5) fire and marine insurance laws

advertisement

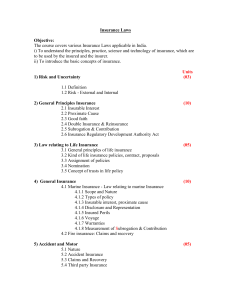

FIRE AND MARINE INSURANCE LAWS IN INDIA LECTURE TO TRAINEES OF TATA MOTORS ON 3 FEBRUARY, 2012 MAJ. GEN. NILENDRA KUMAR DIRECTOR AMITY LAW SCHOOL NOIDA BASIC LAW CONCEPT Pooling of resources capable of being distributed in times of calamities such as fire, floods, epidemics and famine etc. INSURANCE It is the act of providing against a possible loss, by entering into a contract with one who is willing to give assurance, that is, to bind himself to make good such loss, should it occur. POLICY means the instrument by which the contract is made PREMIUM means the stipulated consideration The interest of the insured must exist a) Life at the time of effecting the insurance b) Marine Insurance at the time of loss c) Fire throughout the period insured Insurance is a method of sharing financial losses of few from a common fund who are equally exposed to the same loss. Insurance is a federal subject in India Indian Marine Insurance Act, 1963 Indian Insurance Act, 1938 The General Insurance Business (Nationalisation) Act, 1972 100 general insurance companies merged into four companies. The General Insurance Corporation of India (GIC) 1. 2. 3. 4. Oriental Insurance Co. Ltd. New India Assurance Co. Ltd. National Insurance Co. Ltd. United India Insurance Co. Ltd. Insurance Regulatory and Development Authority Act, 1999 REGULATORY BODIES IRDA - Insurance Regulatory and Development Authority TAC - Tariff Advisory Committee Absence of any statutory enactment governing fire insurance Legal terms commonly used ASSURANCE Assurance in contract means “making secure”, insure. It means the act of assuring, a declaration tending to inspire full confidence. ASSURANCE AND INSURANCE There is a tendency to use “Assurance” for contracts of “life insurance” and “insurance” for risks upon property. An assurance represents the principle and insurance the practice. INSURABLE PROPERTY means any ships, goods or other movable which are exposed to maritime perils. IMPORTANT ELEMENTS IN INSURANCE 1. Subject matter of insurance 2. The peril or risk 3. The likely financial loss RISK is the unforeseen element which may impede one’s progress in achieving the objective. PARTIES 1. Insured. Party effecting insurance (individual, company, firm or corporate body etc.). 2. Insurer. Party granting the protection under an insurance policy. 3. Policy. It is the evidence of contract. INDEMNITY is the compensation for loss or injury sustained or to make good the loss or damage. UTMOST GOOD FAITH Since insurance shifts risk from one party to another, it is essential that there must be utmost good faith and mutual confidence between the insured and the insurer. WARRANTY means an assurance by the assured that he will not do some particular thing or will fulfil any condition that are decided in advance. ASSIGNMENT means transfer of rights and liabilities of an insured to another person who had acquired insurable interest in the property insured. INSURABLE INTEREST A person who is so interested in a a property as to have benefit from its existence and prejudice by its destruction is said to have insurable interest in the property. Such a person can insure the property against fire. Usual Types of General Insurance 1. Marine 2. Fire 3. Miscellaneous MARINE INSURANCE It is an agreement whereby the insurer undertakes to indemnify the assured, in the manner and to the extent thereby agreed, against marine losses, that is to say, the losses incidental to marine adventure. A large proportion of marine insurances is made at the risk of individuals called underwriters. MARINE INSURANCE 1. Hull Insurance. The loss associated with the floating crafter. 2. Cargo Insurance. Loss or damage to goods during transit by rail, road, sea or other. Marine insurance covers the loss or damage of ships, cargo, terminals and any transport or property by which cargo is transferred acquired or held between the points or origin and final destination. Ship includes every description of vessel used in navigation. Maritime Perils means the perils consequent on, or incidental to, the navigation of the seas that is to say, perils of the sea, fire, war perils, pirates, rovers, thieves, captures, seizures, restraints and detainments of princes and people. MARINE INSURANCE Almost all policies are agreed value policies. The insured and the insurer agree that the sum insured is the value of the property insured so that the agreed amount is payable in case of total loss. Mixed Sea and Land Risks Section 4 A contract of marine insurance may, by its express terms, or by usage of trade, be extended so as to protect the assured against losses on inland waters or on any land risk which may be incidental to any sea voyage. FIRE INSURANCE BUSINESS A contract of insurance by which the insurer agrees for consideration to indemnify the assured upto a certain extent and subject to certain terms and conditions against loss or damage by fire, which may happen to the property of the assured during a specific period. FIRE INSURANCE CONTRACT Principle Object. Insurance against the loss or damage occasioned by fire. Insurer’s Liability. Limited by the sum assured and not necessarily by the extent of loss/damage sustained by the insured. Insures. Has no interest in the safety or destruction of the insured property apart from the liability undertaken under the contract. RISKS COVERED UNDER FIRE INSURANCE 1. 2. 3. 4. Fire Lighting Aircraft damage Riots, strikes, malicious and terrorism damage 5. Storm, cyclone, typhoon, tempest, hurricane, tornado, flood and inundation 6. Impact damage 7. Subsidence and landslide including rockslide 8. Bursting and/or overflowing of water tanks apparatus and pipes 9. Missile testing operations 10. Bus fire RISKS NOT COVERED BY FIRE INSURANCE POLICY 1. Theft during or after the occurance of any insured risk 2. War or nuclear peril 3. Electrical break downs 4. Ordered burning by a public authority Sub terranean fire APPROACH Fire policies have to be assigned with the consent of the insures. Marine cargo policies can be freely assigned without the consent of the insurer, the logic being that the ultimate buyer is usually not known at the time of taking the cover. MOTOR VEHICLE If the vehicle is a total loss, the sum insured or the value of the vehicle, whichever is less is paid. If the vehicle is damaged, the cost of repair is paid. If the parts are replaced, the cost of new parts will be subjected to the depreciation. In all cases, the age and general maintenance of the vehicle is considered. SUMMARY The losses against which a merchant or ship owner is not protected by insurance. a) b) c) d) e) f) Acts of own government Breaches of the revenue laws Breaches of the law of nations Consequences of deviation All losses arising from unseaworthiness All loss arising from unusual protraction of the voyage g) All loss to which the ship owner is liable when his vessel does damage to others ANY QUESTIONS