Topic: - Post-Optimality Analysis

advertisement

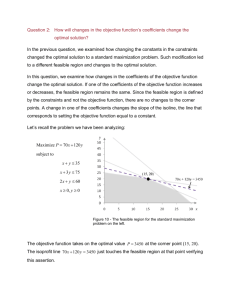

Topic: Post-Optimality Analysis By: - 1. 2. Malik Faizan Ishtiaq Ahmad 1. 2. Post-Optimality Analysis constitutes a very major and important part of most operations research studies, particularly in typical linear programming applications. Suppose an optimum solution to the given LPP is obtained, it is necessary to study the changes in the current optimum solution due to the changes in the parameters of the LPP. The changes in the parameters of the LPP are of two types: Discrete Continuous This is focuses on the effect of the discrete changes in the parameters on the optimum solution, which is called post-optimality Analysis. This analysis also sometimes referred to as “what-if analysis” because it studies what would happen to the optimum solution if different assumptions are made about future conditions. On the other hand, this chapter concentrates on the continuous changes in parameters, which are called parametric programming. For example we take the example of poultry industry where an LP model is commonly used to determine the optimal feed mix per broiler. The weekly consumption per broiler varies from 0.26 lb (120 grams) for a oneweek-old bird to 2.1 lb (950 grams) for an eight-week-old bird. Additionally, the cost of the ingredients in the mix may change periodically. These changes require periodic recalculation of the optimum solution. PostOptimal Analysis determine the new solution in an efficiently way. Feasibility Analysis, is an analysis of the viability of an idea. It describes a preliminary study undertaken to determine and document a project’s viability. The results of this analysis are used in making the decision whether to proceed with the project or not. The feasibility of the current optimum solution my be affected only if (1) the right hand side of the constraints is changed. (2) a new constraint is added to the model. In above both cases, infeasibility occurs when at least one element of the right-hand side of the optimal tableaus become negative. That is one or more of the current basic variaibel become negative. This change requires recomputing the right-hand side of the tableau using the following formula: - Recall that the right-hand side of the tableaus gives the values of the basic variables Addition of New Constraints The addition of a new constraint to an existing model can lead to one of the two cases:_ 1. The new constraint is redundant, meaning that it is satisfied by the current optimum solution, and hence can be dropped from the model altogether. 2. The current solution violates the new constraint, in which case the dual simplex method is used to restore feasibility. Changes Affecting Optimality 1. 2. This considers two particular situations that could affect the optimality of the current solution: Changes in the original objective coefficients. Addition of the new economic activity (variable) to the model. Changes in the Objective Function Coefficients: 1. 2. The Changes affect only the optimality of the solution. Such changes thus require recomputing the z-row coefficients (reduced cost) according the following procedure:Compute the dual value. Use the new dual values. In this question, we examine how changes in the coefficients of the objective function change the optimal solution. If one of the coefficients of the objective function increases or decreases, the feasible region remains the same. Since the feasible region is defined by the constraints and not the objective function, there are no changes to the corner points. A change in one of the coefficients changes the slope of the isoline, the line that corresponds to setting the objective function equal to a constant. The objective function takes on the optimal value P 3450 at the corner point (15, 20). The isoprofit line 70x +120y = 3450 just touches the feasible region at that point verifying this assertion. As the coefficient on x is decreased, the isoprofit line for the optimal solution gets less steep. At a value of 40, the isoprofit line passes through (0, 25) and (15, 20). At this point, the isoprofit line forms the border of the feasible region there so all points on the line between (0, 25) and (15, 20) yield the same maximum profit. If the coefficient is decreased to a value less than 40, (15, 20) is no longer part of the optimal solution. As the coefficient on x is increased, the isoprofit line for the optimal solution gets steeper. At a value of 120, the isoprofit line passes through (0, 25) and (25, 10). The isoprofit line forms the border of the feasible region there, so all points on the line between (0, 25) and (25, 10) yield the same maximum profit. If the coefficient is increased to a value greater than 120, (15, 20) is no longer part of the optimal solution. As long as the coefficient on x in the objective function falls between 40 to 120, the optimal solution includes x, y 15,20 . If the coefficient is equal to 40 or 120, any ordered pair on a line connecting 15, 20 to one of the adjacent corner points is optimal. However, if the coefficient on x falls outside of 40 to 120 the optimal solution moves to a new corner point. Recall that the coefficient on x in the objective function is the profit for each frame bag. If the profit per frame bag were to increase by up to $50 (to $120) or decrease by up to $30 (to $40), the optimal solution would not change. This solution, 15 frame bags and 20 panniers, is fairly insensitive to changes in the coefficient on x. Even though the location of the optimal solution does not change over this range, the profit does not change. Notice that we are only varying one coefficient at a time. Varying both coefficients simultaneously is beyond the scope of this presentation Thank You