Dear Alumni: - East Carolina University

advertisement

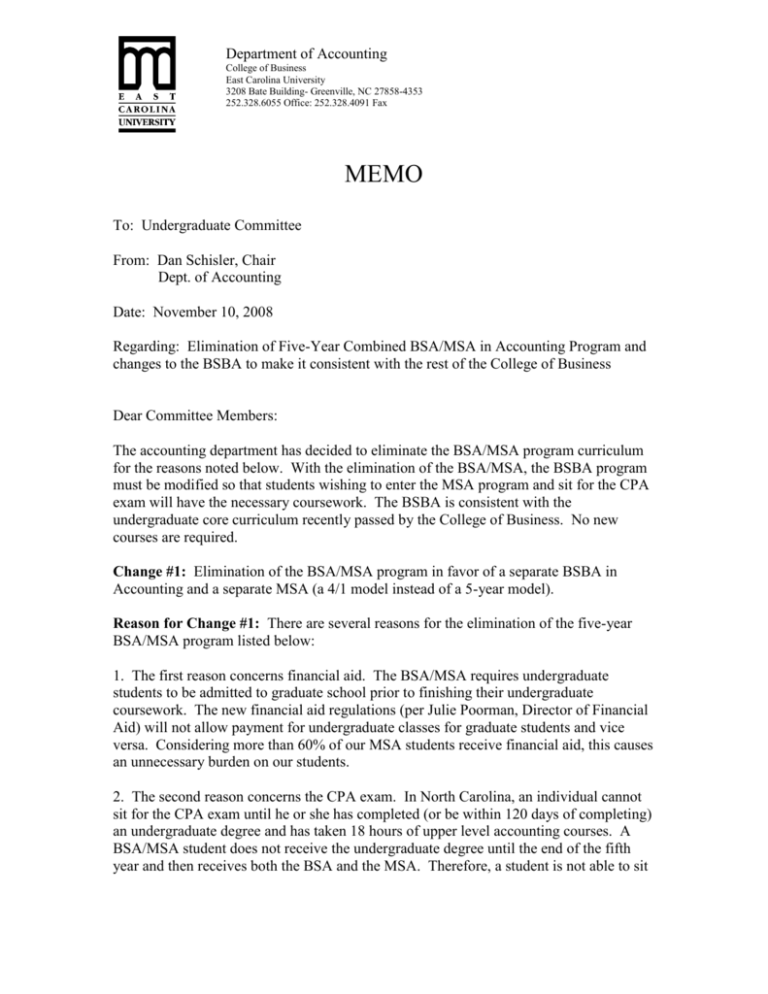

Department of Accounting College of Business East Carolina University 3208 Bate Building- Greenville, NC 27858-4353 252.328.6055 Office: 252.328.4091 Fax MEMO To: Undergraduate Committee From: Dan Schisler, Chair Dept. of Accounting Date: November 10, 2008 Regarding: Elimination of Five-Year Combined BSA/MSA in Accounting Program and changes to the BSBA to make it consistent with the rest of the College of Business Dear Committee Members: The accounting department has decided to eliminate the BSA/MSA program curriculum for the reasons noted below. With the elimination of the BSA/MSA, the BSBA program must be modified so that students wishing to enter the MSA program and sit for the CPA exam will have the necessary coursework. The BSBA is consistent with the undergraduate core curriculum recently passed by the College of Business. No new courses are required. Change #1: Elimination of the BSA/MSA program in favor of a separate BSBA in Accounting and a separate MSA (a 4/1 model instead of a 5-year model). Reason for Change #1: There are several reasons for the elimination of the five-year BSA/MSA program listed below: 1. The first reason concerns financial aid. The BSA/MSA requires undergraduate students to be admitted to graduate school prior to finishing their undergraduate coursework. The new financial aid regulations (per Julie Poorman, Director of Financial Aid) will not allow payment for undergraduate classes for graduate students and vice versa. Considering more than 60% of our MSA students receive financial aid, this causes an unnecessary burden on our students. 2. The second reason concerns the CPA exam. In North Carolina, an individual cannot sit for the CPA exam until he or she has completed (or be within 120 days of completing) an undergraduate degree and has taken 18 hours of upper level accounting courses. A BSA/MSA student does not receive the undergraduate degree until the end of the fifth year and then receives both the BSA and the MSA. Therefore, a student is not able to sit for a section (four sections of different topics) of the CPA exam in a timely manner (soon after the material is covered) but must wait until the end of the program. 3. With the two programs, there was often a perception of a two-tier program and a difficulty in explaining the program. The original design of the program was to have a track for individuals wanting to be CPAs and a track for other accounting students that wanted to go into industry or government. However, the recruiters tended to focus on the five-year students and it actually reduced the importance of the graduate degree. In North Carolina (and most other states), one cannot become a CPA without the completion of 150 semester hours of college work (they can take the CPA exam with an undergraduate degree but cannot be certified without 150 hours and work experience). 4. Currently, a student has to make a decision at the beginning of his or her senior year whether or not to go to the five-year BSA/MSA program. If the student then decides to finish the four-year degree either because of failure to get into the graduate school or for other personal reasons, the student must go back and take two additional classes and has some wasted coursework. This along with transfer credit problems makes the 4/1 program much more attractive for the student. 5. For the Banner system, the duel program was/is a nightmare. Accounting students are coded in Banner as either intended accounting majors BSBA, intended accounting majors BSA/MSA, BSBA accounting majors, BSA/MSA undergraduate, BSA/MSA graduate BSBA. The coding and registration (not to mention the new CAPP program for senior summaries) will be much simpler with the 4/1 program. Change #2: The change is to move ACCT 3731 from a “choose from” to a required course. Reason for Change #2: ACCT 3731 is currently a required course for the five-year BSA/MSA student. Since all accounting students will be in the same undergraduate program per this proposal, the class must be required. The topics in ACCT 3731 are integral to the CPA exam and required for employment by many government agencies. Thus, this course needs to be required for both the student just getting the undergraduate degree or for those entering the Masters program to become CPAs. Change #3: The change is to reduce the number of elective hours from 12 semester hours to 6 semester hours. Reason for Change #3: Because of the addition of the Strategy First and Leadership First classes into the business core for all business majors, we must reduce elective hours to be consistent with (same number of total hours) the other College of Business concentrations. The accounting program has 24 semester hours in the concentration compared to 18 semester hours for the other College of Business concentrations. All of the accounting concentration hours are either required for the CPA exam or are prerequisites for courses required for the CPA exam. East Carolina University is a constituent institution of the University of North Carolina. An Equal Opportunity/Affirmative Action Employer The following information is included with this packet: 1. 2. 3. 4. 5. 6. This explanatory memo; Course Proposal Forms – not applicable – no new courses required ; Mark Catalog Copy; Final (unmarked) Catalog Copy; E-mail messages – not applicable Minutes from Faculty meeting noting unanimous approval from the accounting faculty. 7. New BSBA checksheet. 8. Signature Form. Thank you for your consideration on this matter. If there are any questions or concerns, please contact me a schislerd@ecu.edu or 328-6055. Sincerely, Dan Schisler, Ph.D., CPA Chair, Accounting Department East Carolina University is a constituent institution of the University of North Carolina. An Equal Opportunity/Affirmative Action Employer