variable calculate

advertisement

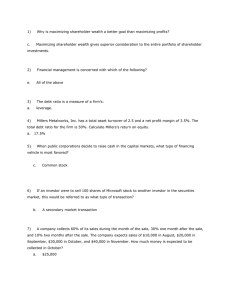

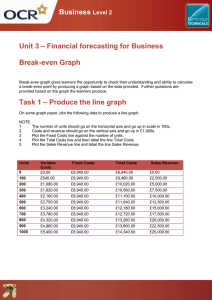

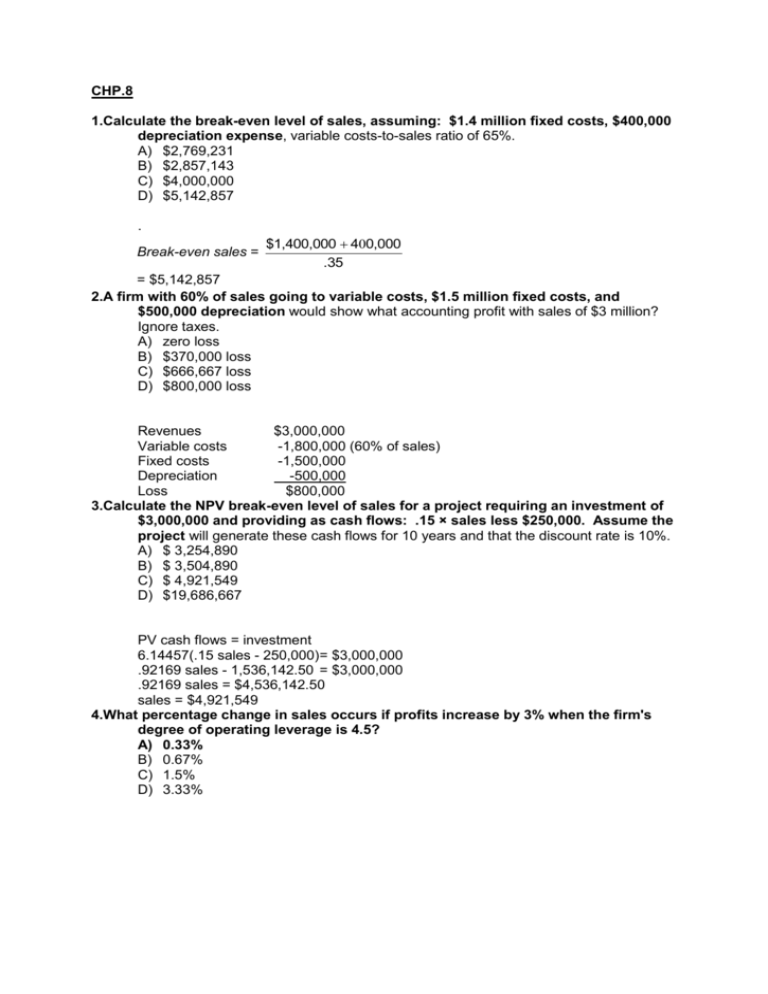

CHP.8 1.Calculate the break-even level of sales, assuming: $1.4 million fixed costs, $400,000 depreciation expense, variable costs-to-sales ratio of 65%. A) $2,769,231 B) $2,857,143 C) $4,000,000 D) $5,142,857 . Break-even sales = $1,400,000 400,000 .35 = $5,142,857 2.A firm with 60% of sales going to variable costs, $1.5 million fixed costs, and $500,000 depreciation would show what accounting profit with sales of $3 million? Ignore taxes. A) zero loss B) $370,000 loss C) $666,667 loss D) $800,000 loss Revenues $3,000,000 Variable costs -1,800,000 (60% of sales) Fixed costs -1,500,000 Depreciation -500,000 Loss $800,000 3.Calculate the NPV break-even level of sales for a project requiring an investment of $3,000,000 and providing as cash flows: .15 × sales less $250,000. Assume the project will generate these cash flows for 10 years and that the discount rate is 10%. A) $ 3,254,890 B) $ 3,504,890 C) $ 4,921,549 D) $19,686,667 PV cash flows = investment 6.14457(.15 sales - 250,000)= $3,000,000 .92169 sales - 1,536,142.50 = $3,000,000 .92169 sales = $4,536,142.50 sales = $4,921,549 4.What percentage change in sales occurs if profits increase by 3% when the firm's degree of operating leverage is 4.5? A) 0.33% B) 0.67% C) 1.5% D) 3.33% DOL 4.5 = = % change in profits % change in sales 3% % change in sales 4.5% change in sales 3% = 4.5 4.5 % change in sales = 0.67%