Quiz 3

advertisement

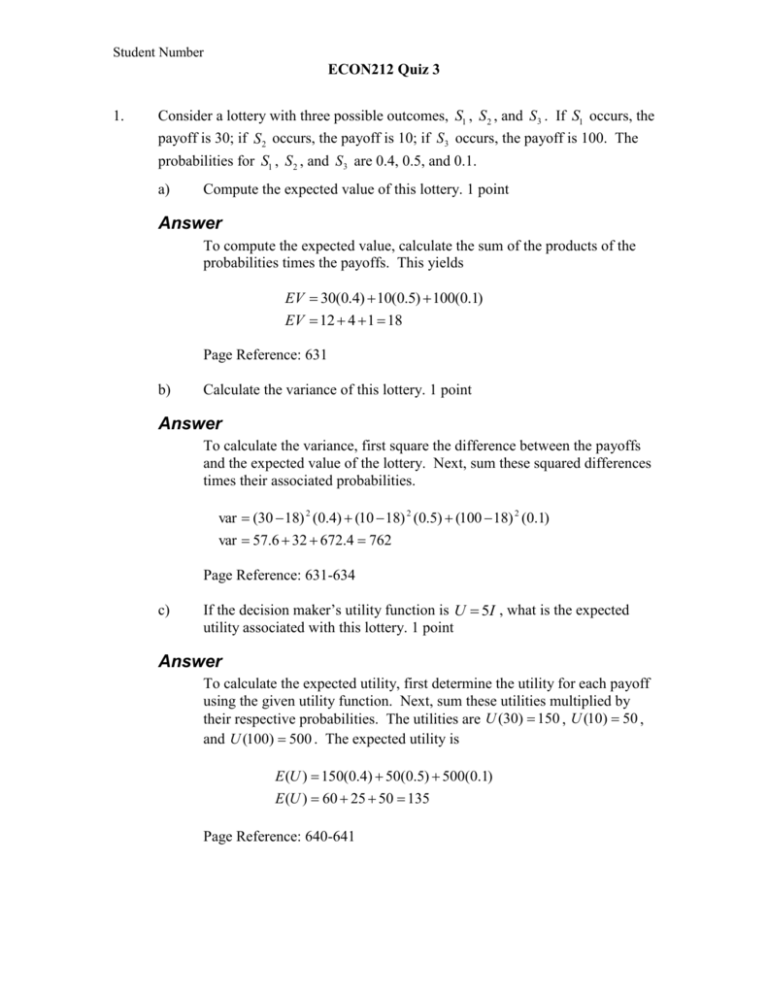

Student Number ECON212 Quiz 3 1. Consider a lottery with three possible outcomes, S1 , S 2 , and S 3 . If S1 occurs, the payoff is 30; if S 2 occurs, the payoff is 10; if S 3 occurs, the payoff is 100. The probabilities for S1 , S 2 , and S 3 are 0.4, 0.5, and 0.1. a) Compute the expected value of this lottery. 1 point Answer To compute the expected value, calculate the sum of the products of the probabilities times the payoffs. This yields EV 30(0.4) 10(0.5) 100(0.1) EV 12 4 1 18 Page Reference: 631 b) Calculate the variance of this lottery. 1 point Answer To calculate the variance, first square the difference between the payoffs and the expected value of the lottery. Next, sum these squared differences times their associated probabilities. var (30 18) 2 (0.4) (10 18) 2 (0.5) (100 18) 2 (0.1) var 57.6 32 672.4 762 Page Reference: 631-634 c) If the decision maker’s utility function is U 5I , what is the expected utility associated with this lottery. 1 point Answer To calculate the expected utility, first determine the utility for each payoff using the given utility function. Next, sum these utilities multiplied by their respective probabilities. The utilities are U (30) 150 , U (10) 50 , and U (100) 500 . The expected utility is E (U ) 150(0.4) 50(0.5) 500(0.1) E (U ) 60 25 50 135 Page Reference: 640-641 Student Number ECON212 Quiz 3 d) If the decision maker had a choice between this lottery and a guaranteed payoff of 27, which should she choose given her utility function from part c)? 1 point Answer The guaranteed payoff of 27 has an expected utility of 5(27) 135 . Thus, the guaranteed payoff has exactly the same expected utility as the lottery. Since the person is risk-neutral, she is indifferent between the guaranteed payoff and the lottery. Page Reference: 640-641 2. Consider two lotteries, A and B . With lottery A , there is a 20-percent chance that you will receive $80, a 50-percent chance that you will receive $40, and a 30percent chance that you will receive $10. With lottery B , there is a 40-percent chance that you will receive $30, a 30-percent chance that you will receive $40, and a 30-percent chance that you will receive $50. a) Verify that these two lotteries have the same expected value but that lottery A has a higher variance than lottery B . 1.5 point Answer EV A 80(0.2) 40(0.5) 10(0.3) EV A 16 20 3 39 EV B 30(0.4) 40(0.3) 50(0.3) EV B 12 12 15 39 Yes, both lotteries have an expected value of 39. var A (80 39) 2 (0.2) (40 39) 2 (0.5) (10 39) 2 (0.3) var A 336.2 0.5 252.3 589 var B (30 39) 2 (0.4) (40 39) 2 (0.3) (50 39) 2 (0.3) var B 32.4 0.3 36.3 69 Lottery A has a higher variance than lottery B . Page Reference: 631-634 b) Suppose that your utility function is U I . Compute the expected utility for each lottery. Which lottery has the higher expected utility? Why? 1.5 point Student Number ECON212 Quiz 3 Answer E (U ) A 80 (0.2) 40 (0.5) 10 (0.3) E (U ) A 1.79 3.16 0.95 5.9 E (U ) B 30 (0.4) 40 (0.3) 50 (0.3) E (U ) B 2.19 1.90 2.12 6.21 Lottery B has the higher expected utility. In general, when two lotteries have the same expected value but different variances, a risk-averse decision maker will have a higher expected utility for the lottery with the lower variance, lottery B in this case. Page Reference: 637-638 3. Consider the production function Q 2K 3 L 3 1 a) 1 What is the equation of the isoquant corresponding to Q 10 ? 1.5 point Answer To find the equation of the isoquant, solve the production function for K in terms of L . Q 2K 3 L 3 1 1 10 2 K 3 L 3 1000 8 KL 125 KL 125 K L 1 1 Page Reference: 229-230 b) What is the equation of the isoquant corresponding to an arbitrary level of output, Q ? 1.5 point Answer Perform the same exercise as in part a) leaving Q as a variable. Student Number ECON212 Quiz 3 Q 2K 3 L 3 1 Q 3 8 KL Q3 K 8L Page Reference: 229-230 1