Doc 2: FEC Frequently Asked Questions and Rates

advertisement

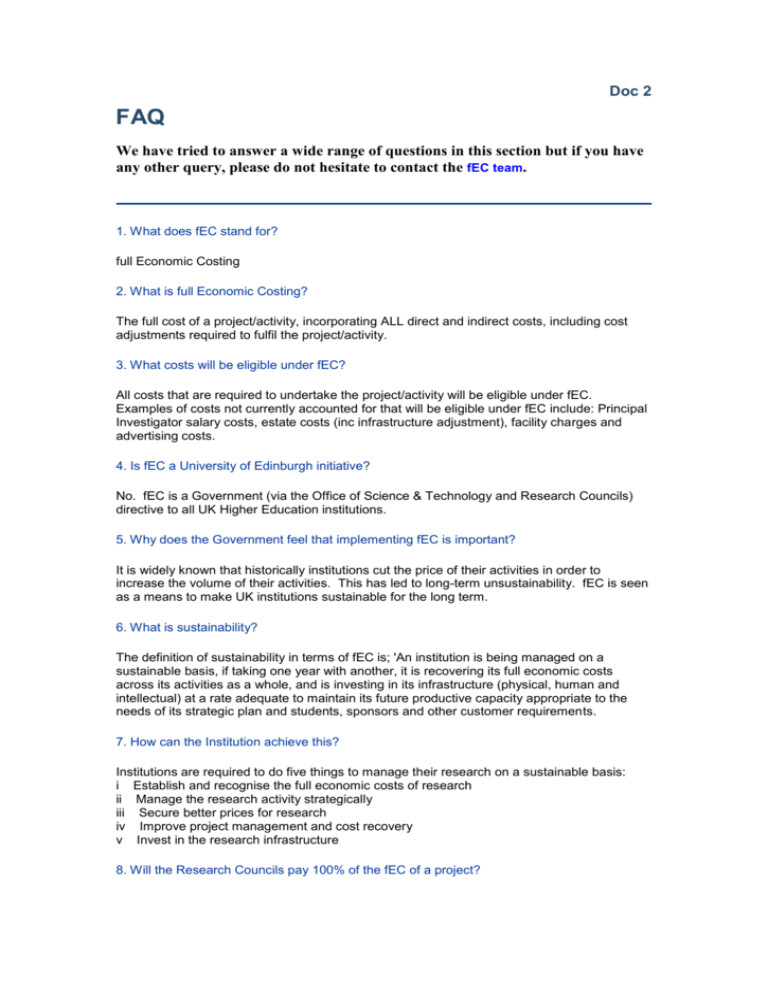

Doc 2 FAQ We have tried to answer a wide range of questions in this section but if you have any other query, please do not hesitate to contact the fEC team. 1. What does fEC stand for? full Economic Costing 2. What is full Economic Costing? The full cost of a project/activity, incorporating ALL direct and indirect costs, including cost adjustments required to fulfil the project/activity. 3. What costs will be eligible under fEC? All costs that are required to undertake the project/activity will be eligible under fEC. Examples of costs not currently accounted for that will be eligible under fEC include: Principal Investigator salary costs, estate costs (inc infrastructure adjustment), facility charges and advertising costs. 4. Is fEC a University of Edinburgh initiative? No. fEC is a Government (via the Office of Science & Technology and Research Councils) directive to all UK Higher Education institutions. 5. Why does the Government feel that implementing fEC is important? It is widely known that historically institutions cut the price of their activities in order to increase the volume of their activities. This has led to long-term unsustainability. fEC is seen as a means to make UK institutions sustainable for the long term. 6. What is sustainability? The definition of sustainability in terms of fEC is; 'An institution is being managed on a sustainable basis, if taking one year with another, it is recovering its full economic costs across its activities as a whole, and is investing in its infrastructure (physical, human and intellectual) at a rate adequate to maintain its future productive capacity appropriate to the needs of its strategic plan and students, sponsors and other customer requirements. 7. How can the Institution achieve this? Institutions are required to do five things to manage their research on a sustainable basis: i Establish and recognise the full economic costs of research ii Manage the research activity strategically iii Secure better prices for research iv Improve project management and cost recovery v Invest in the research infrastructure 8. Will the Research Councils pay 100% of the fEC of a project? No. Research councils will pay between 80% of the fEC. 9. So where does the balance come from? The matching costs can come from a variety of institutional sources but will mainly be derived from the Quality Review (QR) funding received as part of the dual support system. 10. Will other funders pay 100% of the fEC of a project? Some. Government Departments have been instructed by the Treasury to pay 100% of fEC. Commercial contracts will be expected to pay 100% of fEC and will do so on commissioned research. Charity funders are likely to pay a proportion of fEC or they may exclude some of the eligible costs from proposals submitted to them. 11. Can QR money be used to subsidise any project? No. QR funds can only be used to subsidise projects that are in the 'public good'. 12. What is public good? Public Good can be defined as a project that allows the academic to freely publish the results or where the IPR remains the property of the institution. 13. Will fEC lead to projects costing more and therefore to a reduction in volume? Possibly. fEC will identify the costs that have always existed when running a project/activity. All parties must be aware of what the fEC of the project is and should pay according to the status (public good or limitation on publication). Obviously should there be no additional funding provided to the funders of research , volume will decline. However the Government has made more funding available to Research Councils and via the Dual Support System in an attempt to hold the volume of RC projects at current rates. 14. When did fEC come into force? In April 2006 the first Research Council awards received using fEC. 15. Where can I find out more detailed information on fEC? More information on fEC can be found on http://www.jcpsg.ac.uk and http://www.research&innovation.ed.ac.uk/ 16. Laboratory Technician Rates There are now three categories for lab technicians available: 1) Directly Allocated This rate is applied when a project requires a technician who will not work full time on that project and will not fill in timesheets, the category Directly Allocated must be used. The income from DA technicians is returned to the School/Project. 2) Directly Incurred This rate is only applied when a technician works full time on a project or will fill in timesheets. 3) Lab technician infrastructure rate This rate is added to ALL applications per research FTE, where a lab-based estates rate is applied. The purpose of the rate is to recover the cost of the time that laboratory technicians spend on general laboratory services that are not charged to specific research grants. This income stream is returned to the School/Project. 17. Indexation of Grants All applications in excess of one year (other than to Research Councils and other sponsors whose rules do not allow indexation) should be indexed. Until further notice, the uplift factor for indirect costs, estates and the laboratory technician infrastructure rate will be 1.05. All categories of resources bid for should be indexed. Where there is a shortfall in awarded salary due to the difference between the rate of indexation applied by the funder and that applied by the University (NOT where difference is caused by pay reward modernisation) the School has several options: (a) to vire from another resource heading where permitted. (b) to shorten the time commitment of the staff member. (c) to sign for the overspend from another account. Such a shortfall is an estimate only. Adopting such approaches can be problematic, especially the option of shortening contracts to fit income. All projects should be costed on an fEC basis, regardless of sponsor. The exception to this rule, on de minimis grounds, is projects costing under £15,000. 18. Replacement Teaching Where the Principal Investigator’s salary is required for replacement teaching, it can go in the application as a Directly Allocated cost (i.e. no timesheets required), but the income WILL be available to use to pay replacement teaching. A new code will appear on finance packs attributing this income to replacement teaching and it will not be available for any other use. However, this will only be allowed where the Head of School has signed off in advance – at application stage - that the money will be required for this purpose, and this purpose only. 19. Sliding Scale of Return as FEC income increases over 80%/Commercial Profit Where funding on an fEC-costed award exceeds 80%, the return of indirect costs etc to schools increases proportionately (14% of 80+%). Where a Research Contract secures funding in excess of 100% of the full economic cost, then a profit will be generated, and the position must be discussed immediately with the Director of Finance, as a liability to Corporation Tax may emerge. Where the funding for a Research Contract is less than the full economic cost of the project, the School will be liable to pick up the shortfall. 20. Can FEC be waived? The full economic cost should be established for all research projects costing in excess of £15,000. The full economic cost should not, however, be confused with the price to be set for the project. For the time being, very few projects will recover the full economic cost, and so the bulk of projects will be taken on at a price less than fEC. 21. Indirect and Estate Rates for Support Services For Support Services (in the Library particularly, where some research projects are carried out) the HSS rate is currently used because UoE does not have a separate rate for Support Services. Where a unit straddles Support Services and a School in any College, the rate applied is based on Principal Investigator and where the authorisation for the proposal has come from. 22. Retention of indirect and estates when PI moves to another university The original employing institution retains incurred costs and the new institution accepts the transferred remainder. This principle applies to staff moving to, as well as from, Edinburgh. 23. Ceilings imposed by Sponsors Should a sponsor appear to be backtracking on public commitments to fund projects on an fEC basis, these should be questioned and brought to the attention of the Director of Finance. Investigators should apply fEC to all applications. 24. EU Framework 7 All Framework Programme 7 project costs are to be calculated on an fEC basis. Rates have been established for FP7 applications (EU-fEC), one rate per College. The cost model selected is the Simplified Method. The methodology has been reviewed by Internal Audit. Cost spreadsheets are available from ERI contacts. Directly Allocated are not applicable; all costs are Directly Incurred. In accordance with sponsor rules timesheets must be completed by ALL staff charged to projects. Indirect and estates cost recovery rates must be applied to all academic staff, although no rates should be applied to postgraduate researchers on FP7 applications (whether paid by stipend or contract of employment). Exceptions to using EU-fEC are Marie Curie, European Research Council and Coordination and Support Actions, the European Commission reimburses indirect costs using different flat rates. 25. How will the University deal with income under a DA Investigator? 100% of the FUNDER CONTRIBUTION to the investigators salary will now be returned to the College/ School. Note this is 80% of the salary under current Research Council funding. If an investigator chooses to use the DI category, regardless of whether this is approved by the Research Council or not, they still receive 100% of the FUNDER CONTRIBUTION- not 100% of the full salary. 26.Why has the University identified Major Research Facilities (MRFs) and Small Research Facilities (SRFs) and what do I do if the facility I require for my project is not on the published list? The University of Edinburgh has produced rates for both Major and Small Facilities. The costs of these facilities have been removed from the indirect and estates rates and must therefore be included in grant applications where the facility is required for a project. The costs, which will be provided on the request by the facility managers or school administration, should be used for proposals to Research Councils and government bodies and as the basis of negotiation with other funders. This change to the costing of research grants means that the facilities will receive income to cover not just their direct costs but to fund t he replacement of equipment thus enabling them to operate on a more sustainable basis in the long terms. Over the coming years, other facilities will adopt this basis of charging for recovering costs on research grants. If the facility you require is not already on a published list (available on request to ERI) then you will be given a form, which should be filled out by the administrator for your school/ facility along with the College Accountant. A rate will be established for that facility and it will be added to the list. You will then be able to use the income for that resource if the project is awarded. If the form is not filled in and the facility is not properly identified, the income will be withheld until the procedure is completed. 27. Where can I get help with costings for research application? Please contact the relevant college team in www.eri.ed.ac.uk/researchservices/costings/index.htm ERI for help with costings- fEC rates The following information on indirect, estates and laboratory technician infrastructure rate was approved by the fEC Group (22/1/09) and has been supplied to RCUK. RATES TO BE ADDED PER RESEARCH FTE CHSS CMVM CSCE Rates effective from February 2009 £ £ £ Estates lab rate 10,685 15,632 12,842 Estates non-lab rate 5,770 9,750 7,605 Indirect rate 45,159 40,493 40,664 Lab technicians rate (infrastructure) 68 1,208 397 Based on an indexation rate of 3%. For more information on historical rates please contact the fEC team. For help on research proposal costings please contact the Research Support Advisor for your School- ERI