Mutli-Period Model of Consumption and PIH

Optimal Consumption over

Many Periods

Facts About Consumption

Consumption Under Certainty

Permanent Income Hypothesis

Uncertainty and Rational Expectations

Facts About Consumption

• Conflicting Consumption Data!

MPC out of long-term changes in income higher than short-term (over business cycle).

• Total consumption is smoother than income over time.

• Consumption of non-durables is much less volatile than income while consumption of durables is more volatile than income.

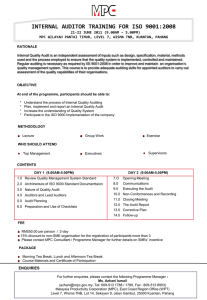

FIGURE 3: Consumer Spending and

Disposable Income

$5,619

$3,036

0

1964

1960

1955

1947

1941

1939

1942 1943

1929

1945

2004

1970

1995

1994

1992

1990

1988

1991

1989

1986

1987

1985

1984

1979

1976

1980

1978

1974

2003

2002

2001

2000

1998

1997

1999

1996

$3,432

Real Disposable Income

$6,081

Copyright © 2006 South-Western/Thomson Learning. All rights reserved.

Figure 3.9 Percentage Deviations from Trend in

Real Consumption (black line) and Real GDP

(colored line) 1947 –2006

Figure 8.6 Percentage Deviations from

Trend in GDP and Consumption, 1947 –

2006

A Multi-Period Model

• Consider the case where individuals live for T periods.

• Let a

0

= s

0

(1+ r ) represent initial wealth.

• Consumers choose { c t

} for t = 1,2,…,T which solves max U ( c

1

, c

2

, , c

T

) subject to y t

s t

1

( 1

r )

c t

s t

(BC)

• Combining (BC) for each period gives the multi-period lifetime (intertemporal) BC: t

T

1

( 1

y t r ) t

1

s

0

( 1

r )

t

T

1

( 1

c t r ) t

1

PDV of Lifetime

Income + Initial Wealth

PDV of Lifetime

Consumption

Method 1

• LaGrangian:

L

U ( c

1

, c

2

, c

T

)

t

T

1

( 1

y t r ) t

1

s

0

( 1

r )

t

T

1

( 1

c t r ) t

1

FOC:

U c t

( 1

r ) t

1

Combining gives

U c t

U c t

1

( 1

r ) for t = 1,…,T

MRS ct,ct+1

= (1+r)

Method 2

• LaGrangian:

L

U ( c

1

, c

2

, c

T

)

t

T

1

t

{ y t

s t

1

( 1

r )

c t

s t

}

FOC:

U c t

t

t

( 1

r )

t

1

Combining gives

U

U c t c t

1

( 1

r ) for t = 1,…,T for t = 1, … T-1

MRS ct,ct+1

= (1+r)

• An optimal sequence {c t

*} for t=1,…,T solves

U c t

U c t

1

( 1

r )

(T-1 equations) and the lifetime BC: t

T

1

( 1

y t r ) t

1

s

0

( 1

r )

t

T

1

( 1

c t r ) t

1

• Example:

Time-separable utility function

U ( c

1

, c

2

, , c

T

)

u ( c

1

)

b u ( c

2

)

b

2 u ( c

3

)

b

T

1 u ( c

T

)

T b t

1 u ( c ) t t

1 where b

< 1 is the time discount factor: b

1 /( 1

r

) and r is the rate of time preference.

• Hence an optimal sequence {c t

*} for t=1,…,T solves u ' ( c t

)

b u ' ( c t

1

)( 1

r )

(T-1 equations) and t

T

1

( 1

y t r ) t

1

s

0

( 1

r )

t

T

1

( 1

c t r ) t

1

Consumption with Certainty

• The optimal consumption decision, given r, is

{ c t

} for t = 1,2,…,T solving

U c t

( c

1

, , c

T

)

U c t

1

( c

1

, , c

T

)

( 1

r ) for t = 0,1,…,T-1, and we

t

T

1

( 1

y t r ) t

1

a

0

t

T

1

( 1

c t r ) t

1

• Simple Example:

(i) Time separable utility with r

= 0

(b

=1)

.

(ii) Zero interest rate: r = 0.

c

1

T t

T

1 y t

a

0

The permanent income hypothesis – consumption decisions are based upon a constant proportion of lifetime wealth

(“permanent income”) – M. Friedman.

• Consumption is smoother than income.

• Conflicts with traditional view of the importance of current income. (current income by itself doesn’t matter!)

• Statistical estimation of simple consumption functions may not be useful:

C

a

b ( Y

T )

• Saving will be very sensitive to income (in example, s t

s t

1

y t

c )

• Problem – if future income is known with certainty, then there should be no consumption fluctuations. (see

Graph)

PIH with Uncertainty

• Consumers have information about current income but not sure about future income.

• Let E t be the expectation based upon all information up to and including period t.

• Consumer’s Problem: In each period t choose { c t

} and { s t

} to maximize subject to

E t t

T

t b t

t u ( c t

) y t

s t

1

( 1

r )

c t

s t

• The lifetime BC is given by: we

T

( 1

E

t r y

) t t

t t

t

• For simplicity, assume

s

0

(i) b

= 1 (no time discounting) t

T

t

( 1

E t

r c t

) t

t

(ii) r = 0, (zero interest rate)

(iii) u ( c )

c

( 1 / 2 ) c

2

• FOC at date t=1:

(quadratic utility) u ' ( c

1

)

E

1 u ' ( c

2

)

• Law of Itterated Expecations : The expected value given time-t information of an expected value given time t+1 information of a future variable is the expected value of that future variable conditional on time-t information.

• Example:

E t

E t

1 z t

2

E t z t

2

• Substituting utility function into FOC: c

1

E

1 c

2 or more generally c t

E t c t

1 for t = 1, …, T-1

• Notice this implies: c

1

E

1 c

1

E

1 c

2

E

1 c

T

• The lifetime BC is t

T

1

E

1 c t

T t

1

E

1 y t

s

0

Substituting in the FOC from previous slide: c

1

1

T t

T

1

E

1 y t

s

0

This is the “uncertainty” version of PIH.

• Calculating c

2 and using c

1 from above gives: c

2

c

1

T

1

1 t

T

2

E

2

( t

t

T

2

E

1

( t

• This says that changes in consumption over time are due to revisions in the expectation of future income

(i.e. new information)

Random Walk Hypothesis

• Robert Hall - “Stochastic Implications of the Life-

Cycle/ Permanent Income Hypothesis: Theory and

Evidence,” 1978,

Journal of Political Economy

• Recall household FOC:

E c

c

1 2 1

• If consumers have rational expectations, then this implies consumption follows a random walk: c

2

c

1

2 where E

1

2 and

2

T

1

1 t

T

2

[ E

2

( y t

)

E

1

( y t

)]

0

• More generally, consumption follows c t

1

c t

t

1 where E t

t

1

0

• The random walk hypothesis (R. Hall) says

(i) The best predictor of future consumption is current consumption.

(ii) If current consumption is based upon efficiently utilizing all information about future income, changes in consumption are unpredictable (

D c =

)

(iii) MPC out of permanent shocks to income are larger than MPC out of temporary shocks.

• Implications

(i) Anticipated changes in income should have no effect on consumption.

(ii) All changes or “shocks” to consumption are permanent.

(iii) Consumption Smoothing

MPC out of temporary income shocks will be smaller than out of permanent shocks to income.

• Empirical Evidence of Random Walk – anticipated

(predictable) changes in income do increase consumption but by much less than 1-1 (50 cents to the $).

• Reasons Random Walk Theory of Consumption does not hold 100%:

(1) Borrowing Constraints: Inability of consumers to have easy access to credit markets.

(2) Market Interest Rate Fluctuations: If all consumers want to borrow market rates are driven up!

• Resolves conflict between various consumption data:

MPC for temporary changes in income

< MPC for permanent income changes.

FIGURE 3: Consumer Spending and

Disposable Income

$5,619

$3,036

0

1964

1960

1955

1947

1941

1939

1942 1943

1929

1945

2004

1970

1995

1994

1992

1990

1988

1991

1989

1986

1987

1985

1984

1979

1976

1980

1978

1974

2003

2002

2001

2000

1998

1997

1999

1996

$3,432

Real Disposable Income

$6,081

Copyright © 2006 South-Western/Thomson Learning. All rights reserved.

Figure 3.9 Percentage Deviations from Trend in

Real Consumption (black line) and Real GDP

(colored line) 1947 –2006

Real GDP & Consumption: 2005-2009

Figure 8.10 Scatter Plot of Percentage Deviations from Trend in Consumption of Nondurables and

Services Versus Stock Price Index

Figure 8.9