Yours sincerely, - Local Government Association of South Australia

advertisement

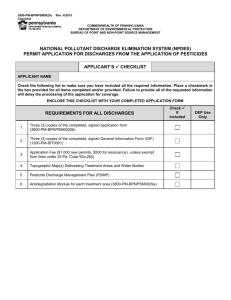

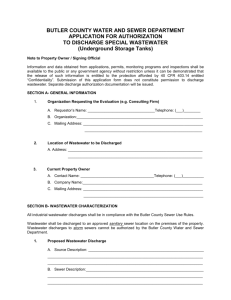

TITLE: TRADE WASTE CHARGING PROCEDURE REFERENCE NUMBER: RESPONSIBLE DEPARTMENT: Health & Public Safety APPLICABLE LEGISLATION: SA Public Health Act 2011 Water Industry Act 2012 Local Government Act 1999 STRATEGIC PLAN: Strategic Imperatives: Urban Growth Shared Aspirations: Human Settlements RELATED POLICIES / CORPORATE GUIDELINE: Trade Waste Discharge Policy APPROVED: <<Insert Date>> NEXT REVIEW DATE: <Insert Date>> 1. PURPOSE This procedure outlines the charges associated with the Trade Waste Discharge Policy (and the legal basis for them), the criteria for these charges and the process of applying the charges. Charges for trade waste discharges are imposed under the Local Government Act 1999 (the Act) and fall into one of two categories: a CWMS service charge (based upon the level of usage) that is imposed under section 155 of the Act (the amount payable in respect of this charge is declared annually as part of the Council’s annual rates declaration); and Volume (Trade Waste) and Specific Pollutant charges that are payable in accordance with conditions that attach to a section 56 authorisation issued by the Council under section 56 of the Water Industry Act 2012. These charges are imposed by the Council in exercise of its powers under section 188(1)(a) and (f) of the Act. Trade Waste Charging Procedure 7 January 2014 Page 1 of 7 2. PROCEDURE 2.1 Trade Waste Charges Charge Type Volume (Property Unit Charge) Explanation Charge This is an existing charge that is paid by ALL premises serviced by CWMS and is applicable Unit Charge to commercial & industrial premises. 1 standard dwelling (Property Unit) This is the CWMS service charge imposed under section 155 of the Act. Volume Charge (Trade Waste) The trade waste volume charge will apply to non-domestic loadings being discharged to CWMS. It will be calculated by subtracting the domestic and non-trade waste proportion from the total volume of water used (where flow meters are not installed). Unit Charge $/ 100KL This charge is imposed under section 188 of the Act. Specific Pollutant Charge This charge will apply to pollutants being discharged to CWMS above the charging concentration range. It applies for Biological Oxygen Demand (BOD) & Suspended Solids. Unit Charge $/Kg BOD, SS This charge is imposed under section 188 of the Act. 2.2 Local Acceptance Criteria Charges apply for discharges exceeding the levels accepted as part of the annual CWMS service charge as outlined below: Unit Accepted for Annual Service Charge Accepted and charged at tariff Tariff charge (range) Not accepted (refer to Council’s Register of Fees & Charges for current fee) Volume 500KL >500KL $25/100KL - Biological Oxygen Demand (BOD) max. concentration of 200 mg BOD5 L-1 or 530 g BOD5 /day concentration range 200-600 mg BOD5 L-1 or max 1.8 Kg BOD5 /day $1.50/Kg BOD5 Suspended Solids max. concentration of 200 mg SS L-1 or 530 gSS d-1 concentration range 200-600 mg SS L-1 or max. 1.6 $0.92/Kg SS concentrations above 600 mg BOD5 L-1 or 1.8 Kg BOD5/day concentrations above 600 mg SS L-1 Trade Waste Charging Procedure 7 January 2014 Page 2 of 7 Kg SS/day 2.3 or 1.6 Kg SS/day Charging Categories Charges will be applicable to businesses that discharge high strength and/or volume discharges. These will be determined by applying a category rating for premises dependent on specific discharge criteria. Category 1 – High Strength Discharges Trade waste generators who discharge specific pollutants such as BOD or Suspended Solids in large volumes (greater than 500KL/annum) and/or at concentrations above the charging criteria for that pollutant (200mg/L BOD & SS, or a maximum daily loading for each) Category 2 – Low Strength/High Volume Discharges Trade waste generators who discharge specific pollutants below the charging criteria, but produce a high volume of wastewater (greater than 500KL/annum). These businesses may also discharge other parameters (such as oil and grease) that require additional treatment. Category 3 – Low Strength/Low Volume Discharges Trade waste generators who discharge specific pollutants below the charging criteria and have relatively low volumes (less than 500KL per annum). Category 4 – No Trade Waste Discharge Premises that do not discharge a trade waste will not require a trade waste permit, and will only be subject to the annual property unit charge – the same as for residential properties. 2.4 Application of the Charges Charges only apply to those premises that discharge in excess of the acceptance criteria for volume, BOD or suspended solids (ie category 1 and 2). Charges are applied as per table 1: Table 1: Application of Fees & Charges for each Category Category 1 2 3 4 Property Unit Charge Volume (Trade Waste) Charge X X X X X X Specific Pollutant Charge Trade Waste Charging Procedure X 7 January 2014 Page 3 of 7 2.5 Determination of Trade Waste Discharge Determination of the trade waste discharge is via one of the following ways: 1. Indirectly via the determination of a trade waste fraction for the discharge into CWMS. This will be determined from water usage data and will take into consideration domestic discharges already covered by the annual CWMS service charge and other factors such as irrigation, cooling towers etc. A trade waste fraction form needs to be completed for discharges that exceed the annual volume allowance of 500KL where a flow meter is not used. The trade waste fraction form will determine the total percentage of water used within the business operation that does not discharge to CWMS as part of their operations. Domestic effluent (ie sewage) will be addressed through the relative number of property units charged to that property. The domestic wastewater volume will then be deducted from the total water usage using the standard allocation of one property unit equal to 182.5KL per annum. Therefore, if a business discharges all wastewater used in its operations to CWMS other than domestic sewage, the business will have a discharge factor of 100%. Domestic effluent will be charged separately as per the current rating policy. The trade waste fraction shall be applied to the total volume used on the water bill minus the number of property units multiplied by 182.5KL. Total trade waste volume (KL) = V Total water bill volume (KL) = V1 Number of property units = N V = V1 – (N * 182.5KL) Council will allocate a standard industry fraction for dischargers who fail to provide details of trade waste volume (attachment 1). 2. Directly via the installation of a water meter at a final discharge point upstream to any influx from domestic effluent. Where a meter is installed in the trade wastewater line, charges will be applied directly to the meter reading. Meters are to be maintained by the discharger and serviced regularly to ensure the readings’ accuracy and records must be kept to document this. Where non-mains water is used such as bore or stormwater and can be discharged to CWMS above 500KL per annum, a meter will need to be installed (see below). Water Usage will be obtained during routine inspections. Trade Waste Charging Procedure 7 January 2014 Page 4 of 7 2.6 Category 1 – Sampling Requirements Sampling is required for category 1 premises to determine the quality of the wastewater being discharged to CWMS and the appropriate charge. Premises that have the potential to be a category 1 discharger will also be required to undertake wastewater analysis. Category 1 premises will need to provide quarterly data to enable calculation of an average discharge amount for the annual charge. Wastewater analysis shall be taken from a final point of trade waste discharge upstream to any mixing with domestic effluent. Unlike the volume charge, the pollutant charge will be directly proportional to the wastewater analysis. 2.7 Payment of Trade Waste Charges The CWMS Service Charge (applicable for categories 1-4) is payable in conjunction with Council rates and is specified on all rates notices issued in respect of rateable properties that connect to the CWMS. The principal ratepayer of a property is liable to pay this charge under the Act. Volume (Trade Waste) and Specific Pollutant charges are adopted annually pursuant to Section 188 of the Act, and are based upon the costs to Council associated with managing trade waste discharges. The charges, once adopted, are set out in the Council’s Schedule of fees and charges, which is available on its website at: www.dcmtbarker.sa.gov.au Invoices will be issued in respect of trade waste premises on a quarterly basis for the Volume (Trade Waste) and Specific Pollutant charges. The Council may recover outstanding trade waste charges as rates in arrears pursuant to section 144(2) of the Act. In this event, the principal ratepayer of the relevant trade waste property is liable to pay the relevant amount under the Act. 2.8 ATTACHMENT 1 – STANDARD INDUSTRY FRACTIONS From Sydney Water and Tweed Shire Council Standard Industry Fractions Bakery Butcher Car wash Carpet cleaner Concrete batching plant Dry cleaner Film processor Fish shop Fruiterers Laundromat Panel beater Pottery Restaurants Service Station Take away outlet Trade Waste Charging Procedure 90% 90% 97-100% 90% 2% 75% 95% 95-100% 100% 90% 100% 49% 90% 70% 95% 7 January 2014 Page 5 of 7 3. REVIEW This Standard Operating Procedure will be reviewed every four (4) years or earlier in the event of changes to legislation or related Policies and Procedures or if deemed necessary by the Health & Public Safety Department. 4. ACCESS TO THE PROCEDURE The Standard Operating Procedure is available to staff via the Policies & Operating Guidelines section of the Intranet. 5. FURTHER INFORMATION For further information on this Standard Operating Procedure, please contact: Title: The Manager, XXX Phone: XXX Trade Waste Charging Procedure 7 January 2014 Page 6 of 7 Trade Waste Charging Procedure 7 January 2014 Page 7 of 7