Midterm 1 - Economics

advertisement

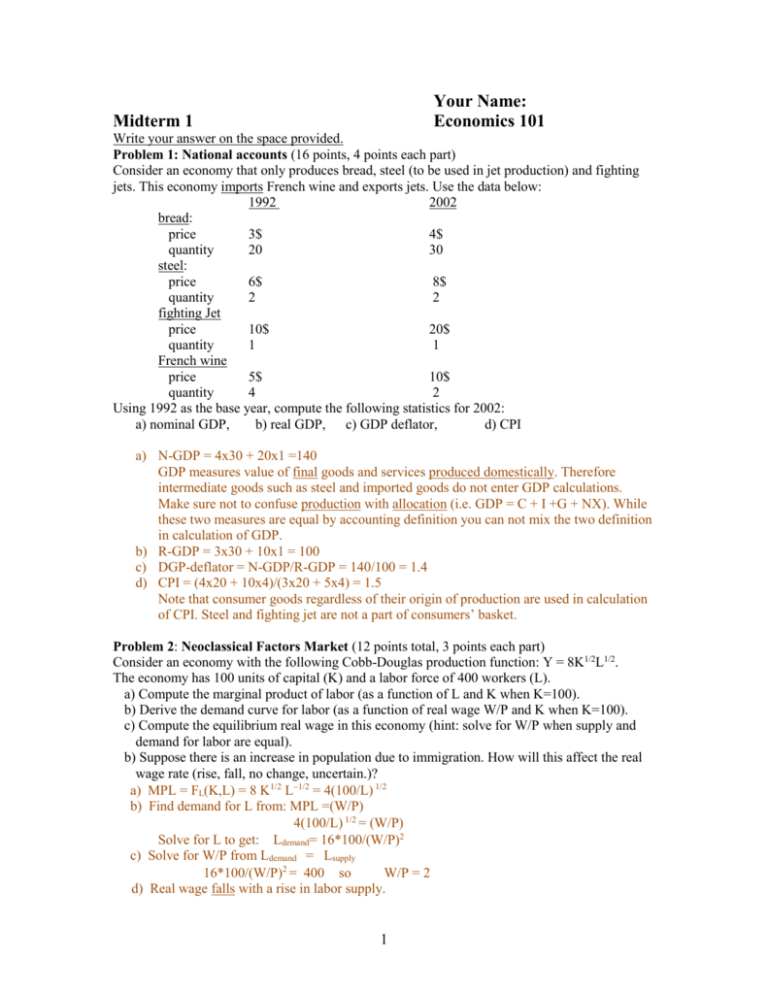

Your Name: Economics 101 Midterm 1 Write your answer on the space provided. Problem 1: National accounts (16 points, 4 points each part) Consider an economy that only produces bread, steel (to be used in jet production) and fighting jets. This economy imports French wine and exports jets. Use the data below: 1992 2002 bread: price 3$ 4$ quantity 20 30 steel: price 6$ 8$ quantity 2 2 fighting Jet price 10$ 20$ quantity 1 1 French wine price 5$ 10$ quantity 4 2 Using 1992 as the base year, compute the following statistics for 2002: a) nominal GDP, b) real GDP, c) GDP deflator, d) CPI a) N-GDP = 4x30 + 20x1 =140 GDP measures value of final goods and services produced domestically. Therefore intermediate goods such as steel and imported goods do not enter GDP calculations. Make sure not to confuse production with allocation (i.e. GDP = C + I +G + NX). While these two measures are equal by accounting definition you can not mix the two definition in calculation of GDP. b) R-GDP = 3x30 + 10x1 = 100 c) DGP-deflator = N-GDP/R-GDP = 140/100 = 1.4 d) CPI = (4x20 + 10x4)/(3x20 + 5x4) = 1.5 Note that consumer goods regardless of their origin of production are used in calculation of CPI. Steel and fighting jet are not a part of consumers’ basket. Problem 2: Neoclassical Factors Market (12 points total, 3 points each part) Consider an economy with the following Cobb-Douglas production function: Y = 8K1/2L1/2. The economy has 100 units of capital (K) and a labor force of 400 workers (L). a) Compute the marginal product of labor (as a function of L and K when K=100). b) Derive the demand curve for labor (as a function of real wage W/P and K when K=100). c) Compute the equilibrium real wage in this economy (hint: solve for W/P when supply and demand for labor are equal). b) Suppose there is an increase in population due to immigration. How will this affect the real wage rate (rise, fall, no change, uncertain.)? a) MPL = FL(K,L) = 8 KL = 4(100/L) b) Find demand for L from: MPL =(W/P) 4(100/L)= (W/P) Solve for L to get: Ldemand= 16*100/(W/P) c) Solve for W/P from Ldemand = Lsupply 16*100/(W/P)= 400 so W/P = 2 d) Real wage falls with a rise in labor supply. 1 Problem 3: Growth Accounting (12 points, 2 pts a, 2 pts b, 4 pts c and 4 pts d) The table below shows the growth rate of real output Y, Labor force L and real capital stock K in U.S. over two periods of 1948-73 and 1973-97. Year 1948-73 1973-97 Percentage Change Y L K 3.7 2.0 2.6 2.7 2.1 2.9 Suppose the following Cobb Douglas production function: Y= ALa Kb, where a=.07 (output elasticity of labor) and b=0.3 (output elasticity of capital) . a) How much did capital contribute to economic growth over 1948-73? b) How much did labor contribute to economic growth over 1948-73? c) How much did total factor productivity (or technological growth) contribute to economic growth over 1948-73? d) While labor and capital growth rates are higher in 1973-97 compared to 1948-73 years, output growth is one percentage point lower what explains this difference? Percentage change Year 1948-73 1973-97 a) b) c) d) aL/L bK/K A/A 1.4 1.5 0.78 0.9 1.5 0.3 Contribution of capital = b *percentage change in K = 0.3*2.6 = 0.78 Contribution of labor = a*percentage change in L = 0.7*2.0 = 1.4 Percentage change in A = 3.7 – 1.4 - 0.78 = 1.52 The difference in output growth rates in the two periods is mainly due to the slow down in technological progress of 1973-97 period. Problem 4: Neoclassical Economy: (12 points, 4 points each part) Suppose the supply side of an economy is characterized as follows: Y = 2K + 4L, K = 200, L = 100 Suppose the demand side of the economy is characterized as follows (all in units of goods): G = 100, T = 100, C = 150 + 0.5(Y-T), and I = 350 - 1000r a) Compute total supply and the equilibrium levels consumption, interest rate, and investment. b) Congressional Republicans wish to consider cutting taxes. Discuss what effects this fiscal policy would have on the economy above. In particular, state for each of the variables you computed in part (a) whether it will rise, fall, not change, or if it is impossible to tell. (No calculations required.) c) Suppose the Congressional Republicans do not wish to generate a budget deficit by cutting taxes, so they propose to cut government spending and taxes by the same amount. Now state for each of the variables you computed in part (a) whether it will rise, fall, not change, or if it is impossible to tell. a) Y= 2*200 + 4*100 = 800. C = 150 + 0.50(800-100) = 500 Y = C + I + G = [150 + 0.50(800-100)] + [350 - 1000r] + 100 800 = 500 + [350 - 1000r] + 100 -150 = -1000r so r = 0.15 I = 350 - 1000r = 350 - 1000(0.15) = 200. b) A tax cut reduces national saving which leads to a rise in interest rate and a reduction in investment. Consumption will increase by the amount of tax cut times MPC. 2 c) Since government expenditure and tax are cut by an equal amount public saving will not change. But a tax cut increases disposable income more than consumption leading to a rise in private saving. This will increase total saving which in turn leads to a reduction in interest rate and a rise in investment. Problem 5: Solow Growth Model: (12 points total, 4 points each part) Suppose the U.S. can be characterized by the production function: Y = F(K,L) = 2K1/2L1/2. Assume there is no technological progress. a) Calculate the steady state value of capital-labor ratio and output per capita in terms of depreciation rate d, saving rate s and population growth rate n. b) What is the steady state growth rate of total output and of output per capita? c) For d = 8%, n = 2%, and s = 10% calculate the steady state value of capital-labor ratio, output per capita and consumption per capita. a) Steady-state condition: sf(K/L*) = (d + n) K/L* so s[2(K/L*)1/2] = (d + n)K/L* s2[4(K/L*)] = (d + n)2(K/L*)2 K/L* = 4s2/(d + n)2 Y/L* =2(K/L*)1/2 =2[4s2/(d + n)2]1/2 =4s/(d + n) b) At steady state growth rate of total output Y = growth rate of population growth n growth rate of output per capita Y/L = zero. c) K/L* = 4x[(0.09) 2/(0.07 + 0.02) 2 ] = 4 Y/L* = 2(K/L*)1/2 = 2(4)1/2 = 4 C/L* = (1-s) Y/L* = (1 - 0.10) x 4 = 0.9 x 4 = 3.6 Problem 6: Convergence (12 points total, 3 points each) Although the U.S. and Mexico share a large common border, their economies are very different. Most prominent is the fact that Mexico has a lower level of income per person than the U.S. Use the growth theories studied in class to answer the following questions a) State whether the level of income per person in Mexico in the long run will be higher than in the U.S., lower, or the same, or if it is impossible to tell. (Assume unless stated otherwise that the underlying features of the two economies are the same: same saving rate, depreciation rate, Cobb-Douglas production function, population growth rate, with no technological progress.) b) Now re-answer the question in part (a) if you know that Mexico has a higher population growth rate. c) Now re-answer the question in part (a) if you know instead that Mexico has a higher rate of technological progress (as defined in class). (Same population growth rates again.). d) Now re-answer the question in part (a) if instead both countries have production functions with constant returns to capital and no labor (ie. Y=AK). (Same population growth rates again and no technological progress.) Discuss your reasoning briefly. a) Income per person in Mexico will increase and converge to that of U.S. in the long run b) Income per person in Mexico will remain lower than that of U.S. in the long run c) Income per person in Mexico will increase and surpass that of U.S. in the long run d) Income per person in Mexico will remain lower. With equal saving rates, output per person in both countries will grow at the same rate but they will not converge. 3 Problem 7: Unemployment (6 points total) (a) Assume that for Belize the natural rate of unemployment is 0.125 and the rate of job finding is 0.56. What is the fraction of employed workers who lose their jobs each month (the rate of job separation? (b) Explain what is meant by wage-rigidity. What are three examples of wage-rigidity? Problem 8: Quantity Theory of Money (10 points total, 5 points each part) Suppose in Singapore the velocity of money is constant, real GDP grows by 7% per year each year, the money stock grows by 10% per year, and the nominal interest rate in 8%. a) Using the quantity theory of money and the Fisher relation, what should be the inflation rate and the real interest rate in Singapore? b) Suppose the central bank of Singapore decides to lower inflation by lowering the money supply growth rate to 9% (all else constant). Now what would be the equilibrium values of inflation and the nominal interest rate? (Assume the Classical Dichotomy holds here.) a) %M + %V = %P + %Y so 10% + 0 = %P + 7% so %P = 3%, r = i - = 8% - 3% = 5% b) now 9% + 0 = %P + 7% so %P = 2% Since the real interest rate is determined by the real side of the economy, r is still 5%. So the nominal interest rate will become i = r + = 5% + 2% = 7%. 4 Problem 8: True-False (24 point, 3 points each) Say if the following statements are True or False. If they are false write the correct statement a) Cutting government expenditure is more effective in reducing interest rate than an increase in taxes of an equal amount. True. b) The Solow growth model predicts that countries that have higher investment shares (i.e., I/GDP) will grow faster. False. In Solow model saving rate is inconsequential to growth rate. Note that I/GDP = saving rate (since I=S=sGDP). c) Empirical studies show that GDP per capita growth rates and investment shares are positively correlated meaning there is a relation between saving rate and growth rate. True. d) For capital-effective labor ratio to remain constant capital stock must increase at a rate equal to the sum population and technological growth rates plus rate of depreciation. False. For K/EL to remain constant K must grow at a rate equal to the growth rate of population n plus the growth rate of technological progress g, that is (n + g). e) Saving rate has no effect of the transitory (before reaching steady-state) growth rate of output per worker. True. Level of saving has no effect on growth in the Solow model. However a change in saving rate affects transitory growth rate. f) In the Solow growth model higher saving rate will always lead to a higher level of consumption per person. False. Increase in saving rate will increase income per person and consumption per capita only up to a point, after which consumption per capita will decrease (too much saving reduces consumption). g) In a Solow growth model with no technological change, the long run growth rate of output per worker is zero because of the law of diminishing marginal productivity of capital. True. h) Empirical findings strongly support the convergence hypothesis. False. Only OECD and some Asian countries are converging, most other countries are not. 5