Balance –of-Payments Adjustments with Exchange Rate Changes

advertisement

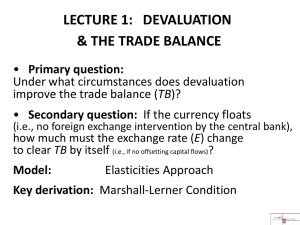

International Economics Li Yumei Economics & Management School of Southwest University International Economics Chapter 16 The Price Adjustment Mechanism with Flexible and Fixed Exchange Rates Organization 16.1 Introduction 16.2 Adjustment with Flexible Exchange Rates 16.3 Effect of Exchange Rate Changes on Domestic Prices and the Terms of Trade 16.4 Stability of Foreign Exchange Markets 16.5 Elasticities in the Real World 16.6 Adjustment Under the Gold Standard Chapter Summary Exercises Internet Materials 16.1 Introduction How a nation’s current account is affected by price changes under flexible and fixed exchange rate systems How the nation’s current account is affected by income changes in the nation and abroad Assumptions There are no autonomous international private capital flows, that is international private capital flows take place only as passive responses to cover temporary trade imbalance The nation wants to correct a deficit in its current account by exchanging rate changes 16.2 Adjustment with Flexible Exchange Rates Introduction This section studies the method of correcting a deficit in a nation’s current account or balance of payments by a depreciation or a devaluation of the nation’s currency Price Adjustment Mechanism(价格调整机制) It means that both a depreciation and a devaluation operate on prices to bring about adjustment in the nation’s current account and the balance of payments Income Adjustment Mechanism(收入调整机制) It relies on income changes in the nation and abroad to bring about adjustment in the nation’s current account and the balance of payments Balance –of-Payments Adjustments with Exchange Rate Changes Figure 16.1 The process of correcting a deficit in a nation’s balance of payments by a depreciation or devaluation of its currency is Shown It is assumed that US and EMU are the only two economies in the world and that there are no international capital flows, so that US demand and supply curves for euros reflect only trade in goods and services FIGURE 16-1 Balance-of-Payments Adjustments with Exchange Rate Changes. Explanation of Figure 16.1 At the exchange rate of R=$1/ €1, The quantity of euros demanded by US is €12billion per year, while the quantity supplied is €8billion. As a result, US has a deficit of €4 billion (AB) in its balance of payments With D€ and S€, a 20 percent depreciation or devaluation of the dollar would completely eliminate the deficit (point E). Exchange rate from R=$1/ €1 to R= R=$1.2/ €1, the quantity of euros demanded and the quantity supplied would be equal at €10billion per year, and US balance of payments would be in equilibrium With D★€ and S★€, a 100 percent depreciation or devaluation would be required t eliminate the deficit (point E★) Derivation of the Demand Curve for Foreign Exchange Figure 16.2 In Figure 16.1 US demand curve for euros ( D€) is derived from the demand and supply curves of US imports in terms of euros (shown in the left panel of Figure 16.2) In Figure 16.1 US supply curve for euros ( S€) is derived from the demand and supply curves of US exports in terms of euros (shown in the right panel of Figure 16.2) DM is the US demand for imports from the EUM interms of euros at R=$1/ €1, while SM is the EUM supply of imports to US When the dollar depreciates by 20 percent to R=$1.2/ €1, SM remains unchanged , but DM shifts down by 20 percent to D’M. FIGURE 16-2 Derivation of the U.S. Demand and Supply Curves for Foreign Exchange. Derivation of the Supply Curve for Foreign Exchange Figure 16.2 In the right panel of Figure 16.2, DX is the EMU demand for US exports in terms of euros, and SX is the US supply of exports to EMU at R=$1/ €1. With DX and SX, the euro price of US exports is PX= €2, and the quantity of US exports is QX=4billion units, so that the US quantity of euros earned or supplied is €8 billion. This corresponds to point A on S€ in Figure 16.1 When the dollar is devalued or is allowed to depreciate by 20 percent to R= $1.2/ €1, DX remains unchanged, but SX shifts down by 20 percent to S’X 16.3 Effect of Exchange Rate Changes on Domestic Prices and the Terms of Trade Domestic Prices The depreciation or devaluation of the dollar stimulates the production of US import substitutes and exports and will lead to a rise in prices in US, while it reduces the euro price of US imports and export (Figure 16.2) Terms of Trade Since the prices of both the nation’s exports and imports rise in terms of the domestic currency as a result of its depreciation or devaluation, the terms of trade of the nation can rise, fall , or remain unchanged, depending on whether the price of exports rises by more than, less than, or the same percentages as the price of imports. 16.4 Stability of Foreign Exchange Markets Introduction This section examines the meanings of and the conditions for stability of the foreign exchange Market Stable Foreign Exchange Market When a disturbance from the equilibrium exchange rate gives rise to automatic forces that push the exchange rate back toward the equilibrium level. Unstable Foreign Exchange Market When a disturbance from equilibrium pushes the exchange rate further away from equilibrium. Stable and Unstable Foreign Exchange Markets Figure 16.3 A foreign exchange market is stable when the supply curve of foreign exchange is positively sloped or, if negatively sloped, is less elastic (steeper) than the demand curve of foreign exchange A foreign exchange market is unstable if the supply curve is negatively sloped and more elastic (flatter) than the demand curve of foreign exchange FIGURE 16-3 Stable and Unstable Foreign Exchange Markets. Explanation of Figure 16.3 Left panel of figure 16.3 repeats D€ and S€ from Figure 16.1. With D€ and S€ , the equilibrium exchange rate is R=$1.20/ €1, at which the quantity of euros demanded and the quantity supplied are equal at €10billion per year (point E). If the exchange rate fell to R=$1/ €1, there would be an excess demand for euros, which would automatically push the exchange rate back up toward the equilibrium rate of R=$1.20/ €1. If the exchange rate rose to R=$1.40/ €1, there would be an excess quantity supplied of euros, which would automatically drive the exchange rate back down toward the equilibrium rate of R=$1.20/ €1, the left panel of figure 16.3 is stable Center panel of Figure 16.3 shows the same D€ as in the left panel, but S€ is now negatively sloped but steeper than D€. It is the stable Right Panel of Figure 16.3 looks the same as the center panel, but the labels of the demand and supply curves are reversed, so that now S€ is negatively sloped and flatter than D€ . It is unstable. The Marshall-Lerner Condition Introduction The Marshall-Lerner Condition tells us whether the foreign exchange market is stable and unstable . Implications It indicates a stable foreign exchange market if the sum of the price elasticities of the demand for imports (DM) and the demand for exports (DX), in absolute terms, is greater than 1. If the sum of the price elasticities of DM and DX is less than 1, the foreign exchange market is unstable , and if the sum of these two demand elasticities is equal to 1, a change in the exchange rate will leave the balance of payments unchanged. 16.5 Elasticities in the Real World Introduction This section examines how the price elasticity of demand for imports and exports is measured and present some real-world estimates, discuss the J-curve effect, and examine the “pass-through” of exchange rate changes to domestic prices Elasticity Estimates Before World War Ⅱit was widely believed that the foreign exchange market was stable but the demand for and the supply of foreign exchange were very elastic During eh 1940s, a number of econometric studies were undertaken to measure price elasticities in international trade, it was founded that the sum of the demand elasticities on the average barely exceeded 1, so that while the foreign exchange market was stable Orcutt (1950) for the belief that the early studies of 1940s result from the identification problem (Figure 16.4) in estimation. FIGURE 16-4 The Identification Problem. The J-Curve Effect and Revised Elasticity Estimates Introduction Not only are short-run elasticities in international trade likely to be much smaller than long-run elasticities, but a nation’s trade balance may actually worsen soon after a devaluation or depreciation Over time , the quantity of exports rises and the quantity of imports falls, and export prices catch up with import prices, so that the initial deterioration in the nation’s trade balance is halted and then reversed. Economists have called this tendency of a nation’s trade balance to first deteriorate before improving as a result of a devaluation or depreciation in the nation’s currency the J-curve effect. (see Figure 16.5) FIGURE 16-5 The J-Curve. Explanation of Figure 16.5 When the nation’s net trade balance is plotted on the vertical axis and time is plotted on the horizontal axis, the response of the trade balance to a devaluation or depreciation looks like the curve of a J. The figure assumes that the original trade balance was zero It shows that starting fro the origin and a given trade balance, a devaluation or depreciation of the nation’s currency will first result in a deterioration of the nation’s trade balance before showing a net improvement (after time A) Empirical studies by Harberger (1957), Houthakker and Magee (1969), Stern, Francis, and Schumacher (1976), Spitaeller (1980), Artus and Knight (1984), and Marquez (1990) Case studies See Figure 16.6 and Figure 16.7 FIGURE 16-6 Effective Exchange Rate of the Dollar and U.S. Current Account Balance, 1980-2001. FIGURE 16-7 U.S. Merchandise Trade Deficit with Japan and Yen/Dollar Exchange Rate. Exchanging Rate Overshooting Conclusion due to the size and quickness of stock adjustments in financial assets as opposed to adjustments in trade flows , in the short run exchange rate must overshoot or by pass their longrun equilibrium level for equilibrium to be quickly reestablished in financial markets. Over time, as the cumulative contribution to adjustment coming from the real (e.g. trade) sector is felt, the exchange rate reverses its movement and the overshooting is eliminated Time Path to a New Equilibrium Exchange Rates Introduction The model that examines the precise sequence of events that leads the exchanger rate in the short run to overshoot its longrun equilibrium was introduced by Rudi Dornbusch in 1976 and can be visualized with Figure 15.5 Panel (a) It shows at time t0 the Fed unexpectedly increases US money supply by 10 percent, from $100 billion to $110 billion, and keeps it at that higher level Panel (b) It shows the 10 percent unanticipated increase in US money supply leads to an immediate decline in US interest rate, from 10 percent to 9 percent at time t0 (Figure continues on next slide) FIGURE 15-5 Exchange Rate Overshooting. Currency Pass-Through Implication Not only are there usually lags in the response of a nation’s trade and current account balances to a depreciation of its currency, but the increase in the domestic price of the imported commodity may be smaller than the amount of the depreciation even after lags Pass-Through Effect The proportion of an exchange rate change that is reflected in export and import price changes 16.6 Adjustment Under the Gold Standard Introduction This section examines the operation of the international monetary system known as the gold standard The gold standard also relies on an automatic price mechanism for adjustment but of a different type from the one operating under a flexible exchange rate system The Gold Standard The international monetary system operating from about 1880 to 1914 under which gold was the only international reserve, exchange rates fluctuated only within the gold points, and balance-of-payments adjustment was described by the pricespecie-flow mechanism Under the gold standard, each nation defines the gold content of its currency and passively stands ready to buy or sell any amount of gold at that price Gold export point and gold import point Since deficits are settled in gold under this system and nations have limited gold reserves, deficits cannot go on foreve but must soon be corrected The Price-Specie-Flow Mechanism Implication The automatic adjustment mechanism under the gold standard is the price-specie-flow mechanism Quantity Theory of Money (货币数量理论) It postulates that the nation’s money supply times the velocity of circulation of money is equal to the nation’s general price index times physical output at full employment. With V and Q assumed constant , the change in P is directly proportional to the change in M. Equation: MV=PQ ( M the nation’s money supply, V the velocity of circulation of money, P the general price index, Q the physical output) Chapter Summary Traditional trade or elasticity approach to exchange rate determination Correcting a deficit in balance of payments by devaluating its currency or allowing it to depreciate A devaluation or depreciation of a nation’s currency increases the domestic currency prices of the nation’s exports and import substitutes and is inflationary Stable or unstable foreign exchange market Empirical estimates of elasticities in international trade The gold standard Exercises: Additional Reading Marshall-Lerner condition , see: A. Marshall, Money, Credit and Commerce (London: Macmillan, 1923) A. Lerner, The Economics of Control (London: Macmillan, 1944) R.M Stern, The Balance of Payments ( Chicago: Aldine, 1973), pp. 6269 Estimates of Elasticities in International Trade, see: T.C.Chang, “ International Comparison of Demand for Imports,” Review of Economic Studies, 1945-1946,1945, pp.53-67 T.C.Chang, “ A Statistical Note on World Demand for Exports,” Review of Economics and Statistics, February 1948, pp. 106-116 Internet Materials http://research.stlouisfed,org/fred http://www.iadb.org http://www.adb http://www.iie.com