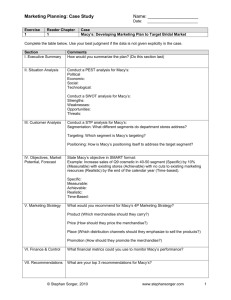

ppt - Stephan Sorger

advertisement

Chapter 3: Company and Competitors Disclaimers: All logos, photos, etc. used in this presentation are the property of their respective copyright owners and are used here for educational purposes only. Some material adapted from: Lehmann & Winer, “Analysis for Marketing Planning”, 7th ed Some material adapted from: Kotler & Keller, “Marketing Management”, 13th ed See book: Sorger, “Marketing Planning” for full bibliography • • • • Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Company Analysis: Identity/ Focus/ Culture Term Description Identity What makes the business different from others Focus Emphasis on a particular market segment or product Culture Shared experiences, beliefs, and norms that characterize an organization (Kotler, MM) The movie “Office Space” portrayed a company with a distinct culture Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.3 Company Analysis: Go To Market Approach Term Description Go-to-Market Delivery mechanism for firm’s value proposition Value Proposition Benefit firm delivers through its offering Delivery Mechanism Distribution channels used to deliver offering Example: UPS Store vs. drop box vs. truck Methods to guide customers through sales process Initial contact Fulfillment UPS goes to market through several delivery mechanisms Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.4 Company Analysis: Company Strengths Category Description People Leadership, Skill, Knowledge, Background, Character Steve Jobs vs. John Sculley Products/ Services Competitive advantage through technology: Subaru Distinguishing features: Apple Value-added services: Nordstrom, Lexus Company Reputation: L.L. Bean Customer Service: Amazon.com Customers Loyal, happy, committed customer base: Buick Examples of great people, great products, and great service Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.5 Company Analysis: Company Weaknesses Category Description People Inexperience, Poor judgment, Unethical: Madoff Products/ Services Poor design: Microsoft Vista Company Reputation: AIG Customers Unhappy customers: Moving companies, … Examples of people, products, and service that definitely are not strengths Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.6 SWOT Analysis Helpful to Organization Strengths Internal to organization Harmful to Organization Weaknesses - Dominant player - Huge installed base - Vista - Perception of bloatware Opportunities Threats External - Trend: Portability to organization - Trend: Social Networking - Trend: Cloud Computing - Competitor: Ubuntu (Linux)* * Asymmetrical threat: Microsoft more of a threat to Ubuntu than vice versa Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.7 Competitor Analysis: Approach Competitor Information Goals: • Identity/ Focus/ Culture • Go to market approach • SWOT • Market share • Perceptual data • Anticipated strategies Competitive Research Secondary Primary Competitive Analysis Competitive Results • Identify Competitors • Calculate Market share • Build SWOT • Build profiles • Summary table • SWOT for each competitor • Perceptual map • Anticipated strategies and counterstrategies Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.8 Secondary Research: Sources Source Description Analyst reports Industry analyst reports on state of market Example: Gartner: Magic Quadrant report: $1,995 Magazines, e-zines; gives insider look at market Example: InfoWorld, CNET.com, CIO, InfoWeek General business magazines, e-zines Example: Fortune, Business Week Gives opinionated view of activities in market Example: http://blogs.gartner.com Competitive collateral can give positioning hints Example: Download brochure from website Competitors post releases on new events Example: See source of quote for targeted role Public companies must issue financial information Example: CEO outlook often suggests next steps Government puts out wealth of info, especially B2B Example: NAICS info, Census info Product details, Customer details, Executive team Trade press Business press Blogs Collateral Press Releases Annual Reports/10Ks Government Competitor website Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.9 Primary Research: Sources Source Description Customers Ask customers formerly using competitor product Caveat: Some might be limited by NDA agreements Ask sales force about rumors on competition Will be familiar with competitors’ sales pitches Non-sales employees can also give market insight Interview many to get multiple viewpoints Technicians in field often see evidence of competitors Example: Customer installed competitor’s system Investors/boards have financial knowledge Tip: Look at competitor website to see investors Major suppliers familiar with all competitors Caveat: Might be reluctant to share knowledge Can provide specialized commissioned reports Meet specific needs, but very expensive Sales Force Employees Field Service Investment bankers Suppliers Consulting firms Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.10 Competition Identification: Four Levels of Competition Level Description Direct Competitors Near-identical products/ services Often companies are arch rivals Example: Hertz vs. Avis rental cars Category: Rental cars Indirect Competitors Similar, but not identical products/ services Example: Hertz vs. Taxi Category: Hired transportation Need-based Competitors Products/ services that satisfy basic need Example: Hertz vs. Public Transit Category: Traveler’s transportation Budget Competitors Products/ services with same budget Example: Hertz vs. Seeing Broadway show (Stay at airport hotel and save money) Category: Traveler expenses under $200 Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.11 Four Levels of Competition: Competition Identification Level Description Direct Competitors Near-identical products/ services 1 Category: Consumer-based PC CPUs 2 Possibilities: Intel, AMD, Motorola 3 Threat: AMD Indirect Competitors Similar, but not identical products/ services Category: Computer components Possibilities: High-speed RAM, SSD, GPU Threat: nVidia, ATI graphics cards Need-based Competitors Products/ services that satisfy basic need Category: Consumer-based computers Possibilities: BlackBerry, iPhone, Cloud Threat: Next-generation super smart phone Budget Competitors Products/ services with same budget Category: Consumer electronics < $250 Possibilities: Game console, secure networks Threat: Secure networking Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.12 Competitive Analysis: Market Share Estimation Term Description Market Share Proportion of market served by company Calculation Share(A) = Secondary Research Purchase existing industry reports that predict shares Primary Research Commission specialty firm to determine share Revenue(A) . Revenue of Entire Market Here, “PC Guy” explains to “Mac Guy” how big the PC market share is Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.13 Market Share Research Term Description B2C (Consumer) Market research for business to consumer goods Examples: Shampoo, Appliances, Bread Firms: Nielsen, Dun & Bradstreet, Arbitron, others B2B (Business) Market research for business to business goods Examples: Welding machines, Enterprise software Firms: Gartner, Forrester, IDC, AMR, others Much information available for free B2C Analyst Firms B2B Analyst Firms Example of free research Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.14 Competitive Analysis: Predicting Future Strategies Value Chain Model for Sources of Competitive Advantage Firm’s Infrastructure Human Resource Management Technological Development Procurement Inbound Outbound Marketing Operations Logistics Logistics & Sales (Delivery) Margin Service Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.15 Competitive Analysis: Predicting Future Strategies Executive Team Profiles Example: Yahoo Autodesk - Grew revenues Sun, Digital, 3M On board of Cisco On board of Intel Skadden, el al, LLP M & A specialist Symantec Adobe McKinsey M & A specialist NetApp Sun On board of Cisco Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.16 General Competitor Attack & Counter-Attack Strategies Encirclement Attack (Overwhelm enemy) Bank of America vs. other banks: 17,000 ATMs Counterattack: Differentiation: Credit Unions Frontal Attack (Attack strength) Attacker Microsoft vs. Google (Bing) Counterattacks: Invade attacker territory: FedEx ground delivery Diversification: BP: “Oil” “Energy” Contraction: Sara Lee: Spin off Hanes Defender Flank Attack (Exploit weakness) Sunlight vs. Cascade: Spots on dishes Counterattack: Fix weakness, Court action Guerilla Attack (Random attacks) Blog posts against major firms Counterattack: Vigilant monitoring Bypass Attack (Expand into new areas) New products: Pepsi launched Aquafina before Coke could launch Dasani New geographies: Starbucks expanded into China before competitors New technologies: Nintendo leapfrogged Sony with Wii (1) Adapted from Kotler & Keller, “Marketing Management”, 13th ed, Pearson, 2009. Page 306 Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.17 Competitive Analysis Results: Comparison Table Criteria Ben & Jerry’s Objectives Market share=38% Market share=42% Get foothold Overtake H-D Increase lead Get foothold Strategies Promotions Indulgence Low price Go upscale Differential Adv. Social respons. Global brand Extend coffee Luxury symbol Expected future 2000: purchased by Unilever Strong finances; Spend on ads New flavors; Use Nestle conn. to build distrib. Expand flavors outside of coffee Emphasize luxury Haagen-Dazs Starbucks Godiva Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.18 Competitive Analysis Results: Perceptual Map - Perceptual Maps: Show how brands compare - Axes labels and placement through focus groups - Example: Computer operating systems - Evaluation criteria: Interoperability, + Ease of Use: Reliability, Intuitive Scalability, Security Ease of Use, Affordability - Interoperability: Technical Expertise + Interoperability: Plug n’ Play - Ease of Use: Frustrating Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.19 Market Research: Approach Define Problem & Research Objectives Develop Research Plan Gather Data Analyze Data Present Findings Make Decision Example: Should American Airlines introduce Internet service? Too general; Change to: 1. Should American offer an Internet connection? 2. If so, should it be on First Class only? 3. What price should it charge? 4. On what planes and routes should it offer the service? Important: Select Evaluation Criteria for Decision! Maximize Revenue? Profit? ROI? Customer Satisfaction? (1) Kotler & Keller, “Marketing Management”, 13th ed, Pearson, 2009. Pages 91 - 103 Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.20 Market Research: Development of Research Plan Contact Method Data Sources - Mail questionnaire - Telephone interview - Personal interview - Online interview Sampling Plan - Sampling unit - Sample size - Sampling procedure - Secondary - Primary Research Plan Research Instruments - Questionnaires - Qualitative Measures - Technological Devices Research Approaches - Observational Research - Ethnographic Research - Focus Group Research - Survey Research - Behavioral Data - Experimental Research (1) Kotler & Keller, “Marketing Management”, 13th ed, Pearson, 2009. Pages 91 - 103 Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.21 Market Research: Research Approaches Approach Description Observational Watch what people do with product Example: Observe customer using Quicken program Ethnographic Similar to anthropological research Immerse into consumers’ lives to understand them Bank of America found that most women round up Result was “Keep the Change” program Focus Group Gathering of 6 – 10 people with moderator Non-random group; typically heavy users of product Goal: Understand motives behind behaviors Problems: Seen as artificial; dependent on moderator Behavioral Analyze records of behavior Supermarket scanning data, Online purchases Experimental Scientifically valid research Set up matched groups: Target group vs. Control group Are differences in observed responses statistically significant? Survey See next slide Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.22 Market Research: Surveys & Research Instruments Approach Description Surveys Goal: Measure opinions of large group using instrument Instruments Qualitative measures: Unstructured, open-ended questions Usually conducted one-on-one with respondent Questionnaires: Closed-end and Open-end questions Usually closed-end questions for online surveys Technological devices: Electronic means to gather data Example: Galvanometer to measure response to ad Approach Typical: Do qualitative study first to small group of respondents Follow up with questionnaire to large group Online Popular: www.surveymonkey.com; Effective and free Design survey, Collect responses, Analyze results Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.23 Questionnaire Questions: Closed-End Name Description Example Dichotomous 2 possible answers Are you male or female? Male___ Female_X_ Multiple choice 3+ possible answers How many classes are you taking? 1_X_ 2___ 3 or more___ Semantic Differential Scale with bipolar words How much homework is assigned? Too little------------------X----Too much Likert Scale Agreement/Disagreement Small class sizes permit more focus Strongly Disagree__ Disagree__ Not Sure__ Agree__ Strongly Agree__ Importance Scale Rates importance In-class videos to me are: Extremely important__ Very important__ Somewhat important __Not very important __ Not important__ Rating Scale Rates Poor to Excellent The teaching quality of this course is: Poor__ Fair__ Good__ Very Good__ Exc.__ Intention to Buy Rates Intent to Buy If the same instructor offered another course: Not buy__ Probably not buy__ Not sure__ Probably buy__ Definitely buy__ Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.24 Questionnaire Questions: Open-End Name Description Example Unstructured Discussion question What is your opinion of this course? Answer_______________________________ Word Association Mention first word you think of What comes to mind when you think of: (Strength of association) This class_____________________________ The textbook___________________________ The teacher____________________________ Sentence completion Complete the sentence When I pick a class, I look for: ______________________________________ Story completion Complete the story “I went to last week’s class, and noticed that we didn’t have a video. I felt the following way:” ______________________________________ Balloon picture Fill in the empty balloon Fill in the balloon for the picture on the left TAT Thematic Apperception Test Write a story about the picture on the right Balloon Test Picture: TAT Story Picture: Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.25 Market Research: Sampling Plan Approach Description Sampling Unit Who should we survey? Generally best to survey target market Sample Size How many people should we survey? Large sample sizes More statistically significant Generally, best to sample at least 1% of population (min. 20) Procedure How should we choose the respondents? Probability sample: More accurate Allows confidence limits to be calculated for sampling error Makes sample more representative Non-probability sample: Cheaper and faster Market research sampling procedures are often complicated Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.26 Market Research: Probability and Non-Probability Samples Probability Samples Term Description Simple Random Sample Every member has an equal chance Example: Picking phone numbers at random Stratified Random Sample Divide population into groups (such as age) then pick samples from the groups Cluster (Area) Sample Divide population into areas (like city blocks) then pick samples from the areas Simple Random Sample Stratified Random Sample Cluster (Area) Sample Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.27 Market Research: Probability and Non-Probability Samples Non-Probability Samples Term Description Convenience Sample Select most accessible population member Example: Next 10 people walking into office Judgment Sample Select those likely to give accurate information Example: Members of online product forum Quota Sample Select certain number of people per category Example: 5 people in each age group Convenience Sample Judgment Sample Quota Sample: Pick 1 of each group Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.28 Market Research: Analyzing Information Procedure Description Processing Cleansing: Delete/ correct known bad data Coding: Assigning numbers to open-end questions Example: “Why selected?”: Price=1; Quality=2 Tabulation Frequency table: # of respondents for each answer Cross-tabulations: Frequency counts with 2+ variables Statistics Mean, Mode, Standard Deviation, Variance, Range Tests: Chi-square; K-S test (Goodness of Fit) Tests: Z-Test (Rating significantly higher than mean) Tests: t-Test (Like Z-test, but for small sample sizes) One-way tabulation Cross-tabulation What OS do you prefer? What OS do you prefer? Operating System Total Operating System Total 18-25 26-35 35-50 Windows 7 Windows Vista Windows XP Apple OSX Linux 38% 8% 22% 16% 16% Windows 7 Windows Vista Windows XP Apple OSX Linux 38% 8% 22% 16% 16% 14% 1% 2% 7% 5% 13% 3% 5% 5% 5% 11% 4% 15% 4% 6% Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.29 Market Research: Presenting the Findings Topic Description Objectives State background and objectives of research Methodology How research was conducted Qualitative: What questions? How asked? How many people? Quantitative: How was survey conducted? How many people? Findings Graphs helpful for displaying research results Bar Chart: Good for showing respondent preference Pie Chart: Good for showing parts of a whole Histogram: Good for showing frequency of results Bar Chart “Most users prefer Windows 7” Pie Chart “40% of students use Gmail” Histogram (Frequency Chart) “Most users are 25-35” Windows 7 XP Linux Apple OSX Vista Age Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.30 Market Research: Making the Decision Topic Description Statistics Tests will indicate degree of confidence in data Solutions Generate multiple solutions to solve problem at hand Criteria Review evaluation criteria set forth in beginning of research Select solution that maximizes decision criteria Triangulate Use multiple data points to confirm decision Similar to how sailors locate their position from multiple points Avoid relying on just one data point Use triangulation to confirm decision using multiple data points Marketing Planning © Stephan Sorger 2010: www.stephansorger.com; Ch. 3 Situation Anyl. II: 3.31