Solving LP with LINDO & Excel: Lecture Notes

advertisement

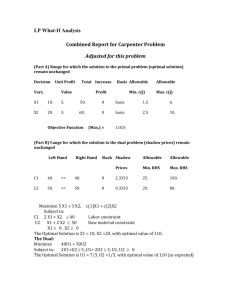

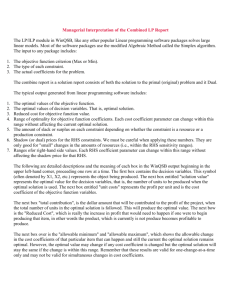

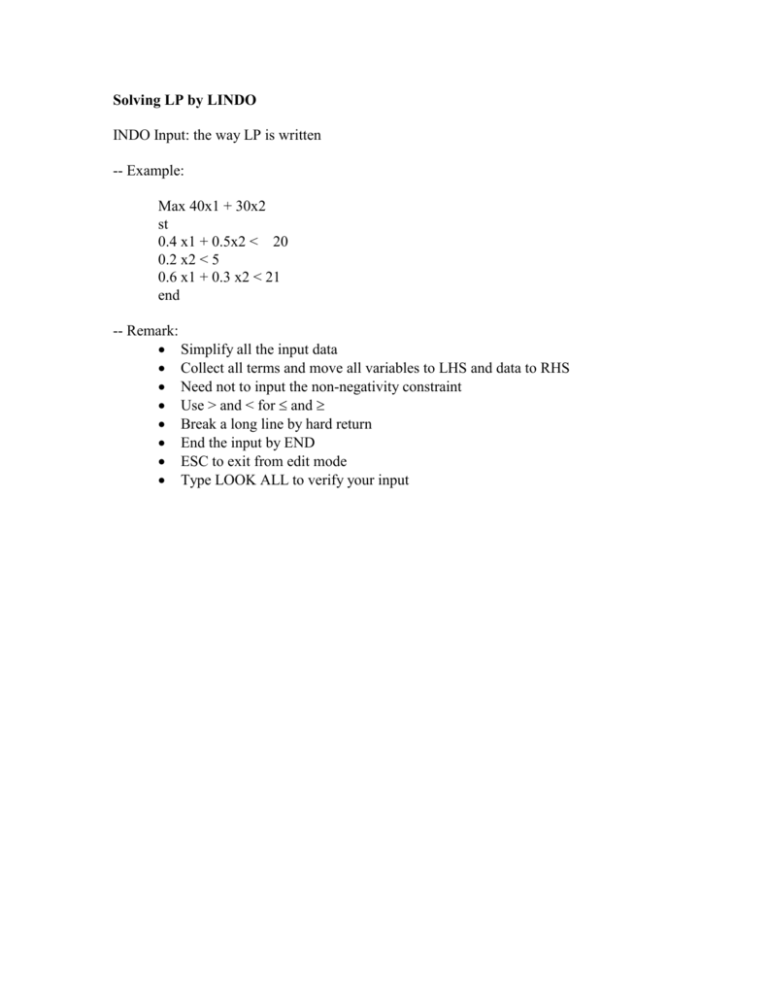

Solving LP by LINDO INDO Input: the way LP is written -- Example: Max 40x1 + 30x2 st 0.4 x1 + 0.5x2 < 20 0.2 x2 < 5 0.6 x1 + 0.3 x2 < 21 end -- Remark: Simplify all the input data Collect all terms and move all variables to LHS and data to RHS Need not to input the non-negativity constraint Use > and < for and Break a long line by hard return End the input by END ESC to exit from edit mode Type LOOK ALL to verify your input LINDO Output LP OPTIMUM FOUND AT STEP 2 OBJECTIVE FUNCTION VALUE 1) VARIABLE X1 X2 ROW 2) 3) 4) 1600.0000 VALUE 25.000000 20.000000 SLACK OR SURPLUS .000000 1.000000 .000000 NO. ITERATIONS= REDUCED COST .000000 .000000 DUAL PRICES 33.333330 .000000 44.444440 2 RANGES IN WHICH THE BASIS IS UNCHANGED: VARIABLE X1 X2 ROW 2 3 4 OBJ COEFFICIENT RANGES CURRENT ALLOWABLE ALLOWABLE COEF INCREASE DECREASE 40.000000 20.000000 16.000000 30.000000 20.000000 10.000000 CURRENT RHS 20.000000 5.000000 21.000000 RIGHTHAND SIDE RANGES ALLOWABLE ALLOWABLE INCREASE DECREASE 1.499999 6.000001 INFINITY 1.000000 9.000001 2.249999 Interpreting the LP Output: Optimal OBJ: Solution (Optimal Variable Value): Reduced Cost of each variable: Improvement needed in the objective coefficient (unit price, cost) for a current zero variable (activity) to become positive. or Deterioration in objective value that occurs if the current zero variable is forced to increase by one unit. 0 for a positive variable + for a zero variable Slack or Surplus of each constraint: Difference between LHS and RHS: < constraint: = resource available - resource used > constraint: = actual performance - requirement Slack or Surplus = 0: binding constraint * tight resource (for < constraint) * requirement barely satisfied (for > constraint) Slack or Surplus > 0: loose constraint * abundant resource (for < constraint) * requirement over fulfilled (for > constraint) Dual Price of each constraint: Improvement in the objective value if the RHS is increased by one unit. * Value of additional resource * Cost of more requirement < constraint: > constraint: = constraint: DP + DP DP either sign Dual Price 0 <==> Slack or Surplus = 0, binding constraint Relationship Among Output data: Variable value 0 + vs. Reduced Cost + 0 Slack or Surplus 0 + vs. Dual Price + (< const), - (> const) 0 RHS Range: The range that the RHS can change without changing the dual price of the binding constraints and the current nonzero variables (status) in the solution. Within the range: * The marginal value of resource does not change (profit grows at constant rate: DP). * The structure of optimal solution (which product to produce) does not change, however, the optimal solution (production quantities) will change if the RHS of a binding constraint changes. Obj. Coefficient Range: The range that an objective coefficient can change without changing the current optimal solution, however, both dual prices (of binding constraints) and reduce costs (of non-zero variables) will change. Questions based on the LP output of the RMC fuel and solvent example: 1. 2. 3. 4. 5. How much material 2 has been used in the current production plan? How much are you willing to pay an additional unit of material 1, 2, and 3? Are you willing to pay $66.7 for additional 2 units of material 1? Are you willing to sell 3 units of material 3 for $44.44 each unit? Will you be interested in producing a new product, each of which sells for $50 and requires 0.6 unit of material 1, 0.4 unit of material 2 and 0.5 unit of material 3? 6. If the price of fuel additive increases to $50 per unit, do you suggest change the current production plan? 7. If the prices of fuel additive and solvent change to $45 and $35, respectively, do you suggest change the current production plan? 8. How much are you willing to pay for 1 unit of Material 1, 2 units of Material 2, and 2 units of Material 3? Solving LP by Microsoft EXCEL Step 1. Organize the LP data in an Excel worksheet Step 2. Establish the relationship between the Decision Variables and the Outputs Step 3. Set Solver parameters (objective function and constraints) From menu bar, choose Tools and then Solver. A dialog box will show up. Set Target Cell to be the cell that contains the objective value. Specify Max or Min LP. Set Changing Cells to be cells that contain decision variables. Choose Add to input constraints in the dialog box. Repeat the process until all constraints are inputted. Do not forget the nonnegativity constraints. When the above process is completed, choose OK. A summary of your inputs will show up. Verify and make necessary changes. Step 4. Solve the LP Choose Solve to solve the LP. A solution results dialog box will show up. In the Results section, select both Answer and Sensitivity. Choose OK to get the report sheets. Interpreting the Excel solution Target Cell -- value of the objective function Adjustable Cells -- values of decision variables Status of each constraint and slack Reduced cost (for a zero decision variable) -- improvement needed in the objective coefficient (unit price) for the variable (product) to be positive (attractive, produced) Dual price (for a constraint) -- change (instead of improvement) of the objective function value due to a unit increase of the RHS of the constraint. Ranges of objective function coefficients (so that the current optimal solution remains unchanged) Ranges of RHSs of constraints (so that the current status of each constraint (binding, not binding) and its dual price remain unchanged) A Minimization LP Example for Output Interpretation A 16-ounce can of dog food must contain protein, carbohydrate, and fat in at least the following amounts: protein, 3 ounces; carbohydrate, 5 ounces; fat, 4 ounces. Four types of gruel are to be blended together in various proportions to produce a least-cost can of dog food satisfying these requirements. The contents and prices for 16 ounces of the gruel are given below: Contents and price Per 16 oz of gruel Gruel Protein Carbohydrate Fat Price ($) 1 3 7 5 4 2 5 4 6 6 3 2 2 6 3 4 3 8 2 2 Answer the following questions based on the LP output: 1. Interpret the optimal solution. 2. The dog food buyer is willing to pay $.6 more if you increase the protein content by 0.5oz and keep the other contents unchanged. Do you want to accept the offer? 3. If the gruel 1 seller wants to offer you 20% discount on the product, will you be interested in buying the gruel 1? 4. If the unit price of gruel 2 and 3 increase by $0.5 and that of gruel 4 decreases by $0.5, do you want change the current dog food mix? 5. If you are allowed to change the dog food requirement by increasing the protein by 0.5oz and decreasing the fat by 0.5oz, what would you recommend on the dog food price?