Chapter 3 – Statistical Concepts & Market Returns

FIN 6456 QUANTITATIVE METHODS IN FINANCIAL ANALYSIS

Chapter 3 – Statistical Concepts & Market Returns

The following class notes are meant only as a tool to see what we have covered in the class. In case, you have missed the class get the class notes from your friends and listen to the class lecture. Note that nothing can substitute your presence in the classroom while the lecture is being delivered. If however, you have missed the class this will help you in understanding as to what we did in the class.

The class lecture and the notes will be taken off the website every week. From now on, I will try to put the class notes (summarized version) of the class notes and the class lecture on

Wednesdays. Same day the previous class notes and lecture will be taken off the web.

1/7

BRIEF NOTES

Finance is the economics of uncertainty. Decisions are made about the future without the event taking place and models are built based on future decisions using past data.

Any events can be classified into two groups:

(1) Deterministic – We can know the outcome of the action taken today (Certain)

Eg: Deposit in CD Account, We know the ROI.

(2) Stochastic (Probabilistic) - Risky Future

Definition I:

For any ‘action’ taken today, the outcome can be fall in the following four categories:

Description of the Future:

(1) Certain – Know the outcome with probability 1

(2) Risky Future – For action taken today, Outcome can be guessed or predicted only upto a probability distribution

(3) Uncertain Future: Outcomes can be guessed or predicted but probability cannot be

assigned.

(4) Complete Ignorance: Taking decisions in total ignorance of what is going on.

Note: We can prove using mathematics but not using statistics. Therefore “Prove” should not be used in statistics. In Statistics, three people can give three interpretations of the same results.

Definition II:

Ex-Ante - Before the fact

Ex-Post - After the fact

All finance models are ex-ante (i.e.) developed before the fact and input to these models are expost is taken.

Definition III:

Population & Sample

Definition IV: Types of measurement or data.

(1) Nominal - It is also known as frequency or classification.

(2) Ordinal - It can be ranked and is in hierarchy.

(3) Interval - It has units attached to it eg. height, weight

(4) Ratio - They are pure numbers.

Definition V: Categorization of Data

(1) Cross Sectional – On many units at one point in time

2/7

(2) Inter temporal or time series – On one unit across time

Eg: Watching the price of stock everyday at 4 PM

(3) Panel Data – On many units across time

Note: (INTERTEMPORAL OR TIME SERIES USED FREQUENTLY IN FINANCE).

TOPIC SAMPLE POPULATION

Measures of Central Tendency:

(a) Mode

(b) Median

(c) Mean

(d) Variance

(e) Relative Variance or

Coefficient of variation

Geometric Mean: Geometric mean cannot be computed for a data series if one of the measurements is zero or negative.

Harmonic Mean is usually used in physics (Ignore it for now).

Rewriting Geometric Mean Formula:

G

n x

1

, x

2

......

x n

G

x

1

, x

2

,......

x n

n

1 ln G

ln

x

1

, x

2

,....

x n

n

1

1 n ln

x

1

, x

2

,....

x n

1 n

ln x

1

ln x

2

...

ln x n

1 n i n

1 ln x i

Note: When computing sample variance, you are not aware of the true population mean, therefore we compute the sample mean based on the sample data and mimic or proxy the population mean. By doing so, we have taken away one degree of freedom; hence the divider is n-1. By computing sample mean, we are putting one constraint on the sample variance.

Note: Variance and Standard Deviation are always positive. It cannot be a negative number.

3/7

Coefficient of Variation: Ranking Units based on single attributes.

Standard Deviation is a measure of risk.

Arithmetic Mean is a measure of return.

Relative variance or coefficient of variation:

For sample

Standard deviation / Arithmetic mean

For Population (same as above)

Skewness:

Skewness is the measure of left or right deviation of the probability distribution from the normal probability distribution. It can be positive or negative. Its denominator is always positive but the numerator can be positive or negative.

For sample

SK

n

1 n

n

2

i n

1

X i

X

3 s

3

As we know s

2 n

1

1 n i

1

X i

X

2

So s

3

n

1

1 i n

1

X i

X

2

3

2

For Population

1

N

I

N

1

X i

3

3

=

1

According to Karl Pearson, the pure statistical measure of skewness formula equals

4/7

1

1

N i n

1

X i

1

N i n

1

X i

3

2

2

3

Above formula is the pure statistical measure of skewness.

Note:

1. Varianc e & Standard deviations are always positive.(It can’t be a negative number)

2. Skewness can be +ve or –ve .Its denominator is always +ve but numeratoe can be

+ve or –ve .

Skewness: “The Measure of left or right deviation of the probability distribution from the normal probability distribution”

Measure of Deviation:

Positive skewness or skewed to the right

Negative skewness or skewed to the left

Kurtosis:

Kurtosis measures the height (peakedness in statistical terms)

Sample Kurtosis equals

Ku

n

1

n n

n

2

1

n

3

i n

1

X i s

4

X

4

n

n

n

2

3

1

1

2

Kurtosis can be leptokurtic and plutokurtic

For normal distribution skewness equals 0 and kurtosis equals 3.we cam summarise the properties of normal distribution as follows:

1. Mean = Median = Mode

2. Skewness = 0

3. Kurtosis = 3 or excess kurtosis = 0

4. probability distribution is symmetric

Co-variance:

For sample n

1

2 i n

1

x i

x

y i

y

or

1 n

2

i n

1 x i y i

n x y

5/7

For Population

1

N i

N

1

x i

x

y i

y

or

1

N

i

N

1 x i y i

N

x

y

Variance:

Variance is a measure of intra deviation of each unit fron its mean. It is a measure of risk not “the risk ”.

Variance =

1

N i n

1

x i

2

=

xy

1

N

1

N n i

1

x i

x i

i n

1

x i

x

y i

y

Some points about Variance:

1. Variance is used as a measure of risk.

2. Variance is always positive

3. By definition, the risk of the riskless asset is zero. But it doesn’t mean that it will not have the variance.

4. Variance is taken as a measure of risk only when we are going to proxy the future outcomes using the past data.

5. If variance is taken as a measure of risk, its numerical value in isolation by itself doesn’t mean anything.

6. Variance or riskness is a relative concept except in one case when the asset by definition is riskless, then it is zero.

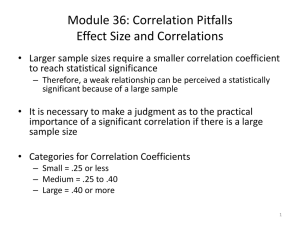

Co-efficient of Correlation:

The Co-efficient of Correlation measures the strength of linear relationship between two variables.

x .

y

Cov

x

.

y

When computing Co-efficient of Correlation make sure that there is a reason to correlate them.

Important points about Co-efficient of Correlation

- If the Coefficient of Correlation is zero, it doesn’t mean that they are not related but it only mean that they are not linearly related.

- If the variables are independent by definition, the Co-efficient of Correlation will be zero as shown in the above example GNP of USA and Birthrate of India.

6/7

- The Co-efficient of Correlation has a range from -1 to +1, meaning that it is perfectly negatively correlated(-1) or perfectly positively correlated(+1).Therefore the magnitude of co-efficient of correlation has a meaning.

Some points about co-variance

1. The magnitude of Covariance doesn’t mean anything. Whereas the sign of Co-variance has a meaning. If it’s negative, means negatively correlated and if it’s positive, means positively correlated.

2.

If the Co-variance is zero, then there is no linear relationship between two variables.

7/7