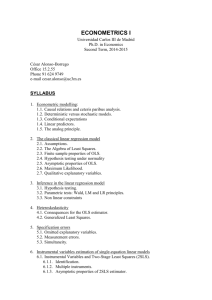

PowerPoint slides

advertisement

Postwar Metrics

Session 15

1970s

Problems with the Phillips curve:

• Trade-off between inflation and

unemployment / real output

• Used as a (Keynesian) policy instrument

• Appeared not to be that stable as originally

was supposed (not by Phillips!)

• Stagflation: increase of both inflation and

unemployment

Rational expectations

Expectations and the Neutrality of

Money (1972):

• No usable trade-off, notwithstanding

econometric evidence

• Rational agents + inadequate price

signals + equilibrium system

Econometric policy evaluation: A

critique (1976)

• No invariance under policy

interventions

Robert Lucas

Lucas Critique (1976)

y F ( x1 , , x n ; 1 , , m )

invariant for policy variations

Tastes and Technology

Debate in and about econometrics

CC econometrics has failed

• Hendry, David F. (1980). Econometrics –

Alchemy or Science? Economica.

• Sims, Christopher A. (1980). Macroeconomics

and Reality. Econometrica.

• Leamer, Edward E. (1983). Let’s take the con

out of econometrics. American Economic

Review.

1985

• August 19

A Symposium on Econometric

Methodology at the World Congress of the

Econometric Society. David Hendry, Edward

Leamer and Christopher Sims.

• December 29 Joint Session with the HES at

the Annual Meeting of the AEA: ‘First Forays

Into the History of Econometrics’. Roy Epstein,

Mary Morgan and Chris Gilbert. Edward

Leamer was discussant.

• Foundation of Econometric Theory by Peter

C.B. Philips

Editorial policy of ET

5. To publish historical studies on the evolution

of econometric thought and on the subject's

early scholars.

6. To publish high-level professional interviews

with leading econometricians.

David Hendry

LSE inaugural lecture

Econometrics: Alchemy or Science?

LSE approach: General to Specific

Keynes according to Hendry

Problems of the linear regression model:

• using an incomplete set of determining factors (omitted variables bias)

• building models with unobservable variables (such as expectations)

• estimated from badly measured data based on index numbers

• obtaining spurious correlations from the use of proxy variables and

simultaneity

• being unable to separate the distinct effects of multicollinear variables

• assuming linear functional forms not knowing the appropriate dimensions

of the regressors

• mis-specifying the dynamic reactions and lag lengths

• incorrectly pre-filtering the data

• invalidly inferring causes from correlations

• predicting inaccurately (non-constant parameters)

• confusing statistical with economic significance of results

• failing to relate economic theory to econometrics.

Additional problems:

•

•

•

•

•

•

stochastic mis-specification

incorrect exogeneity assumptions

inadequate sample sizes

aggregation

lack of structural identification

inability to refer back uniquely from observed

empirical results to any given initial theory

Keynes’s critique still relevant:

“It is difficult to provide a convincing case for

the defence against Keynes’s accusation almost

40 years ago that econometrics is statistical

alchemy since many of his criticisms remain

apposite.”

Don Patinkin (1974 Presidential Address to the

Econometric Society): “I find it somewhat

depressing to see how many of them are, in

practice, still of relevance today.”

Hendry’s methodology

“The three golden rules for econometrics are

test, test and test; that all three rules are broken

regularly in empirical applications is fortunately

easily remedied. Rigorous tested models, which

adequately described the available data,

encompassed previous findings and were

derived from well based theories would greatly

enhance any claim to be scientific.”

Christopher Sims

VAR approach

(vector auto regressive)

Response against Koopmans critique of

Measurement without Theory: CC

methodology implies too much a priori

theory

“I think the most reliable way to do

empirical research in macroeconomics is to

use assumptions drawn from ‘theory,’

which actually means intuition in most

cases, as lightly as possible and still develop

conclusions.”

Edward Leamer

• Economic tricks, econo-mystics,

icon-ometrics

• Bayesian approach

• Statistical approach too much based

on statistics developed in

agricultural experimentation (RCT,

R.A. Fisher)

Non-econometric response

• Kydland and Prescott carrying out the Lucas

program to localize invariance not in the

relations but in the parameters.

• Stable facts = stylized facts = NBER facts

• Calibration

NBER Working plans

Observable characteristics

“The way we have chosen is to observe the

business cycles of history as closely and

systematically as we can before making a fresh

attempt to explain them.”

Woodward: Data - Phenomena

• Phenomena are relatively stable and general features of

the world and therefore suited as objects of explanation

and prediction.

• Data, that is, the observations playing the role of

evidence for claims about phenomena, on the other

hand involve observational mistakes, are idiosyncratic

and reflect the operation of many different causal

factors.

• Theories are not about observations but about

phenomena.

Stylized Facts

“Since facts, as recorded by statisticians, are

always subject to numerous snags and

qualifications, and for that reason are incapable

of being summarized, the theorists, in my view,

should be free to start off with a ‘stylized’ view

of the facts – i.e. concentrate on broad

tendencies, ignoring individual detail”

- Nicholas Kaldor (1961), 'Capital Accumulation

and Economic Growth.’

Kaldor’s Facts

1.

2.

3.

4.

5.

6.

The continued growth in the aggregate volume of production and

in the productivity of labour at a steady trend rate;

A continued increase in the amount of capital per worker;

A steady rate of profit on capital;

Steady capital-output ratios over long time periods

A high correlation between the share of profits in income and the

share of investment in output; a steady share of profits (and of

wages) in societies and/or in periods in which investment

coefficient (the share of investment in output) is constant.

There are appreciable differences in the rate of growth of labour

productivity and of total output in different societies, the range of

variation (in the fast-growing economies) being of the order of 2-5

per cent.

Stylized Kaldor’s facts

Solow: “There is no doubt that they are stylized, though it

is possible to question whether they are facts.”

1. Output per worker grows at a roughly constant rate

that does not diminish over time.

2. Capital per worker grows over time.

3. The capital/output ratio is roughly constant.

4. The rate of return to capital is constant.

5. The share of capital and labor in net income are

nearly constant.

6. Real wage grows over time.

Lucas’s Program

“A ‘theory’ is not a collection of assertions

about the behavior of the actual economy but

rather an explicit set of instructions for building

a parallel or analogue system – a mechanical,

imitation economy. A ‘good’ model, from this

point of view, will not be exactly more ‘real’

than a poor one, but will provide better

imitations. Of course, what one means by a

‘better imitation’ will depend on the particular

questions to which one wishes answers.”

Computational Experiment

•

•

•

•

•

pose a question

use a well-tested theory

construct a model economy

calibrate the model economy

run the experiment

Question

how much-questions instead of why-questions

Measurement

In our business cycle studies, we do not try to fit or

explain anything. Rather, we derive the business

cycle implications of growth theory. […] We

emphasize that we deduce the quantitative

implications of theory for business cycle fluctuations.

Well-tested Theory

Theory:

set of instructions for building a mechanical

imitation system to answer a question

Well-tested:

to provide reliable answers to a class of

questions

Calibration

data are used to calibrate the model economy

so that it mimics the world as closely as

possible along a limited but clearly specified,

number of dimensions

Stylized Facts of Economic Growth

Stylized Facts

1. Real output grows at a more or less constant rate.

2. The stock of real capital grows at a more or less

constant rate greater than the rate of growth of the

labor input.

3. The growth rates of real output and the stock of

capital tend to be about the same.

4. The rate of profit on capital has a horizontal trend.

Real Business Cycles

Instructions:

y t a t F ( k t , ht )

max E { (1 ) u ( c t ,1 h t )}

t

c , x ,h

t

to

ct + x t y t

(1+)kt+1 = (1-)kt + xt

Calibration I: Shaping

Stylized Facts of Economic Growth

F ( k t , h t ) (1 )

u ( c t ,1 h t )

(c

1

t

t (1 )

kt h

(1 h t ) )

1

1

t

1

1

Question

What is the quantitative nature of fluctuations

induced by technology shocks?

Technology:

at e

zt

zt+1 = zt + t

t ~ N (0, )

Calibration II: Parameter values

Technology

Tastes

0.40

0.012

0.95

0.007

0.0156

0.987

1

0.64

0.012