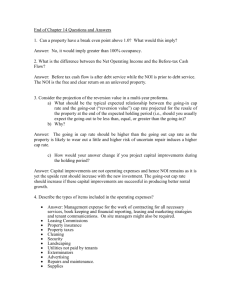

Assumptions

Assumptions

Recognizing the sensitivity of the model to variations in our inputs, we sought reputable and widely used sources for our assumptions.

Below is a discussion of our assumptions and the sources and methodologies used in their estimation.

On the cost-related side, we assumed a construction cost of $225

PSF for office and $210 PSF for residential. Our parking costs are estimated at $40,000 per parking space. These figures were based on conversations with Milford Reynard, the chief estimator for Linbeck Construction Company, a large construction firm based in Boston. The construction costs, mentioned above are based on detailed information concerning site development costs, shell and core costs, and interior finish costs for our class ‘A’ office component and 12-story residential space. We projected the cost of building “green” at 5% of construction costs. This was based on research, specifically a study done by the State of California, which determined that there was an average 2-3% cost premium on buildings that received a LEED rating of certified or silver.

Additional research on the United States Green Building Council

USGBC website describes projects that realized no additional cost for “going green” if design elements were incorporated early and efficiently. Our team added a few percentage points and assumed a fairly conservative “green” premium of 5% to parlay potential cost overruns and take into account that this will be our team’s first attempt at sustainable design. Additionally our 5% was supported by the chief estimator at Linbeck Construction. We assumed a cost escalation of 5% from today until the start of construction. We determined this rate based on a February 13,

2006 conversation with Tom Fanning, a Senior Vice President at

Spaulding and Syle Colliers, a Boston based real estate development services firm. For escalation of operating expenses and taxes, we used general expectations of overall price inflation.

This value was estimated by subtracting the yield of a Inflation

Indexed Five year Treasury Bond from the yield of a non-protected

Five year Treasury Bond, resulting in a market expectation of

2.61% for a going forward inflation rate.

On the revenue-related side, we determined the proper going-in cap rate by using the income return component of the 2005

Boston area NCREIF index. This resulted in a 6.96% cap rate for office and 4.45% for apartments. For the immediate sale upon stabilization model, we used the going-in cap rates to determine reversion values due to the negligible deterioration of the building during the one year lease-up term. For the ten year hold model, we took the respective spread between going-in and going-out cap rates from the Korpacz 2005 report (this spread represents the physical and functional obsolescence of buildings during a ten year period) and added those spreads to the going-in cap rates from the NCREIF index to determine the appropriate going-out cap rates. This resulted in a going-out cap rate of 7.26% for office and

5.42% for apartments.

Apartment rents were estimated by selecting projects with comparable amenities, location, fitout and other characteristics and took the average rental rates for those competitive developments. Office rents were estimated by taking market class

A office rents and adjusting downward to account for the fact that it is on the ground floor. Rental escalation from today until start of lease-up was conservatively estimated at 2%, below the Torto-

Wheaton forecasts of 2.7% for 2006. For the ten year hold model, we assumed rent inflation at 3%, again based on Torto-Wheaton

Research multi-housing forecasts. Vacancy figures of 5% for apartments and 12.3% for office were also based on Torto-

Wheaton reports.

Interest rates for construction and permanent financing along with required returns for various equity sources were determined through conversations with Jane Seiden at Key Bank, Matt

Lombardi at Investor’s Circle and a permanent loan officer at

Deutsche Bank.

Construction timeline was also based on detailed information received from the chief estimator at Linbeck Construction. The schedule was done in phases that were deemed realistic for the

Boston submarket.