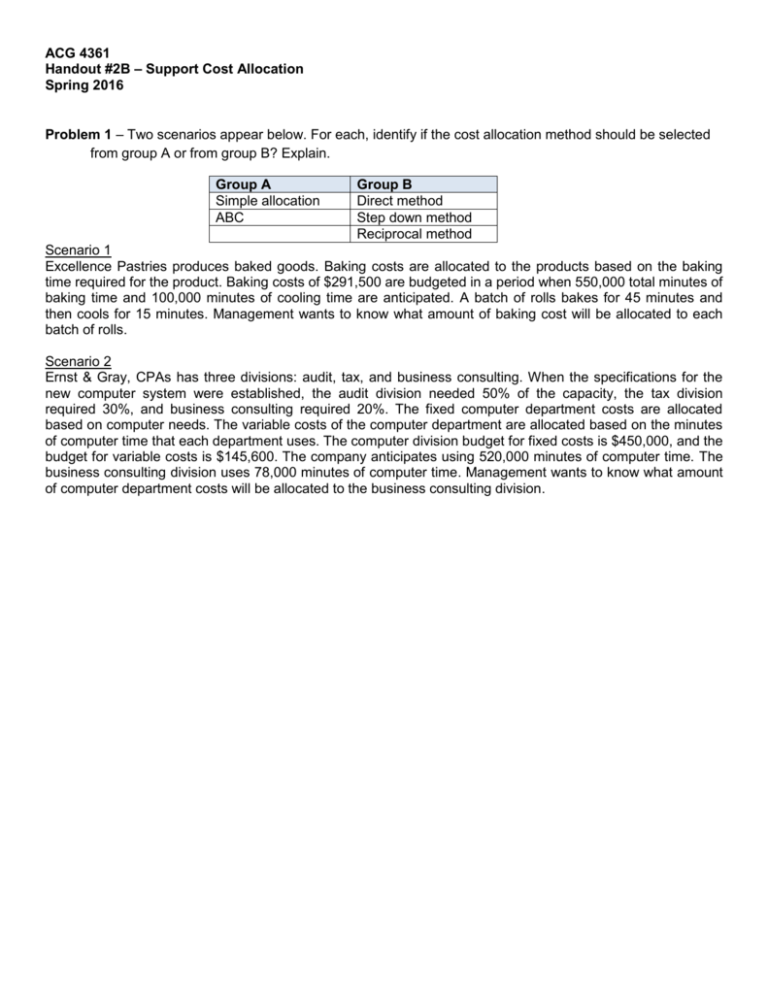

ACG 4361 Handout #2B – Support Cost Allocation Spring 2016 Problem 1 – Two scenarios appear below. For each, identify if the cost allocation method should be selected from group A or from group B? Explain. Group A Simple allocation ABC Group B Direct method Step down method Reciprocal method Scenario 1 Excellence Pastries produces baked goods. Baking costs are allocated to the products based on the baking time required for the product. Baking costs of $291,500 are budgeted in a period when 550,000 total minutes of baking time and 100,000 minutes of cooling time are anticipated. A batch of rolls bakes for 45 minutes and then cools for 15 minutes. Management wants to know what amount of baking cost will be allocated to each batch of rolls. Scenario 2 Ernst & Gray, CPAs has three divisions: audit, tax, and business consulting. When the specifications for the new computer system were established, the audit division needed 50% of the capacity, the tax division required 30%, and business consulting required 20%. The fixed computer department costs are allocated based on computer needs. The variable costs of the computer department are allocated based on the minutes of computer time that each department uses. The computer division budget for fixed costs is $450,000, and the budget for variable costs is $145,600. The company anticipates using 520,000 minutes of computer time. The business consulting division uses 78,000 minutes of computer time. Management wants to know what amount of computer department costs will be allocated to the business consulting division. Problem 2 The corporate office for TerraTime provides 2 kinds of services (maintenance and personnel) to TerraTime’s 3 locations (East, West, South). Maintenance costs are allocated on the basis of square feet, and personnel costs are allocated based on the basis of number of employees. Square Feet Employees Direct Costs Support Departments: Maintenance 1,200 8 $32,000 Personnel 1,800 6 $21,000 Operating Departments: East 3,000 32 $47,000 West 2,000 16 $54,000 South 5,000 40 $97,000 Use the three methods to allocate support department costs to determine: A. Total support costs allocated to each location B. Total department costs after allocation for each location DIRECT Direct costs Support Depts. Maintenance Personnel $32,000 $21,000 Allocate maintenance Allocate personnel Total costs allocated Total costs by dept. STEP DOWN Operating Departments East West North $ 47,000 $ 54,000 $ 97,000 (32,000) $ - (21,000) - $ - Support Depts. Maintenance Personnel $ 9,600 6,400 16,000 7,636 17,236 64,236 3,818 10,218 64,218 9,545 25,545 122,545 $ $ Operating Departments East West North Direct costs $32,000 $21,000 $47,000 $54,000 $97,000 Allocate maintenance (32,000) 4,881 8,136 5,424 13,559 - (25,881) - $ 9,411 17,547 $64,547 4,706 10,129 $64,129 11,764 25,324 $122,324 Allocate personnel Total costs allocated Total costs by dept. RECIPROCAL Direct costs Allocate maintenance Allocate personnel Total costs allocated Total costs by dept. $ - Support Depts. Maintenance Personnel $32,000 $21,000 Operating Departments East West North $47,000 $54,000 $97,000 (34,185) 5,215 8,691 5,794 14,485 2,185 (26,215) $ $ 8,738 17,429 $64,429 4,369 10,163 $64,163 10,923 25,408 $122,408 0 0 Problem 3 Sanyo Products is a manufacturer of data storage devices. Sanyo operates two support departments—maintenance and technology, and two production departments—assembly and testing. Maintenance costs are allocated on the basis of square footage occupied, and technology costs are allocated on the basis of the number of workstations. The following data relate to allocations of service department costs: Maintenance Technology Assembly Testing Department costs $43,200 $61,500 $87,000 $15,000 Square footage 5,000 10,000 20,000 15,000 Workstations 4 5 20 16 In good form, prepare a complete analysis of the allocation of support costs using the reciprocal method. Show all calculations and circle the amount of the total allocated support costs to the technology department. DO NOT round in the interim. DIRECT Direct costs Support Depts. Maintenance Technology $ 43,200 $ 61,500 Operating Departments Assembly Testing $ 87,000 $15,000 Support Depts. Maintenance Technology $ 43,200 $ 61,500 Operating Departments Assembly Testing $ 87,000 $15,000 Support Depts. Maintenance Technology $ 43,200 $ 61,500 Operating Departments Assembly Testing $ 87,000 $ 15,000 Allocate maintenance Allocate technology Total costs allocated Total costs by dept. STEP DOWN Direct costs Allocate maintenance Allocate technology Total costs allocated Total costs by dept. RECIPROCAL Direct costs Allocate maintenance Allocate technology Total costs allocated Total costs by dept. Problem 4 iElectric has 2 operating departments—industry and private for which the corporate office provides 2 kinds of services, administrative and housekeeping. Administrative costs are allocated on the basis of number of employees, and housekeeping costs are allocated based on the basis of number of square feet. iElectric recognizes the step-down allocation based on the department that renders the largest proportion of its costs to other support departments. Administrative Housekeeping Industry Private Departmental Costs $43,000 39.000 63,000 41,000 # of Square feet 1,000 5,000 4,000 6,000 # of Employees 10 4 42 24 A. Show calculations to identify which department from which you should begin allocating support costs, and concisely explain your choice of department. B. Determine the complete reciprocated cost of each of the two support departments (i.e., set up the two simultaneous equations and solve for the total cost in each.)