CHAPTER 6

advertisement

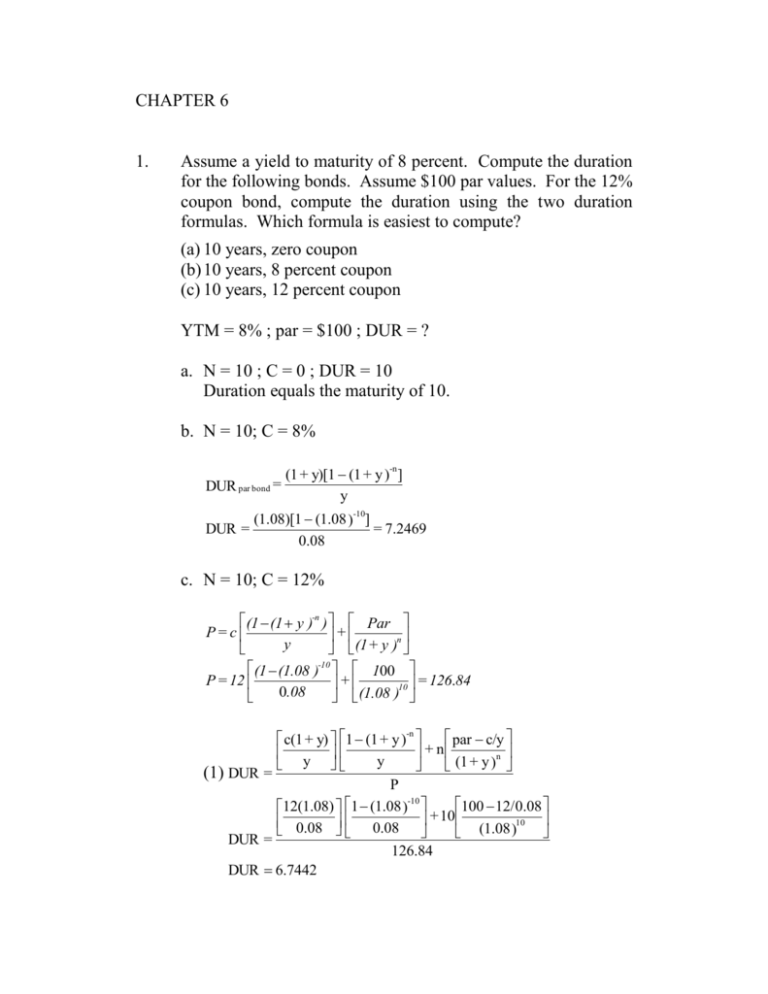

CHAPTER 6 1. Assume a yield to maturity of 8 percent. Compute the duration for the following bonds. Assume $100 par values. For the 12% coupon bond, compute the duration using the two duration formulas. Which formula is easiest to compute? (a) 10 years, zero coupon (b) 10 years, 8 percent coupon (c) 10 years, 12 percent coupon YTM = 8% ; par = $100 ; DUR = ? a. N = 10 ; C = 0 ; DUR = 10 Duration equals the maturity of 10. b. N = 10; C = 8% DUR par bond = DUR = (1 + y)[1 (1 + y )-n ] y (1.08)[1 (1.08 )-10] = 7.2469 0.08 c. N = 10; C = 12% (1 (1 y )-n ) Par P= c + n y (1 + y ) (1 (1.08 )-10 100 P = 12 = 126.84 + 10 0.08 (1.08 ) par c/y c(1 + y) 1 (1 + y )-n + n y y (1 + y )n (1) DUR = P -10 100 12/ 0.08 12(1.08) 1 (1.08 ) 0.08 0.08 + 10 (1.08 )10 DUR = 126.84 DUR 6.7442 (1.08)[1 (1.08 )-10] (2) DUR par bond = = 7.2469 0.08 c/P DUR non par = n [n DUR par] y 12 / 126.84 DUR non par = 10 10 7.24689 0.08 DUR non par 6.7442 2. In problem 1, assume that yields change from 8 to 9 percent. Work out the exact change in price and compare it with the change in price predicted by duration. Explain the difference. Assume $100 par values. a. (P1 P0) = P0 (42.24 46.32) = - 0.0880 46.32 - (Change in yield)(DUR) = (-0.01)(10) = -0.10 The duration approximation is slightly more than 1 percent too large in absolute value. b. (P1 P0) = P0 (93.58 100) = - 0.0642 100 - (Change in yield)(DUR) = (-0.01)(7.2468) = -0.0725 The duration approximation is 0.83 percent too large in absolute value. c. ( P1 P0 ) P0 = (119.25 126.84) = - 0.0598 126.84 - (Change in yield)(DUR) = (-0.01)(6.7442) = -0.0674 The duration approximation is 0.76 percent too large in absolute value. 3. Compute the duration of a portfolio composed of a ten-year, zero coupon bond and a ten-year, 8 percent coupon bond. Yield to maturity is 8%. For simplicity assume each bond has a par value of $100. Suppose that equal dollar amounts are invested in the two bonds. Bond 1: N = 10; C = 0; FV = 100; I/YR = 8; PV = ? PV = 46.319 DUR zero coupon bond = n = 10 Bond 2: N = 10; C = 8; FV = 100; I/YR = 8; PV = ? PV = 100 (P1)(DUR) + (P2)( DUR 2) P1 + P2 ( 46.319 )(10) + (100)( 7.247 ) = 8.1185 DUR portfolio= 146.319 DUR portfolio = 4. A perpetual bond has a coupon of $6 and a yield to maturity of 6 percent. Work out the actual percentage change in price and the duration approximation in the following three cases: (a) The yield decreases by 1 percent (b) The yield increases by 1 percent (c) The yield increases by 8 percent. P0 = 6 = $100.00 0.06 DUR perpetual = a. P1 = 1 + y 1.06 = = 17.67 y 0.06 6 = $120.00 0.05 % change = 120 100 = 0.2 = 20% 100 %P ( Duration )y 17.67 0.01 17.67% b. P1 = 6 = $85.71 0.07 % change = 85.71 100 = - 0.1429 = - 14.29% 100 %P ( Duration )y 17.67 (0.01) 17.67% 6 = $42.86 c. P1 = 0.14 % change = 42.86 100 = - 0.5714 = - 57.14% 100 %P ( Duration )y 17.67 (0.08) 141.36% 8. Suppose that the interest rate on all bonds is 6%. Which is a correct statement? (a) The duration of a par bond can never be greater than 18 for any maturity. (b) The duration of a premium bond can never be greater than 17, even for long maturities. (c) The duration of a 15-year Treasury strip exceeds the duration of all par bonds. (d) The duration of a discount bond can never exceed 17. (e) None of the above. DUR c=0 17.67 = 1 y y par Premium 1 1 (a) is correct . 17.67 M 9. Suppose all interest rates are 7%. We observe a bond with a duration of 18. What can we say about the coupon rate of this bond? DUR 15.2857 = 1 y y 1 1 15.2857 This must be a discount bond. Par bonds have a coupon rate of 7%. So, discount bonds have a coupon rate below 7%. 10. Compute the duration for the following bond. Coupon = $9, par = $100, maturity = 12 years. The yield to maturity is 10%. c / P DUR N N DUR par y P = 93.1863 9 / 93.1863 DUR 12 12 7.495061 0.10 9 / 93.1863 12 4.504939 0.10 12 4.5049390.965807 12 4.350012 7.64938. N