Donation Process August 2011 - College of Agricultural, Human

advertisement

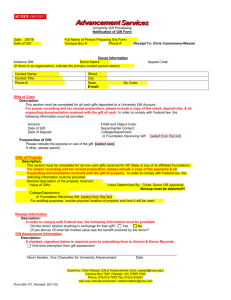

Washington State University Donation Process August 2011 CAHNRS & WSU EXTENSION OFFICE OF ALUMNI AND FRIENDS Please call us with questions regarding fundraising, acceptance and management of gifts, gift transmittals, and acknowledgements to CAHNRS or Extension. Or drop by and visit us anytime! Hulbert Hall Room 223 PO Box 646228 Pullman, WA 99164 PH: (509) 335-2243 Fax: (509) 335-9213 www.cahnrsalumni.wsu.edu Major Gift Officers and Staff for CAHNRS and Extension: Caroline Nilsson Troy, Executive Director of Development, CAHNRS, ctroy@wsu.edu Linda Bailey, Assistant Director of Development, CAHNRS: lmbailey@wsu.edu Melissa Bean, Assistant Director of Development, CAHNRS, melissa.bean@wsu.edu Alisa May, Assistant Director of Development, CAHNRS: amay@wsu.edu Ben McLuen, Assistant Director of Development, CAHNRS: benjamin_mcluen@wsu.edu Mary-Kate Murray Development Coordinator, mk.murray@wsu.edu Britta Nitcy, Principal Assistant, E-mail: nitcy@wsu.edu WSU DEVELOPMENT Each college and branch campus of WSU has its own Alumni and Development office staff that reports jointly to the dean of the college and to the WSU Foundation. More information regarding the WSU Foundation can be found at http://wsufoundation.wsu.edu As an agent of WSU, the WSU Foundation promotes, accepts, and manages all private gifts and private grants made to WSU. Overseen by a board of trustees and through services provided by the University, the foundation manages all gifts in accordance with the donor’s wishes within applicable state laws. When gifts are received, they are to be delivered to our office. Our Secretary Senior makes copies of the information then hand delivers the originals to the President’s Office (this is done on a daily basis). At that time, the documentation is picked up and delivered to the WSU Foundation’s Office of Advancement Services, which is the centralized facility for gift processing, accounting and records management for alumni addresses and management of the University’s advancement information. FUNDRAISING FOR CAHNRS and WSU EXTENSION The mission of the Office of Alumni and Friends is to support the tradition of excellence of the teaching, research and extension endeavors of the College of Agricultural, Human, and Natural Resource Sciences and WSU Extension by generating private contributions to supplement the College’s state and federal revenues. A development officer is assigned to each unit in College of Agricultural, Human, and Natural Resource Sciences and WSU Extension. Contact the Office of Alumni and Friends to see who is assigned to your unit. HERE’S HOW YOU CAN HELP! Involve alumni and influencers with departments, advisory boards, research activities, field days, discussion of needs of various projects. Be positive. People give to strength. Match prospective donors with a project they are interested in funding. Your assigned development officer can help you with this. Thank all donors for their support of CAHNRS and Extension, let them know how the money was used (through progress reports, scholarship letters, etc.) The number one reason that people make a charitable gift is because they are asked. We ask!! And ask, and ask, and ask! DIFFERENCE BETWEEN A GIFT AND A GRANT A gift is a voluntary contribution to the University. A contribution is defined as a gift when all of the following conditions apply: Funds are given irrevocably. The donor does not require that goods or services be forthcoming from WSU as a condition (implied or otherwise) of the contribution. Rights to any publication, inventions and patents resulting from use of such funds reside with WSU. If, according to these criteria, a contribution is determined not to be a gift, it should be processed through the Business and Finance Office as a grant. Grants are charged a percentage for indirect costs (up to 55%), where 100% of gift money is given directly to the area it is designated for. See more on grants at http://www.ogrd.wsu.edu TYPES OF GIFTS Gifts to WSU can be made in three forms: 1) outright; 2) conveyance of the gift so the donor retains income from it for his or her lifetime, such as a charitable remainder trust; and 3) in the form of a bequest through the donor’s will or living trust. The term, “gift” or “donation” can apply to any of the following: Cash (currency, coin, checks, money orders, bank drafts, etc.) Securities (stocks, bonds, life insurance, etc.) Non-cash gift (books, equipment, animals, collections, etc.) Real property (homes, farms, land, etc.) Inventions, patents and copyrights Mineral rights (oil wells, etc.) Fractional or remainder interests Deferred arrangements (life income, charitable remainder trust, etc.) Wills, bequests, living trust and devises. WHEN YOUR OFFICE RECEIVES CASH DONATIONS 1. Complete a gift transmittal form. See gift transmittal form attached or email Britta at nitcy@wsu.edu for an on-line form in Excel. 2. Attach a copy of all correspondence that was received with the gift or sent by the donor explaining the gift. 3. Attach the check! 4. Make a copy of the gift transmittal and the attachments for your records. 5. Hand-carry the gift transmittal, check, and attachments to the Office of Alumni and Friends in Hulbert Hall Room 223. (Off campus offices can mail to PO Box 646228, Pullman, WA 99164-6228) We will record the donation, make copies for files, and deliver the donations to the President’s office (this is done on a daily basis). The information will be picked up and delivered to WSU Foundation’s Advancement Services for processing. A receipt is sent by the WSU Foundation to the donor as proof that the gift was received and deposited as requested. WHEN YOUR OFFICE RECIEVES NON-CASH GIFTS (a.k.a. in-kind gifts) EVERY gift to CAHNRS or Extension is important – to the departments, to the college, and to the donors who made the gift. We can’t thank donors if we don’t know they made a gift! So please help us by letting us know when you’ve received an in-kind gift. Non-cash gifts, such as equipment, books, animals, etc. must have: 1. A brief gift description as well as an actual date received typed on the non-cash gift transmittal form. On the gift transmittal, be sure to specify the 17A account the non-cash gift should be credited to. 2. A letter or documentation from the donor describing the item and stating the value. Gifts of $4,999 and less will be reported at the value declared by the donor or determined by a qualified expert on the WSU faculty or staff. Gifts with fair market values of more than $5,000 will be credited at the values placed on them by qualified independent appraisers, paid for by the donor. All gifts $100,000 and above require a completed Non-cash Gift Agreement. (See attached NonCash Gift Guidelines and Guidelines for Counting and Recognizing Gifts to WSU for more detailed information) WEEKLY GIFT REPORTS The Office of Alumni and Friends prints Weekly Gift Reports that summarize all gifts to the college processed during the week reported. Our office checks for accuracy, and sends each department a listing of the weekly gifts made to them. THANKING OUR DONORS Once the gift has been processed: For cash donations, a receipt is sent by Advancement Services to the donor as proof that the gift was received and deposited as requested. For non-cash donations, the donor is sent a receipt and should complete an IRS Form 8283 for their tax purposes. All donors, no matter what the amount of their donation, are sent a thank you postcard or letter from Dean Bernardo (CAHNRS) or Associate Dean Kirk Fox (Extension). Thank you letters and postcards are sent out on a weekly basis. Faculty or Staff members who support through a continuing payroll deduction or who send partial pledge payments are sent thank you notes annually or at the completion of their pledge. President Floyd sends a thank you letter for all gifts of $50,000 or more. The WSU Foundation President sends a thank you letter for all gifts between $10,000 - $49,999. The Director of Annual Giving sends an acknowledgement and/or thank you letter for all gifts between $1,000 - $9,999. The department chair or county director is encouraged to send acknowledgments to donors who have given to their unit or county. Please send a copy to our office. GIFT CLUBS Gift clubs have been created as a means of appropriately recognizing the generous contributions of donors and ensuring University-wide consistency. Lifetime Cumulative Giving Clubs: Platinum Laureate ($10,000,000 and above) Crimson Laureate ($5,000,000 - $9,999,999) Silver Laureate ($1,000,000 - $4,999,999) Crimson Benefactor ($500,000 - $999,999) Benefactor ($100,000 - $499,999) These generous donors are publicly recognized at the Foundation’s annual recognition gala , receive a benefactor plaque or medallion, profiled in the annual report, and given all privileges of a President’s Associate. Annual Gift Clubs: President’s Associates FY 2011 (July 1, 2010 – June 30, 2011) $1,500 annually FY 2012 (July 1, 2011 – June 30, 2012) $2,000 annually FY 2013 (July 1, 2012 – June 30, 2013) $2,500 annually All members of the President’s Associates receive special recognition in various WSU publications, invitation to pre-game receptions and other events. In the WSU Foundation’s annual publication each donor is categorized by annual donation. The categories are: The Platinum President’s Associates Club ($10,000 - $99,999 annually) The Crimson President’s Associates Club ($5,000 - $9,999 annually) The Silver President’s Associates Club ($2,500 - $4,999 annually) President’s Associate Club ($1,500 - $2,499 annually) Deferred Gift Club (The Legacy Club): The Legacy Associates (pledges through wills, bequests, deferred gifts) receive a letter from the president and a WSU pin. Crimson Partner: Certain services and partial interest contributions worth $50,000 or more that provide value to WSU but not recognized by the IRS as qualified charitable gifts such as software licenses, advertising space, hotel rooms, loan of equipment, etc. CALL-A-COUG The WSU Call-A-Coug phone solicitation program raises funds and friends for WSU by having WSU students make phone calls, providing information about a particular college or department, asking for a donation, and sparking a renewed interest in the University as a whole. Each college has a few weeks in the fall and in the spring where the callers focus just on them. Each Fall CAHNRS asks each department for updated information (fact sheets) on department news, enrollment, and what gifts to the department will support. These fact sheets are used by the callers to inform their conversations with alumni and friends. 17A ACCOUNTS A development fund (17A account) may be established for any worthwhile purpose that is within the University’s mission and that meets the WSU/WSU Foundation minimum $5,000 requirements for creation of a separate fund and evidence that the fund will be active. The only exception to this is that we can establish a new account in an area or department where a 17A account doesn’t already exist. A Gift Use Agreement (GUA) is needed for all endowed funds established and a Current Use Agreement (CUA) for all current use funds established. An account is set up once there is funds to deposit to the account. Types of accounts: Unit Development Fund: Each department or county can establish one 17A account for deposit of unrestricted donations to their unit for which the donor has not specified a particular use, or has specified a broad and undefined use. Expendable Fund (current use): used for discretionary or restricted use within a department and may be established with a minimum of $5,000 plus evidence of expected future gifts. To reduce the number of gift accounts to be administered, new contributions can often be placed in existing accounts and still fulfill the intent of the donor. Endowed Fund: is a permanent fund in which the principle is never expended, and a percentage of income is used to annually carry out the donor’s stated purposes. Excess income over the amount paid out each year is retained in the endowment for enhanced growth. Each endowment consists of a principal account and a separate income account. Endowed gifts are placed in the principal account and held in perpetuity for investment. A proportion of income from the principal account is transferred to the income account on a quarterly basis, which then becomes available for current or future use. See attached Endowment Investment Policies for more details. There are various endowed accounts that can be established. Minimum principal for establishing a named endowment fund: Endowed scholarship $25,000 Graduate Fellowship $25,000 Lectureship $25,000 Merit Scholarship $50,000 Distinguished Merit Scholarship $100,000 Distinguished Graduate Fellowship $150,000 Distinguished Professorship $250,000 Endowed Chair $1,000,000 ($1.5 Mil gift, the Provost’s office provides .5 FTE match) Expenditures from 17A Accounts: Gift funds (17A accounts) shall be expended through the use of standard University forms and procedures for the expenditure of public funds (e.g. purchase requisitions, travel expense vouchers, invoice vouchers, etc.). Contact CAHNRS or Extension Business and Finance Office for more information. Contact the Office of Alumni and Friends for assistance concerning gifts or establishing new 17A accounts. FOR MORE INFORMATION Contact the Office of Alumni and Friends to discuss any fundraising mailings, newsletters, fundraising ideas, prospective donors, more information, etc. We are here to help you!