Cubanski_Medicare Part D_final 101012

advertisement

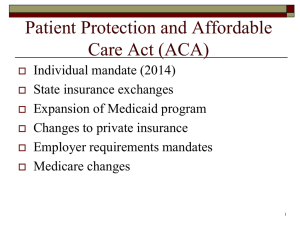

MEDICARE PART D: PAST AND PRESENT Juliette Cubanski, Ph.D. Associate Director, Program on Medicare Policy The Henry J. Kaiser Family Foundation MAPRx Congressional Briefing Washington, D.C. October 10, 2012 Exhibit 1 Medicare Part A, Part B, and Part C • Part A – Hospital Insurance Program – Inpatient hospital, skilled nursing facility, home health, and hospice care • Part B – Supplementary Medical Insurance – Physician visits, outpatient hospital, preventive services, home health • Part C – Medicare Advantage plans – An alternative to Original Medicare; beneficiaries can enroll in a private plan to receive all Medicare-covered benefits and (often) extra benefits Exhibit 2 History of Medicare and Prescription Drugs, 1965-2006 1965: Medicare enacted — no prescription drug coverage 1969: HEW Task Force on Prescription Drugs 1988: Passage of Medicare Catastrophic Coverage Act (MCCA) - includes a drug benefit 1989: MCCA repealed 1993: Clinton proposed a Medicare Drug benefit as part of the Health Security Act 1965 1970 1975 1980 1985 1990 1995 2000 2005 2000: Clinton releases plan to provide drug coverage under a new Medicare Part D 2000: Bill to create a Medicare drug benefit (H.R. 4680) passes the House, 217-214 2002: Bill to create a Medicare drug benefit (H.R. 4954) passes the House, 221-208; Several competing proposals for a Medicare drug benefit fail to pass the Senate 2003: Medicare Prescription Drug, Improvement, and Modernization Act (MMA) signed into law by President Bush 2006: Medicare prescription drug coverage begins Exhibit 3 The Need for a Medicare Drug Benefit • Because of their age and health conditions, Medicare beneficiaries tend to be sicker and use more health care services than others • Prior to 2006, Medicare beneficiaries did not have access to a governmentsubsidized drug benefit through Medicare • Existing sources of drug coverage included: – Employer-sponsored retiree health benefits – Individually-purchased Medigap supplemental policies – State Medicaid programs for low-income Medicare beneficiaries – Medicare managed care plans – Veterans Administration, state pharmacy assistance programs, pharmaceutical company assistance programs • One-third had no drug coverage in 2004 – Those without coverage used fewer drugs but spent more out-of-pocket than those with coverage – Cost-related non-adherence (skipping/splitting doses, not filling prescriptions) was more common among those without coverage Exhibit 4 Medicare Part D – Prescription Drug Benefit • Medicare Part D, enacted as part of the Medicare Modernization Act of 2003, took effect in 2006 – Part D is provided exclusively through private plans; benefits are not offered directly through the traditional fee-for-service program – Enrollment in a Part D prescription drug plan is voluntary • Beneficiaries may enroll in one of two types of private plans to get the Part D benefit – Stand-alone prescription drug plans (PDPs) to supplement traditional Medicare – Medicare Advantage prescription drug plans • Additional subsidies available for people with low incomes and modest assets to help pay for premiums and cost-sharing – Below 150% poverty ($16,755/individual, $22,695/couple in 2012) – Assets less than $11,570/individual, $23,120/couple in 2012 Exhibit 5 The Role of CMS in Regulating Part D • CMS exercises a great deal of authority over Part D and plays a critical role in regulating and overseeing the program and market operations, including: – Reviewing and approving plan bids annually – Establishing the rules for coverage, subject to law – Regulating plan marketing materials – Monitoring plan behavior and sanctioning plans for violations of rules and regulations – Implementing legislative changes (e.g., closing the “doughnut hole” – Reacting to marketplace, legislative, and political conditions with new rules, guidance, and regulations – Providing consumer information (e.g., the Medicare Plan Finder) Exhibit 6 Prescription Drug Coverage Among Medicare Beneficiaries in 2012 Part D non-LIS enrollees 21.7 million All other 13.5 million 43% 26% 9% Employer subsidy 4.5 million 22% Part D LIS enrollees 11.0 million Total Medicare Enrollment in 2012 = 50.7 million Total Part D Enrollment (excluding employer subsidy) = 32.7 million NOTE: LIS is low-income subsidy. Total Part D and Medicare enrollment based on 2012 intermediate estimates. SOURCE: Kaiser Family Foundation Analysis of data from the 2012 Medicare Trustees report. Exhibit 7 Medicare Part D Enrollment, 2006-2012 PDP enrollees MA-PD enrollees In millions: 23.2 24.6 25.8 27.0 27.9 9.5 10.1 29.5 10.8 30.9 11.4 6.6 7.5 8.4 16.6 17.1 17.4 17.5 17.8 18.7 19.5 2006 2007 2008 2009 2010 2011 2012 NOTE: LIS is low-income subsidy. Total Part D and Medicare enrollment based on 2012 intermediate estimates. SOURCE: Kaiser Family Foundation analysis of data from the CMS Medicare Advantage, Cost, PACE, Demo, and Prescription Drug Plan Contract Report - Monthly Summary Report, 2006-2012. Exhibit 8 Number of Medicare Part D Stand-Alone Prescription Drug Plans, by Region, 2013 National Average: 31 drug plans 28 ME, NH 30 30 OR, WA 32 32 28 31 IA, MN, MT, NE, ND, SD, WY 34 ID, UT 29 34 31 32 29 31 31 30 31 23 33 32 NJ 38 PA, WV 31 31 33 32 AL, TN 30 32 29 IN, KY 31 30 30 35 23 23-29 drug plans (10 states and DC) NOTE: Excludes Medicare Advantage Drug Plans. SOURCE: Kaiser Family Foundation analysis of Centers for Medicare & Medicaid Services (CMS) PDP landscape source file, 2013. CT, MA, RI, VT 30-31 drug plans (18 states) 32 drug plans (14 states) 33-38 drug plans (8 states) 29 DE, DC, MD EXHIBIT 99 Exhibit Number of Medicare Part D Stand-Alone PDPs, by Benchmark Status, 2006-2013 LIS benchmark plans 1,875 Non-benchmark plans 1,824 1,689 1,576 1,429 1,235 1,329 1,381 1,020 409 2006 640 2007 495 2008 1,109 1,041 1,045 777 714 713 1,269 308 307 332 327 332 2009 2010 2011 2012 2013 NOTE: Excludes Part D plans in the territories. SOURCE: Georgetown/NORC analysis of CMS PDP landscape source files, 2006-2012, for the Kaiser Family Foundation. Exhibit 10 Number of Low-Income Subsidy “Benchmark” Plans Offered by Two Major Part D Sponsors, 2006-2013 Number of PDP regions (out of 34): 33 2006 2007 2008 2009 2010 34 2011 2012 34 30 25 27 2013 34 34 31 25 23 10 4 3 0 UnitedHealth Humana ~ 2 million LIS enrollees in 2011 < 1 million LIS enrollees in 2011 NOTES: Counts include combined offerings of merged organizations. SOURCE: Georgetown/NORC analysis of CMS PDP landscape files, 2006-2012, for the Kaiser Family Foundation. 34 Exhibit 11 Standard Medicare Prescription Drug Benefit, 2013 CATASTROPHIC COVERAGE Catastrophic Coverage Limit = $6,955* in Estimated Total Drug Costs COVERAGE GAP Enrollee Plan pays 15%; pays 5% Medicare pays 80% Brand-name drugs Enrollee pays 47.5%; Plan pays 2.5% 50% manufacturer discount Generic drugs Enrollee pays 79%; Plan pays 21% Initial Coverage Limit = $2,970 in Total Drug Costs INITIAL COVERAGE PERIOD Enrollee pays 25% … But most plans do not offer the “standard” benefit, and coverage varies across most dimensions, including: Monthly premiums Deductibles The “doughnut hole” Covered drugs and utilization management restrictions Cost sharing for covered drugs Plan pays 75% $325 Deductible NOTE: *Amount corresponds to the estimated catastrophic coverage limit for non-low-income subsidy enrollees ($6,734 for LIS enrollees), which corresponds to True Out-of-Pocket (TrOOP) spending of $4,750 (the amount used to determine when an enrollee reaches the catastrophic coverage threshold. SOURCE: Kaiser Family Foundation illustration of standard Medicare drug benefit for 2013 (standard benefit parameter update from Centers for Medicare & Medicaid Services, 2012). Amounts rounded to nearest dollar. Exhibit 12 Cost Sharing for Brand-Name Drugs in the Medicare Part D Coverage Gap, 2010-2020 Paid by Enrollee 50% 50% 100% minus $250 rebate 50% 2010 2011 50% 2012 Paid by Plan Manufacturer Discount 50% 50% 50% 50% 50% 50% 50% 50% 2.5% 2.5% 5% 5% 10% 15% 20% 25% 35% 30% 25% 2018 2019 2020 47.5% 47.5% 2013 2014 45% 2015 45% 2016 40% 2017 SOURCE: Kaiser Family Foundation analysis of the standard Medicare drug benefit under the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010. Exhibit 13 Cost Sharing for Generic Drugs in the Medicare Part D Coverage Gap, 2010-2020 Paid by Enrollee 7% 14% 21.0% 28.0% Paid by Plan 35% 42% 49% 56% 63% 75% 100% 93% 86% 79% 72% 65% 58% 51% 44% 37% 25% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 SOURCE: Kaiser Family Foundation analysis of the standard Medicare drug benefit under the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010. Exhibit 14 Weighted Average Premium for Medicare Part D Stand-Alone PDPs, by Region, 2013 National Weighted Average: $40.18 $37.14 ME, NH $40.53 $37.63 OR, WA $39.00 IA, MN, MT, NE, ND, SD, WY $45.90 $42.52 $40.59 $37.13 $35.22 $37.98 $42.46 $40.25 $32.71 $43.47 $41.44 ID, UT $29.25 $43.39 $40.72 $39.40 $39.73 $39.40 DE, DC, MD $41.01 $41.08 AL, TN $42.71 $39.90 $41.43 $35.99 $29 to <$38 (8 regions) NOTE: Excludes Medicare Advantage Drug Plans. SOURCE: Kaiser Family Foundation analysis of Centers for Medicare & Medicaid Services (CMS) PDP landscape source file, 2013. NJ $43.54 IN, KY $40.71 $38.07 $41.49 PA, WV $43.68 $41.01 CT, MA, RI, VT $38 to <$40 (7 regions) $40 to <$42 (11 regions) $42 to <$46 (8 regions) $38.01 Exhibit 15 Weighted Average Monthly Premiums for Medicare Part D Stand-Alone PDPs, 2006-2013 $40 $35.09 $37.25 $38.29 $40.18 $37.57 $35 $29.89 $30 $25.93 2012-2013: 7% increase $27.39 $25 2006-2013: 55% increase $20 $15 $10 $5 $0 2006 2007 2008 2009 2010 2011 NOTES: Average premiums are weighted by enrollment in each year. Excludes plans in the territories. SOURCE: Georgetown/NORC analysis of data from CMS for the Kaiser Family Foundation. 2012 2013 Exhibit 16 Premiums in Medicare Part D Stand-Alone PDPs with Highest 2012 Enrollment, 2006-2013 PDP Rank in 2012 2012 Enrollment (of 17.7 million) Weighted Average Monthly Premium1 % Change Number (in millions) % of Total 2006 2012 2013 20122013 20062013 AARP MedicareRx Preferred 4,011,357 22.6% $26.31 $39.85 $40.42 +1% +54% CCRx Basic 1,768,148 10.0% $30.94 $30.75 $33.33 +8% +8% Humana WalmartPreferred 1,511,850 8.5% -- $15.10 $18.50 +23% -- Humana PDP Enhanced 1,374,479 7.8% $14.73 $39.58 $43.77 +11% +197% Silverscript Basic 1,322,856 7.5% $28.32 $30.24 $32.55 +8% +15% NOTES: 1Average premiums are weighted by enrollment in each region for each year. SOURCE: Georgetown/NORC analysis of CMS 2006-2012 PDP Landscape Source Files for the Kaiser Family Foundation. Exhibit 17 Costs for Top Brands in Stand-Alone PDPs with Highest 2012 Enrollment in DC Zip Code (20037) AARP MedicareRx Preferred Advair Diskus Celebrex Crestor Cymbalta Lantus Lyrica Namenda Nexium Spiriva Zetia $43 $60 $43 $74 $346 (not covered) $127 $127 $71 $43 $58 $114 $86 $43 $49 $227 $43 $43 Humana Walmart Preferred $89 $43 $57 $36 $43 $47 $69 $43 $43 CCRx Basic $186 $139 $139 SOURCE: Kaiser Family Foundation analysis of data from Medicare Plan Finder. $275 (not covered) Exhibit 18 Median Cost Sharing for Medicare Part D Plans, 2006 and 2012 2006 2012 $92 $84 $55 $41 $28 $5 $5 $5 $6 PDP MA-PD Generics PDP $55 $42 $27 MA-PD Preferred brands PDP MA-PD Non-preferred brands 29% 25% 33% 25% PDP MA-PD Specialty NOTES: Part D cost-sharing amounts are medians. Analysis excludes generic/brand plans, plans with coinsurance for regular tiers, and plans with flat copayments for specialty tiers. SOURCE: Georgetown/NORC analysis of data from CMS for MedPAC and the Kaiser Family Foundation. Exhibit 19 Medicare Part D Spending and Financing Part A Part D is funded by premiums, general revenues, and state payments Plans are paid a fixed amount for each enrollee “Reinsurance” payments from the government protect plans from unexpectedly high costs Outpatient Prescription Drugs (Part D) Hospital Outpatient Services Physician Payments Part A and B Part B Part D 12% 26% Hospital Inpatient Services 5% 12% 5% Skilled Nursing Facilities 12% Other Services 4% Home Health 23% Medicare Advantage (Part C) Total Benefit Payments, 2011 = $551 billion NOTE: Numbers do not sum to 100% due to rounding. Total does not include administrative expenses and is net of recoveries. SOURCE: CBO Medicare Baseline, March 2011. Exhibit 20 Comparison of Projected and Actual Medicare Part D Benefit Spending, 2006-2013 CBO (2003) and Medicare Trustees (2012) (Billions of Dollars) $105 2003 CBO projections $64 $53 $39 $48 $116 $72 $49 $79 $52 $86 $56 $95 $60 $61 $68 2012 Medicare Trustees actual estimates (2006-2011) and projections (2012-2013) Difference, estimate less actual $ % 2006 2007 2008 2009 2010 2011 2012 2013 $13.8 $16.3 $22.8 $26.6 $30.6 $35.1 $43.9 $48.2 74% 75% 68% 66% 65% 63% 58% 58% NOTE: CBO projections are adjusted from fiscal years to calendar years. Medicare Trustees actual spending amounts are adjusted for reconciliation payments. Amounts exclude offsetting receipts from beneficiary premium payments and state “clawback” payments for dual eligibles. All totals include administrative costs. SOURCE: J. Hoadley analysis of data from Congressional Budget Office (July 2004) and 2012 Medicare Trustees Report for the Kaiser Family Foundation. Exhibit 21 Factors Affecting Medicare Part D Drug Spending Trends Slower overall drug spending growth compared to projections Slow pipeline for new drugs since the start of Part D More use of generic drugs since the start of Part D • Generic penetration in Part D: 61% in 2007; 75% in 2010 Slow growth in retail drug prices • Lower prices due to generic substitution balanced out higher prices for brand drugs Larger manufacturer rebates and other discounts • Trustees say rebates have exceeded expectations Lower-than-expected Part D enrollment • ~90% projected, ~70% actual Exhibit 22 Medicare Part D: Adding It Up Coverage Out-of-pocket drug spending, use, and access 90% have drug coverage; 65% through Part D plans ~10% lack drug coverage 11 million receiving low-income subsidies A few million low-income eligible but without subsidies Out-of-pocket drug spending is generally lower Some enrollees may pay more – e.g., dual eligibles and those in the coverage gap Drug use is higher and costrelated skipping is generally lower Drug prices Lower for those who had no drug coverage prior to Part D Higher for dual eligibles and drugs with no competitors Program spending Lower than initially projected Due partly to lower-thanprojected Part D and low-income subsidy enrollment Choice Lots of plans means more options for beneficiaries Lots of plans could lead to confusion and difficulty choosing the best plan