UPMA_2014_Busting_the_Myths_of_Money

advertisement

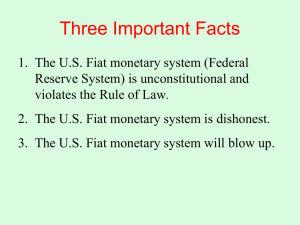

Busting the Myths of Money UPMA Sept. 2014 We don’t have a minimum wage problem. We have a money problem! Three Myths of United States Money 1. The Dollar is anything Congress declares it to be. 2. The value of Money is anything the I.R.S. says it is. 3. Centralized Banking is necessary for a stable economy. Myth 1: The Dollar is anything Congress declares it to be! • Can Congress (or the courts for that matter) change the definition of words used in the Constitution without a constitutional amendment? • Eisner v. Macomber, 252 U.S. 189, 206 (1920) • Congress cannot by legislation alter the Constitution, from which alone it derives its power to legislate, and within whose limitations alone that power can be lawfully exercised. Examining Myth 1 Constitutional Units of Measure: Definition when the Constitution was Ratified Unit of Measure Times Stated Year 33 One revolution of the earth around the sun’s axis Day 21 One revolution of the earth around it’s own axis Hour 1 15 degree rotation of the earth around it’s own axis Mile 1 A unit of linear measure equal to 5,280 feet Dollar 2 A coin containing 371.25 grains of silver Eisner v. Macomber, 252 U.S. 189, 206 (1920) Congress cannot by legislation alter the Constitution, from which alone it derives its power to legislate, and within whose limitations alone that power can be lawfully exercised. Money of the Constitution Article I Section 8, Clause 5 [The Congress shall have Power] To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; Article I Section 9, Clause 1 … a Tax or duty may be imposed on such Importation, not exceeding ten dollars for each Person. Article I Section 10, Clause 1 No State shall … make any Thing but gold and silver coin a Tender in Payments of Debts. Amendment VII In Suits at common law, where the value in controversy shall exceed twenty dollars, the right of trial by jury shall be preserved, and no fact tried by a jury, shall be otherwise reexamined in any Court of the United States, than according to the rules of the common law. What is One Dollar? One Dollar is a standard unit of measurement Money: 371 ¼ grains of Silver minted = $1.00 Analogous Time: 24 Hours = 1 Day * 7 = 1 Week Weight: 16 Ounces = 1 Pound * 2000 = 1 Ton Length: 1 Inch * 12 = 1 Foot * 3 = 1 Yard Does the Constitutional Dollar standard exist today? • Yes! How do we know? • The number $1.292929292. It is derived from the constitutional dollar unit. Title 31 U.S.C. §5116(b)(2): The Secretary shall sell silver under conditions the Secretary considers appropriate for at least $1.292929292 a fine troy ounce. Congress’ Responsibility to Regulate the Value of Coin Key: 1 troy oz = 480 grains 1 troy oz = 31.1034 grams 1 troy oz = 1.09714 oz X 100 = (4,630 grains of Copper) 1 Cent 1 Dollar (46.3 grains of Copper) (371.25 grains Silver) X 10 = (3,712.5 grains of Silver) 1 Dollar 1 Eagle (10 Dollar) (371.25 grains Silver) (247.5 grains Gold) Congress has the responsibility to regulate the value of all minted coins to the fixed pure metal Dollar standard Supreme Court - Coin Money is a Constitutional Requirement United States v. Marigold, 50 U.S. (9 How.) 560, 567568 (1850): “ [Congress has] the duty of creating a pure metallic Marigold was International Bancorp standard of cited value in: throughout the Union. The power of money and of De regulating was delegated Llc v.coining Societe Des Bains Mer et its Duvalue Cercle Des, 329 F. to Congress by the Constitution for … preserving the 3d 359, May 19, 2003 uniformity and purity of such standard of value * * * "If the medium could immediately be expelled, and substituted by one it had neither created, estimated, nor authorized one possessing no intrinsic value then the power conferred by the Constitution would be useless wholly fruitless of every end it was designed to accomplish. • 1792 Penny Myth 2: The value of Money is anything the I.R.S. says it is! The IRS claims the following argument Frivolous: • U.S. Monetary Law changed in 1985. 2. Constitutional money was reintroduced in 1986. 3. FOIA documents show that the only substance to the IRS’ position is the assertion itself. 1. In a transaction using gold and silver coins, the value of the coins is the face value of the coins and not their fair market value for purposes of Thompson v. Butler, determining taxable income. 95 U.S. 694, 696 (1878) (Source 2007-14 I.R.B, pg. 885 April 2, 2007) Thompson v. Butler was recently cited in: Crummey v. Klein Independent School District (Unpublished Opinion, U.S. Ct. App. for the 5th Circuit, No. 08-20133, 2 October 2008). A coin dollar is worth no more for the purposes of tender in payment of an ordinary debt than a note dollar. The law has not made the note a standard of value any more than coin. It is true that in the market, as an article of merchandise, one is of greater value than the other; but as money, that is to say, as a medium of exchange, the law knows no difference between them. Examining Myth 2 A Dollar is a Dollar! • 31 U.S.C. §5119(a) “the Secretary shall … maintain the equal purchasing power of each kind of United States currency” • 31 USC 5112(e) (e) Notwithstanding any other provision of law, the Secretary shall mint and issue, in quantities sufficient to meet public demand, coins which (1) are 40.6 millimeters in diameter and weigh 31.103 grams; (2) contain .999 fine silver; (3) have a design (A) symbolic of Liberty on the obverse side; and (B) of an eagle on the reverse side; (4) have inscriptions of the year of minting or issuance, and the words "Liberty", "In God We Trust", "United States of America", "1 Oz. Fine Silver", "E Pluribus Unum", and "One Dollar"; and (5) have reeded edges. The constitutional Dollar – a minted Coin containing 371 ¼ grains of silver – guarantees value: “It is significant that this power of coining money is mentioned in the same sentence in the Constitution as the power to "fix the standards of weights and measures,“ for the framers regarded money as a weight of metal and a measure of value. Roger Sherman, a delegate to the Constitutional Convention, wrote that “If what is used as a medium of exchange is fluctuating in its value, it is no better than unjust weights and measures…which are condemned by the Laws of God and man …”. Gold Commission Report. Public Law 96-389 Myth 3: Centralized Banking is necessary for a stable economy. Thomas Jefferson put it this way “I sincerely believe, with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.” “Bank-paper must be suppressed, and the circulating medium must be restored to the nation to whom it belongs.” Source: http://www.monticello.org/site/jefferson/private-banks-quotation What are the effects of using fiat-currency? 1. An unrealized loss of capital and property; 2. A loss of real economic value; 3. The loss of the full economic impact of automation; Unrealized losses of capital and property Property = # Egg Cartons = # Lawful Money $ (Brown Eggs) 1957 = = # Legal Tender $ = U.S. Silver Certificate 1,600 Sq. Ft. Home ~37,700 ($)13,500 No Lawful Money Available = 1982 $13,500 Fed. Res. Bank Note 1,600 Sq. Ft. Home 2007 ~37,700 = “$85,400” = = Fed. Res. Bank Note 1,600 Sq. Ft. Home ~37,700 ($)13,500 “$175,000” Quiet Theft! Property = # Egg Cartons = # Lawful Money $ # Legal Tender $ (Brown Eggs) Buy 1957 = = = U.S. Silver Certificate 1,600 Sq. Ft. Home Sell 2007 ~37,700 = ($)13,500 $13,500 = = Fed. Res. Bank Note 1,600 Sq. Ft. Home ~37,700 ($)13,500 $175,000 No Cartons of Eggs Gain No Lawful Money Gain Federal Reserve Note “Gain” of $161,500 No Gain No Tax Due No Gain No Tax Due After FRN Tax results in a Physical Egg Carton Loss of 11,922 Cartons of Eggs After FRN Tax results in a Lawful Money Property Loss of ($)4,269 Alleged Tax Due ~FRN$55,000 The purported Federal Reserve Note “Gain” is actually a “quiet theft” in that it results in a physical property loss with the perception of an actual gain. What is the effect of using unconstitutional legal tender? Stock = # Egg Cartons = # Lawful Money $ # Legal Tender $ (Brown Eggs) 1962 = = = U.S. Silver Certificate 1982 ~5,424 300 Shares IBM Stock after splits No Lawful Money Available = Fed. Res. Bank Note 75 Shares IBM Stock after splits 2007 $1,942.00 $1,942.00 4 Shares IBM Stock ~4,266 = “$4,884” = = ~6,571 $2,338.56 Fed. Res. Bank Note “$30,501.00” IBM Stock Splits: 1964-05-18 [5:4], 1966-05-18 [3:2], 1968-04-23 [2:1], May 29, 1973 [5:4], Jun 1, 1979 [4:1], May 28, 1997 [2:1], May 27, 1999 [2:1] Quiet Theft! Stock = # Egg Cartons = # Lawful Money $ # Legal Tender $ (Brown Eggs) Buy 1962 = = = U.S. Silver Certificate IBM Stock Sell 2007 ~5,424 = $1,942.00 $1,942.00 = = Fed. Res. Bank Note IBM Stock ~6,571 $2,338.56 17% Gain in Eggs Cartons 17% Lawful Money Gain Federal Reserve Note “94% Gain” of $28,559 Tax Due $59.48 Alleged Tax Due (15%) ~FRN$4283.85 Tax Due ~172 Egg Cartons After FRN Tax results in a Physical Egg Carton Loss of 923 Cartons of Eggs “$30,501.00” FRN Inflation results in a 83% tax rate or $328.45 of the $396.56 of the purported gain The purported Federal Reserve Note “Gain” is actually a “quiet theft” in that it results in an 83% tax rate with the perception of 15% tax rate. The loss of the full economic impact of automation. 12 Automation lowers the cost of production. Inflation however ensures the appearance of increased revenue while providing bankers unearned profits (red) 10 8 ■ Inflated Sale price Inflation adj 3.2% ■ Sale price 6 cost/unit 4 2 0 1 3 5 7 However, lower cost of production often results in lower revenue. Thus, to increase revenue a manufacture either has to increase sales or add more features to maintain 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 57 59 61 revenue. Example – Ford Mustang 1965 $2,557 Features • Convertible • 170 CID /101 HP 6 cylinder engine • Drum brakes • Bucket Seats with lap belt restraint • No air conditioner • AM Radio Example – Ford Mustang 2007 $31,700 Features • Convertible • 4.0 L /210 HP 6 cylinder engine SOHC • Ventilated disc brakes • Bucket Seats with lap belt restraint • Air conditioner • 120W Stereo / iPod input The Lawful Money Cost of a Ford Mustang has Remained Constant 1965 = = U.S. Silver Certificate ($) 2,557 2007 = ($) 2,557 = Fed. Res. Bank Note ($)2,557 $31,700