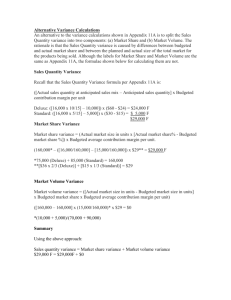

CHAPTER 8 Budgetary Control and Variance Analysis Learning

advertisement

CHAPTER 8 Budgetary Control and Variance Analysis Learning Objectives After studying this chapter, you will be able to: 1. Understand how companies use budgets for control. 2. Perform variance analysis. 3. Interpret variances to determine possible corrective actions. 4. Explain how nonfinancial measures complement variance analysis. Overview As we know, it is not enough just to make plans. We need to check periodically to see whether everything is going according to plan and whether any corrective actions are necessary. For example, we might review a day’s activities. Did we accomplish what we set out to do? Do we need to change our schedule for the next day? Similarly, large organizations compare actual revenues, costs, and profits with budgeted amounts to determine whether they need to make changes to their products, marketing policies, production processes, or purchasing procedures. In this chapter, we focus on short-term measures of control. We begin by discussing the role of budgets in the control process. We then present the mechanics of variance analysis, a technique firms use to determine why actual revenues, costs, and profit differ from their budgeted amounts. Variance analysis helps organizations determine whether their people and processes are performing as expected. It also helps organizations motivate their employees and improve future planning decisions. Finally, we discuss how organizations can use nonfinancial measures, in addition to variance analysis, to help control operations. Learning Objective 1 Understand how companies use budgets for control. Budgets As the Basis for Control 1. As you learned in Chapter 7, a good plan is the foundation for effective control. 2. Without a well-conceived plan against which to compare actual performance, it is difficult to determine how we are doing or what we could do to improve. 3. Cindy makes assumptions for the following items to estimate costs: a. Raw Materials Quantities b. Raw Materials Prices c. Labor Requirements d. Wage Rate e. Variable Overhead f. Fixed Costs 4. The information determined is used to prepare the master budget. 5. The master budget is a plan that presents the expected revenues, costs, and profit corresponding to the expected sales volume as of the beginning of that period. 1 Learning Objective 2 Perform variance analysis. How to Calculate Variances 1. A variance is the difference between an actual result and a budgeted amount. 2. We classify a variance as favorable or unfavorable based on their effect on current profit. a. A favorable (F) variance means that performance exceeded expectations—actual revenue exceeded budgeted revenue or actual cost was less than budgeted cost. b. An unfavorable (U) variance means that performance fell short of expectations—actual revenue was less than budgeted revenue or actual cost exceeded budgeted cost. 3. We denote favorable variances with positive numbers and unfavorable variances with negative numbers. 4. Thus, we calculate sales, contribution margin, and profit variances as the actual result less the budgeted amount (e.g., actual profit - budgeted profit). 5. In contrast, because costs represent outflows, we calculate cost variances as the budgeted amount less the actual result (e.g., budgeted labor cost 2 actual labor cost). 6. The total profit variance formula is shown below: Total Profit Variance = Actual Profit - Master Budget Profit 7. Variances are often related in the movement of amounts. For instance, if actual sales exceed budgeted sales, costs will increase as well. a. Example: Increased sales give rise to increased labor costs. b. Despite the seemingly simple relationship noted above, there are other factors to consider. (e.g., wage rates, unit amount fluctuations, etc.) Breaking Down the Total Profit Variance 1. As Exhibit 8.6 shows, in a series of steps, we can break down the total profit variance into several components. 2. Each component informs us about how a certain aspect of operations, such as a change in sales volume or a change in the selling price, affects profit. Flexible Budget 1. Let us begin by breaking down the total profit variance into the sales volume variance and the flexible budget variance. 2. Exhibit 8.6A reproduces the relevant portion of Exhibit 8.6 to help you place this step in context. 3. Using the assumptions in the master budget, companies can develop a CVP relation that projects the profit for any sales level (Called “flexing” the budget). 4. Flexing the master budget changes total budgeted revenues and total budgeted costs to correspond to any sales level. 5. In variance analysis, we are particularly interested in the budget at the actual level of sales, or the flexible budget because profit differences are driven by the difference between budgeted and actual sales. 2 Sales Volume Variance 1. Because the flexible and master budgets only differ in sales volume, we refer to the difference in profit between the two budgets as the sales volume variance. 2. We compute it by subtracting master budget profit from flexible budget profit. 3. Because identical assumptions are made about sales price and variable costs, the budgeted unit contribution margin is the same for both the master and the flexible budgets. 4. Therefore, changing the volume of sales proportionately changes profit by the budgeted unit contribution margin, as follows: Sales Volume Variance = Flexible Budget Profit - Master Budget Profit = (Actual Sales Quantity - Budgeted Sales Quantity) x Budgeted Unit Contribution Margin 5. The variances for each line item simply represent changes in revenue and costs that are strictly proportional to the change in sales volume (not individual revenue or cost components). 6. Thus, the net profit effect, which also equals the difference in contribution margins, is all we should interpret. 7. In Appendix B, we discuss how firms can split the sales volume variance into two pieces. Flexible Budget Variance 1. The difference in profit between the actual results and the flexible budget is the flexible budget variance. Flexible Budget Variance = Actual Profit - Flexible Budget Profit 2. Before we move to the component variances, let us first look at the sales volume variance and the flexible budget variance graphically. 3. Exhibit 8.8 shows how variances isolate the effect of one factor while controlling for other factors. 4. Once we know the actual volume of activity, we use the flexible budget to calculate what the expected profit is—the budgeted profit given the actual volume. 5. On the graph, the difference between points A and C on the y-axis, the profit or loss in dollars, is the total profit variance. 6. This variance is the difference between the master budget and the actual results and is made up of two components. a. The first, the difference between points A and B, between the master budget and the flexible budget, is the sales volume variance. b. The second, the difference between points B and C, between the flexible budget and the actual results, is the flexible budget variance. 3 Components of the Flexible Budget Variance 1. In the next step of variance analysis (see Exhibit 8.6B), we split the flexible budget variance into three components: the sales price variance, fixed cost variances, and variable cost variances. 2. We calculate these individual variances by comparing the lines for revenue and each kind of cost between the flexible budget and actual results. Sales Price Variance 1. In reference to the text example, recall that the flexible budget provides the expected revenue for the actual number of cakes sold. 2. However, because the actual price per cake was lower than the budgeted price, actual revenue differed from expected revenue. 3. We compute the sales price variance between actual revenues and flexible budget revenues, as follows: Sales Price Variance = Actual Revenue - Flexible Budget Revenue = (Actual Sales Price x Actual Sales Quantity) - (Budgeted Sales Price x Actual Sales Quantity) = (Actual Sales Price - Budgeted Sales Price) x Actual Sales Quantity Fixed Cost Variance 1. We refer to any difference between budgeted and actual fixed costs as a spending variance. Fixed Cost Spending Variance = Budgeted Fixed Costs - Actual Fixed Costs 2. Recall from Chapter 5 that the CVP relation assumes that fixed costs should be the same for all sales levels within the relevant range. 3. However, even in the short term a firm’s actual expenditure on fixed costs could differ from the budgeted amount. Variable Cost Variances 1. These variances are the differences between the budgeted costs (from the flexible budget) and the actual costs. 2. Cindy should not attribute these variances to the increased sales volume. 3. Why? The reason is that the costs in the flexible budget—the benchmark for this variance—are already adjusted for the actual volume of operations. Input Quantity and Price Variances 1. The final step is to calculate input quantity and price variances corresponding to variable costs. 2. A variable cost variance equals the amount in the flexible budget less the actual cost. 3. To calculate the flexible budget cost, we multiply the budgeted input per unit of sales by the actual sales quantity. 4. The product is the flexible budget quantity of the input. 4 5. Then, multiply this quantity by the budgeted cost per unit of the input to find the flexible budget cost. 6. The actual total cost of any input is the actual cost per unit of the input times the actual quantity of the input used. 7. In sum, the amounts in the flexible budget represent budgeted prices and budgeted quantities for the actual sales. 8. Meanwhile, actual quantities and actual prices dictate actual results. The differences in the amounts are the variances for variable costs. 9. For each of the line items, the input price variance is the difference between the “as if” budget and actual results. 10. The input quantity variance is the difference between the amounts in the flexible budget and the “as if” budget. 11. The text provides a summary of variance calculations associated with variable costs. Learning Objective 3 Interpret variances to determine possible corrective actions. Interpreting and Using Variances 1. Companies generally prepare a budget reconciliation report that provides management with a summary that bridges actual and expected performance. 2. The report helps pinpoint which areas to investigate in order to take appropriate corrective actions and also highlights areas of exceptional performance. 3. Variances can arise: a. during the normal course of operations. b. because of a more permanent change in the firm’s operating environment. c. because budgets or standards are either too tight or too loose. General Rules for Analyzing Variances 1. There are three general rules to follow in a variance investigation: a. Investigate all significant variances, whether favorable or unfavorable. b. Examine trends. c. Consider the total picture. Investigate All Large Variances 1. Large variances could signal a permanent change in the operating environment. 2. It is important to understand certain changes that result in long term implications. Trends in Variances 1. Trends in variances often point to inherent problems. 2. Trends in variances also could arise because of biases that influence the setting of standards. a. Marketing personnel can intentionally “underestimate” market demand. b. Production personnel can “overstate” costs to give an artificial “cushion” to not exceed them. c. 5 Linking Variances—The Big Picture 1. It is important to step back and see how the variances are connected to each other. 2. For instance, unfavorable sales price variances could lead to favorable sales volume variances. 3. An excessive focus on generating favorable input price variances provides the purchasing manager with a natural incentive to look for “good” deals by sacrificing quality, purchasing in bulk quantities, or agreeing to flexible delivery schedules. 4. Such practices could lead to unfavorable variances elsewhere in the organization. 5. Also, revenue and cost variances sometimes have the same underlying cause. Making Control Decisions in Response to Variances 1. Firms should use all of the variances to investigate the validity of underlying budget assumptions and targets. 2. They then need to collect additional information to choose among alternate explanations. 3. Only then should companies decide on suitable corrective actions. Learning Objective 4 Explain how nonfinancial measures complement variance analysis. Nonfinancial Controls 1. Variance analysis has some limitations. 2. These limitations apply whenever controls are based on financial data from a firm’s accounting system. 3. The primary limitations of variance analysis pertain to timeliness and specificity. 4. The lack of timeliness and specificity in financial variances force organizations to use other, primarily nonfinancial controls to ensure that they are meeting organizational objectives. Nonfinancial Measures and Process Control 1. Nonfinancial measures can provide immediate and specific feedback to employees about the status of the environment and the outcomes of their decisions. 2. We all need feedback, or control, information to perform our jobs effectively. 3. In all cases, there is an expected or budgeted value for each measure. Nonfinancial Measures and Aligning Goals 1. In addition to helping firms identify problems with their processes, nonfinancial measures also help align goals. 2. This dual role for nonfinancial measures is similar to that for financial measures. 3. In general, financial controls are more useful for evaluating managers at higher levels in an organizational hierarchy, whereas nonfinancial controls are more useful for monitoring and evaluating employees at lower levels, engaged in day-to-day operations. 4. Problems that are not fixed in a timely manner when and where they arise will give rise to unfavorable financial variances at the end of the week or the month, and it becomes a manager’s responsibility to take corrective actions next time around. 6 CHAPTER 8 REVIEW QUESTIONS TRUE/FALSE 1. A budget is the benchmark for evaluating actual performance. 2. An unfavorable variance means that actual revenue exceeds budgeted revenue or actual cost was less than budgeted cost. 3. We use a master budget to decompose the total profit variance into two major components: the sales volume variance and the flexible budget variance. 4. In variance analysis, we are particularly interested in the budget at the actual level of sales, or the flexible budget. 5. Variance could arise because budgets or standards are either too tight or too loose. 6. Relevance and Specificity are the two primary reasons organization use nonfinancial measure as well as financial measures for control measures. MULTIPLE CHOICE 1. Total profit variance equals: A. Forecasted profit less master budget profit. B. Master budget profit less forecasted profit C. Actual profit less master budget profit. D. Actual profit less forecast. 2. Suppose actual profit before taxes is $9,900 and master budget profit before taxes is $8,000, what is the total profit variance: A. $1,800 Favorable. B. $1,800 Unfavorable. C. $1,900 Unfavorable. D. $1,900 Favorable. 3. Using a flexible budget, we break down total profit variance into two major components: A. The sales volume variance and the flexible budget variance. B. The master budget variance and the flexible budget variance. C. The static budget variance and the sales volume variance. D. The master budget variance and the sales volume variance. 7 4. Which is not a main reason why variances could arise? A. Variances could occur during the normal course of operations. B. Variance could arise due to a more temporary change in the firm's operating environment. C. Variances could occur because budgets or standards are either too tight or too loose. D. Variance could occur due to more permanent change in the firm's operating environment. 5. (Actual Sales Price X Actual Sales Quantity) - (Budgeted Sales Price X Actual Sales Quantity) = A. Sales Volume Variance. B. Flexible Budget Variance. C. Sales Price Variance. D. Input Price Variance. 6. What is not a characteristic of a budget reconciliation report? A. The report helps pinpoint which areas to investigate in order to take appropriate corrective actions. B. It provides management with a summary that bridges actual and expected performance. C. The report highlights areas of exceptional performance thus organizations can learn from "success" stories. D. The report begins with fixed spending variance. 7. Firms use budgets for control for which of the following reasons: A. A good plan is the foundation of effective control. B. It is difficult to evaluate the performance of the firm without comparing a well-conceived plan with actual performance. C. It is the benchmark for evaluating actual performance. D. All of the above. 8. Smith's Tool Company manufactures tools for multiple uses. For the month of May, Smith budgeted to manufacture and sell 10,000 tools at a price of $52. Smith's management estimated the unit variable cost at $32 and budgeted fixed costs of $50,000 for the month. During May, Smith actually sold 9,200 tools, earning $470,000 in revenue. In addition, Smith's actual total variable and fixed costs amounted to $282,000 and $46,000. What is the sales price variance? A. $50,000 Favorable. B. $8,400 Favorable. C. $8,400 Unfavorable. D. $50,000 Unfavorable. 9. Smith's Tool Company manufactures tools for multiple uses. For the month of May, Smith budgeted to manufacture and sell 10,000 tools at a price of $52. Smith's management estimated the unit variable cost at $32 and budgeted fixed costs of $50,000 for the month. During May, Smith actually sold 9,200 tools, earning $470,000 in revenue. In addition, Smith's actual total variable and fixed costs amounted to $282,000 and $46,000. What is the variable cost variance? 8 A. B. C. D. $38,000 Favorable. $12,400 Favorable. $38,000 Unfavorable. $12,400 Unfavorable. 10. Smith's Tool Company manufactures tools for multiple uses. For the month of May, Smith budgeted to manufacture and sell 10,000 tools at a price of $52. Smith's management estimated the unit variable cost at $32 and budgeted fixed costs of $50,000 for the month. During May, Smith actually sold 9,200 tools, earning $470,000 in revenue. In addition, Smith's actual total variable and fixed costs amounted to $282,000 and $46,000. What is the fixed cost variance? A. $4,000 Favorable. B. $6,000 Favorable. C. $6,000 Unfavorable. D. $4,000 Unfavorable. MATCHING 1. Match the items below by entering the appropriate code letter in the space provided. A. B. C. D. E. Sales Price Variance Input Price Variance Flexible Budget Purchase Price Variance Total Profit Variance F. G. H. I. J. Budget Reconciliation Report Sales Volume Variance Unfavorable Variance Input Quantity Variance Variance ____ 1. A report that uses variances to reconcile the difference between master budget profit and actual profit. ____ 2. A difference between an actual result and a budgeted amount that leads to a decrease in profit. ____ 3. The difference between an actual result and a budgeted amount. ____ 4. A budget that is based on actual level of sales. ____ 5. Actual profit less master budget profit. ____ 6. Flexible budget profit less master budget profit. ____ 7. Profit effect associated with the difference between the budgeted and actual input quantity used. ____ 8. Actual revenue less flexible budget revenue. 9 ____ 9. The difference between the budgeted and actual price of materials multiplied by the actual quantity of materials purchased. ____ 10. Profit effect associated with the difference between the budgeted and actual price of an input. SHORT PROBLEMS 1. Suppose a local pastry factory purchased 800 pounds of materials (flour) during April at a total of $1,040. Recall that the factory actually used 675 pounds to make the 400 pastries during April and that it budgets to pay $1.10 per pound of materials. Required: What was the local pastry factory's purchase price variance for April? 2. Suppose a local pastry factory, for the most recent month, budgeted to purchase and use 525 pounds of flour at $1.05 per pound. Budgeted output was 3,000 strawberry pastries (i.e. the factory budgets to make 3 pastries per pound of flour). The factory actually purchased and used 650 pound of flour at $0.99 per pound; actual output for the month was 3,500 strawberry pastries. Required: What were the local pastry factory's flour price and quantity variances for the most recent month? 10 CHAPTER 8 REVIEW QUESTIONS ANSWER KEY TRUE/FALSE 1. L01 – True 2. L02 – False 3. L02 – False 4. L02 – True 5. L03 – True 6. L04 – False MULTIPLE CHOICE 1. L02 – C 2. L02 – D 3. L02 – A 4. L03 – B 5. L02 – C 6. L03 – D 7. L01 – D 8. L02: – C [$470,000 - (9,200 X $52)] = $8,400 Unfavorable 9. L02 – B [(9,200 x 32)- $282,000 = $12,400 Favorable 10. L02 – A ($50,000- $46,000 = $4,000 Favorable) MATCHING 1. 2. 3. 4. 5. F H J C E 6. 7. 8. 9. 10. G I A D B SHORT PROBLEMS 1. (Appendix A) Purchase price variance = (Budgeted input price – Actual input price) × Actual quantity purchased. Moreover, we know that the unit cost is $1.30 ($1,040/800) for the amount of materials purchased. Applying the formula, we have: ($160) = (1.10 – 1.30) × 800 pounds. Thus, the purchase price variance for March is $160 U. 11 SHORT PROBLEMS (CONT.) 2. (L02) To calculate the flour price and quantity variances, we need to know: (1) the flexible budget for flour; (2) the “as if” budget for flour with actual efficiencies; and (3) the actual results. The table below provides the required computations and accompanying variances. Flour Flexible Budget1 $643.13 Quantity Variance $39.37 U “As if” budget2 $682.50 Price Variance $39.00 F Actual Results3 $643.50 1 $643.13 = 3,500 pastries in actual output × .18 (= 525/3,000) pounds of flour budgeted per pastries × $1.05 budgeted cost per pound. 2 $682.50 = 650 pounds of flour actually used × $1.05 budgeted cost per pound. 3 $643.50 = 650 pounds of flour actually used × $0.99 actual cost per pound. Thus, the factory's flour price and quantity variances were $39.00 F and $39.37 U, respectively, for the most recent week. The flour quantity variance is unfavorable because the factory actually made 3,500/650 = 5.4 pastries per pound of flour rather than the budgeted 5.7 pastries per pound of flour. Note: To calculate the flexible budget amount, we need to start with actual output, which equals 3,500 strawberry pastries. Since the factory budgets to make 3 pastries per pound of flour, the flexible budget quantity for flour = 3,500/3 = 1,167 pounds of flour. 12