Individual Market Training

advertisement

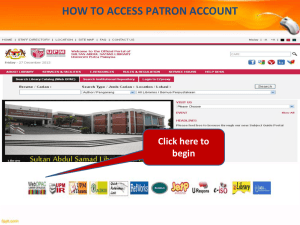

UPMC Advantage Individual & Family Plans for 2015 Today’s Agenda • • • • • • • • 2 Overview 2015 Plans New Business Applications Renewals Completing Renewals in IKA I&F UPMC Individual Advantage Rate Change Public Shopping Tool Overview Producer Commissions Overview Pennsylvania Marketplace Enrollment: 318,077 4 2015 Rating Limitations – Inside and Outside Health Insurance Marketplace 5 Essential Health Benefits 6 Actuarial Value – Inside and Outside Health Insurance Marketplace Silver Gold 60% 70% 80% 90% Lowest Moderate Moderate Highest Offer Essential Benefits Yes Yes Yes Yes Must Offer in Health Insurance Marketplace No At least 1 plan At least 1 plan No Bronze Actuarial Value Monthly Premiums 7 Platinum Explanation of Out-of-Pocket Maximum The ACA requires all non-grandfathered plans effective January 1, 2014, and after to have a single out-of-pocket maximum for all plan coverage. – Includes medical, pharmacy, mental health, pediatric dental EHB, and pediatric vision EHB – Expenses include deductibles, copayments, and coinsurance – Out of pocket maximums in 2015: • $6,600 for individuals and $13,200 for families • $6,450 for individuals and $12,900 for families on Qualified High Deductible plans 8 2015 Plans Choose a Network. Choose a Plan. We are offering the same 9 plans in 3 different networks. Potential members should first choose a network based on their residence and provider needs, then choose a plan that best suits their medical needs. • THREE networks – Premium (PPO) – Select (EPO) – Partner (EPO) • NINE plans (Plan names: Metal Level Deductible/PCP – Network) – Two Bronze – Four Silver (One HSA) – Two Gold – One Platinum 10 UPMC Advantage Networks for 2015 UPMC Premium Network • • • • 11 29-county network for our PPO plans Broadest of all networks Includes all UPMC providers and UPMCowned facilities as well as many independent providers and facilities Members can go outside the network but will pay a greater share of the cost if they do UPMC Advantage Networks for 2015 UPMC Select Network • • 12 Covers the five-county region of Allegheny, Beaver, Butler, Washington, and Westmoreland Includes all UPMC providers and UPMC-owned facilities as well as our community partners: – Heritage Valley Hospital – Butler Memorial Hospital – Monongahela Valley Hospital – Excela Health – Washington Health System UPMC Advantage Networks for 2015 UPMC Partner Network • • • 13 Only offered to people who live in Allegheny or Erie county. Plans offered in this network are the least expensive. Includes only UPMC providers and UPMC-owned facilities. – In Erie, there are a select number of independent providers and facilities that are included. Although individuals who reside in Erie and Allegheny are the only ones who can purchase in this network, they can receive care from any UPMC provider or UPMC-owned facility in the 28-county service area. 2015 Individual and Family Plans Catastrophic $6,600/$0 – Premium Network Silver $0/$50 – Premium Network Silver $1,750/$30 – Premium Network Silver $3,250/$10 – Premium Network Gold $500/$15 – Premium Network Gold $750/$10 – Premium Network Platinum $250/$20 – Premium Network 14 Silver HSA $2,000/20% - Select Network Silver $0/$50 – Select Network Silver $1,750/$30 – Select Network Silver $3,250/$10 – Select Network Gold $500/$15 – Select Network Partner Network EPO Silver HSA $2,000/20% Premium Network Bronze $6,000/$25 – Select Network Select Network EPO Premium Network PPO Bronze $5,500/$40 – Premium Network Bronze $6,000/$25 – Premium Network Bronze $5,500/$40 – Partner Network Bronze $5,500/$40 – Select Network Bronze $6,000/$25 – Partner Network Silver HSA $2,000/20% – Partner Network Silver $0/$50 – Partner Network Silver $1,750/$30 – Partner Network Silver $3,250/$10 – Partner Network Gold $500/$15 – Partner Network Gold $750/$10 – Select Network Gold $750/$10 – Partner Network Platinum $250/$20 – Select Network Platinum $250/$20 – Partner Network Individual and Family Plans • E-visits (UPMC AnywhereCare): Half the cost of a primary care visit • Advantage Choice Formulary – $0 generics for oral cholesterol agents, oral hypertensive agents, non-sedating antihistamines, proton pump inhibitors, and antibiotics – 4-tier formulary – Cost-share associated with each Rx tier depends on the medical plan • Pediatric dental and vision for children under 19 is included • All plans have embedded deductibles with the exception of the Silver HSA plan, which is aggregate • Podiatry and acupuncture covered, but require prior authorization • Private duty nursing and bariatric surgery are not covered • New for 2015: Alternative medicine discounts via MyHealth Community 15 Aggregate vs. Embedded • Aggregate plans have a single deductible and single outof-pocket (OOP) that the entire family must meet, either by a combination of claims or by one person in the family. – Individual plans have an individual deductible and OOP max. • Embedded plans have an individual deductible and OOP limit within their family deductible and OOP limit. They are met when one person in the family reaches the individual limit, or when a combination of family members’ claims reaches the family limit. – Embedded plans are considered more family-friendly because they limit an individual’s exposure within a family plan. 16 Catastrophic Plan Features Catastrophic $6,600/$0 • 2015 Plans Bronze $5,500/$40 Bronze $6,000/$25 Silver HSA $2,000/20% Silver $0/$50 Silver $1,750/$30 Silver $3,250/$10 Gold $500/$15 Gold $750/$10 Platinum $250/$20 17 • • • • Available to consumers under the age of 30 before the plan year begins Low premium with higher out-ofpocket costs $6,600 deductible Three visits to primary care physician not subject to deductible; $30 copayment Designed for people who want “just-in-case” coverage Bronze Plan Features 18 • Low monthly premiums • Higher cost-shares at the points of services • Primary care visits not subject to deductible • Generic prescriptions not subject to deductible Silver HSA Plan Features • Qualified High Deductible plans eligible for health savings account (HSA) • HSA members don’t pay taxes on the money put into their account, or the money spent on medical expenses. Plus, the money in an HSA grows taxfree • 80/20 plan & $2,000 deductible • Cost-share reduction plans available for individuals based on income level and household size 19 Silver $0/20% Plan Features • This plan does NOT have a deductible and only has copayments; does not have coinsurance • Higher copayments for ER and hospital • $600 ER • $1,000 Outpatient • $4,000 Inpatient • Intended for individuals who want predictable copayments and are relatively healthy • Cost-share reduction plans available for individuals based on income level and household size 20 Silver Plan Features • Benefits that are NOT subject to deductible: • PCP • Specialist • Lab • PT/OT • RX Gld$500/$15 21 • Cost-share reduction plans available for individuals based on income level and household size Gold and Platinum Plan Features • Richest plans out of all metal levels • Lower cost-shares • Higher premiums than the Bronze and Silver Plans • May be attractive to individuals coming off group plans since these are similar to group 22 Individuals Purchasing Through the Marketplace Are Eligible for Help Paying for Coverage Advanced Premium Tax Credits (APTC) For consumers with incomes between 100% and 400% FPL • Helps consumers pay their premiums • Members who qualify can choose to have these funds reimbursed to them when they file their tax returns OR the federal government can pay the insurance company directly each month to lower their monthly bills 23 Individuals Purchasing Through the Marketplace Are Eligible for Help Paying for Coverage Cost-Share Subsidies • • • 24 For consumers with incomes between 100% and 250% FPL Lowers the cost-shares/out-of-pocket expense Individuals with incomes between 100 and 250% FPL may be eligible for both a cost- share reduction plan and a Premium Tax Credit Silver $1,750/$30 Cost-Share Reduction (CSR) Options FPL CSR variation 150%-100% 94% Individual: $75 Family: $150 200%-150% 87% Individual: $500 Family: $1,000 250%-200% 73% Individual: $1,750 Family: $3,500 251% + Base 70% Individual: $1,750 Family: $3,500 Annual out-ofpocket maximum Individual: $1,000 Family: $2,000 Individual: $2,250 Family: $4,500 Individual: $4,800 Family: $9,600 Individual: $6,600 Family: $13,200 Plan payment level 20% 20% 20% 20% Provider office visit (for illness or injury) $5 $15 $30 $30 Specialist office visit $10 $30 $80 $80 Emergency care 20% after deductible 20% after deductible 20% after deductible 20% after deductible Retail prescription drugs $2-$10-$25-50% (up to $500) $4-$25-$45-50% (up to $500) $8-$45-$90-50% (up to $500) $8-$45-$90-50% (up to $500) Annual deductible 25 How Can Consumers Learn More and Apply? • Contact insurance agent/producer - If subsidy-eligible www.healthcare.gov (enter NPN) or Web-based entity - If not subsidy-eligible IKA I&F platform 26 New Business Applications IKA Individual & Family (I&F) New Business Application in IKA I&F • Same look and feel; follows same easy application flow • Several new enhancements and additions • New cut-off date: Members can apply up to the end of the month for an effective date of the 1st of the following month – Example: Can apply on 12/31/14 for a 1/1/15 effective date. – However, please note that if an application is not accepted until Dec. 31, our claims system will not be updated in time to use their benefits on Jan. 1. • Change to Confirmation of Enrollment letter: Only one letter will be generated per application group – Total family premium will be included instead of individual premiums – All members on the policy will be listed on letter • All the changes also apply to the renewal flow 28 Enhanced Filters on Select Plans Page • Network • Metallic Level • Coinsurance • Plan Type 29 Electronic Plan Document Question • Added to Personal Details/About You page. • Please encourage applicants to select this option. Instead of receiving their policy documents in the mail, they will access them electronically via MyHealth OnLine. 30 New: 5 Questions Added to Optional Page 31 Details for Optional Questions • Each Yes/No question asks for additional details • Can be completed for each applicant 32 E-Signature Page • 33 Only the subscriber signature is required regardless of the number of applicants Individual and Family Renewals 2015 Renewals for Marketplace Plans • Since the ACA-compliant plans are based on the calendar year, all members enrolled in 2014 plans will renew coverage on January 1, 2015. • The annual renewal period is: – On-Exchange: November 15 - December 15 – Off-Exchange: November 15 - December 31 • We are not offering the 2014 plans in 2015; however, we are automatically enrolling members into a new 2015 plan. • Members are mapped into a 2015 plan within the same metal level. 35 What are Marketplace (subsidy-eligible) members’ options at renewal? 1. Do nothing. If members like the plan we have mapped them into, all they have to do is keep paying their monthly premium. Members who are covered in the Marketplace in 2014 and are subsidy-eligible needed to consent that CMS would be able to communicate with the IRS for 2015. Since issuers have no way of knowing if a consumer granted this permission, all consumers are encouraged to visit Healthcare.gov to review their application and select the plan that best suits their needs. 2. Shop for a new plan. If members do not like the plan we have mapped them into or if they would like to see what other options are available to them, they can shop for and enroll in a new plan. On Marketplace: • If members want to change plans, they must do so by December 15. • Plan changes during the renewal process will be completed through Healthcare.gov. 36 How do Marketplace Members Renew? Members have four options to complete renewal: 1. Log in to Healthcare.gov. Here they can view the details of their new plan and shop for and enroll in a different 2015 plan option, including other carriers. 2. Create an account at www.UPMCHealthPlan.com. UPMC Health Plan will offer direct enrollment functionality, allowing consumers to complete the application through our site. 3. Call UPMC Health Plan Account Management. An account manager can assist them with the renewal process and talk to them about the 2015 plan options. 4. Contact their producer/insurance agent. Producers/insurance agents can utilize the private exchange platform - Go Health. 37 2015 Renewals: Off-Exchange ACA Plans • All members will be auto-enrolled into a new 2015 ACA plan at renewal, with the exception of members enrolled in Essential Bronze (NAH16) and Enhanced Silver (NAH32). – These members will continue in those plans for 2015, and all benefits will reset on Jan. 1, 2015. – We want to encourage these members to shop for a new 2015 plan. • The 2014 plan will end on Dec. 31, 2014, and the new 2015 plan will automatically begin on Jan. 1, 2015. • If a member is registered for auto-deduction, the new monthly premium will be deducted in December for January’s coverage. 38 Logging in to MyHealth OnLine Members should log in to MyHealth OnLine to be directed to IKA: Coverage and Benefits Make Changes Coverage Changes 39 How will we notify members? • We will mail letters to all subscribers prior to November 15. • Subscribers will also receive an email. – The email will be generated from IKA I&F – A PDF of the renewal letter will be attached. • If a member has not logged in to complete renewal by December 2015, the subscriber will receive a reminder email. • A Producer Update will be emailed when the renewals are available to view in IKA I&F. 40 Completing Renewals in IKA I&F Renewal Search • Select Renewal Search from the I&F drop-down menu. • All members due for renewal will be listed on this page. • The new 2015 plan and renewal letter is listed for each group. 42 Beginning Renewal: Member Dashboard • • • 43 Click “Edit Renewal Now” button to begin the renewal. All member maintenance functions will also be available, but any changes may affect the renewal rates. All members will be moved to “completed status” because they will already have been enrolled in the new 2015 plan. Editing Renewal Application • • 44 A member can make changes to the renewal application up to December 31. If a member has already completed renewal, select the “Edit Renewal” link under the member maintenance actions list. Renewal Member Verification • • • • 45 Verify information for all members on policy. Can choose not to renew coverage by selecting “Waived.” Can also add dependents (effective date will be 1/1/15). Can modify Tobacco Use and ZIP code/County. Select Plans for Renewal • Both current and new plan information is listed for easy comparison of rates and benefits. • Can shop for and enroll in a different plan in the same manner as completing a new application. 46 Select Dental Plans for Renewal • Dental buy-up plans will remain the same in 2015. • Members will remain in the current plan, if applicable. (Rate may increase if a member moves age bands.) • Members can change, add, or drop buy-up dental coverage at renewal. 47 Cart Summary • • 48 The original mapped plan will always appear in the cart summary. If a member wants to change plans at renewal, he must check the box next to the new plan(s). Enrollment and Premium Summary • • 49 There is no premium screen. We will continue to use the payment information we have on file if enrolled for auto-deduction. There is no additional step for member acceptance. From here, the member will be asked to sign the renewal application and the renewal will be complete. UPMC Individual Advantage Rate Change UPMC Individual Advantage Rate Change • Members can remain in their medically underwritten plans at least through the end of 2015. • The PID has approved a rate increase for all Individual Advantage plans (Value, Savings, and Goals), which will be applied to all members effective January 1, 2015. • Members will receive a letter and email in November informing them of the rate change. • Benefits will still reset upon their 12-month policy anniversary date in 2015. 51 Shopping for a 2015 ACA-Compliant Plan • Individual Advantage members can easily shop for and switch to a 2015 ACA plan. • Start by clicking on the Shop Now button in the blue banner on the top of member dashboard. • They will be able to see all the 2015 plan options and systematically switch to a new 2015 plan via IKA I&F. • Members will retain the same member ID. • The option to change to a new plan will be available to members during the open enrollment period (11/15/14-2/15/15). 52 2015 Individual & Family Public Shopping Tool Overview Revised Homepage on November 15 54 New Learning Landing Page – Accessed From “Get the Facts” 55 11/7 – 11/14: Window Shopping 56 New Dashboard – For Returning Users Only • • • 57 Orients returning user to what they have done and next steps. Content is dynamic, based on the status we receive from the FFM. Example: This user has an estimated tax credit but did not go to the FFM. Basic census information is included here because the user did not go to the FFM where that information is required. New – Tax Credit Calculation Screen • Replaces the “likely to qualify” screen. • Users who have completed the FFM tax credit verification process will not see this screen; they will see the dashboard. 58 New – Plan Display and Enhanced Filters Networks based on ZIP code entered 59 Plan and Rate Displays Per Network Shoppers will see two rates if they qualify for a tax credit. This rate will indicate (est.) for estimate if they have not verified the amount on the FFM. 60 Existing - Off-Exchange Purchase (via IKA) - Cart • • • 61 If user selected “Add to cart” or Skip Tax Credit Off-Exchange purchase via IKA Profile created if haven’t already done so New - Exchange Purchase Experience (FFM Direct) - Cart • • • 62 User clicked on “use tax credit” button next to the rate. This user has not been to the FFM to apply/verify their tax credit (user has an estimated tax credit). Apply for a tax credit takes the user to the profile screen if they have not yet completed one with instructions on what will happen (screen 16). They will be redirected to the Marketplace to verify their tax credit. New - Exchange Purchase Experience (FFM Direct) - Cart • User clicks “Use tax credit” on rate page. • User has verified/applied for tax credit on the FFM and has returned (non estimated rate). • User will be purchasing an exchange product with government approved subsidy applied. • Purchase will take the user to the attestation screen. 63 Responsive Design – Existing Can view same site: • Online • Tablet • Smartphone 64 Producer Commissions 2015 Standard Producer – Individual Commissions SELECT AND PARTNER NETWORK PREMIUM NETWORK YEAR 1 $18.00 $14.00 YEAR 2 $14.00 $10.00 YEAR 3 $12.00 $8.00 YEAR 4+ $6.00 $5.00 Note: You are not required to write business through a GA. You can write business directly with UPMC Health Plan. 66 Commission Increase Override Schedule • Standard Producer/Agency Override Schedule 250-499 members: $1.00 per member override 500-999 members: $2.00 per member override 1,000+ members: $4.00 per member override *Book of business assessment based upon total individual block of business ending June 30 of every calendar year. 67 2015 Resources and Materials • Producer Update containing 2015 rate sheets and producer sales brochure will be sent within the next few days. • “Window Shopping” for 2015 plans begins on 11/7; visit www.upmchealthplan.com/coverage to learn more. • Producer OnLine will be updated with 2015 plan documents. 68 Appendix 6 9 Key Components – Public I&F Shopping 1. 11/7 – 11/15 single webpage providing products, rates, and the Inside Sales phone number. 2. New learning homepage: One place where users can go to learn about health insurance, ACA, etc. 3. Subsidy/tax credit calculation 4. Dynamic links to our FFM direct enrollment experience • Prospects will start on our site; we will route them to the FFM to verify their subsidy/tax credit; they will be redirected back to our site for enrollment (plan selection, plan details, compare/print/email, checkout, and payment) 5. New plan display, incorporating the networks 6. Incorporating rates with and without subsidy/tax credit applied 7. Usability modifications 1. Updating covered individuals 2. Revised filter logic 3. Minor updates to the plan details 70 Current Value-Adds in Today’s Experience • • • • • • • • 71 Profile information collected for remarketing Responsive design (coded specifically for desktop, mobile, and tablet) Ability to continue to IKA for “on exchange” purchases Ability to compare up to three plans Print, email, and save results Return to where the user left off Hesitation screen popup for help if no keyboard or mouse movement by the user Analytics and tracking U.S. Steel Tower 600 Grant Street Pittsburgh, PA 15219 www.upmchealthplan.com